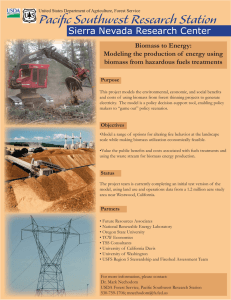

6 Environment, Energy, and Economic Development om as a public

advertisement