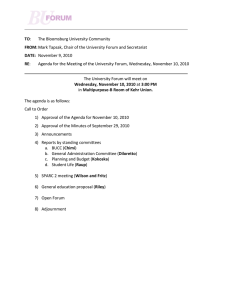

GLOBAL FORUM ON TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES

advertisement