Regular Board Meeting Agenda

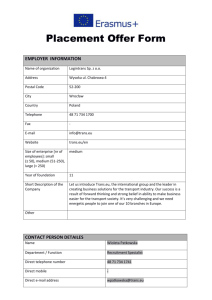

advertisement