Government in the Standard Solow Model 1 Basic setup Jorge F. Chavez

advertisement

Government in the Standard Solow Model

Jorge F. Chavez∗

October 30, 2012

1

Basic setup

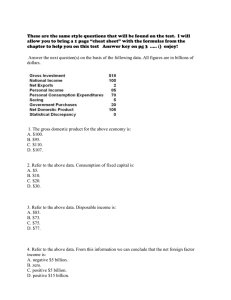

Time is discrete. The economy is inhabited by Lt households which growth at a rate n every

period. That is Lt+1 = (1 + n)Lt . The technology is of the Cobb-Douglas type with constant

returns to scale and besides capital and labor, includes government spending1 .

Yt ≡ F (Kt , Lt , Gt ) = Ktα Lγt Gβt

where α, β, γ > 0 and α + β + γ = 1 (CRS assumption). Here, the productive government

assumption comes into play sice it increases the output of the firm.

The resource constraint now includes Gt :

Ct + It + Gt ≤ Yt ≡ Ktα Lγt Gβt

2

The case of a lump-sum tax

Suppose first that the government poses a lump-sum tax (a tax that you pay in fix amount,

“just because you are born”). Each person pays the same amount, independent of income.

For simplicity we will assume that the government runs a balanced budget: there is no debt

and government spending Gt is financed entirely by aggregate tax reveneus Tt :

Gt = Tt

The Ricardian Equivalence guarantees that we do not need to worry about any other way to

finance government spending (why?).

Let Ytd = Yt − Tt denote disposable income after the lump sum tax is collected. We will be

using the long-run Keynesian consumption function:

Ct = (1 − s)Ytd

∗

1

e-mail:j.chavez-cotrado@warwick.ac.uk

One possibility would be to think of Gt as public infrastructure

1

where (1 − s) is the marginal propensity to consume and s is the usual saving rate.

The aggregate stock of capital follows the usual law of motion:

Kt+1 = It + (1 − δ)Kt

Using the no population growth assumption (L0 = 1 and n = 0) and the fact that savings are

a constant portion of disposable income (which is equivalent to assume that consumption is a

constant proportion of disposable income) then:

(1 + n)kt+1 = s(yt − τt ) + (1 − δ)kt

where τt = Tt /Lt . Then:

kt+1 =

s(ktα τtβ − τt ) + (1 − δ)kt

(1 + n)

Note that we could assume that individuals pay exactly the same amount of tax every period,

that is τt = τ . This is equivalent at assuming that Tt grows at the same rate as population

to that the ratio Tt /Lt remains constant. Hence τ here would be just another parameter and

therefore the non-linear difference equation is well specified.2 The steady-state condition is then:

s(k α τ β − τ ) = δk

Remark 2.1. Because Gt = Tt enters in the production function, the above setting cannot

yield the standard setting with no taxes. That is, we cannot easily shut-down taxes in the above

model to get the standard version of the Solow model with Cobb-Douglas production function.

Remark 2.2. How would the steady state condition would change if we use an income tax

instead of a lump-sum tax scheme?

2

Otherwise the sequence {τ } would act as an exogenous forcing term for the path of kt+1 and its treatment

would make things a little bit more complicated.

2