1 | P a g e Page | 1

advertisement

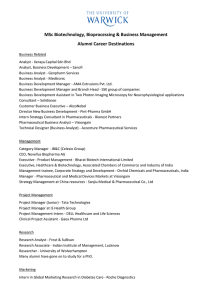

1|Page Report By: Surbhi Lohia – surbhi@dynamiclevels.com Page | 1 Biocon- Making Survival Cheaper Page 2 Company Overview and Stock Price 3 Product Overview 4 Syngene: Exclusively Inclusive 6 Pharma Sector Outlook 7 Govt Initiatives in Pharma 8 Company Financials 9 Peer Comparison 13 Shareholding Pattern 14 Biocon enters Japan 16 Investment Rationale 17 Source: Company, www.dynamiclevels.com Company’s Overview and Stock Price Biocon is India’s largest biotech company run by Kiran Mazumder Shaw. It has presence in more than 100 countries. Biocon has been driven by its strategy to provide affordable access to advanced biopharmaceuticals for global patient populations. It aspires to become a US $ 1 billion company by FY 18. As a fully integrated biopharma company it delivers innovative biopharmaceutical solutions, ranging from discovery to development and commercialization, leveraging the cutting edge science, costeffective drug development capabilities and global scale manufacturing capacities, to move ideas to market. F16 Results highlights are as follows: Revenues grew 16.9% YoY to 978.8 crore mainly due to 32.8% growth in the research segment Syngene. Biopharma segment grew 8.6% YoY to 531 crore due to biosimilar launches in emerging markets, EBITDA margins declined 31 bps YoY to 21.8% mainly due to higher R&D expenses. EBITDA grew 15.3% YoY to 213.3 crore. BIOCON Share Price Performance EXCHANGE SYMBOL BIOCON Current Price * (Rs.) 610.35 Face Value (Rs.) 5 52 Week High (Rs.) 628.5(4-5-16) 52 Week Low (Rs.) 395.3(24-8-15) Life Time high (Rs.) 628.5(4-5-16) Life Time low (Rs.) 85 (2-12-08) Average Daily Movement 14.28 Average Volume 1178973 1 Month Return (%) 16.18 P/E Ratio (x) 13.67 Book Value 208.29 Market Cap 12252.00 (Cr) % of Promoter holding Pledged 0.04 COMPANY PROFILE OF BIOCON Chart Hypothesis: Above is the weekly price chart of Biocon for last 1 yr, in which we can see that it made a new high of628.5 and has given breakout of important level of 545. Page 3 Date of Incorporation 29-Nov-1978 Date of Listing 07-Apr-2004 Management Name Designation M Damodaran Addnl.Independent Director Jeremy Levin Addnl.Independent Director Vijay Kuchroo Addnl.Independent Director Kiran Mazumdar Chairperson & MD Shaw Arun Chandavarkar Joint MD & CEO Daniel M Bradbury Non Exe. Director Russel Walls Non Exe. Director Suresh N Talwar Non Exe. Director Bala S Manian Non Exe. Director Mary Harney Non Exe. Director Charles L Cooney Non Exe. Director Ravi Mazumdar Non Exe. Director John Shaw Vice Chairman Registered Office Address 20th K M, Hosur Road,Electronic City,560100,Bengaluru,Karnataka,India Website http:// www.biocon.com Source: Company, www.dynamiclevels.com Product Overview Biocon has systematically leveraged its technology platforms from enzymes to small molecules to recombinant proteins and antibodies. Through partnerships and alliances, Biocon has strategically moved up the value chain from supplying pharmaceutical bulk actives to developing proprietary molecules and own branded formulations. In the areas of custom and clinical research services, collaborative partnerships with complementary biotechnology and pharmaceutical companies are yielding rich results. These partnerships will positively impact all phases of discovery portfolio. Biocon offers range of products from fermentation derived small molecules to recombinant proteins and antibodies. In the specialized field of custom biomanufacturing, Biocon provides high quality, cost-competitive services to domestic and international pharmaceutical companies. Small Molecules: Biocon's Small Molecules business is built on a robust foundation of unique expertise in fermentation technology and entrenched presence in the chronic therapy space. Biocon’s differentiated portfolio spans complex molecules ranging from cardiovascular and anti-obesity agents to immuno-suppressants and narrow spectrum antibiotics. It provides affordable access to patients and partners across the globe. APIs: Biocon is one of the largest statins and immunosuppressant’s manufacturers in the world and a preferred partner for Active Pharmaceutical Ingredients (APIs). With a strong focus on R&D in the Small Molecules business, Biocon has built a robust pipeline of complex generic products. A steady stream of new Drug Master Files (DMF) is filed with various regulatory authorities in several countries. Generic Formulations: Biocon is developing value-added generic formulations for both emerging and developed markets. The Generic Formulations business, established in 2012, filed its first set of Abbreviated New Drug Applications (ANDAs) in the US and Marketing Authorization Applications (MAAs) in the EU during FY 15. These filings are in line with their strategy of reducing the threat arising from the commoditization of APIs, by moving up the value chain to develop generic finished dosages for global markets. Page 4 Source: Company, www.dynamiclevels.com Forward integration of complex fermentation-based APIs, expertise in producing large-scale sterile injectables and manufacturing capabilities for device-based products are Biocon’s key differentiators in the competitive generic formulations business. To strengthen this business further, Biocon is also setting up a greenfield oral solid dosage facility. Biosimilars: Biocon has leveraged its core strength of fermentation technology to develop a wide portfolio of generic Insulins and Analogs, biosimilar Monoclonal Antibodies (MAbs) and recombinant proteins. Biocon has emerged as a significant global player by competence and pioneering technology capabilities. As the Biosimilars opportunity unfolds, Biocon is at the right place, at the right time. Biocon is rapidly growing its development, regulatory and clinical expertise, along with world class manufacturing capabilities, to make therapies affordable to patients, on a global scale. Biocon is well positioned to contribute towards lowering costs and increasing access to this highly innovative class of drugs. The Biosimilars opportunity is set to expand as patents expire on leading biologics and patients demand lower priced drugs. A number of top-selling biologics are due to lose product patent protection over the next 5-7 years, opening up a wealth of new possibilities for biosimilars players. Key therapy areas such as cancer, diabetes and rheumatoid arthritis will spearhead this new wave of biosimilars. Biocon is well placed to leverage many of these opportunities. Biocon is entering emerging markets with Recombinant Human Insulin (rh-Insulin), Insulin Analogs and Monoclonal Antibodies (MAbs), key products in Biosimilars portfolio. Branded Formulations: Branded Formulations has been a strong growth driver and a considerable value builder for Brand Biocon. The Company is committed to achieving market leadership in its chosen therapeutic areas through a carefully orchestrated strategy of product differentiation and personalized medical support. Biocon's presence in the chronic disease segment in India, is represented by over 80 brands spread across six therapeutic segments: Metabolics, Oncotherapeutics, Nephrology, Comprehensive Care, Immunotherapeutics and Virology. Page 5 Source: Company, www.dynamiclevels.com Syngene: Exclusively inclusive: Syngene has championed the ‘Exclusively inclusive’ philosophy of Biocon by offering niche services to a large and diverse clientele. It has also established exclusively dedicated R&D centers for some of its anchor clients like Bristol. Incorporated in 1993 as a subsidiary of Biocon Limited, Syngene is a leading custom research and manufacturing organization, which supports R&D programs from lead generation to clinical supplies. At Syngene Clinical development group, partners with global pharmaceutical and biotechnology companies in their clinical development programs. It evaluates the safety and efficacy of new drugs across a wide range of therapeutic indications. Syngene team ensure: - Timely execution of projects - Cost effectiveness and quality of the projects - Confidentiality and protection of intellectual property Syngene International IPO oversubscribed 31 times. Mr. Jonathan Hunt, Chief Executive Officer - Syngene International Limited said, “We are happy to report excellent revenue growth of 31% during Q4 FY16, with revenues growing from Rs 254 Cr in Q4 FY15 to Rs 334 Cr in Q4 FY16. This growth has been driven by robust performances within all three of our key business verticals; dedicated R&D centers, discovery services as well as development & manufacturing services. On a full year basis, I am happy to report strong revenue growth of 28%; this momentum, combined with our extensive capital investment plans, puts us “on-track” to achieve our mid-term revenue target for FY 18 and deliver excellent returns for our investors” Page 6 Source: Company, www.dynamiclevels.com Pharmaceutical Sector Outlook The Indian pharmaceuticals market is the 3rd largest in terms of volume and 13th largest in terms of value. Branded generics dominate the pharmaceuticals market, constituting nearly 70 to 80 % of the market. India is the largest provider of generic drugs globally with the Indian generics accounting for 20 % of global exports in terms of volume. The Indian pharmacy industry, which is expected to grow over 15 % p.a. between 2015 and 2020, will outperform the global pharmacy industry, which is set to grow 5 % p.a. between the same periods. Presently the market size of the pharmaceutical industry in India stands at US$ 20 billion. India has the largest number US FDA compliant plants. The industry is expected to reach US$ 55 million by 2020, out of which US$ 30 million will be for exports. Increasing investments in the sector • The Indian pharmaceuticals market increased at a CAGR of 17.46 per cent in 2015 from US$ 6 billion in 2005 and is expected to expand at a CAGR of 15.92 per cent to US$ 55 billion by 2020. • By 2020, India is likely to be among the top three pharmaceutical markets by incremental growth and sixth largest market globally in absolute size. • India’s cost of production is significantly lower than that of the US and almost half of that of Europe. It gives a competitive edge to India over others. Generic drugs form the largest segment • With 70 per cent of market share (in terms of revenues), generic drugs form the largest segment of the Indian pharmaceutical sector. • India supplies 20 % of global generic medicines market exports in terms of volume, making India the largest provider of generic medicines globally and expected to expand even further in coming years • Over the Counter (OTC) medicines and patented drugs constitute 21 % and 9 %, respectively, of total market revenues of US$ 20 billion. Page 7 Source: Company, www.dynamiclevels.com Government Initiatives in Pharma The Government of India’s 'Pharma Vision 2020' aims at making India a global leader in end-to-end drug manufacture. Approval time for new facilities has been reduced to boost investments. Further, the government introduced mechanisms such as the Drug Price Control Order and the National Pharmaceutical Pricing Authority to deal with the issue of affordability and availability of medicines. Some of the major initiatives taken by the government to promote the pharmaceutical sector in India are as follows: Indian Pharmaceutical Association, the professional association of pharmaceutical companies in India, plans to prepare data integrity guidelines which will help to measure and benchmark the quality of Indian companies with global peers. The GOI plans to give incentive to bulk drug manufacturers, including both state-run and private companies, to encourage ‘Make in India’ programme and reduce dependence on imports of active pharmaceutical ingredients (API), nearly 85 % of which come from China. The Department of Pharma has set up an inter-ministerial coordination committee, which would periodically review, coordinate and facilitate the resolution of the issues and constraints faced by the Indian pharmaceutical companies. The Department of Pharma has planned to launch a venture capital fund of Rs 1,000 crore to support start-ups in the R&D in the pharmaceutical and biotech industry. Indian and global companies have expressed 175 investment intentions worth Rs 1,000 crore in the pharmaceutical sector of Gujarat. Telangana has proposed to set up India's largest integrated pharmaceutical city spread over 11,000 acres near Hyderabad, complete with effluent treatment plants and a township for employees, in a bid to attract investment of Rs 30,000 crore in phases. Hyderabad, which is known as the bulk drug capital of India, accounts for nearly a fifth of India's exports of drugs, which stood at Rs 95,000 crore in 2014-15. Page 8 'Pharma Vision 2020' aims at making India a global leader in end-to-end drug manufacture. GOI plans to give incentive to bulk drug manufacturers Encourage ‘Make in India’ programme and reduce dependence on imports of API Source: Company, www.dynamiclevels.com Company Financials Income Statement (in Cr) Net Sales Other Operating Income Total Income From Operations Increase/Decrease in Stocks Consumption of Raw Materials Purchase of Traded Goods Employees Cost Depreciation Other Expenses Total Expenditure Operating Profit Other Income PBIT Interest P/L Before XO Items & Tax Exceptional Item P/L Before Tax Tax PAT Minority Interest Net Profit/(Loss) For the Period Equity Share Capital Reserves EPS (Rs.) Mar16 Quarterly 970.3 8.5 978.8 23.9 307.8 29.5 173.5 62.8 231 828.5 150.3 24.7 175 1.4 173.6 268.4 442 58.2 383.8 -22.9 360.9 100 -18.05 Dec15 Quarterly 828.2 8.2 836.4 -28.5 310.3 30.9 158.9 62.1 175.7 709.4 127 19.7 146.7 1.5 145.2 -145.2 24.1 121.1 -18.1 103 100 -5.15 Sep15 Quarterly Jun15 Quarterly 828.48 8.72 837.2 -41.2 346.66 24.16 149.68 59.61 160.24 699.15 138.05 24.6 162.65 2.93 159.72 307 466.72 137.69 329.03 -23.06 305.97 100 -15.3 778.96 54.03 832.99 13.99 290.12 22.42 154.27 57.8 140.01 678.61 154.38 23.52 177.9 4.42 173.48 -173.48 36.95 136.53 -10.29 126.24 100 -6.31 Mar15 Quarterly 830.38 7.3 837.68 9.88 292.29 35.34 136.56 58.52 178.38 710.97 126.71 16.83 143.54 -143.54 95.16 238.7 21.9 216.8 -15.26 201.54 100 -10.08 Mar16 Annual 3,405.90 79.5 3,485.40 -31.8 1,254.90 107 636.3 242.3 699 2,907.70 577.7 84.5 662.2 10.2 652 575.4 1,227.40 256.9 970.5 -74.4 896.1 100 3,954.70 44.81 Profitability Highlights: Top line of the company has increased YoY from 830 Cr to 970 Cr Co has exceptional item of rs 268.4 Cr exceptional item was on account of the previously deferred amounts of Rs 268 crore relating to clinical trial and development activities of insulin products with its Mexican partner, Lab PiSA The firm’s contract research arm Syngene had contributed about 33% to Biocon revenues. If we exclude the exceptional item PAT has gone down QoQ by 6%, on including the exceptional item the PAT has gone up by 217% Page 9 Source: Company, www.dynamiclevels.com Balance Sheet (In Mn) Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Total Current Assets(A) Cash & Near Cash Items Short Term Investments Accounts & Notes Receivable Inventories Other Current Assets Total Long-Term Assets(B) Long Term Investments Gross Fixed Assets Accumulated Depreciation Net Fixed Assets Other Long Term Assets Total Assests(A+B) Total Current Liabilities (C) 18,072 2,984 5,421 4,958 4,137 572 17,784 478 19,766 6,327 13,439 3,867 35,856 10,606 19,997 2,836 7,310 4,917 3,783 1,151 19,453 511 23,217 7,852 15,365 3,577 39,450 10,158 22,400 4,735 7,208 5,097 3,984 1,376 21,761 645 26,610 9,672 16,938 4,178 44,161 9,899 26,388 5,564 9,476 5,998 3,766 1,584 31,118 645 37,577 11,711 25,866 4,607 57,506 13,796 24,626 4,620 6,049 7,705 4,527 1,725 39,128 1,000 44,688 13,943 30,745 7,383 63,754 15,547 39,932 19,213 4,285 8,229 5,114 3,091 44,884 4,123 NA NA 38,837 1,924 84,816 16,276 Accounts Payable Short Term Borrowings Other Short Term Liabilities Total Long Term Liabilities(D) Long Term Borrowings Other Long Term Borrowings Total Liabilities Minority Interest Share Capital & APIC Retained Earnings & Other Equity Total Shareholders Equity(E) Total Liabilities & Equity(C+D+E) Book Value Per Share 2,965 2,474 5,167 4,545 658 3,887 15,151 377 3,788 16,540 20,705 35,856 102 3,478 1,873 4,807 6,530 698 5,832 16,688 38 3,788 18,936 22,762 39,450 114 3,455 1,033 5,411 6,663 1,640 5,023 16,562 653 3,788 23,158 27,599 44,161 135 3,472 2,575 7,749 12,620 6,062 6,558 26,416 823 3,788 26,479 31,090 57,506 151 4,293 3,476 7,778 13,779 7,696 6,083 29,326 1,722 3,788 28,918 34,428 63,754 164 5,471 3,949 6,856 24,872 20,724 4,148 41,148 3,112 1,000 39,556 43,668 84,816 203 Balance Sheet Highlights: Total assets of the company has 136% which shows that overall growth of BIOCON has more than doubled in last 6 years Long term Borrowing of the company has almost doubled YoY, BIOCON is mainly investing on expansion and R&D, with the expectation of creating positive cashflows in the years to come. Book Value has doubled in 6 years from 102 to 203. Biocon has retained good portion of earnings from 16540 to 39556 million Page 10 Source: Company, www.dynamiclevels.com Cash Flows (In Mn) Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Net Income 3,675 3,384 5,089 4,138 4,974 Depreciation & Amortization 1,567 1,758 1,793 2,036 2,210 Other Non-Cash Adjustments 2 (480) 76 (548) (1,215) Changes in Non-Cash Capital 2,692 980 (1,923) 377 (3,540) Cash From Operating Activities 7,936 5,642 5,035 6,003 2,429 6 0 1 28 -- (1,890) (2,745) (3,586) (7,885) (8,381) Increase in Investments (825) (1,541) (1,981) (2,479) -- Decrease in Investments 21,105 823 1,643 2,170 -- Other Investing Activities (21,730) (473) (236) (1,623) 2,967 Cash From Investing Activities (3,334) (3,936) (4,159) (9,789) (5,414) Dividends Paid (768) (997) (1,162) (1,755) (1,446) Change in Short Term Borrowings (594) (535) (1,028) 1,634 171 Increase in Long Term Borrowings 623 174 1,191 4,579 3,247 Decrease in Long Term Borrowings (1,769) (215) (206) (186) (145) 97 348 1,379 344 105 Cash From Financing Activities (2,411) (1,225) 174 4,616 1,932 Net Changes in Cash 2,191 481 1,050 830 (1,053) Free Cash Flow (CFO-CAPEX) 6,046 2,897 1,449 (1,882) (5,952) Free Cash Flow To Firm 6,106 2,941 1,483 (1,870) (5,932) Free Cash Flow To Equity 4,312 2,321 1,407 4,173 (2,679) Free Cash Flow per Share 30.92 14.79 7.40 (9.59) (29.76) Disposal of Fixed Assets Capital Expenditures Other Financing Activities Cash Flow Highlights: BIOCON has incurred capital expenditure due to which overall cash flow of the Company has become negative Operating Cash flow is positive but declined due to deal with Syngene. Page 11 Source: Company, www.dynamiclevels.com Ratio Analysis Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Valuation Ratios Price Earnings 19.85 13.84 10.53 20.13 18.87 10.79 EV to EBIT 17.31 11.74 11.80 15.21 19.42 17.48 EV to EBITDA 12.17 7.76 8.09 10.94 13.42 12.31 Price to Sales 3.77 2.29 2.16 2.89 3.04 2.84 Price to Book 3.39 2.10 2.03 2.80 2.87 2.38 Dividend Yield 0.01 0.02 0.03 0.01 0.01 0.01 EBITDA Margin 0.29 0.25 0.23 0.25 0.23 0.24 Operating Margin 0.21 0.17 0.16 0.18 0.16 0.17 Profit Margin 0.21 0.17 0.20 0.14 0.16 0.26 Return on Assets 0.11 0.09 0.12 0.08 0.08 0.12 Return on Equity 0.19 0.16 0.20 0.14 0.16 0.24 Current Ratio 1.70 1.97 2.26 1.91 1.58 2.45 Quick Ratio 1.26 1.48 1.72 1.52 1.18 1.95 52.90 67.24 97.70 35.46 31.52 56.64 Tot Debt/Capital 0.13 0.10 0.09 0.22 0.25 0.36 Tot Debt/Equity 0.15 0.11 0.10 0.28 0.32 0.57 Asset Turnover 0.55 0.54 0.59 0.57 0.51 0.46 Accounts Receivable Turnover 3.80 4.15 4.96 5.19 4.51 4.28 Accounts Payable Turnover 2.86 2.43 2.95 3.03 3.28 NA Effective Tax Rate 0.15 0.14 0.16 0.20 0.15 0.21 Profitability Ratios Leverage & Coverage Ratios Interest Coverage Ratio (EBIT/I) Others Ratio Analysis: Biocon’s debt equity has increased but still the company is managing to maintain it below 1 benchmark of pharma industry Return on Asset has increased yoy by 50% from 0.08 to 0.12 Return on Equity has increased yoy by 50% from 0.16 to 0.24 Biocon’s Interest Coverage ratio is very good 56.64 which signifies company has enough earnings (EBIT) to repay its increasing debt. Page 12 Source: Company, www.dynamiclevels.com Peer Comparison Company Name: Latest Fiscal Year: 52-Week High 52-Week High Date 52-Week Low 52-Week Low Date Daily Volume Current Price: 52-Week High % Change 52-Week Low % Change Total Common Shares Market Capitalization Total Debt Minority Interest Cash and Equivalents Current Enterprise Value BIOCON WOCKHARDT CIPLA LTD LTD LTD 03/2016 03/2016 03/2015 628.50 1,748.20 748.00 5/4/2016 12/2/2015 8/17/2015 395.30 705.75 494.55 8/24/2015 2/12/2016 3/29/2016 389,572 580,864 331,729 617.55 963.25 535.00 -1.7% -44.9% -28.5% 56.2% 36.5% 8.2% 200.0 110.5 803.0 123,510.0 106,440.0 429,810.6 24,673.0 22,041.9 17,033.3 3,112.0 4,703.7 1,804.8 23,498.0 14,781.1 9,354.9 127,797.0 118,404.5 441,078.9 AUROBINDO PHARMA 03/2015 891.50 12/30/2015 582.00 2/25/2016 701,934 817.40 -8.3% 40.4% 584.0 478,317.6 NA NA NA 514,102.6 LUPIN SUN LTD PHARMA 03/2015 03/2015 2,129.00 1,010.10 10/6/2015 5/25/2015 1,280.00 704.00 3/29/2016 11/24/2015 203,378 763,878 1,609.55 806.10 -24.4% -20.2% 25.7% 14.5% 449.5 2,071.2 725,419.0 1,940,015.7 NA NA NA NA NA NA 725,758.3 1,902,859.9 Above table shows that among all the peers BIOCON is the strongest having hit 52 week high recently in 2016 while all the shares have hot 52 week low in 2016 Price & Volume Comparison INSTRUMENT Price Avg. Volume Market Cap (Rs. in Cr) BIOCON 617 1140382 12207 AUROBINDO 815 1621480 47773 PHARMA CIPLA 535 1968193 43109 LUPIN 1609 1103972 72355 SUN PHARMA 803 2564929 193816 WOCKHARDT 958 991621 10501 BIOCON is a Midcap Company with good average volume INSTRUMENT BIOCON AUROBINDO PHARMA CIPLA LUPIN SUN PHARMA WOCKHARDT FII Holding & P/E Ratio Comparison Int. INSTRUMENT % FII P/E Debt Coverage Holding Ratio Equity BIOCON 13.63 13.62 0.32 84.15 AUROBINDO 28.78 26.19 0.75 16.64 PHARMA CIPLA 9.85 25.59 0.16 13.83 LUPIN 37.03 35.97 0.05 393.41 SUN PHARMA 26.41 49.79 0.3 14.53 WOCKHARDT 2.23 32.26 0.54 14.05 BIOCON has lowest PE ratio, with low Debt equity and high interest coverage ratio. Price Performance Comparison Price 1M 617.3 13.79 815.6 7.7 535.1 6.36 1609.7 4.24 803.95 -0.79 958 -0.76 3M 33.41 18.1 -0.38 -13.36 -5.9 -0.59 6M 39.38 -1.79 -16.41 -10.33 10.02 -38.2 1Y 40.63 27.08 -18.05 -9.32 -14.35 -26.2 BIOCON is the top performer given highest return in last 1 year where its peers have given negative return. Page 13 Source: Company, www.dynamiclevels.com Shareholding Pattern Shareholding Pattern Mar-16 Dec-15 Sep-15 Jun-15 Promoter and Promoter Group (%) 60.72 60.72 61.02 61.02 Indian 39.92 39.92 39.92 39.92 Foreign 20.80 20.80 21.10 21.10 Institutions (%) 19.35 19.77 19.21 19.91 FII 13.63 12.80 11.83 11.59 DII 5.72 6.97 7.38 8.33 NonInstitutions (%) 19.93 19.51 19.76 19.06 Bodies Corporate NIL NIL 1.44 1.55 Others 17.99 17.66 18.32 17.51 Custodians 1.94 1.85 NIL NIL Total no. of shares (cr.) 20.00 20.00 20.00 20.00 BIOCON’S shareholding shows that FII investment has been contact throughout the year Persons holding securities more than 1% of total number of shares under category Public Shareholding. Glentec International Kiran Mazumdar Shaw ARUN SURESH CHANDAVARKAR Franklin Templeton Investment funds KIRAN MAZUMDAR SHAW - Trust LIC of India Health Protection Plus fund MURALI KRISHNAN K N RELIANCE CAPITAL TRUSTEE CO. LTD Swiss Finance Corporation (Mauritius) Ltd Category Promoters Promoters Non Promoters Non Promoters Non Promoters Non Promoters Non Promoters Non Promoters Non Promoters Mar-15 61.02 40.42 20.60 19.10 10.73 8.37 19.87 2.65 17.23 NIL 20.00 Mar-16 Dec-15 Sep-15 Jun-15 Mar-15 19.77 39.64 1.1 3.02 1.75 1.55 1.05 1.23 NIL 19.77 39.64 1.1 NIL 1.75 2.36 1.05 1.28 NIL 19.77 1.86 1.1 2.93 NIL 2.5 1.14 NIL 1.03 19.77 39.64 1.1 2.79 NIL 2.93 1.14 NIL NIL 19.77 39.64 1.1 2.7 NIL 3.12 1.14 NIL NIL Promoters of BIOCON have kept their investment constant throughout the year Page 14 Source: Company, www.dynamiclevels.com 0.53% 3.97% Geographic Ownership Distribution Unknown Country 79.14% United States 9.49% India 5.75% Luxembourg 3.97% Britain 0.53% Finland 0.28% Ireland 0.27% Others 0.57% 0.28% 5.75% 0.27% 0.57% 9.49% India Luxembourg 79.14% Ireland 4.23% 1.98% 75.24% Investment Advisor 4.23% Government 1.98% 75.24% Individual Government Ownership (Institutiona l) Ownership Statistics Shares Outstanding (M) 200.0 Float 33.8% Ownership (Institutional) 36.80% Ownership (Retail & Other) 18.34% Ownership (Insider) 44.85% Page 15 Other Investment Advisor 18.55% 18.55% Individual Britain Finland Institutional Ownership Distribution Other Unknown Country United States 44.85% 36.80% 18.34% Ownership (Retail & Other) Ownership (Insider) Source: Company, www.dynamiclevels.com BIOCON enters Developed Market for the 1st time ever. BIOCON received first regulatory approval in a developed country to sell its biosimilar product 'Insulin Glargine' in Japan. In Japan BIOCON will be partnering with FUJIFILM Pharma the key pharma Co in that country. This is the first biosimilar that would enter Japan from any non multinational company (MNC). Japan has only 3 players for the product currently. This will offer business worth USD 8-10 billion from FY17. This deal will also help BIOCON enter other developed markets especially US and Europe. Insulin is almost approaching USD 100 million businesses; this is a significant regulatory approval that will enable BIOCON to exponentially grow its insulin and insulin analogue business in the years to come. The company hopes to enable the Japanese government to bring down its healthcare expenditure on diabetes with the use of this cost effective, high quality biosimilar Insulin Glargine. The company aims to capture a significant share of the Japanese Glargine market of USD 144 million which is the second largest market outside of North America and Europe and is largely dominated by disposable pens. Page 16 Source: Company, www.dynamiclevels.com Investment Rationale The global market opportunity for biosimilars is estimated to reach US$24 billion in 2019. The Indian pharmaceutical market size is expected to grow to US$ 100 billion by 2025, driven by increasing consumer spending, rapid urbanization, and raising healthcare insurance among others. Big Pharma is beginning to realize that global priorities are shifting from providing exclusive and expensive drugs to more affordable drugs which can help enhance access. The opportunities are in the fast-growing emerging markets, where the old business model of expensive medicines targeted at niche populations of affluent patients will not work. Biocon has been driven by its strategy to provide affordable access to advanced biopharmaceuticals for global patient populations. Through ‘Exclusively inclusive’ approach, BIOCON is developing a specialty portfolio of products that can benefit millions of patients the world over. BIOCON has set out to build global reach and economies of scale and is steadfastly investing in developing a range of affordable therapies for diabetes, cancer and autoimmune diseases, most of which were previously unaffordable and hence inaccessible to many. The biotech industry is fast approaching its own patent cliff. Some recent biosimilars approvals are beginning to make a difference by increasing accessibility for a larger patient population. Biocon, with its rich pipeline of biosimilars under development, is at the right place at the right time. BIOCON’s aim over the next 10 years is to provide Biocon’s Insulin products to one in five diabetic patients in need of insulin-based therapy, anywhere in the world. BIOCON is the largest producers of insulins in Asia. Over the past decade, more than a million patients have benefited from Biocon’s inclusive diabetes management portfolio. The on-time commissioning of the Malaysia plant, designed as Asia’s largest integrated insulins manufacturing facility, has put BIOCON on track to become one of the world’s largest insulin producers. BIOCON’s entry into Japan will offer business worth USD 8-10 billion from FY17 Biosimilars: Indian Positioning We recommend BUY in BIOCON @ 560-580 with the Target of 750 as BIOCON is the Market leader globally in biopharma and is trading at a very low PE of 14 compared to industry PE of 42. Page 17 Source: Company, www.dynamiclevels.com Disclaimer: Research Disclaimer and Disclosure inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations, 2014. Dynamic Equities Pvt. Ltd. is a member of National Stock Exchange of India Ltd. (NSEIL), Bombay Stock Exchange Ltd (BSE), Multi Stock Exchange of India Ltd (MCXSX) and also a depository participant with National Securities Depository Ltd (NSDL) and Central Depository Services Ltd.(CDSL). Dynamic is engaged in the business of Stock Broking, Depository Services, Investment Advisory Services and Portfolio Management Services. Dynamic Equities Pvt. Ltd. is holding company of Dynamic Commodities Pvt. Ltd. , a member of Multi Commodities Exchange (MCX) & National Commodity & Derivatives Exchange Ltd.(NCDEX). We hereby declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered. SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise letters or levied minor penalty on for certain operational deviations. Answers to the Best of the knowledge and belief of Dynamic/ its Associates/ Research Analyst who prepared this report DYANMIC/its Associates/ Research Analyst/ his Relative have any financial interest in the subject company? No DYANMIC/its Associates/ Research Analyst/ his Relative have actual/beneficial ownership of one per cent or more securities of the subject company? No DYANMIC/its Associates/ Research Analyst/ his Relative have any other material conflict of interest at the time of publication of the research report or at the time of public appearance? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation from the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have managed or co-managed public offering of securities for the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months? No DYANMIC/its Associates/ Research Analyst/ his Relative have received any compensation or other benefits from the Subject Company or third party in connection with the research report? No DYANMIC/its Associates/ Research Analyst/ his Relative have served as an officer, director or employee of the subject company? No DYANMIC/its Associates/ Research Analyst/ his Relative have been engaged in market making activity for the subject company? No General Disclaimer: - This Research Report (hereinafter called “Report”) is meant solely for use by the recipient and is not for circulation. This Report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The recommendations, if any, made herein are expression of views and/or opinions and should not be deemed or construed to be neither advice for the purpose of purchase or sale of any security, derivatives or any other security through Dynamic nor any solicitation or offering of any investment /trading opportunity on behalf of the issuer(s) of the respective security (ies) referred to herein. These information / opinions / views are not meant to serve as a professional investment guide for the readers. No action is solicited based upon the information provided herein. Recipients of this Report should rely on information/data arising out of their own investigations. Readers are advised to seek independent professional advice and arrive at an informed trading/investment decision before executing any trades or making any investments. This Report has been prepared on the basis of publicly available information, internally developed data and other sources believed by Dynamic to be reliable. Dynamic or its directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information / opinions / views. While due care has been taken to ensure that the disclosures and opinions given are fair and reasonable, none of the directors, employees, affiliates or representatives of Dynamic shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including loss profits arising in any way whatsoever from the information / opinions / views contained in this Report. The price and value of the investments referred to in this Report and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance. Dynamic levels do not provide tax advice to its clients, and all investors are strongly advised to consult with their tax advisers regarding taxation aspects of any potential investment. Opinions expressed are our current opinions as of the date appearing on this Research only. We do not undertake to advise you as to any change of our views expressed in this Report. User should keep this risk in mind and not hold dynamic levels, its employees and associates responsible for any losses, damages of any type whatsoever. Dynamic and its associates or employees may; (a) from time to time, have long or short positions in, and buy or sell the investments in/ security of company (ies) mentioned herein and it may not be construed as potential conflict of interest with respect to any recommendation and related information and opinions. Without limiting any of the foregoing, in no event shall Dynamic and its associates or employees or any third party involved in, or related to computing or compiling the information have any liability for any damages of any kind. We and our affiliates/associates, officers, directors, and employees, Research Analyst(including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/company (ies) discussed herein or act as advisor to such company (ies) or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of Research Report. Dynamic may have proprietary long/short position in the above mentioned scrip(s) and therefore may be considered as interested. The views provided herein are general in nature and does not consider risk appetite or investment objective of particular investor; readers are requested to take independent professional advice before investing. This should not be construed as invitation or solicitation to do business with Dynamic. Dynamic Equities Pvt. Ltd. are also engaged in Proprietary Trading apart from Client Business. https://www.dynamiclevels.com/en/disclaimer Page 18 Source: Company, www.dynamiclevels.com