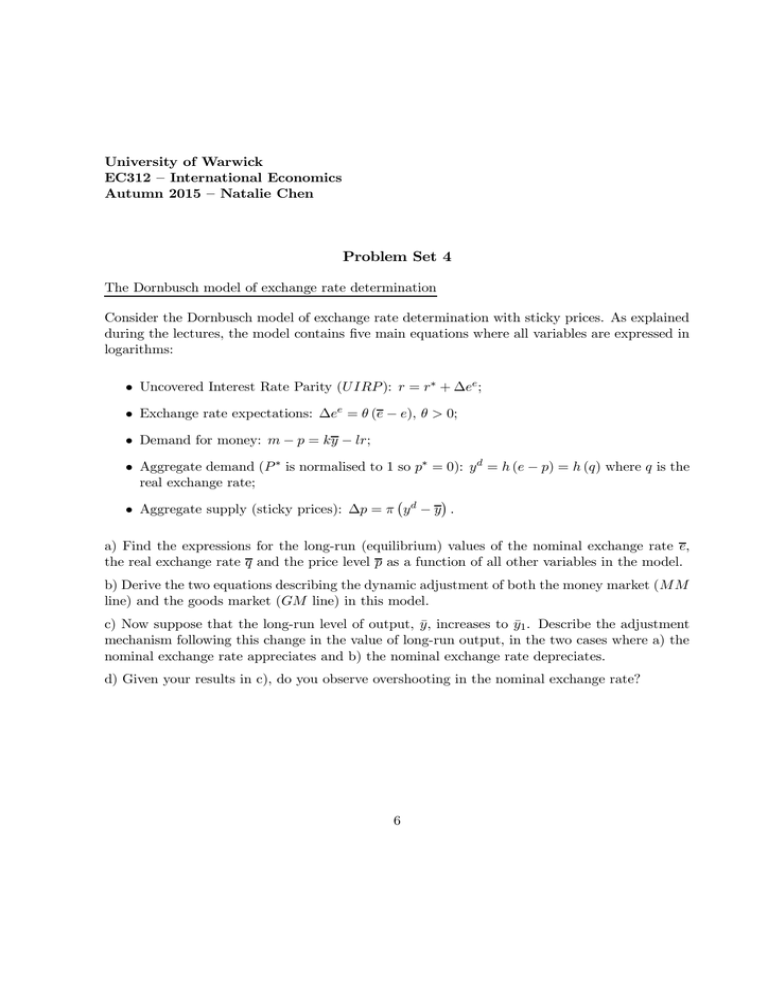

Problem Set 4

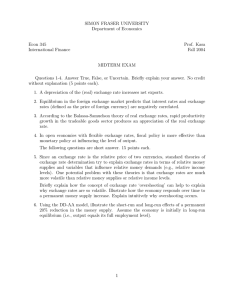

advertisement

University of Warwick EC312 – International Economics Autumn 2015 – Natalie Chen Problem Set 4 The Dornbusch model of exchange rate determination Consider the Dornbusch model of exchange rate determination with sticky prices. As explained during the lectures, the model contains …ve main equations where all variables are expressed in logarithms: ² Uncovered Interest Rate Parity ( ): = ¤ + ¢ ; ² Exchange rate expectations: ¢ = ( ¡ ), 0; ² Demand for money: ¡ = ¡ ; ² Aggregate demand ( ¤ is normalised to 1 so ¤ = 0): = ( ¡ ) = () where is the real exchange rate; ¡ ¢ ² Aggregate supply (sticky prices): ¢ = ¡ a) Find the expressions for the long-run (equilibrium) values of the nominal exchange rate , the real exchange rate and the price level as a function of all other variables in the model. b) Derive the two equations describing the dynamic adjustment of both the money market ( line) and the goods market ( line) in this model. c) Now suppose that the long-run level of output, ¹, increases to ¹1 . Describe the adjustment mechanism following this change in the value of long-run output, in the two cases where a) the nominal exchange rate appreciates and b) the nominal exchange rate depreciates. d) Given your results in c), do you observe overshooting in the nominal exchange rate? 6