CORPORATE GOVERNANCE

advertisement

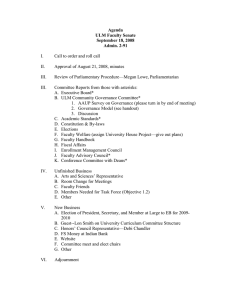

CORPORATE GOVERNANCE Course Description The module will examine the ongoing convergence of the corporate and market laws in relation to the universal issues in doing international business ethically. We will review the corporate governance mechanisms, the methods of expropriating investors and the current reforms of ensuring corporate control and diminishing of the level of corporate abuse. Topics covered include comparative corporate governance, the contemporary corporate governance theories, including market, political, cultural and historical approaches, economics of corporate governance, governance standards and future developments. Course Requirements and Credits Course Requirements : Graduate status Course Credit Hours : 50 hours Target Audience Doctoral students. Instructional stage. Learning Objectives The module examines the sensitive issues of corporate governance, social responsibility and control. We will be reviewing the legal and ethical systems of a number of countries, aiming to show the differences that exist and the difficulty in dealing with this very difficult and complex topic of business. Suggested Readings □ Corporate Governance: International Edition, John R. Nofsinger, Kenneth A. Kim, ISBN: 013128732X, Publisher: Prentice Hall, Copyright: 2004 Suggested further readings: □ Legal Basis of Corporate Governance in Publicly Held Corporations: A Comparative Approach, Arthur Roy Pinto (Editor), University of London Institute of Advanced Legal S, Gustavo Visentini (Editor), ISBN: 9041196633, May 2002, Publisher: Kluwer Law International □ Keeping Better Company: A Study of Corporate Governance in Five Countries, 2nd ed., Jonathan Charkham, ISBN13: 9780199243181, Oxford University Press. □ Harvard Business Review on Corporate Governance (a Harvard Business Review Paperback), Walter J. Salmon, John Pound, Edward E. Lawler,III, Gordon Donaldson, David Finegold, ISBN: 1578512379, January 2000, Publisher: Harvard Business School Publishing, □ Corporate Finance and Governance: Cases, Materials, and Problems for an Advanced Course in Corporations, Lawrence E. Mitchell, Lewis D. Solomon, Lawrence A. Cunningham, ISBN: 0890891621, January 1997, Publisher: Carolina Academic Press □ International Corporate Governance Network: http://www.icgn.org/ □ Global Corporate Governance Forum: http://www.gcgf.org/ □ World Bank, Corporate Governance Initiative: http://www.worldbank.org/html/fpd/privatesector/.. □ Organization for Economic Cooperation and Development, Corporate Governance Initiative: http://www.oecd.org □ Corporate Governance Journal: http://www.academyofcg.org/ejournal.htm □ Board of Directors http://www.nonprofits.org/npofaq/keywords/1a.html □ Corporate Board Member Magazine http://www.boardmember.com/ □ European Corporate Governance Institute http://www.ecgi.org/codes/country_pages/ on Governance: □ Institute http://www.iog.ca/boardgovernance of Corporate Governance Codes: □ Index http://www.ecgi.org/codes/all_codes.htm Course Outline □ Overview of the mechanisms, codes, issues and practices of corporate governance. Theoretical aspects of corporate governance: contracting, transaction cost economics, agency theory, decision-making, □ Horizontal, vertical, private and public accountability. □ Corporate governance issues and impact at different stages of company’s life. □ Introduction to Global Corporate Governance. Globalization of governance. Comparative corporate governance. □ The forms of corporate ownership and control internationally. The role of the state. The role of private capital. □ The corporate governance function in small and medium-sized companies. □ Securities Markets. Cross listing, fair and unfair competition among securities markets, the roles of the government regulations in creating a competitive regulatory environment. Piggybacking and Bonding □ Effect of corporate governance on stock prices. Price signals and feedback information □ Debt contracting and debt structures □ Institutional investors. The role of these in monitoring companies and impact between enterprise and accountability. □ Investor protection around the world. Tunneling. Institutions and the law. Convergence thesis. Theory of path dependence and rent-protection theory. Functional convergence. □ Beyond the law: role, impact and enforcement. Methods of achieving regulatory order □ Market based vs bank based economies. □ Auditors and auditing. □ Board functions, board compositions, monitoring committees, accountability to shareholders and stakeholders. □ International and domestic issues in executive compensation, management, Boards of Directors and codes of best practice □ Corporate governance and finance in the USA. Characteristics of the US system. Advantages and disadvantages. Recent developments, problems and issues faced by the legal and ethical system. CrossBorder M&A and Cross-Listing □ Corporate governance and finance in the EU. Characteristics of the German, Italian, French systems. Advantages and disadvantages. Recent developments, problems and issues faced by the legal and ethical system. Cross-Border M&A and Cross-Listing □ Corporate governance and finance in Japan. Characteristics of the Asian systems. Advantages and disadvantages. Recent developments, problems and issues faced by the legal and ethical system. CrossBorder M&A and Cross-Listing □ Corporate governance and finance in Latin America . Characteristics of the Latin American Systems. Challenges, recent developments, problems and issues faced by the legal and ethical system. □ Substitutability and complementarity in corporate governance mechanisms □ Issues in short termism. □ The role of governance in innovation in the economy. □ Codes. Code contant. Critiques of codes – empirical findings. Impact of codes and roles on shareholder and stakeholder maximization. □ Latest trends in international corporate governance. The new driving forces behind international governance □ Final project Methodology The module consists of virtual classes, discussions and presentations on each topic. Participants work with case studies which illustrate contradictory examples and which demand analytical thinking and strong argumentation skills. Grading Policies Presence : Participation : Final Exam : live video lectures recommended obligatory Final project Contact Information Swiss Management Center Forum for Research and Entrepreneurial Education Baarerstrasse 112 Zug Switzerland