4Q 2014 Earnings Release

advertisement

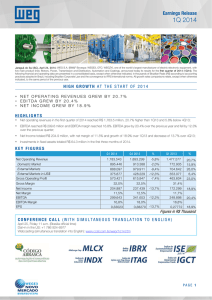

Earnings Release 4Q 2014 Jaraguá do Sul (SC), February 25, 2015: WEG S.A. (BM&F Bovespa: WEGE3, OTC: WEGZY), one of the world’s largest manufacturer of electric-electronic equipment, working mainly in capital goods in five main product lines: Motors, Power, Transmission and Distribution, Automation and Coatings, announced today its results for the fourth quarter of 2014 (4Q14). The following financial and operating data are presented in a consolidated basis, except when otherwise indicated, in thousands of Brazilian Reais (R$) according to accounting practices adopted in Brazil, including Brazilian Corporate Law and the convergence to IFRS international norms. The Growing rates and other comparisons are, except when otherwise indicated, made in relation to the same period of the previous year. CONSISTENCY OF GROWTH AND RESULTS NET OPERATING REVENUES GREW BY 15.1% Net operating revenues in the fourth quarter of 2014 reached R$ 2,179.7 million, for 15.1% growth over the 4Q13 and 6.0% growth over the 3Q14; EBITDA GREW BY 12.1% EBITDA reached R$ 383.0 million and EBITDA margin reached 17.6%. In relation to the same quarter last year EBITDA grew by 12.1%, while compared to the previous quarter there was growth of 9.2%; NET INCOME GREW BY 10.9% Net income totaled R$ 263.3 million, with net margin of 12.1% and growth of 10.9% over the 4Q13 and 1.8% over the 3Q14; INVESTMENTS OF R$ 424.8 MILLION IN 2014 Investments in fixed assets totaled R$ 424.8 million over 2014, being 67% in industrial plants and other installations in Brazil and 33% in expansion projects abroad. KEY FIGURES Net Operating Revenue Domestic Market External Markets External Markets in US$ Gross Operating Profit Gross Margin Net Income Net Margin EBITDA EBITDA Margin EPS (adjusted for splits) Q4 2014 Q3 2014 2.179.695 1.086.902 1.092.793 429.332 698.218 32,0% 263.285 12,1% 382.987 17,6% 0,32642 2.055.972 994.061 1.061.912 466.737 638.533 31,1% 258.569 12,6% 350.699 17,1% 0,32056 % 6,0% 9,3% 2,9% -8,0% 9,3% 1,8% 9,2% 1,8% Q4 2013 1.893.299 913.388 979.911 428.229 615.953 32,5% 237.439 12,5% 341.653 18,0% 0,29439 % 15,1% 19,0% 11,5% 0,3% 13,4% 10,9% 12,1% 10,9% 12M14 12M13 7.840.757 3.876.757 3.964.000 1.684.894 2.484.497 31,7% 954.726 12,2% 1.344.829 17,2% 1,18365 6.828.896 3.432.040 3.396.856 1.569.891 2.236.766 32,8% 843.467 12,4% 1.230.032 18,0% 1,04577 % 14,8% 13,0% 16,7% 7,3% 11,1% 13,2% 9,3% 13,2% Figures in R$ Thousand CONFERENCE CALL (WITH SIMULTANEOUS TRANSLATION TO ENGLISH) February 26, Thursday 11 a.m. (Brasilia official time) Dial---in in the US: +1 786 924-6977 Webcasting (simultaneous translation into English): www.ccall.com.br/weg/4q14.htm PAGE 1 Earnings Release 4Q 2014 ECONOMIC ACTIVITY AND INDUSTRIAL PRODUCTION This was yet another year of slow recovery of the global economic activity. Industrial activity continued to show different pace between the more important economies, as can be gauged by analysis of purchasing manager indexes (PMI). In the US there was a slight loss of dynamism in the last month of the year, but 2014 saw the fastest economic expansion since 2008. In Europe, despite concerns about recession and deflation risks, the German PMI continued fluctuating around 50, that is, near neutrality, a situation similar to the one observed in China. December 2014 55,5 51,2 49,6 Manufacturing ISM Report on Business ® (USA) Markit/BME Germany Manufacturing PMI® HSBC China Manufacturing PMI™ November 2014 58,7 49,5 50,0 October 2014 59,0 51,4 50,4 In Brazil, GDP growth should be around zero in 2014. Brazilian industrial activity continued to show signs of slowdown in the last quarter of the year, without interruption of the trend observed over the year, ending 2014 with decrease of 3.2%, according the survey by the Instituto Brasileiro de Geografia e Estatística (IBGE). Industrial Indicators in Brazil According to Large Economic Categories Change (%) Categories of Use Dec 14 / Nov 14* Dec 14 / Dec 13 Capital Goods Intermediary Goods Consumer Goods Durable Goods Semi-durable and non-durable General Industry -23,0 -0,8 -2,0 -2,2 -1,7 -2,8 -11,9 -1,5 -3,2 -9,7 -1,3 -2,7 Acummulated On Year 12 months -9,6 -2,7 -2,5 -9,2 -0,3 -3,2 -9,6 -2,7 -2,5 -9,2 -0,3 -3,2 Source: IBGE, Research Office, Industry Coordination (*) Series with seasonal adjustments The analyses show general decrease in industry production, reaching practically all large economic categories. In capital goods, which that includes most of our product line and that of our customers, posted the worst performance among all the categories, with decrease of 9.6%, mainly influenced by the slowdown on heavy vehicles production. NET OPERATING REVENUE Net Operating Revenues totaled R$ 2,179.7 million in the fourth quarter of 2014 (4Q14). Growth was of 15.1% over the fourth quarter of 2013 (4Q13) and of 6.0% over the third quarter of 2014 (3Q14). Adjusting net revenues for transactions occurred in the period, organic growth was of 10.8% over 4Q13. Net Operating Revenue per Market (R$ Million) 1.700 1.758 2.056 1.893 1.784 50% 51% 1.822 1.478 48% 52% Q1 13 2.180 52% 50% 49% 50% 52% 51% 50% 48% 50% 49% 48% 50% Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Brazilian Market External Market Although market conditions in the major global economies observe a slowdown in industrial activity, revenue performance remained at a healthy rate, showing that diversification and investment in capacity expansion keeps WEG competitive in global markets. In Brazil, the growing dynamism of the electricity generation, transmission and distribution equipment market offset the weaker performance of the industrial investment and consumption, helping to maintain revenue growth rates in line with the historical pattern. Net Operating Revenue in 4Q14 breakdowns as follows: PAGE 2 Earnings Release 4Q 2014 Brazilian Market: R$ 1,086.9 million, representing 50% of Net Operating Revenue, with 19% growth over 4Q13 and 9.3% growth over 3Q14; External Markets: R$ 1,092.8 million, equivalent 50% of Net Operating Revenue. The comparison in Brazilian Reais shows growth of 11.5% over the same period last year and of 2.9% over the previous quarter. Considering the average US dollar for the quarter, comparison shows growth of 0.3% compared to 4Q13 and decrease of 8.0% over the 3Q14. Organic growth (excluding the transaction in the last 12 months) in the external market was 3.2% over 4Q13. Evolution of Net Revenue according to Geographic Market (R$ Million) Q4 2014 Net Operating Revenues - Brazilian Market 2.179,7 1.086,9 1.092,8 429,3 - External Markets - External Markets in US$ Q3 2014 2.056,0 994,1 1.061,9 466,7 Change 6,0% 9,3% 2,9% -8,0% Q4 2013 1.893,3 913,4 979,9 428,2 Change 15,1% 19,0% 11,5% 0,3% External Market --- Distribution of Net Revenue according to Geographic Market North America South and Central America Europe Africa Australasia Q4 2014 Q3 2014 Change Q4 2013 38,7% 13,7% 38,1% 14,2% 31,7% 18,0% 24,6% 11,4% 11,6% 22,1% 14,0% 11,6% 0,6 pp -0,5 pp 2,5 pp -2,6 pp 0 pp 27,0% 13,7% 9,6% Change 7 pp -4,3 pp -2,4 pp -2,3 pp 2 pp Distribution of Net Revenue per Business Area Q4 2014 Q3 2014 % Q4 2013 % Electro-electronic Industrial Equipments 59,5% 58,5% 1 pp 60,1% -0,6 pp Domestic Market 24,0% 22,5% 1,5 pp 22,7% 1,3 pp External Market 35,4% 36,0% -0,6 pp 37,4% -2 pp Energy Generation , Transmission and Distribution 21,5% 24,2% -2,7 pp 22,9% -1,3 pp Domestic Market 13,8% 14,0% -0,2 pp 12,7% 1,1 pp 7,8% 10,2% -2,5 pp 10,2% -2,4 pp 14,1% 11,5% 2,6 pp 11,0% 3,2 pp External Market Electric Motors for Domestic Use Domestic Market 7,7% 6,6% 1,1 pp 7,5% 0,1 pp External Market 6,4% 4,9% 1,6 pp 3,4% 3 pp Paints and Varnishes 4,9% 5,8% -0,9 pp 6,1% -1,2 pp Domestic Market 4,4% 5,2% -0,8 pp 5,3% -0,9 pp External Market 0,5% 0,5% -0,1 pp 0,7% -0,3 pp BUSINESS AREAS The Industrial Electro-Electronic Equipment area showed slight growth in net operating revenue, in line with the traditional pickup of business pace in the second half of the year. In Brazil we continue to see a weaker performance, with low levels of investment in capacity expansion and poor performance of industrial production. This scenario was noticeable both in serial industrial products as in engineered products. Even the acceleration of the Brazilian currency devaluation was not enough to improve the dynamics of the Brazilian industrial, which continues to invest mainly to maintain the installed base, with capacity expansion investments concentrated in specific cases. In the external markets were able to use our competitive advantage more aggressively. We continue to execute our plan to expand the production platform outside Brazil, with new electric motors production units in Mexico and China, incorporating know-how and building a stronger industrial equipment global brand. The consolidation of the WEG brand among the world’s major capital goods manufacturers allows us to increase the scope of our product and services offering and provide increasingly integrated systems. The Energy Generation, Transmission and Distribution (GTD) business area ended the year with significant expansion compared to 2013. In transmission and distribution (T&D) the demand conditions remained favorable, although prices continue to recover at very slow pace in major world markets, reflecting production capacity and demand balance that is still evolving. In power generation equipment, however, we started to see the first concrete results of improved market conditions in Brazil. From mid-2013, small hydroelectric plants (PCH) started to become more viable and competitive in energy auctions. In addition, we started to see the first PAGE 3 Earnings Release 4Q 2014 revenues from wind generation equipment sales. The outlook for this area remains positive, both for the execution of the current order book as with winning new orders in small hydro, wind and solar, in which WEG already has a local generation systems integration solution and was included in the official energy auctions for the first time in 2014. In the Motors for Domestic Use area repeated in 2014 the good growth in net operating revenue of 2013, with the revenue integration from the acquisition of SINYA/CMM in China. The growth in the Brazilian market was more modest. Despite the changes in the consumption patterns brought by the World Cup in 2014 and the reduction of consumer credit availability, the seasonality of this business is favorable in the fourth quarter, which usually shows the boost in sales in anticipation of the year-end holidays and of the summer. These seasonal variations tend to be less intense in the future, as the internationalization of this business area is advancing with a full products portfolio, able to globally meet our clients’ demands. Finally, the Paints and Varnishes business area has suffered from the weak performance of Brazilian industrial sector, which is its most important market, with only satisfactory growth. The strategy to diversify and leverage cross-selling to customers already developed, however, remains valid for market expansion. COST OF GOODS SOLD Cost of Goods Sold (COGS) totaled R$ 1,481.5 million in 4Q14, 16.0% above 4Q13 and 4.5% above 3Q14. Gross margin reached 32.0%, with reduction of 0.5 percentage points over 4Q13 and increase of 1.0 percentage points over 3Q14. The impacts on gross margin resulting from: (I) difficulty on realigning sales prices at the necessary speed to reflect higher costs from the currency devaluation, which again was present in the quarter; (II) market fluctuations throughout the year, with sharp slowdown in the second quarter in anticipation of hosting the World Cup, followed by some pickup in inventories; and (III) lower value added product mix. Average London Metal Exchange (LME) spot copper prices fell by 7.4% in 4Q14 compared to the average of 4Q13 and fell by 5.2% compared to the average of 3Q14. Steel prices in the international markets fell by 20.7% over 4Q13 and fell by 16.5% over 3Q14. These prices variations are denominated in US dollar. SELLING, GENERAL AND ADMINISTRATIVE EXPENSES Consolidated selling, general and administrative expenses (SG&A) totaled R$ 330.4 million in 4Q14, 14.3% growth over the 4Q13 and 9.0% growth over the previous quarter. As a percentage of Net Operating Revenue, operating expenses represented 15.2% in 4Q14, 0.1 percentage points lower than 15.3% of the 4Q13 and 0.4 percentage points higher than 14.7% of the 3Q14. EBITDA AND EBITDA MARGIN In this 4Q14, EBITDA (according to the Instruction CVM 527/2012) totaled R$ 383.0 million, 12.1% growth over the 4Q13 and 9.2% growth over 3Q14. EBITDA margin reached 17.6%, 0.4 percentage points lower than 4Q13 and 0.5 percentage points higher than 3Q14. Q4 2014 Net Operating Revenues Consolidated Net Income for the Period Net Margin (+) Income taxes & Contributions (+/-) Financial income (expenses) (+) Depreciation & Amortization EBITDA EBITDA Margin 2.179,7 264,3 12,1% 82,0 -31,2 67,8 383,0 17,6% Q3 2014 % 6,0% 2.056,0 0,6% 262,6 12,8% 66,1 24,2% -41,6 -25,1% 6,6% 63,6 9,2% 350,7 17,1% Q4 2013 % 1.893,3 15,1% 237,3 11,4% 12,5% 72,0 13,9% -24,4 27,7% 56,8 19,4% 341,7 12,1% 18,0% Figures in R$ Million PAGE 4 Earnings Release 4Q 2014 110,4 (193,5) 176,0 FX Impact on Revenues (27,1) COGS (ex depreciation) 341,7 Volumes, Prices & Product Mix Changes Selling Expenses (13,9) (12,7) 2,1 General and Administrative Expenses Profit Sharing Program Other Expenses 383,0 EBITDA Q4 14 EBITDA Q4 13 Figures in R$ Million NET FINANCIAL RESULTS In this quarter, net financial result was positive in R$ 31.2 million (positive result of R$ 24.4 million in 4Q13 and positive of R$ 41.6 million in 3Q14). Financial revenues totaled R$ 282.2 million in 4Q14 (R$ 175.1 million in 4Q13 and R$ 208.2 million in 3Q14). Financial expenses totaled R$ 251.1 million (R$ 150.7 million in 4Q13 and R$ 166.6 million in 3Q14). Net financial result growth of 27.7% over the previous year is a result of increase in interest rates obtained on financial instruments in Brazilian market, proving the good credit rating of WEG. INCOME TAX Income Tax and Social Contribution on Net Profit provision in 4Q14 reached R$ 70.2 million (R$ 71.7 million in 4Q13 and R$ 77.7 million in 3Q14). Additionally, R$ 11.9 million were recorded as ‘‘Deferred Income Tax / social contribution’’ debt (debt of R$ 0.4 million in 4Q13 and credit of R$ 11.6 million in 3Q14). NET INCOME As a result of aforementioned impacts, net income for 4Q14 was R$ 263.3 million, an increase of 10.9% over 4Q13 and 1.8% over the previous quarter. The net margin of the quarter was 12.1%, 0.4 percentage points lower than 4Q13 and 0.5 percentage points lower than 3Q14. CASH FLOW 1.147,5 (1.389,8) 3.373,8 196,5 Operating Cash December 2013 Investing 3.328,0 Financing Cash December 2014 Figures in R$ Million In 2014, cash flow from operating activities totaled R$ 1,147.5 million, an increase of 12% over the same period of 2013. The expansion was due to the increase in cash generated from operations, partially offset by increased working capital needs, and especially the higher consumption of cash with payments of income tax and profit sharing. The acceleration of investments in expansion and modernization of productive capacity program, especially with the new unit projects in China and Mexico, as well as acquisitions made during 2014, WEG Balingen, in Germany, CMM and Sinya Group, in China, Efacec PAGE 5 Earnings Release 4Q 2014 Service, in Brazil, FTC, in Colombia, and KATT, in Germany, led to the consumption of R$ 1,389.8 million in investments activities, reversing the cash flow situation observed in 2013. Financing activities generated R$ 196.5 million in 2014. In this period we issued R$ 1,517.8 million new debt and amortized R$ 677.0 million of existing debt, resulting in net increase of R$ 840.7 million, with attractive maturities and interest rates. Additionally, we paid R$ 459.5 million in dividends and interest on stockholders’ capital from the second half of 2013 and the first half of 2014. INVESTMENTS 134,1 132,3 Outside Brazil Brazil 56,8 6,0 61,3 11,8 94,0 63,9 15,6 61,1 13,1 64,3 8,4 50,7 49,5 48,3 48,0 55,9 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 47,9 60,5 23,5 70,6 71,8 Q2 14 Q3 14 86,2 Q4 14 Figures in R$ Million In 2014, WEG started a new cycle of investments for capacity expansion and modernization, with the start of the implementation of new electric motors production units in Mexico and China that will receive investments of US$ 345 million over five years. In 2014 investments totaled R$ 424.8 million, being 67% of it destined to the industrial plants and other installations in Brazil and the remaining to production units and other subsidiaries abroad. In addition, the consolidation of acquisitions made during 2014 added R$ 61.2 million in fixed assets: WEG Balingen, in Germany, and Sinya and CMM Group, in China. However, we have flexibility in implementing our investment program as capacity additions are designed to be modular, responding to the demand and optimizing the capacity occupation to maximize the return on invested capital. Thus, we postponed some disbursements originally scheduled for 2014 over the coming months. DEBT AND CASH POSITION On December 31, 2014 cash, cash equivalents and financial investments totaled R$ 4,194.2 million, almost entirely in fixed income instruments linked to the CDI, invested in Brazilian currency in first-tier banks. Gross financial debt totaled R$ 4,092.1 million, being 36% in short-term and 64% in long-term. December 2014 December 2013 December 2012 Cash & Financial instruments 4.194.224 3.376.029 2.565.532 - Current - Long Term 4.193.177 1.047 3.373.799 2.230 2.563.500 2.032 Debt 4.092.150 100% 3.209.004 100% 2.689.840 100% - Current 1.466.752 36% 912.796 28% 1.645.772 61% - In Brazilian Reais 779.146 462.336 - In other currencies 687.606 450.460 - Long Term - In Brazilian Reais - In other currencies Net Cash (Debt) 2.625.398 64% 2.296.208 1.067.683 578.089 72% 1.044.068 39% 1.701.408 2.048.766 824.910 923.990 247.442 219.158 102.074 167.025 (124.308) Figures in R$ Thousand At the end of the 4Q14 WEG had net cash of R$ 102.1 million (net cash of R$ 167.0 million on December 31, 2014). Over the quarter we raised new funding on attractive terms of maturities and fees. The characteristics of the debt are: The total duration debt is 22.9 months and the long-term portion is 32,1 months. Duration portion denominated in Brazilian Reais is 19.6 months and for the portion in foreign currencies is 28.2 months. PAGE 6 Earnings Release 4Q 2014 The weighted average cost of fixed-rate denominated in Brazilian Reais is approximately 6,3% per year. Floating rate contracts are indexed mainly by the Brazilian long-term interest rate (TJLP). DIVIDENDS As of August 13, 2014, payments declared during the first half of 2014 were made to shareholders, as below: On March 25, as interest on stockholders’ equity (JCP), to shareholders on said date, in the gross amount of R$ 51.8 million; On June 24, as interest on stockholders’ equity (JCP), to shareholders on said date, in the gross amount of R$ 56.9 million; On July 22, as dividends referring to profit recorded in the first half of 2014, in the total amount of R$ 125.3 million. The payments referring to the second half of 2014 (supplementary dividends), to the total amount of R$ 287.1 million, will begin on March 11, 2015. On September 23, as interest on stockholders’ equity (JCP), to shareholders on said date, in the gross amount of R$ 57.9 million; On December 16, as interest on stockholders’ equity (JCP), to shareholders on said date, in the gross amount of R$ 61.7 million; On February 24, as supplementary dividends referring to profit recorded in the second half of 2014, in the total amount of R$ 167.5 million. Event Board Meeting Date Payment Date Gross amount per share Dividends 24/02/2015 11/03/2015 0,207646611 Interest on Stockholders’ Equity 16/12/2014 11/03/2015 0,076470588 Interest on Stockholders’ Equity 23/09/2014 11/03/2015 0,071764706 Dividends 22/07/2014 13/08/2014 0,155386949 Interest on Stockholders’ Equity 24/06/2014 13/08/2014 0,070588235 Interest on Stockholders’ Equity 25/03/2014 13/08/2014 0,083529412 Total 0,665386501 Our policy is to declare interest on stockholders equity quarterly and declare dividends based on profit earned each semester, thus, we reported six different earnings each year, which is paid semiannually. WEGE3 SHARE PERFORMANCE The common shares issued by WEG, traded under the code WEGE3 at BM&F Bovespa, ended the last trading session on December 2014 quoted at R$ 30.60, with nominal gain of 27.7% in the year and gain of 30.9% considering the dividends and interest on stockholders equity declared in the period. PAGE 7 Earnings Release 4Q 2014 35,00 3.500 WEGE3 30,00 3.000 25,00 2.500 20,00 2.000 15,00 1.500 10,00 1.000 5,00 500 0,00 0 Traded shares (thousands) WEGE3 share prices Shares Traded (thousands) The average daily traded volume in 4Q14 was R$ 22.9 million, (R$ 16.7 million in 4Q13). Throughout the quarter 198,284 stock trades were carried out (148,016 stock trades in 4Q13), involving 48.7 million shares and moving R$ 1,419.7 million (R$ 1,016.6 million in 4Q13). FTC ENERGY GROUP ACQUISITION IN COLOMBIA On October 20, WEG S.A. announced the acquisition of FTC Energy Group (‘‘FTC’’), a Bogotá, Colombia, based company that manufactures and assembles electrical panels for process automation. FTC was founded in 1984 and has reached a prominent position in the Colombian oil and gas equipment market, with extensive experience in special panels and electrical rooms. In 2013, FTC reached approximately US$ 10 million in net revenues. The transaction is subject to approval from anti-trust authorities and other technical and commercial terms. KATT ACQUISITION IN GERMANY On December 01, WEG S.A. announced the acquisition of Antriebstechnik KATT Hessen GmbH (‘‘KATT’’), an electric motors manufacturer with headquarters in Homberg, Germany. KATT originated in 2002, from the merger of KATT Motoren, founded in 1924, and its AKS development affiliate. Over the years, KATT has accumulated large experience in manufacture high-speed motors and a strong technological development expertise. The company has two manufacturing units, in Homberg and Dresden, employing around 190 people. Net revenues in 2013 were of approximately € 14.4 million. WEG SELECTED FOR CORPORATE SUSTAINABILITY INDEX (ISE) On November 26, WEG S.A was once again selected to the Corporate Sustainability Index portfolio (ISE) of BM&FBOVESPA. The new ISE’s portfolio, will be valid from January 5, 2015 to January 2, 2016. Company is the sole representative of Machinery and Equipment segment. The inclusion of WEGE3’s shares in ISE, which has been occurring consistently for some years, shows the Company’s commitment with corporate governance good practices, social responsibility and sustainable development. WEG once again authorized disclosure of its answers to the selection questionnaire. PAGE 8 Earnings Release 4Q 2014 RESULTS CONFERENCE CALL WEG will hold, on February 26, 2015 (Thursday), conference call and webcast to discuss the results. The call will be conducted in Portuguese with simultaneous translation in English, following scheduled time: 11 a.m. 9 a.m. 2 p.m. --- Brasília time --- New York (EST) --- London (GMT) Connecting phone numbers: Dial---in for connecting from Brazil: Dial---in for connecting from USA: Toll-free for connecting from USA: Code: (11) 3193-1001 / (11) 2820-4001 +1 786 924-6977 +1 888 700-0802 WEG Access to the webcast: Slides and Portuguese audio: Slides and English translation: www.ccall.com.br/weg/4t14.htm www.ccall.com.br/weg/4q14.htm The presentation will be available in Investor Relations page of WEG website (www.weg.net/ri). Please, call approximately 10 minutes before the call is scheduled to start. PAGE 9 Earnings Release 4Q 2014 BUSINESS AREA Industrial Electro-Electronic Equipment The industrial electrical-electronic equipment area includes low and medium voltage electric motors, drives & controls, industrial automation equipment and services, and maintenance services and parts. We compete in all major markets with our products and solutions. Electric motors and other related equipment find applications in practically all industrial segments, in equipment such as compressors, pumps and fans, for example. Energy Generation, Transmission and Distribution (GTD) Products and services included in this area are electric generators for hydraulic and thermal power plants (biomass), hydro turbines (small hydroelectric plants or PCH), wind turbines, transformers, substations, control panels and system integration services. In the GTD area in general and specifically in power generation, investment maturing terms are longer, with slower investment decisions and longer project and manufacturing lead times. As such, new orders are recorded as revenue after a few months, upon effective delivery to buyers. Motors for Domestic Use In this business area, our operations have traditionally focused in Brazil, where we hold a significant share in the market of single phase motors for durable consumer goods, such as washing machines, air conditioners, water pumps, among others. This is a short cycle business and variations in consumer demand are rapidly transferred to the industry, with almost immediate impacts on production and revenue. Paints and Varnishes In this area, including liquid paints, powder paints and electro-insulating varnishes, we have very clear focus on industrial applications in Brazil, and are expanding to Latin America. Our strategy in this area is cross selling to customers from other operating areas. The target markets ranging from shipbuilding industry to the manufacturers of white line home appliances. We seek to maximize the scale of production and efforts to developed new products and new segments of production and efforts to developed new products and new segments. The information contained in this report relating to WEG’s business perspectives, the projections and results and to the company’s growth potential should be considered as only estimates and were based on the management expectations relating to the future of the company. These expectations are highly influenced by the market conditions and the general economic performance of the country and of the foreign markets which may be subject to sudden change. PAGE 10 Earnings Release 4Q 2014 Annex I Consolidated Income Statement - Quarterly Figures in R$ Thousands 4T14 55 4th Quarter 2014 R$ VA% Net Operating Revenues Cost of Goods Sold Gross Profit Sales Expenses Administrative Expenses Financial Revenues Financial Expenses Other Operating Income Other Operating Expenses EARNINGS BEFORE TAXES Income Taxes & Contributions Deferred Taxes Minorities NET EARNINGS EBITDA 3T14 53 3rd Quarter 2014 R$ VA% 4T13 46 4th Quarter 2013 R$ VA% Changes % Q4 2014 Q4 2014 Q3 2014 Q4 2013 2.179.695 (1.481.477) 698.218 (226.955) (103.443) 282.237 (251.071) 10.245 (62.888) 346.343 (70.152) (11.897) 1.009 263.285 100% -68% 32% -10% -5% 13% -12% 0% -3% 16% -3% -1% 0% 12% 2.055.972 (1.417.439) 638.533 (205.555) (97.548) 208.182 (166.599) 2.072 (50.404) 328.681 (77.674) 11.589 4.027 258.569 100% -69% 31% -10% -5% 10% -8% 0% -2% 16% -4% 1% 0% 13% 1.893.299 (1.277.346) 615.953 (198.657) (90.313) 175.104 (150.694) 3.490 (45.595) 309.288 (71.660) (375) (186) 237.439 100% -67% 33% -10% -5% 9% -8% 0% -2% 16% -4% 0% 0% 13% 6,0% 4,5% 9,3% 10,4% 6,0% 35,6% 50,7% 394,4% 24,8% 5,4% -9,7% n.m -74,9% 1,8% 15,1% 16,0% 13,4% 14,2% 14,5% 61,2% 66,6% 193,6% 37,9% 12,0% -2,1% n.m n.m 10,9% 382.987 17,6% 350.699 17,1% 341.653 18,0% 9,2% 12,1% PAGE 11 Earnings Release 4Q 2014 Annex II Consolidated Income Statement 12M14 55 12 Months 2014 R$ VA% 12M13 Figures in R$ Thousands 46 12 Months 2013 R$ VA% % 2014 2013 Net Operating Revenues Cost of Goods Sold Gross Profit Sales Expenses Administrative Expenses Financial Revenues Financial Expenses Other Operating Income Other Operating Expenses EARNINGS BEFORE TAXES Income Taxes & Contributions Deferred Taxes Minorities NET EARNINGS 7.840.757 (5.356.260) 2.484.497 (820.471) (386.112) 785.503 (651.926) 15.902 (199.464) 1.227.929 (271.583) 5.970 7.590 954.726 100% -68% 32% -10% -5% 10% -8% 0% -3% 16% -3% 0% 0% 12% 6.828.896 (4.592.130) 2.236.766 (716.358) (328.863) 599.974 (526.848) 16.431 (196.223) 1.084.879 (274.858) 35.283 1.837 843.467 100% -67% 33% -10% -5% 9% -8% 0% -3% 16% -4% 1% 0% 12% 15% 17% 11% 15% 17% 31% 24% -3% 2% 13% -1% -83% 313% 13% EBITDA 1.344.829 17,2% 1.230.032 18,0% 9% PAGE 12 Earnings Release 4Q 2014 Annex III Consolidated Balance Sheet Figures in R$ Thousands CURRENT ASSETS Cash & cash equivalents Receivables Inventories Other current assets LONG TERM ASSETS Long term securities Deferred taxes Other non-current assets FIXED ASSETS Investment in Subs Property, Plant & Equipment Intangibles TOTAL ASSETS December 2014 December 2013 (A) (B) R$ % R$ % 8.098.187 69% 6.851.787 68% 4.193.177 36% 3.373.799 33% 1.867.864 16% 1.658.806 16% 1.704.919 14% 1.445.927 14% 332.227 3% 373.255 4% 126.670 1% 123.866 1% 1.047 0% 2.230 0% 55.864 0% 60.376 1% 69.759 1% 61.260 1% 3.557.773 30% 3.165.640 31% 8.224 0% 7.264 0% 2.877.942 24% 2.614.556 26% 671.607 6% 543.820 5% 11.782.630 100% 10.141.293 100% December 2012 (C) R$ % (A)/(B) (A)/(C) 5.710.017 64% 18% 42% 2.563.500 29% 24% 64% 1.472.839 17% 13% 27% 1.306.273 15% 18% 31% 367.405 4% -11% -10% 88.833 1% 2% 43% 2.032 0% -48% 36.891 0% -7% 51% 49.910 1% 14% 40% 3.074.700 35% 12% 16% 7.622 0% 13% 8% 2.537.094 29% 10% 13% 529.984 6% 23% 27% 8.873.550 100% 16% 33% CURRENT LIABILITIES Social and Labor Liabilities Suppliers Fiscal and Tax Liabilities Short Term Debt Dividends Payable Advances from Clients Profit Sharring Other Short Term Liabilities LONG TERM LIABILITIES Long Term Debt Other Long Term Liabilities Deferred Taxes Contingencies Provisions MINORITIES STOCKHOLDERS' EQUITY TOTAL LIABILITIES 3.380.459 173.382 445.577 148.335 1.466.752 111.351 590.815 111.173 333.074 3.262.552 2.625.398 95.316 282.989 258.849 83.234 5.056.385 11.782.630 3.012.824 168.831 331.037 126.655 1.645.772 79.381 358.124 33.559 269.465 1.709.100 1.044.068 137.916 320.503 206.613 91.277 4.060.349 8.873.550 29% 2.578.048 1% 152.739 4% 420.250 1% 139.570 12% 912.796 1% 87.723 5% 459.130 1% 98.005 3% 307.835 28% 2.920.978 22% 2.296.208 1% 95.031 2% 294.405 2% 235.334 1% 84.495 43% 4.557.772 100% 10.141.293 25% 2% 4% 1% 9% 1% 5% 1% 3% 29% 23% 1% 3% 2% 1% 45% 100% 34% 2% 4% 1% 19% 1% 4% 0% 3% 19% 12% 2% 4% 2% 1% 46% 100% 31% 14% 6% 6% 61% 27% 29% 13% 8% 12% 14% 0% -4% 10% -1% 11% 16% 12% 3% 35% 17% -11% 40% 65% 231% 24% 91% 151% -31% -12% 25% -9% 25% 33% PAGE 13 Earnings Release 4Q 2014 Annex IV Consolidated Cash Flow Statement Figures in R$ Thousands 12M14 12M13 12 Months 2014 12 Months 2013 Operating Activities Net Earnings before Taxes Depreciation and Amortization Provisions: Changes in Assets & Liabilities (Increase) / Reduction of Accounts Receivable Increase / (Reduction) of Accounts Payable (Increase) / Reduction of Investories Income Tax and Social Contribution on Net Earnings Profit Sharing Paid Cash Flow from Operating Activities 1.227.929 250.477 395.638 (726.524) (199.394) 156.085 (237.825) (290.872) (154.518) 1.147.520 1.084.879 218.279 379.359 (655.083) (299.506) 187.409 (146.049) (280.483) (116.454) 1.027.434 Investment Activities Fixed Assets Intagible Assets Results of sales of fixed assets Accumulated Conversion Adjustment Long term securities bought Goodwill in Capital Transactions Acquisition of Stakes of non-controlling shareholders Aquisition of Subsidiaries Cash Flow From Investment Activities (427.652) (40.943) 12.355 60.636 (863.979) (2.699) (5.947) (136.523) (1.389.830) (258.699) (21.943) 2.030 83.761 261.046 (5.177) 1.517.761 (677.016) (185.807) 1.104 (459.516) 196.526 1.890.267 (1.353.734) (155.933) 738 (391.987) (10.649) (45.784) 1.071.543 Financing Activities Working Capital Financing Long Term Financing Interest paid on loans and financing Treasury Shares Dividends & Intesrest on Stockholders Equity Paid Cash Flow From Financing Activities Change in Cash Position (6.260) 54.758 PAGE 14