The Global DiamonD RepoRT 2013 Journey through the Value Chain

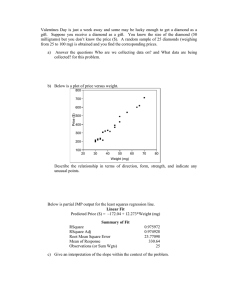

advertisement