Q3 2010 Results Conference Call October 28 , 2010

advertisement

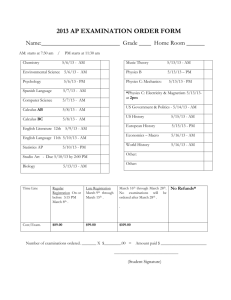

Motors | Automation | Energy | Transmission & Distribution | Paints Q3 2010 Results Conference Call October 28th, 2010 Q3 2010 Conference Call October 28th, 2010 Disclaimer The statements that may be made during this conference call relating to WEG’s business perspectives, projections and operating and financial goals and to WEG’s potential future growth are management beliefs and expectations, as well as information that are currently available. These statements involve risks, uncertainties and the use of assumptions, as they relate to future events and, as such, depend on circumstances that may or may not be present. Investors should understand that the general economic conditions, conditions of the industry and other operating factors may affect WEG’s future performance and lead to results that may differ materially from those expressed in such future considerations. Q3 2010 Conference Call Page 2 October 28th, 2010 General Comments on Q3 2010 Important aspects: Consolidation of acquisitions (ZEST, South Africa, and Voltran, Mexico) Growth in foreign markets, despite the appreciation of the Real. Late cycle business Investment in capacity expansion occurs after the resumption of consumption More evident in areas such as GTD. Recent renewable energies auction has left us optimistic with wind energy in Brazil Long-term attractiveness: Emerging markets growth, with specific demands; Energy efficiency regulation, increasing the market for high-performance products; New, more intelligent and efficient forms to produce, process and use energy ("smart grid“) Brazil specific events, such as FIFA World Cup and Olympic Games Q3 2010 Conference Call Page 3 October 28th, 2010 Quarterly Highlights Gross Operating Revenue Domestic Market External Markets External Markets in US$ Net Operating Revenue Gross Operating Profit Gross Margin Quarterly Net Income Net Margin EBITDA EBITDA Margin Q3 2010 1.419.161 Q2 2010 1.227.421 Growth % 15,6% 906.954 512.207 298.020 831.210 396.211 221.100 9,1% 29,3% 34,8% 889.302 393.200 210.840 2,0% 30,3% 41,3% 1.188.622 373.497 31,4% 141.952 11,9% 209.196 17,6% 1.013.015 309.158 30,5% 116.138 11,5% 174.015 17,2% 17,3% 20,8% 1.055.465 402.210 38,1% 160.103 15,2% 254.840 24,1% 12,6% -7,1% 22,2% 20,2% Q3 2009 Growth % 1.282.506 10,7% -11,3% -17,9% Figures in R$ Thousands Q3 2010 Conference Call Page 4 October 28th, 2010 Gross Operating Revenues Evolution of Gross Revenues – Domestic Market (in R$ million) Evolution of Gross Revenues – External Market (in US$ million) External Market in US$ -8% Quarterly Average FX 2% 23% 2,1702 1,9142 1,6819 1,8649 1,7187 42% 37% 968 785 889 -32% 34% 907 309,9 226,4 553 Q3 2007 Q3 2010 Conference Call Q3 2008 Q3 2009 Q3 2010 Q3 2006 Page 5 Q3 2007 298,0 210,8 168,6 Q3 2006 41% Q3 2008 Q3 2009 Q3 2010 October 28th, 2010 Global Presence Gross Revenues Breakdown – Q3 2010 8% 13% Europe North America 4% Asia & Oceania 7% 64% 6% 5% South & Central America Q3 2010 Conference Call Africa Brazil Page 6 October 28th, 2010 Business Areas Gross Revenues Breakdown – Q3 2010 918 5% 15% 19% 1.489 5% 13% 1.219 6% 13% 1.419 1.283 7% 12% 6% 14% 25% 25% 22% 35% 58% 56% 60% 61% 46% 3T06 3T07 Industrial Equipment Q3 2010 Conference Call 3T08 GTD 3T09 Domestic Use Page 7 3T10 Paints & Varnishes October 28th, 2010 Cost of Goods Sold Other Costs 33% Depreciation 5% Other Materials 18% Q3 2010 Conference Call Other Costs 29% Q3 10 Depreciation 5% Steel & Coper 44% Page 8 Other Materials 24% Q3 09 Steel & Coper 42% October 28th, 2010 Main changes on EBITDA 180,2 (43,6) (3,5) FXImpacto Impact on Cambial sobre Gross Revenues receita bruta (161,4) Deduction Deductionon on Deduction on Gross Gross Gross Revenues Revenues Revenues 254,8 Volumes, Aumento de Prices & volumes & Product Mix preços e mix Changes de produtos EBITDA Q3 09 Q3 2010 Conference Call (20,6) 3,4 COGS CPV (ex depreciação) Selling Expenses General and Administrative Expenses (0,1) 209,2 Profit Sharing Program EBITDA Q3 10 October 28th, 2010 Cash Flows Accumulated 9 months 2010 (336 ) 420 189 273 Fluxo Operacional Q3 2010 Conference Call Fluxo de Investimentos Fluxo de Financiamento Variação do Caixa no Período October 28th, 2010 Financing Policies CASH & EQUIVALENT - Current - Long Term DEBT - Current - Long Term NET CASH (DEBT) Q3 2010 Conference Call September 2010 2.399.773 2.399.773 2.345.147 841.311 1.503.836 54.626 December 2009 2.127.117 2.127.117 1.872.533 895.885 976.648 254.584 Page 12 September 2009 2.003.241 2.003.241 1.932.624 943.532 989.092 70.617 October 28th, 2010 Capacity Expansion Investments Outside Brazil Brazil 91,9 73,8 20,1 63,5 61,4 15,7 71,8 47,8 32,7 38,2 13,7 13,8 19,1 Q1 09 Q2 09 Q3 09 2009 Q3 2010 Conference Call 34,2 24,3 27,2 Q4 09 Q1 10 Page 13 53,7 43,7 13,0 30,1 40,7 Q2 10 Q3 10 2010 October 28th, 2010 Contacts www.weg.net/ir Laurence Beltrão Gomes IRO laurence@weg.net Luís Fernando M. Oliveira Investor Relations Manager +55 (47) 3276-6973 luisfernando@weg.net MSN Messenger luisfernando@weg.com.br Daniel Segalin Investor Relations Analyst +55 (47) 3276-6106 ri@weg.net Q3 2010 Conference Call twitter.com/weg_ir Page 14 October 28th, 2010