H O A Fresh Vision for UK Water Technology 1

advertisement

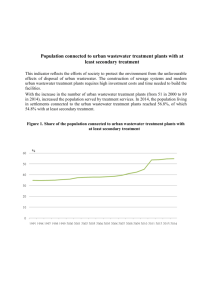

1 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP HO Tapping the potential: A Fresh Vision for UK Water Technology 2 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP CONTENTS 3 4 6 8 14 17 19 23 26 29 Foreword Executive summary A fresh vision A world of opportunities UK strengths: What can we offer? UK constraints: Are we achieving our full potential? An honest appraisal: What shapes our performance? Identifying what works: How can we learn from others? Pinpointing potential: Appropriate target markets Delivering the vision: An action plan to make it happen What is the authority for this report? For the first time, a wide-ranging group of water technology experts from research, policy and industry have come together to analyse opportunities in the global water technology market, examine the UK’s relative position in this market and articulate how the UK can improve its performance. Evidence papers This report has been informed by a number of detailed evidence papers, which can be accessed at www.ukwrip.org/action-groups/business-and-economy. They are: Evidence paper 1: A Fresh Vision Evidence paper 2: A World of Opportunities Evidence paper 3: UK Strengths and Constraints Evidence paper 4: An Honest Appraisal Evidence paper 5: Identifying What Works Evidence paper 6: Pinpointing Potential What is UKWRIP? The UK Water Research and Innovation Partnership (UKWRIP) provides leadership and facilitates co-ordination of water research and innovation initiatives concerned with UK and global water security and the global water market. It brings together government, industry, third sector and research communities. UKWRIP is part of the Living With Environmental Change (LWEC) partnership, which is led by the Natural Environment research council (NERC); it is facilitated by LWEC in partnership with the government Office of Science. UKWRIP has six action groups covering: infrastructure; water use in agriculture; environment and climate change; domestic water use; business and economy; and sanitation and health. For more details please see the website at ukwrip.org.uk This report is an output from UKWRIP’s Business and Economy Action Group, led by Mark Lane, Chair of British Water and Chair of the UK Trade and investment (UKTI) Environment and Water Sector Advisory Group. For a list of contributors to this publication please see the back cover. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Foreword Every nation needs to secure its water supplies for the future, in the face of demographic and climate change, with competing demands from municipal, industrial and agricultural users. Water is vital for our health and welfare. Water also enables the contribution of technology to innovation for energy generation, food security and ecosystem services. This can deliver substantial collateral benefits in reducing carbon emissions, saving costs and increasing resilience to climate change. The UK water industry has a good global reputation through privatisation, world-class consultants and fair dealing in commercial contracts. However, there are opportunities to expand today’s UK global market share in water technology innovation from 3% to at least 10% by 2030, in markets such as wastewater reclamation, smart water, flood security and remote-sensing monitoring systems. This will enable the UK to become an innovation powerhouse in the global water technology sector, driving sustainable growth and creating more small and medium-sized enterprises (SMEs) and jobs in the water technology sector. This report presents the findings from a wide-ranging group of experts from research, policy and industry who, for the first time, have together analysed the opportunities in the global water technology market and examined the UK’s relative position in this market. It highlights the fractured and disparate nature of the UK’s water technology sector and the significant market potential available worldwide if this fractured approach is eliminated. Key challenges include addressing the lack of alignment between research and commercial opportunity, as well as the gap between basic knowledge generation and subsequent commercialisation into marketable products. This will involve providing access to independent national testing, validation and demonstration facilities, complemented by a more co-ordinated and focused international marketing strategy, with a more compelling national branding of UK water capability. This will be important as a catalyst to accessing new market opportunities. I welcome the ‘UK plc’ approach to developing this report and the commitment to continuing this approach in the implementation of the findings and actions. This will result in a better alignment of research to market opportunities and valuable economic growth in the water technology sector. Sir Mark Walport Government Chief Scientific Adviser February 2014 3 4 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Executive Summary Aimed at government, business leaders and investors/funders, this report is inspired by a clear, ambitious yet achievable vision: to see the UK establish itself as an innovation powerhouse in the global water technology1 sector, driving sustainable growth and creating thousands of jobs across the country. What are the current and future opportunities in the global water market? The required expenditure on water and sewerage to 2050 amounts to $8606 billion. Areas where the UK is currently considered to be strong include: • engineering consultancy services •financial consultancy and funding services In the six-year period to 2020, the opportunities in global market sectors identified by this report amount to over $50 billion. •flood management Huge opportunities for the water technology innovation industry also exist in the fields of energy, food security, ecosystem services and resilience to hazards. Development of these opportunities will produce substantial collateral benefits, including carbon reduction, cost savings and secure agricultural production. In responding to this potential, the UK has a strong research and innovation base to build on. •network and environmental monitoring Where does the UK currently stand? England and Wales are generally regarded overseas as having made a success of water privatisation. In addition, the UK is acknowledged as having world-class consultants in the sector and a reputation for fair dealing. But the data show that we could do much better in terms of our performance at global level. Today, the UK’s share of the global market in water technology is just 3% (£1.5 billion), involving around 15,000 jobs in 400 small and medium-sized enterprises (SMEs). 1 • smart water; leakage management •asset management and optimisation •mobile data transmission •waste and wastewater treatment •energy recovery from wastewater •water efficiency. Why are we where we are? Reasons include: •lack of alignment between research and commercial opportunities •the gap between basic knowledge generation and subsequent commercialisation into marketable products •a fragmented industry •disparate national testing, validation and demonstration facilities •no co-ordinated and compelling national branding of UK water capability for international markets •no overarching research or industrial strategy for water. The technology (products and processes) employed by those who manage and use water. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 5 Where could we realistically get to by 2030? We have estimated that the UK could increase its global market share in water technology innovation to at least 10% (£8.8 billion), providing 71,000 jobs and involving around 960 SMEs. Four essential steps to get us there 1 Strengthen the public-private UK Water Research and Innovation Partnership (UKWRIP) Aim: To establish a coherent, unified voice capable of leading forward the UK water technology sector internationally and providing an overall co-ordinated strategy. 3 Provide independent national testing, validation and demonstration facilities Aim: To accelerate collaborative innovation and catalyse its commercialisation. 2 Create a sharp focus on commercial opportunities and customer needs 4 Implement a co-ordinated, focused international marketing strategy Aim: To ensure that these drive forward water technology research, innovation and exploitation in the UK. Aim: To develop a strategic brand built on the UK’s unique selling points and spearheaded by an annual international water congress held in this country. How long do we have? Next steps We know that we are good on water, but our competitors are forging ahead. If we fail to catch up within three years, they will be so far ahead that we will miss the boat. The immediate next step for the UK must be to develop a costed business plan with clear actions and deliverables, based on the main steps outlined above. This report is the work of UKWRIP’s Business and Economy Action Group and is one of a series of UKWRIP outputs. For more information contact Faith Culshaw, UKWRIP co-ordinator, at faith.culshaw@lwec.org.uk 6 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP A Fresh Vision This report is inspired by a clear, ambitious yet achievable vision: to see the UK establish itself as an innovation powerhouse in the global water technology sector, driving sustainable growth and creating thousands of jobs across the country. Successful realisation of this overarching vision will involve the accomplishment of three specific goals by the year 2030: 71,000 jobs jobsjobs 71,000 10% global market share71,000 10% global market share 10% global market share 3% 3% £8.8bn 15,000 £8.8bn £8.8bn 15,000 3% 485% 485% Increase Increase 485% Increase 2014 2014 2014 2030 2030 2030 Growth in the UK’s share of the global market in water technology innovation from 3% to at least 10%, representing an increase from £1.5 billion to £8.8 billion per year. 400400 15,000 375% 375% Increase Increase 960 960 SMEs 960 SMEs SMEs 375% Increase 400 140% 140% Increase Increase 2014 2014 20142030 2030 20302014 2014 2014 Growth in the number of jobs in the UK water technology sector from 15,000 to 71,000. 140% Increase 2030 2030 2030 Growth in the number of SMEs active in this sector from 400 to 960. Attaining these goals will depend on the successful execution of four key actions: 1. Strengthen the public-private UKWRIP Establishing a coherent, unified voice capable of leading forward the UK water technology sector internationally and providing an overall co-ordinated strategy. 2. Create a sharp focus on commercial opportunities and customer needs Ensuring that these drive forward water technology research, innovation and exploitation in the UK. To investigate further, see Evidence Paper 1. 3. Provide independent national testing, validation and demonstration facilities Accelerating collaborative innovation and catalysing its commercialisation. 4. Implement a co-ordinated, focused international marketing strategy Developing a strategic brand built on the UK’s unique selling points and spearheaded by an annual international water congress held in this country. How will realising this vision benefit the sector’s UK stakeholders? Government: ✓ economic growth ✓ jobs ✓ exports ✓ more effective use of existing funding ✓ resilient infrastructure ✓ development of effective national and international water policy ✓ societal and environmental goals Consultancy services: ✓ growth ✓ exports Technology SMEs: ✓ growth ✓ exports Water consumers: ✓ maintenance of services at lower cost ✓ increased recognition of the value of water and its interdependency with other sectors of the economy Environment: ✓ sustainably managed and improved at a lower cost Research communities: ✓ increased real-world impact of research ✓ identification of new research priorities/opportunities ocal authorities & Local Enterprise L Partnerships: ✓ more effective use of funding, better alignment of regional growth with national strategy UK water technology companies: ✓ bigger share of the home market 8 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP A World of Opportunities Around the world, delivery of reliable, sustainable water services poses huge challenges. Tackling these challenges presents major opportunities for the UK water technology sector. Water: the hard facts •at least 1.9 billion people currently rely on unsafe water •4.1 billion people rely on unsafe sanitation •1.7 billion people are threatened by shrinking groundwater resources •36% of the world’s population lives in areas affected by extreme water stress – set to rise to 52% by 2050 •6% of deaths worldwide and 9% of time lost due to ill health stem from inadequate water, sanitation and hygiene •water resources worth $9-24 billion are squandered each year due to leakage and other losses • the global ‘risk to business’ from insecure water supplies totals $400 billion. Water is essential to life and prosperity From a global perspective, the need to provide secure water supplies is paramount. Failure to do so threatens lives and livelihoods. It also holds back economic development. But the scale and complexity of the task are sobering. Growing populations, shifting demographics, climate change, water scarcity at local and regional level, competing demand from domestic, industrial and agricultural users – these are some of the factors that amplify the difficulty of achieving the goal. Yet as the hard facts underline, we urgently need effective solutions. FACT FOR THOUGHT In Riyadh, spending $400 million on basic network repairs would avoid the need for new desalination plants costing $2.1 billion. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 9 Water abstractions worldwide: projected growth to 2030 6900km3 2030 2010 2030 2010 2030 2010 2030 2010 4500km3 3856km3 2699km3 1500km3 434km 900km3 3 Domestic, commercial and municipal 123% increase 733km3 Industrial 105% increase Pressure on supplies will keep ramping up A historic process is now taking place: the biggest ever shift from a rural to an urban world. In 2011, 3.5 billion (50%) of the world’s population lived in towns and cities. By 2050 this will have increased to 6.6 billion (69% of a forecast population of 9.6 billion), applying acute pressure to water supplies. Indeed, taking all factors into account, water abstractions are set to see a 79% increase by 2030. Yet we already abstract 92% of our actual renewable water resources, and imbalances between availability and need are apparent in many parts of the world. It is unclear how the shortfall will be met without extensive innovation in water technology. Climate change poses a big challenge A changing climate is already affecting the world’s water resources. Further impacts – such as increased rainfall at high latitudes, less rainfall elsewhere and a higher frequency of extreme droughts – will become evident as the century progresses. As well as accentuating water imbalances, climate change could increase the cost of coastal flooding to $1 trillion by 2050 compared with Agricultural 67% increase Total 79% increase $6 billion in 2005; major cities such as New York and Guangzhou are likely to come under threat. The risk of flooding both from intense rainfall and associated with growing urbanisation will also increase. Responding to the climate challenge will also, for example, require demand management systems that can cope with changing patterns of water availability. Other emerging threats need to be confronted Conventional wastewater treatment is struggling to deal with threats that may have serious implications for human health. Rivers and drinking water are being contaminated by drugs – in the UK, for instance, discharges from treatment works contain antibiotics and antibiotic-resistant organisms. Persistent Organic Pollutants (POPs) and pesticides are a further source of problems for water supplies and ballast water from ships could contribute to the spread of antibiotic resistance and the introduction of invasive species. 10 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP A Global Priority Deteriorating US water and wastewater infrastructure needs effective solutions. £1 £8 Every spent on flood protection in the UK saves in repairing damage, according to the Environment Agency. UK USA Mexico Africa South America Brazil Severe water stress is a key challenge for Brazil, Russia, India and China (the BRIC countries). 25% of people in towns and cities beyond Western Europe and North America are not connected to piped water. 75% do not have their sewage adequately treated. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 11 31% leakage rate in the Saudi A capital Riyadh causes over 1 million m3 of water to be lost every day. Russia 2% China loses of its Gross Domestic Product due to polluted water resources and depletion of groundwater reserves. Asia Middle East China Saudi Arabia India South East Asia Poor water services are seriously hampering economic development throughout South East Asia. India, Mexico and the Middle East are particularly vulnerable to groundwater depletion. 12 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Keys to success: Investment Keys to success: Innovation In 2013, global capital and operating expenditure on water resources, networks and treatment and on wastewater networks and treatment exceeded $550 billion. In OECD (Organisation for Economic Co-operation and Development) countries, spend is driven by environmental and public health legislation and the need to rehabilitate existing infrastructure. Elsewhere, it is driven by the need for universal service provision and for secure water supplies. At a conservative estimate, $8.6 trillion must be spent to achieve comprehensive global water and sewerage coverage by 2050. Innovation must play a pivotal role. Technologies have already been developed that can contribute to meeting the challenges, but many more will be needed if global goals are to be achieved. Such solutions may address fundamental issues of supply, or focus on optimising water efficiency and cutting the industry’s capital and operating costs (eg by recovering energy and nutrients from wastewater). Across industry as a whole, the market for such technologies is relatively small but faster moving than municipal markets; it also offers higher margins. Municipal markets are cost-led and more conservative but offer greater economies of scale and more scope for repeat business. Required expenditure to 2050 ($ billion) Water OECD countries Global total: 3143 918 1070 BRIC countries 1155 Rest of the world Sewerage 1523 Global total: 5463 1889 2051 Total 2441 2959 3206 Source: OECD, 2011. There are significant multi-billion pound opportunities in the global water and wastewater market over the next 25 years that provide potential for a step-change in engagement for UK companies. Mark Fletcher, Director and Global Water Leader, Arup To investigate further, see Evidence Paper 2. Global total: 8606 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 13 Ten examples of major market opportunities Even within the next six years, huge commercial opportunities will be ripe for exploitation. These include: • $ 23 billion – the projected size of the wastewater reclamation market by 2017, as wastewater is Advanced irrigation transformed from budget-sapping burden to water, energy and nutrient-rich resource Wastewater reclamation • $ 16-23 billion – the projected size of the smart water Smart water market by 2020 as demand grows for real-time data Monitoring andwater remote (satellite) sensing that aids active management Smart soil-monitoring systems • $ 4 billion – the forecast size of the market for monitoring and remote sensing (eg via satellite) by 2020. Such technology can help to anticipate sewer flooding and other incidents, and provide real-time data on water resources and their usage • $ 3.4 billion – the market for advanced irrigation anticipated by 2016 • $ 2.3 billion – the market for smart soil-monitoring systems anticipated by 2020. Other substantial opportunities include: •$82 billion – the municipal and industrial market for water engineering and chemical products, growing at 8% per year • $ 20-35 billion – the potential market for smart flood protection combined with sustainable urban drainage systems (SUDS) for road and surface drainage •$19-26 billion – the projected size of the market for the treatment of ballast water from shipping • $ 4-6 billion – the market in developed economies for water-efficiency solutions (eg waterless urinals, minimal-water washing machines) • $ 3-5 billion – the size of the leakage minimisation and pipeline rehabilitation market. The identification of critical interdependencies beyond the water sector (eg with energy, infrastructure and agriculture) is another key priority that urgently needs to be addressed. Innovations that are adopted need to take account of these interdependencies. Opportunities within the next six years ($bn) 2016 2017 $3.4 Advanced irrigation $23 2020 2020 2020 $4 $2.3 $16 ‒ 23 Wastewater reclamation Smart water Monitoring and remote (satellite) sensing Smart soil-monitoring systems Various sources cited, including Global Water Markets 2011, published by GWI. A better water future • S mart irrigation: using less water and delivering higher crop yields through soil-moisture monitoring and drip irrigation. •Smart distribution: achieving better leakage detection, better-focused maintenance and improved pressure management. •Smart meters: delivering easy-to-use real-time information for customers and utilities alike, with forecast sales of these devices reaching $3-10 billion by 2020. KEY MESSAGE • S mart consumer goods: using minimum or zero water. •Smart water usage: including rainwater harvesting as well as systems for recycling wastewater and greywater. •Mobile communications: enabling customers in developing economies to make payments remotely and inform utilities/agencies about problems with their water and sanitation services. Provision of improved water services worldwide poses challenges that are triggering innovation and opening up extraordinary commercial opportunities. 14 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP UK Strengths: What Can We Offer? Seizing the opportunities requires the right expertise. In several respects, the UK has an impressive platform of capabilities that can provide a springboard to future success. We have a proud pedigree in research and innovation The UK funds a considerable amount of water research and innovation through its research councils. There are also many centres of excellence at universities and elsewhere, as outlined on page 19. Indeed, our track record in innovation stretches back 400 years. From the world’s first city-level water transfer project, completed in 1613 and still one of London’s main water resources, to the invention of the activated sludge process in 1914, arguably no country can match the extent or influence of our pedigree in pinpointing visionary solutions to waterrelated problems. Managing existing water infrastructure is well-established as a key UK strength. We have an enviable reputation for fair play In an era when corruption has emerged as a growing source of international concern, the UK’s reputation for integrity and transparency can help us to break into global markets. In 2012, Transparency InternationaI’s Corruption Perceptions Index ranked the UK an impressive 17th out of 174 countries, underlining our renown for fair and straight dealing. Our utilities are well-regarded internationally The UK’s water and sewerage utilities provide some of the cleanest drinking water in the world. They benefitted hugely from their 1973 river-basin-level reorganisation, which gave the UK a lead of decades over other countries. Moreover, since the industry’s privatisation in England and Wales in 1989, the utilities there have delivered four major capital spending programmes on time and on budget. New capabilities continue to emerge The relentless emergence of innovative companies is an undeniable feature of the UK water technology environment. Those with the pragmatism and determination to overcome challenging domestic trading conditions are best placed to survive, thrive and carve a niche in export markets. Indeed, many of the innovations developed by UK firms offer significant growth potential for the years ahead. Bluewater Bio’s HYBACS at Tubli – the largest wastewater treatment plant upgrade in the Gulf States. There are at least six recognised water innovation hubs worldwide but the UK is not among them. If properly organised, the UK has at least an equivalent innovative capability – and probably a significantly greater one. Tony Conway, Executive Director – Strategic Programmes, United Utilities HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 15 A survey of UK strengths Primary Capabilities Niche Excellence Engineering consultancy services The UK is a recognised global leader, covering disciplines such as project management, asset management planning, environmental management and environmental consulting. Early engagement on projects via consultancy can be a gateway to further commercial opportunities downstream. Network and environmental monitoring Competitive technologies are now emerging in key areas such as river water monitoring, sewer management, high-speed monitoring, satellite applications and flood prediction systems. Financial consultancy and funding services We have an enviable reputation in accountancy, insurance, economic consulting, legal services, marketing and specialist services (eg venture capital, project finance). Newer expertise in outcomes analysis, ecosystems services valuation, risk management and catastrophe modelling is enhancing our standing. Mobile data transmission Our position at the vanguard of the fast-moving field of mobile telecommunications means we are very well placed to apply our expertise to the water sector. Cuts in utility operating costs are just one benefit from leading-edge developments in areas such as mobile payment systems and real-time integration of water and wastewater data. lood management F The UK’s flexible flood management approach has enabled firms to develop flood protection systems, stormwater management solutions and SUDS. We are also developing leading-edge expertise in integrating flood modelling with sensors and river/ satellite-based monitoring to improve early flood warning. aste and wastewater treatment W Although this sphere is dominated by our international competitors (eg France and the US) UK firms have established a presence in some niche areas. mart water: leakage management S The UK excels in a field where the economic benefits are substantial, through improved pipeline performance and lifetimes. No-dig leakage detection/ monitoring solutions and pressure-management systems are particular fields of speciality. Energy recovery from wastewater With interest increasing in deriving energy from sewage treatment, scope exists to find innovative ways of making the process more cost-effective. Specialist UK players are well-positioned to build on existing capabilities and benefit from this trend. Asset management and optimisation As one of the first countries to offer universal water and sewerage, the UK has infrastructure that often dates back many decades – a powerful incentive to devising solutions that allow assets to remain in use for as long as feasible and that optimise performance with minimal disruption. Water efficiency Minimising water demand through so-called ‘disruptive’ innovations – such as minimal-water washing machines, waterless urinals and dry sanitation – offers enormous potential worldwide. UK firms have skills appropriate to establishing a niche presence in this market. 16 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Six snapshots of export success Bluewater Bio Set up in 2007, a key goal of this firm has been to commercialise its HYBACS wastewater technology. 95% of the systems are UK-made, with the emphasis on exports. Following initial orders secured in South Africa and Bahrain (Tubli), a successful pilot-plant test with Severn Trent was completed in 2013. The firm has established a technical alliance with Thames Water. Hydro International Hydro International was founded in 1980, with operations subsequently set up in the US and Ireland. The company specialises in vortex-based stormwater handling systems. Distribution agreements have been secured in Australia, Russia, Saudi Arabia and Singapore. In 2012, 44% of the firm’s £35 million revenues came from beyond the UK. i2O Founded in 2005, i2O has developed a smart pressure management system for water networks that cuts leakage by 25-35% and reduces rates of pipe burst by 40-50%. After securing its first major order in Malaysia, the company now exports to 14 countries and is developing its UK customer base. UK Flood Barriers Founded in 2007, UK Flood Barriers supplies effective, intelligent flood defence technology for the built environment. The company specialises in protecting critical infrastructure, as well as homes and businesses, and is established as a centre of excellence for R&D. It works with its partners Global Flood Defence Systems to service all continents. Syrinix Set up in 2004, University of East Anglia spinout Syrinix has developed the TrunkMinder smart monitoring system. This pinpoints leaks in trunk mains by delivering non-stop real-time data. Thames Water now uses the system, which has also been examined by potential clients in Europe, North America and the Middle East. XP Solutions Originally founded in 1983 as Micro Drainage, this company developed its WinDes software to model surface-water drainage and flood conditions as an aid to storm and flood management. By making modelling exercises much faster, WinDes delivers dramatic productivity gains. In 2008, Micro Drainage merged with a US firm to help drive global exports. FACT FOR THOUGHT KEY MESSAGE Between 2008 and 2013, 41 UK-based firms were showcased at ‘Wet Network’ industry events in London, designed to highlight the capabilities of the water technology sector. The UK has proven strengths in devising and disseminating innovations that can address key water-related challenges worldwide. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 17 UK constraints: Are we achieving our full potential? Despite successes and a long tradition of innovation in water handling and management, the UK sector punches well below its potential weight in global terms. We are a minor international player Overall, the UK is undeniably a ‘bit player’ in the worldwide water technology sector. The Department for Business, Innovation and Skills estimates that our exports of all water-related goods and services total £1.5 billion per year; this represents just 3% of the global market. In 2013, global water and wastewater technology capital spending totalled an estimated £51.2 billion, reinforcing just how modest the performance of ‘UK plc’ currently is. We significantly underperform in many areas In rainwater harvesting and greywater recycling, for example, we lag well behind our international competitors. To date, there have also been limited opportunities for UK firms to develop activities in SUDS. Even in the sphere of smart water – one of the most dynamic in the whole market – there is no coherent framework that encourages UK utilities to innovate. Meanwhile, major global markets such as desalination and irrigation are notable for the limited presence of UK firms. Lack of UK impact: today’s big players in traditional market segments Design & Engineering Process Automation France Veolia Water Suez France Schneider Chemicals & & Control US GE Pentair US Black & Veatch CH2M Hill Tetra Tech Aecom Louis Berger Sulzer ABB Germany Remondis ABB South Korea Doosan Germany Siemens Switzerland Sweden Denmark Grundfos Materials Treatment Technology France SNF Floerger Veolia Water France Veolia Water Degremont US Ecolab Dow Du Pont 3M GE US Ecolab Dow 3M GE Xylem Pall Aquatech BASF Germany Finland Kemira Germany Siemens Canada Bioteq Ovivo Sulzer Switzerland South Korea Doosan Based on Frost and Sullivan’s ‘representative sample of industry participants’, from: Global Smart Water Market ‘Unearthing the REAL Value of Water and the Industry’ presented at the Tekes seminar on BioRefine and Water on 27th November 2012 at the Marina Congress Center in Helsinki by Fredrick Royan – Research Director, Global Environment (Water) Markets. 18 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Negative perceptions are deeply rooted The UK’s innovative capabilities are often overlooked or underestimated, especially within the UK itself. A key reason relates to concern about the UK utilities’ market dominance and a regulatory climate that inhibits innovation. Although this concern is not so pronounced overseas, we are still not seen as a global leader except in smart water. Such perceptions have a tangible impact, inhibiting funding and deterring investment at every stage of the innovation cycle. FACT FOR THOUGHT Just one UK firm, Syrinix, made the 2012 Artemis Project Top 50 Water Tech Listing of the world’s most promising advanced water technology companies. Perception vs reality? UKWRIP’s 2013 UK water survey showed that those whose work is not mainly UK-focused tend to view UK innovation more positively than those focused mainly on the home market. This may be because of the success of UK SMEs and universities in the international water sector. Or it may be due to a ‘legacy view’ of the sector based on its historical standing and UK utilities’ international activities immediately after privatisation. Nevertheless, all respondents shared a broadly negative view of innovation at UK water utility level in particular. Nearly two-thirds gave the utilities a score of five or less out of ten and around one-third gave them a score of three or less. The reason was the utilities’ perceived unwillingness to consider innovation and their perceived lack of success in embedding it. With larger companies also viewed negatively with regard to their ability to innovate, it may fall to SMEs and universities to assume a key role in innovation within the UK water technology sector. To investigate further, see Evidence Paper 3. From our experience, the present regulatory regime provides a lack of legal certainty with resultant formidable barriers to entry for the innovation and selling of water treatment products on the UK market. Joe Barrett, Chairman, RainSafe™ Water KEY MESSAGE Globally, the UK is seen as a niche player – our companies have not secured a dominant position in any traditional water or wastewater market. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP An Honest Appraisal: What Shapes Our Performance? To tackle the shortfall in the UK’s performance, the first step is to dissect the causes and so provide a firm foundation for new thinking. Our overseas presence has declined Until the turn of the millennium, several UK water utilities (eg Thames Water, United Utilities) were established world leaders in the development of international activities. However, following the price cuts in the 1999 Ofwat periodic review, this was no longer the case as these companies scaled back their non-regulated activities. There are a few partial exceptions to this, eg Severn Trent Water, which has retained significant presence in the USA and Italy. Limitations in our home market Not only do UK firms have too low a profile in some of the more attractive market areas, but there is no clear system for introducing home-grown innovation to our utilities. Some of our most successful companies have had to win overseas orders before they could secure the project references needed to break into the UK market. Moreover, five-year asset management programme cycles create a cyclical home market as well as obstructing consistent application of capabilities overseas. FACT FOR THOUGHT Unlike key competitors, the UK sector has no unified platform enabling it to project a coherent image to potential customers worldwide. Investment in private sector R&D and innovation is modest In the UK, water is not seen as an attractive proposition for investors in innovation. Water utilities themselves spend comparatively little on R&D (see page 20); this is largely due to the absence of regulatory incentives to invest where there is no short-term prospect of attractive returns. Lack of co-ordination The UK sector is served by several trade associations including British Water, Water UK and SBWWI (the Society of British Water and Wastewater Industries). But there is no coherent platform for making their collective presence felt worldwide. Lack of integration at government, regulatory, company and utility level also means there is no single point of contact for firms keen to develop a presence at home or abroad. Lack of incentives at regulatory level Separate economic, water quality, environmental and flood regulators have created a fragmented framework that limits capacity to compete overseas. In particular, lack of regulatory incentives for innovation combines with utilities’ inherent conservatism to inhibit utility investment and product development. This contrasts starkly with the regulatory framework for telecommunications, which has explicitly supported innovation and has helped UK mobile services to secure extensive export success. 19 20 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP The Research Conundrum Overall, the UK has a disappointing track record in transforming water-focused research into real-world products and services. Why is this so? UK water research and innovation: How, where, who? Research-based consultancy WRc currently has a research portfolio worth around £2 million. Generally, the volume of spend in the private sector is invisible to external view. ver 60 UK universities conduct research spanning O areas such as freshwater ecology, flood-risk management and modelling, treatment technologies for water and wastewater, and urban drainage. As well as large water engineering departments, many multidisciplinary groups are in place. Extensive expertise also resides at specialist research centres (eg the Centre for Ecology & Hydrology). The focus of funding s the diagram below shows, only research councils occupy A the ‘basic research and training’ zone (one of the biggest areas of spend) within the funding spectrum. Comparatively few players occupy the commercialisation and exploitation zones often dubbed ‘the Valley of Death’. Importantly, because overall support for research is greater than for innovation and for the development of market-ready products, academics tend to target their efforts at the front end of the spectrum. ach year, the research councils channel around £120 E million into water-related research (pure and applied). Recent years have seen a trend towards funding more multi- and interdisciplinary programmes, such as the new UK Droughts & Water Scarcity programme. Securing industry involvement in such programmes is challenging, although companies sometimes act as partners on individual research projects. All UK water utilities subscribe to UK Water Industry Research (UKWIR) for collaborative, ‘one voice’ research, mainly to provide science and methodologies that support sound regulation. UKWIR has an annual budget of around £3.5 million and often co-funds research with regulators and research councils. Each year, water utilities in England and Wales invest an estimated £18 million in R&D. At around 0.18% of revenues, this compares unfavourably with the average figure of 0.4% for French companies Veolia Environnement and Suez Environnement, for example. Indeed, R&D expenditure is falling (eg from £28 million in 2002/03 to £23 million in 2007/08). However, a complete picture of overall spend is currently unavailable.2 he research councils’ primary role is to fund worldT class research and training. But they do also strive for ‘excellence with impact’ and have a range of schemes geared to facilitating knowledge exchange and enabling commercialisation of research results. Such mechanisms include industry internships, studentships, Centres for Doctoral Training and strategic partnerships with business. Some universities have bespoke mechanisms in place to encourage businesses to innovate and grow. For instance, Lancaster University adopts a multi-faceted approach. This includes: provision of ‘incubation’ facilities for business start-ups; the Leading Enterprise and Development (LEAD) programme to enhance company performance; and an ecoinnovation initiative with a commercialisation consultancy linking 50 SMEs with 50 specially recruited PhD students. Water research, innovation and exploitation funding landscape Basic research and training Applied research and development Knowledge exchange and technology transfer Demonstration Commercialisation Exploitation UK research councils Technology Strategy Board (TSB) Defra, DfID and other government departments UK Trade & Investment EU Framework Programme Public Sector Private Sector EUREKA (EU Programme) UK Water Industry Research Water companies Supply chain companies and consultancies NB. Diagram is illustrative only; size of bars does not represent quantity of funding. 2 Water users Reported water utility R&D spend is perhaps misleading when making comparisons with sectors such as pharmaceuticals, as the majority of water innovation spend (including utility R&D staff) is charged to the capital account and not reported as R&D. UK gas and electricity utilities take a similar approach. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 21 Nine reasons why research rarely turns into products/services 1. Lack of an aligned UK vision on water 6. Academic and ‘techie’ cultures Our fragmented sector operates in silos and without a strong, unified voice. Not all academics have the incentive, will or understanding to commercialise their research. Similarly, in early-stage technology companies, it can be hard for the focus to switch from the technology to the market. ‘Techies’ are likely to be more interested in perfecting technology than thinking about customers and markets – even though market pull is often needed to give companies the direction and focus essential to ‘take-off’. 2. Lack of a central innovation hub Innovation activities need to be co-ordinated and disseminated, and organisations need a ‘go to’ point for information on ongoing/planned initiatives and industry contacts. Absence of a hub also slows down the trialling and demonstration of innovative products – testing with several utilities is currently necessary because each has different standards. 3. Funding focuses on research not exploitation Research council funding decisions are mainly based on scientific excellence, with impact a secondary criterion. ‘Directed’ research is most likely to be driven by policy or social needs. There are signs, however, of a move towards more innovation-based funding (eg the EU Horizon 2020 research and innovation programme). 4. Water has not been an explicit TSB priority In 2011, the Technology Strategy Board (TSB) decided against establishing an innovation platform in water because it felt that the UK water utilities were insufficiently supportive of investment in innovation. However, water is treated as a cross-strategy theme and waterrelated projects are funded through several other TSB competitions (eg agri-food and manufacturing). In 2012, a £4 million water security competition funded both evolutionary and revolutionary projects. 5. Lack of ‘co-creation’ to aid take-up Despite mechanisms to involve industry from the outset, it is often hard to achieve genuine co-creation (as opposed to co-funding) of innovations. This may be due to a failure to secure the engagement of the right people in a company (ie those who really understand what science and innovation can do for them). Or the right people may then be unable to cascade research outputs through their organisation due to lack of resources. Fundamentally, businesses are only likely to buy into research if they have a direct commercial interest in the results. 7. Low returns on investment and long lead times for products/services in the UK These not only discourage investors but also make it hard for SMEs to thrive, no matter how good their ideas or innovations. Most UK domestic customers and the regulators looking after their interests are not intrinsically concerned about global growth by the UK sector. Supporting innovation that may require short-term increases in the cost of – and the risk to – services may be a difficult ‘sell’ to customers and regulators. 8. Lack of key skills Within the UK, there is a marked shortfall in the skill set needed to ‘make innovation happen’. Some schemes do exist, however, to improve skills provision – for example, the Engineering and Physical Sciences research council’s WISE and STREAM Industrial Centres for Doctoral Training for the water sector, where engineering doctorates are co-sponsored by industry. 9. Our market is not geared to driving global success The simple fact is that the UK market does not have any focus on global opportunities except for those identified by individual companies. These firms face stiff competition from rivals based in countries that take a long-term view of water and align resources to exploit opportunities. 22 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Swimming against the tide: a research commercialisation case study NERC-funded research led directly to the formation of Salamander, a spinout from the University of Manchester that makes the water quality monitoring product Hydraclam®. It is predicted that, by 2016, this product will have generated over £24 million in Gross Value Added for the UK. Key to this success has been the sheer perseverance and relentless effort necessary to overcome two big barriers: firstly there was no incentive for the private sector to support the underlying research because it focused on generating benefits for society as a whole, and secondly research outcomes were uncertain and combined low return on investment with high risk in terms of developing marketable products. Working with water companies in the UK: the view from academia Academics working in the sphere of water innovation report that water companies have neither the staff nor resources to innovate or develop new technologies systematically. Even if a utility takes a product to pilot stage, it may well not continue beyond that point. This may be because testing and validation can be tortuous or do not fit well with the UK water investment cycle. Fundamentally, to be accepted, innovative ideas need to be mature and low risk (in technical and financial terms) and offer a substantial benefit. A major underlying problem is the relative low cost of water services, making it very hard to justify new approaches. The most expensive elements of innovation – development and demonstration – are generally only carried out by water utilities when civil contractors or process suppliers have introduced new technology on a trial basis at their own expense. Additional resources may be awarded, though, via a research council or TSB scheme. Some recent developments The Defra/Ofwat Innovation Leadership Group, working with UKWRIP and the research councils amongst others, is developing both a model to link research to innovation and market needs, and metrics of UK innovation effort. To investigate further, see Evidence Paper 4. We need earlier, closer links between business and academia, to ensure we capitalise on our world-beating capabilities in linking water systems with other services. Stakeholders have yet fully to appreciate the benefits of innovation through collaboration. Professor Carolyn Roberts, Environmental Sustainability Knowledge Transfer Network KEY MESSAGE A wide variety of factors have blunted the UK water technology sector’s ‘innovation edge’ and its ability to exploit export opportunities. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 23 Identifying What Works: How Can We Learn from Others? Steps that could strengthen the UK’s position in export markets are already being taken by our most successful competitors. Global leadership is spread far and wide In water technology, countries now setting the pace include: France, with companies such as Veolia Environnement, Suez Environnement and Schneider at the forefront; the US, whose prominent players include GE, Xylem and mid-sized firms such as Pentair and Ecolab; Japan, typified by the success of Ebara and Horiba; and Germany, through firms such as Siemens, BASF and Remondis. China, Singapore, India and Israel are rapidly building up an international presence too, particularly in the developing economies. Another feature of the global market – underlining the fact that a big domestic market is not a prerequisite to international success – is the range of players from comparatively small countries: for example, Kemira (Finland) and Bioteq (Canada). These leaders benefit from a partnership approach One thread linking the experiences of many of today’s global leaders is a high level of co-ordination between government, academia, utilities and private sector. This partnership approach – currently absent in the UK – has acted as an engine of growth, providing a robust basis for the development of competitive, innovative companies capable of impressive export performance. KEY MESSAGE FACT FOR THOUGHT Lack of a UK test bed for water technologies is a key factor preventing the development of a genuine national UK water technology cluster. Innovation clusters are key to success Innovation clusters drawing together private and public sector expertise in a culture of co-operation can provide fertile ground for growth. In water technology, there are many international examples of such clusters delivering a powerful impetus to local, regional or national economies. Detailed research into six clusters – in Canada (Ontario), Germany, Israel, the Netherlands, Singapore and the US (Milwaukee) – has highlighted the secrets of their success (see page 24). Current UK innovation clusters are limited in scope A number of current and emerging innovation clusters in the UK are centred on specific parts of the country. (For instance, Liverpool City Region aims to develop the world’s first ‘sustainable coastal city region’ water innovation cluster; this will specialise in marine impacts, river clean-up and smart infrastructure developments.) However, challenges exist around: central co-ordination; a shared sense of focus to join the dots between researchers, entrepreneurs, investors, companies and large infrastructure projects; and clear branding to secure inward investment and global outreach. Innovation clusters and a partnership approach involving government, industry and academia have helped competitors to build a big lead over the UK. 24 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 12 Steps to the Ideal Innovation Cluster Strong central governance, a not-for-profit set-up and a long-term financial commitment from government – these provide the foundation for success. But our research shows an innovation cluster should also be... 1 ... Government-driven and nationally organised. This will facilitate integration of regional initiatives and mobilisation of the whole supply chain (academic organisations, research institutes, manufacturers, financiers, contractors etc). For example, the Ontario cluster was established by an Act of Parliament, while the key elements in the Israeli cluster are shown opposite. 2 ...launched at ministerial level. This can ensure a significant impact on the international political agenda and help to secure a competitive advantage. Input from the German cluster notes that if it had ‘thought bigger’ from the start, it would have more easily established a prominent position in the sector. 3 ...minister-led, with communication at governmentto-government level. This can help to create the confidence needed to encourage involvement by academia and the private sector. The Dutch cluster has benefited from established diplomatic relations that have provided the basis for government-to-government partnerships with five countries. 4 ...defined by a strong brand built on a very compelling story. This makes it easier to implement a pan-media communications strategy and ensure a unified presence at major conferences and other events. The Singapore cluster, for instance, is focused on the challenges posed by the country’s fragile water supply. 5 ...supported by an international water convention or similar platform in the cluster’s home country. This enables the cluster to showcase its expertise and engage with the global water community. It also provides a chance to demonstrate government leadership (eg through ministerial attendance) and to link with wider political/ business agendas. To take just one example, Germany is home to the Wasser Berlin International trade fair and congress. 6 ...rooted in objectives securely based on economic drivers. In fact, such objectives were not an original feature of the six clusters assessed. But the Singapore cluster, for instance, has now developed economic indicators based on growth and jobs. To investigate further, see Evidence Paper 5. 7 ... built on existing networks and/or trade organisations. This can help to ensure all stakeholders are included and can encourage collaboration. Both the German cluster and the Dutch cluster work closely with their respective national water associations. 8 ... strengthened by a facilitator acting as an intermediary between suppliers and end-users of new technologies. For example, a facilitator has helped to focus the Milwaukee cluster on driving exports. 9 ... characterised by a pragmatic approach to Intellectual Property (IP). This can stimulate innovation and maximise its exploitation. In Singapore, IP stays with the commercial entity even where public money has been secured; Singapore has the first call on any application. 10 ... given access to national test facilities. This will facilitate demonstration of innovative technologies by the companies developing them. In Israel, the NewTech programme gives firms access to the national water company’s facilities. They do not pay for this access, but the utility pays a reduced price for the first commercial installation of the assessed technology. 11 ...based at a single, physical campus. Containing high-tech core facilities for shared use, this campus will act as a focal point for activity and a stimulus to innovation. For example, opened in September 2013, Milwaukee’s Global Water Center houses research facilities for universities and established companies, plus ‘accelerator’ space for emerging firms. 12 ...supported by financial incentives. These can be vital in encouraging the inward investment needed to help a cluster to flourish. In Singapore and Israel, for instance, government-led tax incentives are in place to achieve this objective. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 25 Israel’s NewTech cluster Experienced 2ndtime entrepreneurs Technology incubators Government University graduates of water-related studies Multinational companies co-operation Israeli water technology companies Human capital Supporting environment Immigration VC community Technological convergence Cultural elements ICT Water-saving mindset Entrepreneurship Defence technology Life sciences technology Short time-tomarket approach It Works! It Works! It Works! It Works! From ‘dying industrial centre’ to ‘water technology Mecca’ – the remarkable transformation of Milwaukee was highlighted by Forbes magazine in April 2013. Singapore’s approach to IP, combined with tax incentives, has led to a doubling in the number of water technology companies from 50 to around 100. It has also led to an increase in the number of private and public R&D centres from three to 25. Following the devastation caused by Hurricane Sandy in 2012, the US made a direct approach to harness the Netherlands’ flood management expertise – an approach facilitated by the government-to-government links previously forged between the two countries. In 2011, Israel signed an agreement with India to encourage co-operation on urban water systems – the outcome of over a decade of joint R&D and shared investment in water technologies. Without Israel’s water technology cluster, this would have been much harder to achieve. Innovation in the water sector can benefit greatly by looking across regional and national borders to find collaboration partners that provide new insights, perspectives and opportunities. Robert Schröder, Policy Officer*, DG Environment, European Commission * Policy Officer responsible for the European Innovation Partnership for Water (EIP Water), which has brought together stakeholders and innovators from across Europe to boost opportunities in the water sector. See www.eip-water.eu 26 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Pinpointing Potential: Appropriate Target Markets The world is brimming with opportunities for innovative water technologies. So in which fields is the UK best placed to compete successfully? Globally, innovation is gathering pace Acoustic treatment using ultrasound to remove particulates from water. Adsorption through materials such as activated carbon for water and wastewater treatment. Advanced oxidation processes and supercritical water oxidation for the removal of organic contaminants. Aeration in sewage treatment and water after-treatment. Aquaporins for use in water treatment. Biotechnology, bioengineering, biomimicry and gene-based pathogen removal including biological treatment of wastewater through the use of engineered reed-beds, for instance. Ceramic membranes typically for industrial water but now also trialled for domestic water. Coagulation/settling/flotation processes for both chemical and non-chemical treatment. Condensation approaches for lower energy use and optimised purification. De-aeration for industrial applications. Electro-chemical treatment including ion exchange, capacitive deionisation and electrodeionisation. Heat treatment of water and wastewater. Hydrogen/bacteria/algae power plants for energy generation. Macrofiltration to improve the efficiency of treatment processes. Membrane filtration especially to reduce energy intensity and minimise membrane fouling. Nanotechnology for a range of water treatment and other applications. Sensors, monitors and control systems to increase effectiveness of sustainable water infrastructure management and to provide demand management tools. Thermal hydrolysis for energy recovery. Ultra-violet treatment including the use of light-emitting diodes (LEDs) to cut energy demand. Vapour exchange distillation for desalination. Waste heat recovery/utilisation technologies for cutting treatment processes’ energy needs. Water harvesting and water recovery to maximise beneficial use of water resources. List based primarily on a BlueTech Research survey of client demand and a Cambridge Intellectual Property survey of the intensity of patent applications. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 27 Some markets are unattractive to the UK... ...but others offer massive potential In certain markets that are already far advanced, efforts to scale up the UK’s presence are unlikely to produce significant results in heightening competitiveness and boosting commercial success. Three primary examples are: If the UK is to enhance its position in international markets, it is vital to pinpoint exactly where a boost to our competitive capabilities could pay the biggest dividends. Our track record in managing (and maximising the value of) ageing water infrastructure makes this one obvious area where we are ahead of the game and well positioned to secure a dominant global role. But the eight areas summarised on page 28 – where market pull is already driving innovation – also offer particular scope for success. •membrane filtration: a market characterised by intensity of IP protection and fierce competition, with established players from Germany and Japan now facing a stern test from China and Singapore • c hemical treatment: a market dominated by specialists from the US, Germany and other countries, with new players from Asia representing a growing force •desalination: a market dominated by companies that specialise in developing complete systems for countries where they have longstanding relationships. FACT FOR THOUGHT Tens of billions of dollars are expected to be invested in water systems worldwide over the next decade. Botryococcus braunii (an algal species for biofuel production) leaking hydrocarbons. Reproduced with permission from Gordon Beakes. 28 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Eight key growth markets Smarter systems and software for domestic metering and network monitoring With vast potential to transform the way water and wastewater are managed, smart water is the sector’s most dramatic growth area. Major opportunities include network monitoring and smart grids that link metering and monitoring. Urban water management SUDS, greywater recovery and rainwater harvesting offer major scope for growth – and not just in new-builds and new developments. The big social and economic benefits that these technologies can deliver are a key driver of innovation in this field. Low-energy treatment and better process efficiency Ultrapure water, wastewater treatment and optimisation of asset life/performance – these are just some areas where the need to do more for less is stimulating the search for innovative solutions. Flood security From water mapping and monitoring to the need for flexible flood protection barriers, the quest for better ways of reducing the risk and impact of flooding is acquiring increasing urgency. Wastewater reuse Deriving value from wastewater through energy and nutrient recovery and water recycling will lie at the heart of sustainable utility management in the decades ahead. Fracking Recovery of shale gas via fracking – although controversial – is set to stay on the agenda for the foreseeable future. Environmental standards, impact mitigation, leakage management and water treatment/re-use are likely to generate significant opportunities for innovation. Dry sanitation This is a key issue for cities in developing economies where there is a pressing need for approaches that generate zero or minimal wastewater. Megacities By 2025, 800 million people worldwide will be living in cities of over 5 million inhabitants. This will create unprecedented demand for a whole array of innovations, such as sewage treatment techniques suited to densely populated areas. Regional needs, specific priorities •In the EU market, the current emphasis is on the Water Framework Directive (2015-27), the Groundwater Framework Directive (2015-27), the revised Bathing Water Directive (2015 onwards) and new measures addressing chemicals in water. •Across OECD countries, the emphasis is on more advanced systems, sustainable water management and doing more for less. There is also a need to optimise the operating life and performance of ageing infrastructure. • T he BRIC countries are characterised by the priority of urbanisation and development issues, especially the need to mitigate pollution and extend/modernise infrastructure. •In developing economies, the key need is to implement the United Nations’ post-2015 Millennium Development Goals. This involves ensuring universal access to safe water and sanitation by 2030-50 and developing appropriate systems for dealing with urban sewage. To investigate further, see Evidence Paper 6. KEY MESSAGE Boosting our capabilities in water technology innovation can help the UK to break into major growth markets. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 29 Delivering the Vision: An Action Plan to Make It Happen To grasp the opportunities, swift action is essential. Only timely and decisive implementation of a coherent, multi-faceted, fully integrated plan can deliver our fresh vision for UK water technology. 1 Our four-point plan of action Strengthen the publicprivate UKWRIP Aim: To establish a coherent, unified voice capable of leading forward the UK water technology sector internationally and providing an overall co-ordinated strategy. 2 Create a sharp focus on commercial opportunities and customer needs Aim: To ensure that these drive forward water technology research, innovation and exploitation in the UK. Appoint an executive team supported by a nonexecutive board A not-for-profit company (‘the Partnership’) will establish an executive team to undertake market and opportunity analysis identifying the UK’s priority research, development and commercialisation areas. The executive team will be supported by a non-executive board appointed from relevant stakeholders, to provide strategic direction and leadership with a clear business plan for actions and deliverables. Our aim is to have an executive team and non-executive board in place within 12 months of this report’s launch. They will draw in various waterrelated initiatives across the UK and focus them towards common outcomes and on supporting companies across the innovation cycle. Nurture a climate to stimulate innovation The Partnership will align disparate research, funding and corporate efforts towards clearly defined and managed goals, with three principal themes: Create a recognised international port of call for water innovation in the UK The Partnership, through its central innovation and information hub, will provide a single port of call for enquiries and for attracting new entrants to the sector, including smoothing access to funding, mentoring and market information. It will establish a global UK water innovation brand, spreading its message in a coherent and compelling manner. •encouraging water-based research clusters, bringing together academia, government and industry. Funding will be sought from the public and private sectors. This will be based on a short- and mediumterm business plan designed to mobilise resources towards critical market areas and to ensure that product development maintains its alignment with emerging opportunities. •implementing a UK vision for water opportunities and organising the resources needed to deliver it. This will enable the development of products and services that meet rapidly changing national needs and take advantage of the global opportunities available now and in the future •incentivising universities to contribute to innovation and economic development through R&D and project commercialisation work, along with offering more prize opportunities Ensure we have the research we need Research works best when participants are regularly informed about priorities and timings. To align basic and applied research with longer-term commercial opportunities, the Partnership will engage with institutes and advise them about what these priority areas are in the short and medium term. Make research timely and applicable Applied research driven by market needs (usually funded or part-funded by industry) should be reviewed periodically to maintain its applicability. Poorly performing projects or those less applicable to identified market opportunities could have their funding called into question. 30 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP Align our interests and capabilities Research also works best when companies join in the development process as early as possible. SMEs also need to be more engaged with research councils. For all, this involves mitigating and managing the risk involved in supporting research. The slow development and testing times that characterise the sector and inhibit companies and investors from getting more involved in innovation need to be addressed. Market opportunities will be created by the critical interdependencies with the energy, infrastructure and agriculture sectors. These are amongst the fastestgrowing areas of concern relating to water management. The Partnership will also identify appropriate science and technology to meet needs in the developing world. Raise the profile of water opportunities with the Technology Strategy Board By highlighting where the market opportunities lie, the profile of water with the TSB can be raised. A focus on supply-chain companies, water users and exporters, rather than utilities, will help the TSB to appreciate where the needs are. The TSB will review the water sector and global challenges in 2014 and will identify appropriate actions needed to fill any gaps, using this report as a starting point. 3 Provide independent national testing, validation and demonstration facilities Aim: To accelerate collaborative innovation and catalyse its commercialisation. Provide national testing facilities that transform ideas into sustainable and resilient solutions The Partnership will co-ordinate and operate a not-forprofit test bed for innovation, including for wastewater treatment and underground assets. Nationally recognised testing facilities that will be in operation for a substantial period of time can support pilot testing of new technologies and techniques as well as longer-term trialling to optimise innovation by finding out how separate innovations work together most effectively. The purposes of these facilities will include: focusing on existing water infrastructure needs; and providing the opportunity for blue-sky water technology innovation. ecognise that managing our ageing infrastructure is a R unique selling point The application of smart solutions to ageing infrastructure is shared by the rest of the world. This creates a unique selling point for the UK in a market of huge potential. Develop world-leading research clusters The Partnership will encourage research clusters to develop around these facilities. The government can help through tax incentives and matched funding, as has been successfully demonstrated in Singapore, with overseas companies encouraged to use the testing facilities. Role for the UK water utilities Through the government and the regulators, utilities will be encouraged to engage in the testing and development process. KEY MESSAGE Our four-point plan can transform and position the UK water technology sector as a global innovation powerhouse. HTechO Tapping the Potential: A Fresh Vision for UK Water Technology UKWRIP 4 Implement a co-ordinated, focused international marketing strategy Aim: To develop a strategic brand built on the UK’s unique selling points and spearheaded by an annual international water congress held in this country. Get the UK’s voice heard in the global market The Partnership will hold an annual water conference in the UK. This will provide an opportunity to showcase research and its outcomes globally, as is the case in Berlin, Amsterdam, Singapore and Israel. The event will highlight the unified ‘UK HTechO’ approach. Government support in the form of a ministerial keynote speech and the active presence of other senior government representatives is essential. 31 Next steps The immediate next step for the UK must be to develop a costed business plan with clear actions and deliverables, based on the main steps outlined above. Subsequent actions will include: 1. Analysis of existing SME offerings and categorisation into thematic clusters. 2. A ‘UK plc’ water technology conference based around a target audience of national/international tier 1 framework service providers/contractors (eg Costain, Balfour Beatty, Murphy, Arup, Atkins, Mott McDonald). 3. Establishing a not-for-profit test bed for innovation, including for wastewater treatment and underground assets. Improve understanding and so achieve improved effectiveness Through the improved understanding about market opportunities and research priorities, along with better alignment of all the groups involved with water, we can improve the efficiency of our overseas trade missions. Effectively co-ordinated with the Foreign & Commonwealth Office, the Department for Business, Innovation & Skills (Science and Innovation Network) and UK Trade & Investment (UKTI), trade missions should focus on each market’s identified needs with a thematic approach rather than focusing just on highvalue opportunities. For example, smart water and flood control may stimulate interest from those involved in sustainable cities. This will reinforce UKTI’s drive to seize opportunities in the global sustainable cities market. For more information contact Faith Culshaw, UKWRIP co-ordinator, at faith.culshaw@lwec.org.uk Looking ahead, innovation in the water sector should be measured, then invested in and nurtured by one leadership body responsible for agreeing priorities, reporting progress annually and securing new partnerships for innovative investments. Tom Flood, Chair of Defra/Ofwat Innovation Leadership Group UKWRIP is grateful to the following for their active contribution to this report: Mark Lane UKWRIP Business and Economy Action Group Leader, Chair of British Water and Chair of the UKTI Environment and Water Sector Advisory Group, Consultant to Pinsent Masons LLP Ian Bernard formerly Technical Manager, British Water Andrew Bull Programme Director, Costain Faith Culshaw UKWRIP Co-ordinator Peter Drake CEO, Water Industry Forum James Dunning CEO, Syrinix Darren Forbes-Batey Built Environment Team, Trade Group, UKTI Fiona Griffith General Manager, Isle Utilities Ltd Philippa Hemmings EPSRC Theme Leader for LWEC Hans Jensen CEO, UKWIR Adrian MacDonald Professor of Environmental Management, University of Leeds Alison Maydom Water Efficiency and Innovation, Defra Philip Monaghan Founder and CEO, Infrangilis Dan Osborn UKWRIP Champion and LWEC Interim Champion David Lloyd Owen CEO, Envisager Tony Rachwal Industrial Business Fellow (Water), University of Surrey Nicki Randles Director, Andritz Group Neil Runnalls Programme Development, NERC Water Security Knowledge Exchange Programme (WSKEP) and Business Development Manager, Centre for Ecology & Hydrology Mark Smith Managing Director, WRc plc Tom Stephenson Professor of Applied Sciences, Cranfield University David Stuckey Professor of Biochemical Engineering, Imperial College London Sophie Trémolet Director, Trémolet Consulting Nick Veck Head of Strategy and External Affairs, Satellite Applications Catapult Andrew Walker Founder and Managing Director, Blue Gold Marketing Elizabeth Warham Head of Resilience, Government Office for Science Dickie Whitaker Director, Financial Services Knowledge Transfer Network Editor: Barry Hague Consultant designer and communications adviser: Esther Maughan McLachlan Design: Positive2 HTechO Tapping the Potential: A Fresh Vision for UK Water Technology Any views expressed are those of UKWRIP but do not necessarily reflect those of any individual organisations involved in UKWRIP activities, or of the individual organisations that the contributors respectively represent.