Center for Tax and Budget Accountability J 4 2013

advertisement

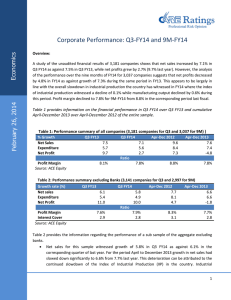

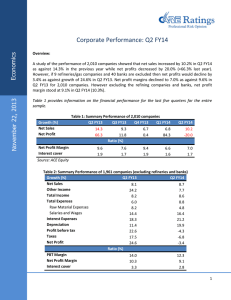

Center for Tax and Budget Accountability J June 4 4, 2013 FY13 Budget Experience • The FY13 budget reduced appropriations for General State Aid Aid, early childhood childhood, and other education priorities • Incorporated changes to the Medicaid program pursuant to the SMART Act • At the outset of the fiscal year, underfunded liability in certain human services programs FY13 Budget Experience • Pension pressures continued to crowd out other areas of state spending • Changes were needed to contain the rising cost of state employee group health insurance benefits • We started the year with a modest revenue projection, not anticipating the “April surprise” FY13 Budget Experience: Cl i O Closing Out the h Fi Fiscall Y Year • The “April April surprise” surprise – using the revenue to pay old bills • We will end FY13 having passed over $1 $1.2 2 billion in GRF supplemental appropriations • GOMB estimates ti t th thatt we will ill end d FY13 with over $2.3 billion less bills on hand FY14 Budget: Pressures and Goals • Rising pension costs pressure other areas of the budget – The GRF payment to the 5 pension systems comprises 17% of the GRF budget – When combined with debt service on bonds issued to make our pension payments in 2003, 2010 and 2011, the state’s contribution is 22% of the overall budget FY14 Budget: Pressures and Goals • Governor’s introduced budget cut General State Aid by $150 $150.4 4 million from FY13 FY13, which would have created a much deeper proration to the Foundation Level p • The state’s subsidy for school p was also cut,, byy $146 $ transportation million from FY13 • Higher g education saw reductions ranging g g from 4% to 5% across lines FY14 Budget: Pressures and Goals • FY14 budget goals included: – Maintaining the 89% proration on GSA – Holding the line on the school transportation funding level – Holding the line on early childhood funding – Fully fund social service programs at their estimated liability FY14 General Revenue Funds by Source $35.446 Billion Federal Receipts 11% Personal Income 45% Other Sources 15% Personal Income - $16.0B Sales S 21% Corporate Income - $2.9B Sales - $7.4B Corporate Income 8% Other Sources - $5.1B Federal Receipts p - $4.0B Personal Income Tax Rates of Midwestern States 10.00% 9.00% 8.00% 7.00% Tax R Rate 6.00% Iowa Wisconsin 5.00% 00% Missouri Kentucky 4.00% Illinois Indiana 3 00% 3.00% Illinois ‐ 2015 2.00% 1.00% 0.00% $0 $50,000 $100,000 $150,000 $200,000 Income (Married Filing Jointly) *Indiana's tax rate includes an average county tax rate of 1.28% $250,000 $300,000 Top Corporate Income Tax Rates of Midwestern States 14.00% 12.00% Inco ome Tax Rate R 12 00% 12.00% 10.00% 8.00% 8 00% 8.00% 7 90% 7.90% 7.00% 6.00% 6.00% 6.25% 4.00% 2 00% 2.00% 0.00% Illinois Kentucky Missouri Indiana Wisconsin Iowa FY14: All Funds Budget $71 Billion $35.4 Billion 50% $8.0 Billion 11% $27.8 $27 8 Billi Billion 39.0% Federal Funds Other State Funds General Revenue Funds FY14 General Revenue Fund Budget: $35.446 Billion Discretionary Spending: $16.7 Billion Non-Discretionary Spending: $18.7 Billion Pensions total 22% FY 2014 Proposed GRF Discretionary y and Non-Discretionary y Appropriations pp p $35.446 Billion Debt Service on Government Services Public Safety Capital Bonds 3% 1% Statutory and Regulation Transfers Out¹ 5% D bt S Debt Service i on 7% Pension Bonds 5% Pensions 17% Operation of State Government =$4 billion (11%). Human Services 15% Government Services - $1,178 Public Safety and Regulation - $1,692 Human Services - $5,202 P- 12 19% Medicaid/Healthcare 23% P- 12 - $6,687 Higher Ed - $1,991 Medicaid/Healthcare - $8,311 Higher Ed 5% Pensions - $5,988 Debt Service on Pension Bonds - $1,655 Debt Service on Capital Bonds - $527 Statutory Transfers Out - $2,172 FY14 Budget Accomplishments • Balanced • Relies on eliminating liabilities in FY13 thanks to revenue surprise • Places an emphasis on funding K-12 and human services: – Increases K-12 K 12 spending by $136 million over FY13 – Funds human service providers at a level that gives them some predictability, and helps them plan