Human Capital and Economic Growth Robert J. Barro

advertisement

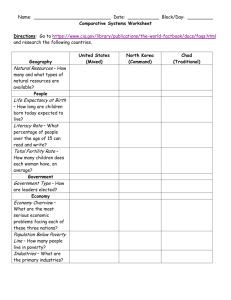

Human Capital and Economic Growth Robert J. Barro Many theoretical models of economic growth, such as those of Nelson and Phelps (1966); Lucas (1988); Becker, Murphy, and Tamura (1990); Rebelo (1992); and Mulligan and Sala-i-Martin (1992), have emphasized the role of human capital in the form of educational attainment. Empirical studies of growth for a broad crosssection of countries, such as those by Romer (1990a), Barro (1991), Kyriacou (1991), and Benhabib and Spiegel(1992), have used proxies for human capital. These studies have, however, been hampered by the limited educational data that were available on a consistent basis for a large number of countries. Recent research by Barro and Lee (1992) through the World Bank has provided better estimates of educational attainment for a large number of countries over the period 1960 to 1985. Hence, these data make it possible to use a broad sample of experience across countries and over time to assess the interplay between human capital and economic growth. This paper summarizes preliminary empirical results that use these data. These results provide empirical support for economic theories that emphasize the role of human capital in the growth process. A new data set on educational attainment Barro and Lee (1992) have used the census-survey data from the United Nations and other sources for more than 100 countries. These figures were combined with information about school-enrollment 200 Roberr J. Burro ratios to construct a panel data set on educational attainment at five-year intervals from 1960 to 1985. Roughly 40 percent of the cells in this data set correspond to direct census-survey observations. The remaining 60 percent of the cells are estimates constructed by a perpetual-inventory method that uses the census-survey values as benchmark stocks and the school-enrollment ratios as investment flows. The numbers in the data set indicate educational attainment at four levels-no formal schooling, some elementary school, some secondary school, and some higher education-for the population aged 25 and over. This population group, rather than the labor force or the population aged 15 and over, was dictated by the availability of data. The figures have been used to estimate the average years of school attainment at the primary, secondary, and higher levels. This estimation takes account of the varying duration of primary and secondary schools across the countries and uses rough estimates of completion percentages at these schools. It should be stressed that the estimates do not consider variations across countries or over time in the quality or intensity of education. The rough quality measures that are available for a large group of countries-like measures of public spending on education and pupil-teacher ratios-have turned out not to contribute to the explanatory value of the human-capital variable for economic growth or other variables. Table 1 summarizes some major features of the data set on educational attainment. The table separates the OECD countries (22 with data) from the developing countries, which are classed into five regions: Middle EastNorth Africa ( I 4 countries), Sub-Saharan Africa (27 countries), Latin AmericaICaribbean (23 countries), Pacific Area (10 countries), and Other Asia (7 countries). The population figures shown are for the overall population of the region, although the schooling data apply to those 25 and over. The figures on educational attainment show the average years of schooling at the primary, secondary, and higher levels, and the total of these three categories. The regional averages were formed as unweighted means of the individual country observations. Human Capital and Economic Growth Table 1 Trends of Educational Attainment by Region RegionIGroup Year OECD (22 countries) 1960 1965 ,1970 1975 1.980 1985 -Middle East/ North Africa 414) 1960 ,1965 .I970 1975 ,1980 1985 Sub-Saharan Africa (27) 1960 1965 .I 970 Total Population (millions) Average years of schooling in primary secondary higher total Latin America1 1960 Caribbean 1965 (23) 1970 1975 1980 1985 Pacific Area (10) 1960 1965 1970 1975 1980 1985 Other Asia (7) 1960 1965 1970 1975 1980 1985 Note: Attainment applies to the population aged 25 and older, but the population figures shown are for total population. The regional values are unweighted means of the average number of years of schooling in each country. 202 Robert J. Barro The table shows that the OECD group had the highest school attainment, beginning with 6.2 total years in 1960 and reaching 8.3 years in 1985. The developing regions have, however, all grown faster in proportionate terms and have therefore been catching up in average years of schooling to the OECD countries. The lowest attainment is in Sub-Saharan Africa, with a range from 1960 to 1985 of 1.2 to 2.2 years, whereas the highest is in the Pacific area, with a range of 3.3 to 5.3 years.1 (Some of the countries in this group-Hong Kong, Singapore, Korea, and Taiwan-now have sufficiently high per capita income so that they no longer warrant the designation of developing country.) Human capital in theories of economic growth Various theoretical models include human capital as a factor of production and assess the accumulation of human capital as an element of the growth process. I consider first the role of human capital in the familiar neoclassical growth model, then examine the implications of theories that allow for imbalances between human and physical capital. Human capital is also important in models that allow for international capital mobility and in theories of the diffusion of technology. Finally, I assess the interplay between human capital and choices of fertility rates. The convergence rate in the neoclassical growth model The standard framework that often guides economists' thinking about economic growth is the neoclassical growth model of a closed economy, due to Ramsey (1928), Solow (1956), Cass (1965), and Koopmans (1965). The long-run per capita growth rate in this model depends entirely on the exogenous rate of technological progress. In the short run-that is, in the transition to the steady state-the growth rate depends inversely on the gap between economy i's per capita product or income, denoted by yi, and its long-run or steady-state position, denoted by yf .2 This result is often referred to as conditional convergence: economy i grows faster the ~owkrits initial income, yi, conditional on its long-run target, yf. In the standard mode1,yf depends positively on the economy's willingness to save and level of Human Capital and Economrc Growth 203 productivity and negatively on the population growth rate. In extended versions of the model, the effective level of productivity can be interpreted to include not only the access to technology, but also government policies in regard to taxation, maintenance of property rights, provision of infrastructure services, and so on. The transitional dynamics can be summarized by the rate of convergence: how much of the gap between yi and yf is eliminated in one year? Empirical evidence discussed by Barro and Sala-i-Martin (199 1, 1992a) for the U.S. states (from 1880 to 1988), regions of seven Western European countries (from 1950 to 1985), and a cross-section of about 100 countries (from 1960 to 1985) indicates that the rate of convergence is on the order of 2 percent per year. That is, if the differences across economies in yf are held constant, then about 2 percent of the gap between the typical poor and rich economy is eliminated in one year. This slow rate of convergence means that it takes 35 and 1 15 years, respectively, for 50 percent and 90 percent of the initial gap to vanish. For the regions of the United States and Western Europe, the steady-state values, yf, appear to be similar, and hence, conditional convergence corresponds to the poor economies catching up to the rich ones. For the broad group of countries, however, the variations in the yTappear to be substantial, partly because of persisting differences in government policies. In this context, therefore, conditional convergence does not imply that the poor countries would tend to grow faster per capita than the rich countries. In the neoclassical growth model, the convergence rate depends mainly on the speed with which diminishing returns to capital set in. If yi is well below yT-so that the ratio of capital to labor, ki, is well below its steady-state value, kf-then the rate of return on capital is high and the economy tends to grow rapidly. As the economy develops, yi and ki rise, the rate of return on capital falls, and the growth rate tends to decrease. If capital is viewed narrowly-say to include machines and buildings but to exclude human capital-then the share of capital in income 204 Robert J. Burro would be low, diminishing returns to capital would set in quickly, and the convergence rate would be high.3 It therefore turns out to be infeasible (if we assume plausible values for the various parameters in the model) to reconcile the neoclassical growth model with a narrow concept of capital. The model fits much better with the empirical estimates of convergence speeds if we take the appropriately broad view of capital to include huinan components. A capital share of about three-quarters-a reasonable figure if human capital is includedgives a slow enough onset of diminishing returns so that the theory can generate a convergence rate of about 2 percent per year. Thus, the slow observed rates of convergence provide indirect evidence for the importance of human capital accumulation in the process of development. Imbalances between physical and human capital Extensions of the neoclassical growth model have distinguished the sector that produces goods--consumables and physical capital-from an education sector that produces new human capital (see, for example, Lucas [I9881 and Mulligan and Sala-i-Martin [1992]). The assumption in these models is that the education sector is relatively intensive in human capital: it takes human capital embodied in teachers to produce human capital in students. One finding stressed by Mulligan and Sala-i-Martin (1992) concerns imbalances between human and physical capital, that is, departures of the ratio of human to physical capital from the ratio that prevails in the long run. The key result is that a higher ratio of human to physical capital and hence, a higher ratio of human capital to output raises the growth rate. A country with an abundance of human capital tends also to focus its investment on physical capital; that is, a high ratio of human to physical capital results in a high ratio of physical investment to gross domestic product. The conclusions about imbalances between human and physical capital are reinforced if the accumulation of human capital involves adjustment costs that are much higher than those applicable to physical capital. (Machines and buildings can be assembled quickly, but people cannot be educated rapidly without encountering a sharp falloff in the Human Capital and Economic Growth 205 rate of return to investment.) An economy with a high ratio of human to physical capital is then like an economy that is described by the transitional dynamics of the usual neoclassical growth model. The economy effectively starts with a quantity of physical capital per worker that is substantially below its steady-state position, that is, far below the amount that matches the large quantity of human capital. The usual convergence effect implies that the growth rate of output exceeds its steady-state value in this situation. A high ratio of human to physical capital applies, as an example, after a war that destroys large amounts of physical capital, but which leaves human capital relatively intact. Japan and Germany after World War I1 are illustrative cases. The theory accords with the empirical observation that countries in this situation tend to recover r a ~ i d l y . ~ Capital mobility The discussion thus far assumes a closed economy: goods do not move across borders, and the residents or government of one economy cannot borrow from or lend to those in another economy. This assumption is unrealistic for countries, but is especially troubling for the analysis of regions of the United States or the Western European countries. It is possible to extend the neoclassical growth model to allow for international trade in goods and assets (see, for example, Barro and Sala-i-Martin [1992b, Ch.21). One result from this extension is that the opening up of the economy to world credit markets speeds up the predicted rate of convergence to the steady state. This speeding up applies especially to forms of physical capital that are not subject to adjustment costs and that can be financed by international borrowing (or are amenable to direct foreign investment). If all capital were of this form and if international credit markets were perfect, then a small country's capital stock and production would converge essentially instantaneously to the steady state. Human capital provides little collateral for lenders and therefore typically cannot be financed by borrowing (or direct foreign investment). Hence, even in an open economy, the accumulation of human 206 Robert J . Barro capital must be financed primarily with domestic savings. This linkage between domestic investment and domestic saving restores the key assumption of the standard neoclassical growth model for a closed economy: capital is subject to diminishing returns and at least part of the capital stock must be financed by domestic savings. The bottom line turns out accordingly to be that the open-economy model with human capital generates rates of convergence that are only slightly higher than those of the standard neoclassical model. If the share of broad capital-physical plus human-is around three-quarters, then the predicted rates of convergence can still match the observed values of about 2 percent per year. The di8usion of technology The most interesting aspect of the recent literature on endogenous economic growth, represented by Romer (1990b) and Grossman and Helpman (1991, Chs. 3,4),concern theories of technological progress in the leading economies. In these models, a technological advance shows up either as the discovery of a new type of product (a new kind of productive input or a new variety of final good) or as an improvement in the quality or productivity of an existing product. These advances require purposive research effort, although the output from the research sector may involve random elements. The incentive to commit resources to research requires a reward for success. In the models, the rewards take the form of monopoly rentals on product innovation. That is, a successful innovator's monopoly position lasts for awhile because of first-mover advantages, secrecy, and possibly formal patent protection.5 Growth can be sustained in these models if diminishing returns do not apply, that is, if the returns from new discoveries do not decline in relation to the costs of making the discoveries. One reason that diminishing returns may not apply is that the potential supply of new ideas and products is effectively unlimited. For a single economy, the endogenous technological progress generated in recent theoretical models substitutes for the exogenous technological progress that is assumed in the standard neoclassical Human Capital and Economic Growth 207 growth model. For studying convergence across economies, the interesting application of the new theories is to the pirocess of adaptation or imitation by followers of the innovations that were made by leaders. The cost of imitation for a follower can be modeled as similar to the cost of discovery for a leader, except that the cost of imitation is likely to be smaller and subject to less uncertainty. These considerations suggest that a follower would grow faster than a leader and thereby tend to catch up to the leader. This conclusion may not hold, however, if the follower country's environment is hostile to investment (in the form here of expenses for technological adaptation) because of poorly defined property rights, high rates of taxation, and so on. Although innovation in the world economy may not be subject to diminishing returns, the process of imitation by a single country would encounter diminishing returns as it exhausts the pool of innovations from abroad that are readily adaptable to the domestic context. This consideration leads to the usual convergence property: a follower country tends to grow faster the larger the stock of potential imitations and hence, the further its per capita income is from that of the leaders. The convergence result is again conditional on aspects of the domestic economy-such as government policies, attitudes about saving, and intrinsic levels of productivity-that affect the returns from technological adaptation. Nelson and Phelps (1966) pointed out that a country with more human capital would be more adept at the adaptation of technologies that were discovered elsewhere. Thus, the higher the stock of human capital for a follower country, the higher the rate of absorption of the leading technology and hence, the higher the follower country's growth rate.6 This conclusion resembles the one that we got from imbalances between the stocks of human and physical capital; each model predicts a positive relationship between the initial stock of human capital per person and the subsequent per capita growth rate. Human capital and fertility In the standard neoclassical growth model, a higher rate of population growth reduces the steady-state value of capital per worker and Roberf J . Barro thereby lowers the steady-state value of per capita income, Y!. The decrease in yF implies that the economy grows in the transition (for a given value of yi) at a slower rate. The rate of population growth is exogenous in this model, and the effect on the steady-state level of capital per worker involves the flow of new capital that has to be provided to accompany the flow of new workers. Richer theories, such as the one by Becker, Murphy, and Tamura (1 990), include the resources expended on children and allow fertility to be a choice variable of families. A key result is that a larger stock of human capital per person raises the wage rate and therefore the time cost of raising children. (The assumption is that the productivity in the sector that raises children does not rise as fast as that in the sectors that produce goods and new human capital.) A higher stock of human capital motivates families to choose a lower fertility rate and to raise the investment in human capital for each child (that is, to substitute quality for quantity in children). These responses of population growth and human capital investment tend to raise the growth rate of output. This model therefore provides another channel through which a larger stock of human capital results in a higher subsequent rate of economic growth. Empirical evidence on human capital and growth across countries Table 2 contains a sample of empirical results from ongoing research on the effects of a number of variables on the growth rate of real per capita GDP. (The data on GDP are the purchasing-power-parity adjusted values constructed by Summers and Heston [1988].) The estimates apply to a panel data set for 73 countries-those with a full set of data-over five-year periods from 1960 to 1985. There are 365 observations in total, five time observations for 73 countries. The estimation is by the seemingly unrelated (SUR) technique, which allows the error term for each country to be correlated over time. The independent variables include the logarithm of real per capita GDP at the start of each period, l~g(yit),a number of variables including government policies that can be interpreted as determinants 209 Human Capital and Economic Growth of a country's steady-state position, y:, and the educational-attainment variable. See the notes to Table 2 for details. Table 2 Panel Regressions for Growth Rate of Real Per Capita GDP, 5-Year Intervals from 1960 to 1985 Independent Variable log (Initial GDP) Estimated Coefficients & Standard Errors -.0167 (.0027) -.0196 (.0024) -.201 (.101) -.050 (.085) -.0226 (.0054) -.0208 (.0049) -.0147 (.0074) -.0107 (.0062) log (School) Openness*log (l+Tarriff Rate) log (l+Black-Market Premium) Freq. of Revols. and Coups FERT Sub-Saharan Africa -- -- Latin America -- -- .05, .38, .22, .31, .08 .07, .52, .26, .44, .22 R ~indiv. , periods Roberr J. Barro Notes to Table 2 The dependent variable is the annual growth rate of real per capita GDP over each period (1960-65, 1965-70, 1970-75, 1975-80, 1980-85). These data are from Summers and Heston (1988). Standard errors are shown in parentheses. There are 365 observations (73 countries and 5 time periods). Coefficients are estimated by seemingly unrelated (SUR) technique, which allows a country's error term to be correlated over time. Separate constants are estimated for each time period. Other coefficients are constrained to be the same for all periods. Initial GDP is real per capita GDP at the start of each 5-year interval. School is 1 plus the average number of years of educational attainment for the population aged 25 and over at the start of each 5-year period. G/Y is the period average of the ratio of real government consumption, exclusive of education and defense, to real GDP. Openness is an estimate of "natural" openness, based on area and distance measures. This variable is a constant for each country. Tarlff rate is an average of official tariff rates on capital imports and intermediates, weighted by shares in imports. Only one observation per country was available for the tariff rate. Black-market premium is the period average of the black-market premium on foreign exchange. Frequency of revolutions and coups is the number of revolutions and coups per year, averaged over the full sample, 1960-85. I/Y is the ratio of real gross domestic investment to real GDP, averaged over each period. FERT is the total fertility rate, averaged over each period. Sub-Saharan Africa is a dummy for countries in sub-Saharan Africa. Latin America is a dummy for countries in Latin America. For given values of the other variables, the estimated coefficient on log(yit), in the first regression is -.0167, s.e. = .0027. Thus, this coefficient differs significantly from zero (t-value = 6.2), and the magnitude indicates a rate of convergence to the steady-state position of 1.7 percent per year.7 The determinants of yTcontained in the first regression of Table 2 are G/Y, the ratio of government consumption exclusive of education and defense to GDP, a measure of distortions due to tariff^,^ the black-market premium on foreign exchange-intended as a proxy for 2// Humart Caprrul and Economic Growth distortions in foreign trade,9 and the frequency of revolutions and coups-intended as a proxy for political stability. These variables affect growth in the expected manner in the first regression: all have negative effects on the growth rate. Since these variables are not the major concern of the present paper, I will not provide a detailed assessment of these results. The schooling variable is entered as log(l+total years of school attainment), where the years of attainment apply to the start of each period. The parameter 1 in the above expression can be viewed as the '~ effective number of years obtained without formal s c h ~ o l i n g .The estimated coefficient on the schooling variable in the first regression, .0232, s.e. = .0041, is positive and highly significant (t-value = 5.7). Thus, for a given value of log(yi,), and for given values of the determinants of yT, countries grew faster if they began each period with a greater amount of educational attainment. As a quantitative example, if average educational attainment begins at two years-the average value prevailing in Sub-Saharan Africa in 1980-theri an increase by 0.3 years would raise the quantity, 1 + years of attainment, by 10 percent and thereby increase the predicted growth rate by 0.2 percentage points per year. (The effect diminishes gradually over time because logbit) then follows a higher path than it would have otherwise.) The second regression shown in Table 2 adds In,the ratio of real gross domestic investment to real GDP, and the total fertility rate. (These variables are measured as averages over each period.) In the Solow version of the neoclassical growth model, the investment ratio (or the saving rate) and the fertility rate (or the growth rate of population) are exogenous variables. These variables do not influence the long-run growth rate, but do affect the steady-state level of per capita output, yT. An increase in Inraises yT, whereas a rise in fertility lowers yT. Therefore, for a given value of logbit), an increase in I/Y would raise the growth rate, whereas an increase in the fertility rate would lower the growth rate. ~ r o man econometric standpoint, the exogeneity of I/Y and the fertility rate with respect to the growth rate are questionable. In any '' 212 Robert J. Burro event, the second regression in Table 2 shows that the estimated coefficient of H i s positive and highly significant (.120, s.e. = .021), whereas that for fertility is negative and significant (-.0037, s.e. = .0012). These results are consistent with the Solow model of economic growth. For present purposes, the most interesting finding from the second regression is that the inclusion of the investment ratio and the fertility rate roughly halves the estimated coefficient on the schooling variable: the estimated value is now .0109, s.e. = .0041. This result suggests that a good deal of the effect of initial human capital on the growth rate works through its effects on investment and fertility. These channels of effect are examined below. The third and fourth regressions shown in Table 2 include dummy variables for Sub-Saharan Africa and Latin America. Both continent dummies are significantly negative, substantially so for Sub-Saharan Africa. The main inference from these results is that the variables considered thus far-including the estimate of educational attainment-are insufficient to explain a significant part of the poor growth performances in these regions. One possibility is that the measures of educational attainment in Sub-Saharan Africa, although low (see Table l ) , do not fully capture the low levels of human capital in this region. Table 3 shows regressions in the same form as Table 2 for the investment ratio, I . , and the total fertility rate. These variables are measured as averages over the periods considered. For present purposes, the important findings are that the schooling variable has a significantly positive effect on I/Y in the first two regressions and a significantly negative on the fertility rate in the last two regressions. Thus, these results confirm the idea that part of the influence of initial human capital on the growth rate involves the positive interaction with investment in physical capital and the negative interaction with the fertility rate. The interaction with physical investment would occur, for example, in the model of imbalances between human and physical capital that was worked out by Mulligan and Sala-i-Martin (1992). The interplay with fertility arises in the theory of Becker, Murphy, and Tamura (1990). Human Capital and Economic Growth 213 The results shown in the second regression of Table 2 showed that the effect of the school-attainment variable on the growth rate remained significantly positive even after holding constant the investment ratio and the fertility rate. A possible interpretation, along the lines of Nelson and Phelps (1966), is that this effect of human capital reflects the enhanced ability to adapt new technologies. Concluding observations Economic theory suggests that human capital would be an important determinant of growth, and empirical evidence for a broad group of countries confirms this linkage. Countries that start with a higher level of educational attainment grow faster for a given level of initial per capita GDP and for given values of policy-related variables. The channels of effect involve the positive effect of human capital on physical investment, the negative effect of human capital on fertility, and an additional positive effect on growth for given values of investment and fertility. Ongoing research is considering the possibilities for improving the measures of educational attainment, especially by using better data on enrollment ratios and more information about school dropouts. The possibilities for measuring the quality of school input, in addition to the quantity, are also being considered. School attainment is, in any event, only one aspect of human capital. Another dimension is health status. Measures of life expectancy-a proxy for health status-turn out to have substantial explanatory value for economic growth and fertility; life expectancy at birth enters in a way similar to educational attainment in the regressions reported in Tables 2 and 3. The interplay between health capital and educational capital is currently being investigated. Robert J. Burro 214 Table 3 Panel Regessions for Ratio of Real Investment to Real GDP and Total Fertility Rate, 5-Year Intervals from 1960 to 1985 Indevendent Variable IN Fertility Rate Estimated Coefficients and Standard Errors log (initial GDP) log (School) Openness*log (1+Tariff Rate) log (1+Black-Market Premium) Freq. of Revols. and Coups Sub-Saharan Africa Latin America R ~indiv. , periods. Note: The dependent var~ablefor the first two regressions is the average over each period of the ratio of real gross domestic investment to real GDP (data from Summers and Heston [1988]).For the last two regressions, the dependent variable IS the average over each period of the U.N. estimate of the total fertility rate (average number of live births per woman over her lifetime). See also the notes to Table 2. Human Capital and Economic Growrh Endnotes 'Table 1 does not cover the formerly centrally-planned economies. These countnes had average years of schooling that were similar to the OECD countries. %he quantities y, and y: have to be Interpreted as values filtered for the effects of exogenous technological progress. The usual procedure is to compute output per unit of effective labor. where effective labor is the aggregate amount of work effort multiplied by the cumulative effect from labor-augmenting technological change. 3 ~ hconvergence e rate depends also on whether the saving rate falls or rises as an economy develops. If a poor economy saves a lot and then lowers its savlng as it grows, then the convergence rate would be hlgher, and vlce versa. Solow (1956) assumed aconstant saving rate, and the optimizing models(of Cass [I9651and Koopmans [1965]) that allow for a varylng saving rate make no clear predictions about whether the rate will fall or rise as an economy develops. (The falling rate of return suggests that the saving rate would decline, but the rise in Income toward its permanent level suggests the opposite.) 4 ~ Imbalance n In the other dlrectionMahlgh ratio of physical to human capital, perhaps as a consequence of an epidemlcUcanalso lead to a growth rate that exceeds the steady-state growth rate. The effect of this klnd of imbalance on the growth rate would be relatively weak, however, if the accumulat~onof human capital were subject to large adjustment costs. 5 ~ h ipaper s focuses on the role of these models as positive theories of economlc growth and abstracts from the Inferences that have been drawn for desirable governmental policies. The policy implications derive from positive or negative gaps between social and private rates of return. Pos~tivegaps can reflect uncompensated spillover benefits In research and production, the consequences of monopoly pricing of the existing goods, and the disincentive effects from taxation. Negativegaps can come from the seeklng of exlstlng monopoly rentals by new entrants or from congestion effects (negative spillovers from economic activity). ?he stock of human capital would also tend to reduce the cost of innovation in leading economies. Hence, more human capital can speed up the rate of innovat~on,an effect that raises the growth rate in leading and following economies. 'More precisely, because the estimation IS canied out at five-year intervals, the coefficient, ,0167, has to be adjusted slightly to compute the instantaneous rate of convergence (see Barro and Sala-i-Martin [1992a]). The implied convergence coefficient turns out in this case to be 1.8 percent per year. he tariff rate enters as an interaction wlth an estimate of natural openness, the country's Thls ratio of imports to GDP that would have occurred in the absence of trade d~stort~ons. openness was estimated to be a negative funct~onof the country's area and 11sweighted-average distance from major markets The Idea IS that distortions due to tariffs have a larger adverse influence on growth for countries that are naturally more open (small countries and countries that are close to major potentlal trading partners). See Lee (1992) for a discussion he black-market premium may also proxy more broadly for otherdistortionary policies and for macroeconomic instablllty. I 0 ~ h value e 1.0 IS close to the non-hear, maximum-likel~hoodestimate of this parameter In Robert J. Bnrro the form of the first regression shown In Table 2. The value was then restncted to 1.0 and was not reestimated for the vanous regressions shown. The logarithm~cform used in the regresslons turned out to fit sllghrly better than a linear form In attainment. he emplncal results are slmllar, however, if lagged values of //Y and FERT are used as instruments. The exogeneity of other vanables In the regresslons. such as revolutions and coups and the black-market premlum, can also be questioned. References Barro, R. J. "Economic Growth in a Cross-Secclon of Countnes," Quarrerl~ Jourrtn/ of Economics. 106 (199 I), pp. 407-43 and J. Lee "Internat~onalCompansons of Educational Attainment, 1960-1985," unpubllshed manuscnpt, Harvard Un~versity.June 1992. and X Sala-i-Manln. "Convergence Across States and Regions." Brookrttgs Pnpers on Economic Acrrvlr?.,No. 1 (1991j, pp. 107-58. and . "Convergence," Jortrttal of Polirrcal Ecor~orn~, 100 ( 1 992a) pp 223-5 1. and . "Economic Growth," unpubl~shedmanuscript, Harvard University, 1992b. Becker, G. S , K. M. Murphy. and R. Tamura. "Human Capltal. Fenlllty, and Economlc Growth," Jourrtal of Polrrrcal Ecottot?t?; 98 (October 1990 supplement), pp S 12-37 Benhabib, J . and M. M. Spe~gel."The Role of Human Capital and Poht~calInstability in Economlc Development." unpubllshed rnanuscnpt. New York Unlverslty, May 1992. Cass, D. "Optlmum Growth In an Aggregate ,Model of Capltal Accumulation," Ret.ie&t'of Econotnic Studies, 32 (July 1965). pp. 233-40. Grossman. G M. and E Helpman. I r ~ t t o ~ ~ ~artd r t oGron.th t~ rtt theGlobrrl E c o t t o n ~Cambndge, ~. Massachusetts M.I.T. P r e ~ s1991. , Koopmans, T.C. "On the Concept of Optlmal Economic Growth." In The Econot?tetrrcAppronch ro De~elopmenrPlannrrtg. Amsterdam: North Holland. 1965 Kynacou. G. A. "Level and Growth Effects of Human Capital. A Cross-Country Study of the Convergence Hypothesis," unpubllshed manuscnpt, New York University, June 1991. Lee, J. "International Trade, Distortions. and Long-Run Economlc Growth," unpublished manuscript, Harvard Unlcerslty. 1992 Lucas, R E. "On the Mechamcs of Development Planning." Jortrturl ofMottetan Econot?tics, 22. (July 1988). pp. 3-42. Mulllgan, C. B and X. Sala-I-Martin. "Some Emplncal Evldence on Two-Sector Models of Endogenous Growth," unpubllshed manuscnpt, University of Chicago, June 1992. Nelson, R. R. and E. S . Phelps. "Investment in Humans, Technological Diffusion, and Economic Growth," American Ecottot?lic Re~,rewPapers crt~dProceed~rtgs,56. (May 1966), pp. 69-75. Ramsey, F.P. "A Mathematical Theory of Savlng." Ecottot71rcJourt~al,38, (December 1928) pp. 69-75. Rebelo, S. "Long-Run Pollcy Analysis and Long-Run Growth." Jourr7ol of Polrricol Econont~ 99 (June 1991). pp 500-21. Romer, P. M "Human Capital and Growth. Theory and Evidence," Cnrrtegie-Rochester Cottferettce Series on Prrbltc Policy 1990a. Solow, R M. "A Contribution to the Theory of Economic Growth." Quanerl? Jo~rnlnlof Ecottomrcs, 70 (February 1956). pp. 65-94. Summers. R. and A. Heston. "ANew Set of Internat~onalComparisons of Real Product and Price Levels Estimates for 130 Countnes. 1950-1985." Review of Irtcome and Wealth 34 (March 1988). pp 1-25.