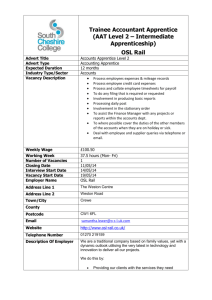

Regulations implementing the National Minimum Wage – a NATIONAL MINIMUM WAGE

advertisement

NATIONAL MINIMUM WAGE Regulations implementing the National Minimum Wage – a report on the Apprentice Rate JUNE 2015 Re egullatio ons imp plem mentting g the e Na ational Min nimu um Wa age e – a reportt on n the e Ap ppre entic ce Rate e Prese ented to Parliamen nt by the S ecretary y of State e for Busiiness, Innova ation and d Skills by y Comma and of He er Majesty y June 2015 Cm 9061 © Crow wn copyright 2015 This pu ublication is licensed under the terms of the Open Governmennt Licence v3.0 except where oth herwise sta ated. To vie ew this lice ence, visit na ationalarchives.gov.uk/doc/open n-governm ment-licence/version/33 or write to the Informa ation Policy Team, The Nationa al Archives s, Kew, London TW99 4DU, or email: psi@nationalarchives.gsi.gov.u uk. arty copyrig ght informa ation you w ill need to o obtain Where we have identified any third pa permisssion from the copyrig ght holderss concerne ed. This pu ublication is available e at www.g gov.uk/government/publicationss Any en nquiries reg garding this publicatio on should be sent to us at National Minim mum rd Wage Team, Abb bey 1, 3 Floor, 1 Vicctoria Stree et, London n, SW1H 0E ET. Print IS SBN 97814 474120098 8 Web IS SBN 97814 474120104 4 ID 26051501 06/15 Printed d on paper containing g 75% recyycled fibre content minimum Printed d in the UK K by the Wiilliams Lea a Group on n behalf of the Controoller of Herr Majesty’s Station nery Office Government report on Apprentice Rate for October 2015 Contents National Minimum Wage and the Low Pay Commission .................................................... 5 The Government’s response to the Low Pay Commission’s 2015 recommendations ........ 6 Government rational for the Apprentice rate ....................................................................... 8 3 4 Government report on Apprentice Rate for October 2015 Regulations implementing the National Minimum Wage – a report on the Apprentice Rate National Minimum Wage and the Low Pay Commission 1. The objective of the National Minimum Wage (NMW) is to provide as much support as possible to the wages of the low paid without damaging their employment prospects by setting it too high. The NMW sets a wage floor below which pay cannot fall ensuring protection for low-paid workers, while also providing incentives to work. 2. The Low Pay Commission (LPC) is an independent body that advises the Government about the NMW. It is made up of 9 commissioners and a chair, drawn from a range of employee, employer and academic backgrounds. The Government specifically asks the LPC to make recommendations based on maximising the wages of the low paid without damaging employment opportunities. The remit for the LPC’s 2015 report1 was published on 18 June 2014. 1 https://www.gov.uk/government/publications/national-minimum-wage-low-pay-commission-report2015 5 Government report on Apprentice Rate for October 2015 The Government’s response to the Low Pay Commission’s 2015 recommendations 3. This report is laid before Parliament in accordance with sections 5 and 6 of the National Minimum Wage Act 1998, reproduced in Annex A. Where matters are referred to the LPC and the regulations depart from any of its rate recommendations, sections 5(4) and 6(3) require the Secretary of State to lay a report before each House of Parliament containing a statement of the reasons for the decision. 4. The report of the LPC recommending NMW rates from October 2015 was submitted to Government in February 2015. This report confirms the Government’s response to the NMW rate recommendations. Copies of the LPC’s report have been laid in the libraries of each House. 5. The LPC’s recommendations follow consultation with businesses and workers and their representatives, together with extensive research and analysis. The recommendations reflect unanimous views of all the Commissioners. In reaching unanimity on their recommendations, the LPC has balanced the need to protect the earnings and jobs of low-paid workers against the difficulties faced by employers and businesses, paying particular attention to the employment prospects of young people. 6. The Government proposes to accept the LPC recommendations for the following rates: • • • • a 20p (3.1%) increase in the adult rate (from £6.50 to £6.70); a 17p (3.3%) increase in the rate for 18-20 year olds (from £5.13 to £5.30) an 8p (2.2%) increase in the rate for 16-17 year olds (from £3.79 to £3.87) a 27p (5.3%) increase in the NMW Accommodation Offset rate (from £5.08 to £5.35) 7. However the Government proposes to depart from the LPC’s recommendation to increase the Apprentice rate by 7p (2.6 %) from £2.73 to £2.80, in favour of increasing the rate by 57 pence to £3.30. This is the largest ever increase (21%) in the NMW for apprentices and will halve the gap with the age rate for 16-17 year olds, currently £3.79 an hour. 8. The draft National Minimum Wage (Amendment) Regulations 2015 will therefore follow the recommendations of the LPC on the NMW rates with the exception of the Apprentice rate. 6 Government report on Apprentice Rate for October 2015 9. The Government will publish a full Impact Assessment which outlines the detailed cost and benefits for the changes to all of the NMW rates. This includes the impact of the proposed increase to the Apprentice rate as discussed in this report. 7 Government report on Apprentice Rate for October 2015 Government rational for the Apprentice rate 10. The Government proposes to depart from the LPC’s recommendation for a 7p increase to £2.80 an hour for the Apprentice rate, in favour of a higher increase of 57p, taking the rate from £2.73 an hour to £3.30. This report considers the reasons for the Government’s decision to depart from this recommendation and summarises the evidence for the Government’s proposal for a larger increase in the Apprentice minimum wage. 11. The Apprentice rate applies to apprentices who are under the age of 19 or in the first year of their apprenticeship. Approximately 75,000 apprentices will be affected by the increase, and this will cost employers an estimated £75.6 million (a direct impact on private sector employers2 of £38.8 million) in increased wage bills. 12. The principle reason for the LPC’s recommendation was a high level of noncompliance for apprentices, although it is at a lower level than in previous years. The LPC judged that large increases in the level of the Apprentice rate could pose risks to provision of available apprenticeship opportunities. The Government see this as cautious approach particularly considering the wider apprenticeship reforms aimed at improving the quality and value of apprenticeships which are considered further below. The Government shares the LPC’s concern about relatively high non-compliance with the Apprentice rate. The Government will continue to raise awareness with employers on their NMW obligations as well as investing in NMW enforcement. 13. We have noted the LPC’s recommendation that the Government should increase its communication of the apprentice rate. We are exploring options for raising awareness of the Apprentice rate. 14. The Government carefully considered the evidence and the LPC’s recommendations in its 2015 report. We recognise the challenges that the LPC has faced, especially during such uncertain economic environment and without an apprentice pay survey in 2013. The LPC has produced a detailed report and 2 To calculate the Business Net Present Value we need to calculate the percentage impact on business for each rate. For the age related rates, we do this by calculating what percentage of affected workers for each rate are private sector employees. For the Apprentice rate calculations, although costings are made using the Apprentice Pay Survey, the survey did not ask if Apprentices were working for a Public or Private sector employer. We therefore used ASHE data to calculate the proportion of affected Apprentices that work for private sector employers. The result was 57%. 8 Government report on Apprentice Rate for October 2015 the Government appreciates the hard work that the Commissioners have put into developing their recommendations. 15. However, after careful consideration, the Government has concluded that there are important reasons that mean we should make a bigger increase to the Apprentice rate. 16. Apprenticeship policy has a growing focus on quality, with Ministers, including the Prime Minister, promoting apprenticeships as a credible alternative to university for gifted young people. Employment remains an essential part of an apprenticeship and we believe that a larger increase in the Apprentice rate of NMW than that recommended by the LPC better reflects the role of apprentices as productive members of an organisation’s current workforce and as an investment in its future. 17. The Government wishes to maintain the attractiveness of Apprenticeships relative to other jobs without training by closing the gap between the Apprentice rate and the age related rates. This, alongside wider reforms, will encourage more young people to consider apprenticeships as a credible alternative to both higher education and jobs without training. 18. The Future of Apprenticeships in England: Implementation Plan in 2013 set out ambitious plans to improve the quality of apprenticeships to make them attractive for young people and more relevant to businesses. Apprenticeships already represent a positive return on investment; the National Audit Office Report3, published in February 2012, found that adult apprenticeships deliver £18 of economic benefits for each pound of Government investment. The report states that there are substantial productivity benefits to employers, amounting to spill over effects of 25% of the wage premium. 19. Furthermore, through the reforms, employers now have a greater role in designing apprenticeships; deciding what apprentices need to learn and how they will be assessed. In terms of quality and attractiveness, standards are designed by employers and include a synoptic assessment that will guarantee that the apprentice is fully competent. There is greater flexibility in assessment so standards developers can choose the most appropriate way to assess Apprentices, for example through practical tasks, a viva or written exam. 20. The reforms also focus on increasing the rigour of apprenticeships with all apprentices having to prove their competence by passing a tough and independently assessed end-point assessment. In addition, the employer will be 3 http://www.nao.org.uk/publications/1012/adult_apprenticeships.aspx 9 Government report on Apprentice Rate for October 2015 involved in deciding when an apprentice is ready to be assessed and apprentices will be graded according to their performance. 21. Some employers have expressed concern about the quality of applicants for apprenticeship positions. A significant increase in the apprentice rate of NMW is an important factor in helping to raise the profile of the programme and attracting greater numbers and a wider range of applicants. 22. We have considered that raising the Apprentice rate could reduce employer demand for apprentices. As well as raising direct employer costs, employers must allow apprentices time off from their work to train. However, the Apprentice rate of £3.30 is still less than the NMW of a non-Apprentice 16 year old. In addition Apprenticeships provide substantial productivity benefits to employers and the Government’s reforms should support a further rise in their productivity. 23. The Government do not take decisions to reject the LPC’s recommendations lightly. The LPC’s independent conclusions have been based on extensive examination of labour market evidence and we do not question the detailed and careful analysis undertaken. However, the Government feels there are important reasons for a larger increase to the Apprentice NMW rate. In reflecting the objectives of both employers and of unions, the LPC plays a crucial role in advising the Government about the NMW. We look forward to working with the LPC to ensure future NMW rates which are affordable for business but also enable workers to benefit from as generous a NMW as possible. 10 Government report on Apprentice Rate for October 2015 ANNEX A Section 5 of the National Minimum Wage Act 1998 The first regulations: referral to the Low Pay Commission. (1)Before making the first regulations under section 1(3) or (4) or 2 above, the Secretary of State shall refer the matters specified in subsection (2) below to the Low Pay Commission for their consideration. (2)Those matters are: (a) what single hourly rate should be prescribed under section 1(3) above as the national minimum wage; (b) what period or periods should be prescribed under section 1(4) above; (c) what method or methods should be used for determining under section 2 above the hourly rate at which a person is to be regarded as remunerated for the purposes of this Act; (d) whether any, and if so what, provision should be made under section 3 above; and (e) whether any, and if so what, descriptions of person should be added to the descriptions of person to whom section 3 above applies and what provision should be made under that section in relation to persons of those descriptions. . (3)Where matters are referred to the Low Pay Commission under subsection (1) above, the Commission shall, after considering those matters, make a report to the Prime Minister and the Secretary of State which shall contain the Commission’s recommendations about each of those matters. (4)If, following the report of the Low Pay Commission under subsection (3) above, the Secretary of State decides: (a) not to make any regulations implementing the Commission’s recommendations, or (b) to make regulations implementing only some of the Commission’s recommendations, or (c) to prescribe under section 1(3) above a single hourly rate which is different from the rate recommended by the Commission, or (d) to make regulations which in some other respect differ from the recommendations of the Commission, or 11 Government report on Apprentice Rate for October 2015 (e) to make regulations which do not relate to a recommendation of the Commission, the Secretary of State shall lay a report before each House of Parliament containing a statement of the reasons for the decision. (5) If the Low Pay Commission fail to make their report under subsection (3) above within the time allowed for doing so under section 7 below, any power of the Secretary of State to make regulations under this Act shall be exercisable as if subsection (1) above had not been enacted. Section 6 of the National Minimum Wage Act 1998 Referral of matters to the Low Pay Commission at any time. (1) The Secretary of State may at any time refer to the Low Pay Commission such matters relating to this Act as the Secretary of State thinks fit. . (2) Where matters are referred to the Low Pay Commission under subsection (1) above, the Commission shall, after considering those matters, make a report to the Prime Minister and the Secretary of State which shall contain the Commission’s recommendations about each of those matters. . (3) If on a referral under this section: (a) the Secretary of State seeks the opinion of the Low Pay Commission on a matter falling within section 5(2) above, . (b) the Commission’s report under subsection (2) above contains recommendations in relation to that matter, and . (c) implementation of any of those recommendations involves the exercise of any power to make regulations under sections 1 to 4 above, . subsection (4) of section 5 above shall apply in relation to the report, so far as relating to the recommendations falling within paragraph (c) above, as it applies in relation to a report under subsection (3) of that section. (4)If on a referral under this section: (a) the Secretary of State seeks the opinion of the Low Pay Commission on any matter falling within section 5(2) above, but . (b) the Commission fail to make their report under subsection (2) above within the time allowed under section 7 below, . the Secretary of State may make regulations under sections 1 to 4 above as if the opinion of the Commission had not been sought in relation to that matter. 12