YOUR RIGHTS ON RESERVE: A LEGAL TOOL-KIT FOR ABORIGINAL

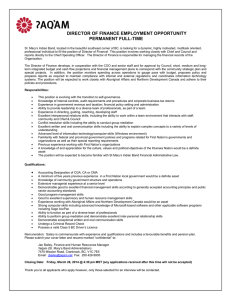

advertisement