Document 12464963

advertisement

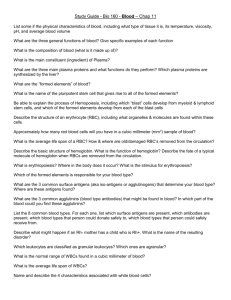

MOVING ON:

FROM ENTERPRISE POLICY TO INNOVATION

POLICY IN THE WESTERN BALKANS

Working Paper No. 108

May 2010

Stephen Roper

Warwick Business School’s Small and Medium Sized Enterprise Centre

Working Papers are produced in order to make available to a wider public,

research results obtained by its research staff. The Director of the

CSME, Professor Stephen Roper, is the Editor of the Series. Any

enquiries concerning the research undertaken within the Centre should be

addressed to:

The Director

CSME

Warwick Business School

University of Warwick

Coventry CV4 7AL

e-mail stephen.roper@wbs.ac.uk Tel. 02476 522501

ISSN 0964-9328 – CSME WORKING PAPERS

Details of papers in this series may be requested from:

The Publications Secretary

CSME

Warwick Business School

University of Warwick

Coventry CV4 7AL

e-mail sharon.west@wbs.ac.uk Tel. 02476 523741

1

Moving on: From enterprise policy to

innovation policy in the Western Balkans

Stephen Roper

Centre for Small and Medium Enterprises, Warwick Business School,

University of Warwick, Coventry, CV4 7AL, UK

Email: Stephen.Roper@wbs.ac.uk

Abstract:

Significant progress has been made in recent years in the development of enterprise

policy in the Western Balkans. Issues remain, however, in the support provided for

innovative enterprises. In this paper we use data from the 2005 Business Environment

and Enterprise Performance Survey to identify the determinants of innovation in

locally-owned firms in the Western Balkans and compare these to the other CEEE

countries and the CIS. Based on an econometric examination of the innovation

production function in each area we observe marked differences in the determinants

of innovation. First, in the Western Balkan countries (WBCs) R&D and higher-level

skills have little impact on firms’ innovation outputs, a result which contrasts strongly

with results for the CEEE, CIS and other more developed economies. Second, we find

no evidence of innovation benefits from urban locations in innovation in the WBCs or

that public support is having any positive effect on innovation outcomes. Again, this

experience is at odds with evidence from other regions. Third, innovation outputs in

the WBCs are being negatively influenced by aspects of the business environment.

These results suggest a need for an active and rather interventionist innovation policy

in the WBCs to address these system failures. A range of policy options are

developed.

Key words: Innovation, Western Balkans, innovation policy, innovation system,

transition

Acknowledgements:

I am grateful to David Storey who suggested the idea for the analysis reported in this

paper. Helpful comments were also received from the editors of this special issue and

two anonymous referees. Interpretations and mistakes are all my own work.

2

Moving on: From enterprise policy to innovation policy in the Western Balkans

1. Introduction

Since the adoption of the European Charter for Small Enterprises in 2003 the Western

Balkans Countries (WBCs) have made substantial progress in the development of

enterprise policy. As of 2010, all of the WBCs have in place the basic legal and

regulatory frameworks necessary for entrepreneurship and business development. In

terms of company registration, for example, almost all of the WBCs have made

significant progress in simplifying registration processes, and reducing the costs and

time taken to register new firms. The development of more targeted enterprise support

measures – for start-ups, export oriented firms or those led by women – remains more

uneven across the WBCs, however. And, even where such measures have been

implemented they often remain under-resourced compared to those in the new EU

Member States (OECD 2009, pp. 14-15). The ‘geography’ of enterprise policy across

the Western Balkans divides countries into three groups at different stages of

development: Albania, Bosnia and Herzegovina (BiH) and Kosovo have established

institutional and legal frameworks for enterprise policy but active policy intervention

remains limited to ad hoc and pilot projects; Macedonia, Montenegro and Serbia have

progressed further towards more comprehensive and nation-wide enterprise policy

implementation; while Croatia is most advanced in terms of enterprise policy with

policy implementation close to that of the new EU Member States1(OECD 2009, pp.

15-16.).

Alongside these developments in enterprise policy, recent studies also provide

evidence of positive attitudes to enterprise in the more economically advanced WBCs.

Comparing public attitudes to enterprise in Croatia, Serbia and Macedonia to EU and

US benchmarks suggests a positive picture with relatively high proportions of adults

in the Western Balkans seeing opportunities for entrepreneurship and feeling that they

have the necessary skill base for business start-up. For example, 53 per cent of

Croatian adults, 56 per cent of those in Serbia and 47 per cent of those in Macedonia

perceived good opportunities for start-up in the next six months in 2008 compared to

1

This is reflected in the recent establishment (January 2009) in Croatia of the South East European

Centre for Entrepreneurial learning (SEECEL) supported by the Croatian government and EU IPA

Programme. See http://www.seecel.hr.

3

48 per cent in the USA2. This is also reflected in reported levels of new business

activity which in all three countries are high by EU standards. In 2008, for example,

7.6 per cent of adults in Croatia were engaged in early stage entrepreneurial activity in

Croatia (Serbia, 7.6 per cent, Macedonia 14.5 per cent) compared to around 10.8 per

cent in the US3.

These developments in enterprise policy and positive attitudes to enterprise in the

WBCs cannot be seen, however, in isolation from the broader economic and policy

context. The most immediate concern is clearly the impact of the current global

recession which led to a sharp collapse in GDP growth rates in 2009 across the WBCs

accompanied by rapid increases in trade deficits and government borrowing (Gligorov

2009). Longer-term, however, if the WBCs are to correct their structural trade

deficits, there is a need to develop more innovative industries which can increase

productivity (Crepon et al. 1998) and compete internationally (Bleaney and Wakelin

2002). In this paper we consider the challenges which the WBCs face in moving on

from the 2003 to 2009 period of enterprise policy development to focus on innovation

policy. As a recent study by Krammer (2009) of the drivers of patenting in Eastern

Europe suggests this may require more public support for R&D and stronger

collaboration between universities and firms. The recent social and economic history

of the WBCs also suggests, however, that increasing innovation in the WBCs may

involve different challenges to those in other transition economies. Svarc (2006) for

example, emphasises the specific socio-political conditions within which innovation

policy in Croatia has developed, while Plenakovik and Pinto (2009) stress the

institutional and structural weaknesses in the Macedonian innovation system. Both

studies also stress the weakness of the innovation capability of many locally-owned

companies in the WBCs, and therefore the need to address this as a policy priority.

This suggests two key questions: First, what currently determines innovation in

locally-owned firms in the WBCs, and how does this differ from other transition and

developed economies? Second, what measures could then be adopted in order to

improve innovation capability in locally-owned firms across the Western Balkans?

Addressing these questions suggests the need for an active and interventionist

2

. Source: Global Entrepreneurship Monitor, 2008 Executive Report, Tables 1 and 2.

Source: Global Entrepreneurship Monitor, 2008 Executive Report, Tables 1 and 2.

3

4

innovation policy to improve corporate innovation capabilities as well as upgrading

nations’ innovation systems across the WBCs.

The remainder of the paper is organised as follows. In Section 2 we provide a

conceptual overview of the rationale for public intervention to support corporate

innovation (Asheim et al. 2007). This highlights the central role of firms’ innovation

capabilities in implementing innovation, and the potential for government intervention

to support such developments. Sections 3 and 4 address our main empirical question

investigating what currently determines innovation in the WBCs. Section 5 concludes

and identifies some potential policy options developed from best practice elsewhere.

2. Public policy and innovation development

Innovation occurs where firms apply new or pre-existing knowledge to introduce new

products, services or business models. This creates competitive advantage giving

innovating firms the opportunity to earn higher profits, gain new sales and potentially

enter new markets. At a fundamental level, the process of innovation or technological

development can be seen as part of an evolutionary dynamic in which products,

processes and services are steadily refined - and occasionally transformed – and

through which firms upgrade their innovation capabilities through organisational

learning (Nelson and Winter 1982). Current thinking also emphasises the social and

interactive nature of the innovation process reflecting the role of innovation

partnerships and networks and the importance of inter-organisational knowledge

flows (Chesborough 2003, 2006). This emphasises the importance of absorptive

capacity, and firms’ ability to identify and absorb external knowledge which can

complement internal knowledge resources (Zahra and George 2002; Roper and Love

2006). It also suggests the notion of an innovation system, i.e. ‘that set of distinct

institutions which jointly and individually contribute to the development and diffusion

of new technologies and which provide the framework within which governments

form and implement policies to influence the innovation process. As such it is a

system of interconnected institutions to create, store and transfer the knowledge, skills

and artefacts which define new technology’ (Metcalfe 1997, pp 461-462).

Innovation systems have been said to comprise three main elements (Autio, 1998): the

knowledge generation sub-system, the knowledge application and exploitation sub5

system, and the linkages between these two sub-systems. The first of these, the

knowledge generation and diffusion sub-system, comprises those organizations whose

corporate objectives relate either to knowledge creation (i.e. researching

organizations), knowledge sourcing, knowledge or technology transfer or regional or

national economic development (e.g. universities, third-level colleges, government

and industry research organisations, and technology transfer and technology

mediating institutions). Here, the position of the different WBCs is rather uneven with

Croatia and Serbia (and to some extent Macedonia and Albania) retaining significant

public sector and higher education R&D capabilities which are weaker elsewhere

(Svarc 2006; Machacova and Elke 2008). More positive perhaps are recent

developments in knowledge transfer and intermediary organisations such as business

centres, innovation and technology centres and inter-firm clusters (OECD 2009, pp.

124-132), although again these remain concentrated in Croatia, Serbia and

Macedonia.

The second key element of a national innovation system highlighted by Autio (1998)

is the innovation capability of firms. Filatotchev (2003), for example, argues that the

experience of a command economy might leave firms poorly equipped to cope with

the rigors of a market environment suggesting, in particular, that managers’ expertise,

flexibility and willingness to take risky decisions may be limited (Uhlenbruck, Meyer,

and Hitt 2003). Kriauciunas and Kale (2006) discuss essentially similar issues of

‘socialist imprinting’ in their study of firms in Lithuania and argue that privatisation

may be one route through which firms may acquire additional innovation capabilities:

‘Foreign Direct Investment (FDI) privatisations are likely to be associated with interfirm networks outside traditional networks, raising absorptive capacity’ (Filatotchev

et al. 2003, p. 341). Jensen (2004) in a study of Polish food producers also emphasizes

the more extensive international networks of externally-owned firms and the more

localized networks of locally-owned firms. Other aspects of firms’ resource base will

also shape their innovation capabilities. In-house R&D, for example, has a direct role

on knowledge creation and innovation {Crepon et al. 1998) and also a complementary

role in strengthening firms’ absorptive capacity (Griffith, Redding, and Van Reenan

2003). Likewise, workforce skills can play an important role in both contributing to

innovation capability (Freel 2005) and absorptive capacity (Roper and Love 2006).

6

The third key element of any innovation system highlighted by Autio (1998) is the

level of cooperation or association between the knowledge generating and knowledge

implementing elements of the system (Cooke and Morgan 1998). The value of such

co-operation in innovation is well established (Simonen and McCann 2008), although

science-industry co-operation often remains weak in transition economies (Svarc

2006; Leskovar-Spacapan and Bastic 2007). In terms of Croatia, at least, Svarc (2006)

attributes this in part to ‘socialist-style science policy’ in which R&D performing and

innovating organisations are separate, and in which innovation itself is technology

driven rather than market-led.

Weaknesses in any of these three aspects of an innovation system may generate

system failure leading to under-performance in innovation (Woolthuis, Lankhuizen,

and Gilsing 2005). This suggests a role for public policy to ‘address systemic failures

that block the functioning of innovation systems or hinder the flow of knowledge and

technology … Such systemic failures can emerge from mismatches between the

different components of an innovation system, such as conflicting incentives for

market and non-market institutions (e.g. enterprises and the public research sector), or

from institutional rigidities based on narrow specialisations or asymmetric

information’ (OECD 1999). More positively, recent thinking in the innovation

systems tradition suggests that national competitive advantage may be ‘consciously

and pro-actively constructed’ as a result of public sector intervention in an innovation

system (Asheim et al. 2007; Cooke and Leydesdorff 2006). There is substantial

evidence, for example, that public support for private sector R&D and innovation

activity can have a positive impact on firms’ innovation outputs in both developed

(Griliches 1995; Mamuneas and Nadiri 1996; Hewitt-Dundas and Roper 2009) and

transition economies (Czarnitzki and Licht 2006).

To evaluate the way in which these different factors come together to influence the

innovation capabilities of locally-owned firms in the WBCs we focus our empirical

analysis on the notion of an innovation or knowledge production function (Griliches

1992; Love and Roper 1999). This relates firms’ innovation outputs to the different

factors which might influence the innovation process both from within and outside the

firm. For firm i this can be written as:

7

I i 0 1 FCi 2 LM i 3 PS i 4ODi i

(1)

Where Ii is an innovation output indicator, FCi is a set of firm-specific characteristics,

LMi is a set of location and market indictors, PSi indicates public support, ODi are

operating difficulties identified by the firm and εi is a random error term.

3. Data and methods

Our analysis of the determinants of innovation in locally-owned firms in the WBCs is

based on data taken from the 2005 Business Environment and Enterprise Performance

Survey (BEEPS). Financed jointly by the European Bank for Reconstruction and

Development and the World Bank this survey was undertaken between 10th March

and 20th April 2005 and included 28 countries including all of the WBCs with the

exception of Kosovo4. The survey objective was to be broadly representative of the

market-driven sectors of each country reflecting the mix of manufacturing and

services activity, but excluding those sectors of each economy subject to government

price regulation and prudential supervision (i.e. banking, electric power, rail transport,

and water and waste water)5. The target population comprised enterprises which were

established prior to 2002, and had between 2 and 10,000 employees6. The survey

achieved an overall response rate of 36.8 per cent with significantly higher response

rates achieved in each of the WBCs (Synovate 2005)7. In each country sampling

frames were constructed from official government company registers, Chamber of

Commerce membership lists and commercial sources such as the Yellow Pages.

To date the main use of the BEEPS data has been to profile aspects of the business

environment in each country and to examine the impact of criminal activity and

corruption on business development. Krkoska and Robeck (2006), for example,

demonstrate the deterrent impact of crime on FDI inflows and job creation. The

4

The 2005 BEEPS covered: Albania, Armenia, Azerbaijan, Belarus, Bosnia, Bulgaria, Croatia, Czech,

Estonia, Serbia and Montenegro, Macedonia, Georgia, Hungary, Kazakhstan, Kyrgyzstan, Latvia,

Lithuania, Moldova, Poland, Romania, Russia, Slovak Republic, Slovenia, Tajikistan, Turkey, Ukraine

and Uzbekistan.

5

Some other quota restrictions relating to size, ownership, exporting and location were also imposed

but probably limited in effect (Synovate 2005, p. 4).

6

This figure reflects the overall response rate to all three elements of the BEEPS 2005 survey (i.e. the

random sample, panel sample and manufacturing overlay). Overall, 26249 firms were contacted with

9655 completed interviews (36.8 per cent).

7

For the Western Balkan countries there was no manufacturing uplift and response rates were: Albania

48.1 per cent; BiH, 46.0 per cent; 50.6 per cent; Croatia, 45.8 per cent; Serbia and Montenegro, 45.8

per cent. (Synovate 2005).

8

BEEPS survey, however, also includes variables reflecting whether firms have

‘developed successfully a major new (or upgraded) product line or service over the

last 3 years’. Around 39 per cent of locally-owned firms in the WBCs reported

developing new products, slightly above the 37 per cent in the CIS countries (Table

1). More significant, however, was the difference in the level of more incremental

product/service upgrading in the WBCs undertaken by a further 29 per cent of firms

(CEEE 22 per cent, CIS 21 per cent). The extent of process innovation among firms in

the WBCs was also marginally above that in the CIS countries (39 per cent of firms

compared to 34 per cent) and significantly greater than that in the CEEE countries (28

per cent). In broad terms these comparisons suggest that the extent of new

product/service and process innovation in the WBCs is broadly in line with the CIS

countries (and above that in CEEE) with an emphasis on more incremental

product/service change.

In addition to these innovation indicators the BEEPS dataset also contains a rich set of

other variables which give an indication of firms’ internal resources and operating

environment. Firm vintage, for example, may reflect the potential for the cumulative

accumulation of knowledge capital by older establishments (Klette and Johansen

1998). Firm size (employment), in-house R&D capability and skill levels also reflect

aspects of absorptive capacity and would be expected to be positively related to firms’

innovation outputs. The BEEPS data suggests that locally-owned firms in the WBCs

were generally larger (average 108 employees) than those in either the CIS or CEEE

countries with higher levels of intermediate (high school qualifications) but generally

had lower levels of graduate employment (Table 1). In terms of their effects on

innovation outputs these factors suggest offsetting positive (firm size) and negative

(skills) effects.

The BEEPS dataset also provides details of the ownership profile of each firm, its

privatisation history and group membership, each of which may also impact on

innovation outputs. Locally-owned firms in the WBCs were also more likely to be

single proprietorships (53.1 per cent) than those in CIS or CEEE countries (Table 1).

In terms of their privatisation history, firms in the WBCs were more likely to be a

privatised firm than in the CIS but less likely to be a private start-up (Table 1).

9

Other factors are included in our estimates of the innovation production function to

reflect differences in firms’ operating environments. To reflect potential differences in

the availability of external knowledge resources – university or research institutes,

skilled labour, specialist support services – for example, we identify whether firms are

located in large city or capital or medium-sized city (Asheim and Isaksen 1996).

Firms in the WBCs seem less concentrated in large cities or the capital than in the CIS

but more strongly concentrated in urban locations than in the other CEEE countries

(Table 1). Firms in the WBCs also seem less likely to have received government

support than those in the CEE countries (Table 1). Finally, the BEEPS dataset also

includes a number of subjective indicators of the general operating difficulties which

firms perceive relating to finance, skills, regulation and corruption (Table 2). Finance,

customs and trade regulation and regulatory and judicial uncertainty were more

commonly reported as important operating difficulties in the WBCs than in the

sample as a whole and may be barriers to innovation (Roper et al. 2008).

4. Empirical results

Bivariate probit models of the innovation production function, reflecting the

probability that locally-owned firms undertook either (new or upgrading) product or

service innovation during the 2002 to 2005 period, are reported in Table 3. The table

includes three models, one each relating to locally-owned firms in the WBCs, the

other CEEE countries excluding the WBCs, and the CIS countries. In each case, the

estimated models included a series of dummy variables designed to capture industry

differences. Statistically significant variables are highlighted. Of primary interest here

are the contrasts between the determinants of innovation in the WBCs and the other

groups of transition economies which might suggest a focus for innovation policy in

the WBCs.

In terms of the impact of firm characteristics on the probability of innovating we see

some key contracts between the WBCs and both the CEEE and CIS countries. Inhouse R&D, in particular, has no significant role in shaping the probability of

innovation in the WBCs, while it increases the probability of innovating by 3.4 per

cent in the CEEE countries and 5.9 per cent in CIS (Table 3). A positive relationship

between in-house R&D is also generally found in more developed economies (Harris

and Trainor 1995; Love and Mansury 2007; Santarelli and Sterlacchini 1990;

10

Simonen and McCann 2008) emphasising the uniqueness of this result for the WBCs.

Similarly, neither high-school level or graduate level skills play any significant part in

shaping the probability of innovation in the WBCs. Again, this result contrasts

strongly with evidence from other developed economies (Freel 2005; Leiponen 2005;

Mutula and Van Brakel 2007) and also the other CEEE economies (Table 3)8.

Another striking difference between the determinants of innovation in the WBCs and

the CEEE and CIS countries is that of the legal status of the firm. While limited

company status has previously been linked to business growth (Storey 1994) it is also

strongly and positively linked to the probability of innovating in both the CEEE and

CIS countries, increasing the probability of innovating by 19-21 per cent (Table 3).

No such impact is evident in the WBCs suggesting that the innovation advantages –

and potentially also the growth advantages – of limited liability status are less evident

in the WBCs than elsewhere. For example, a lack of availability of risk capital in the

WBCs may mean that limited liability status is of less value to business owners than

in situations where external finance is more easily available.

Two important commonalities are also evident in the determinants of innovation

across the areas considered here. In common with CEEE and CIS countries, locallyowned firms in the WBCs which are exporting or which are part of a multi-plant

group are significantly more likely to be innovating than other firms (Filatotchev et al.

2003; Jensen 2004). Moreover, both effects are of similar size with exporting

increasing the probability of product or service innovation by 7.9 per cent and being

part of a multi-plant group increasing the probability of innovation by 9.8 per cent

(Table 3). Both suggest the importance of the inter-relationship between export

activity and innovation (Bleaney and Wakelin 2002; Lachenmaier and Wobmann

2006; Roper and Love 2002; Wakelin 1998) as well as the potential importance of

intra-firm sharing of knowledge or resources. These results provide support for the

arguments made by Filatotchev (2003) suggesting that export market exposure is

more important in shaping firms’ innovation activity than external-ownership.

In summary, although we see commonalities between the firm-level determinants of

innovation in the WBC and other CEEE and CIS economies – around exporting and

8

Interestingly, here for firms in the CIS countries, where graduate skills are more common than in the

WBCs (Table 1), we also find little skills effect on innovation.

11

organisational structure – it is perhaps the differences with are more striking. In

particular, the lack of significance of the R&D and graduate skills variables in the

innovation production function for the WBCs suggests the weakness of the internal

technological capabilities and absorptive capacity of many locally-owned firms’

(Filatotchev et al. 2003). The lack of any firm age or size effect on the probability of

innovating is also somewhat unexpected suggesting the weakness of organisational

learning and lack of any cumulated advantage for innovation (Table 3).

As the innovation systems literature suggests, however, firms’ innovation outputs can

also be strongly influenced by locational factors and their operating environment. In

the innovation production functions we therefore include locational dummies to

capture the potential innovation (agglomeration) advantages of more urbanised

locations (Chai and Huang 2007). For the WBCs in common with the other CEEE

countries the results are disappointing with no evidence of any innovation advantage

from either a large city or medium-sized city location (Table 3). By contrast, being in

a large city or capital in the CIS countries increases the probability of product or

service innovation by around 7 per cent. Other potential environmental effects on the

probability of innovating are reflected in a series of variables reflecting the difficulties

firms perceive in their business environment (Table 2). Perhaps most notable here is

the negative impact of customs and trade regulations on innovation in the WBCs (-10

per cent) with no such effect in either the CEEE or CIS countries. Other operating

difficulties are common across the regions with difficulties related to ‘skills and

education’ having an unexpected positive effect on innovation in each of the three

regions9. Finally, our analysis suggests that in the WBCs (as in the CIS countries)

public support from national, regional or EU sources is having no effect on the

probability of product or service innovation. This is a marked contrast with the other

CEEE countries where regional and EU support are increasing the probability of

innovation (by 13.1 and 17.1 per cent respectively).

Our comparisons suggest that there is little in the business environment in the WBCs

which can compensate for the weaknesses in the internal innovation capabilities of

9

This result is not uncommon in other innovation studies based on cross-sectional data and probably

reflects reverse causality with those firms which are innovating also more likely to be those for which

skill constraints are binding.

12

locally-owned firms. Neither the potential innovation advantages of more urbanised

areas which are evident in the CIS countries, or public supports evident in the CEEE

countries are effective in the WBCs (Table 3). Moreover, environmental factors seem

to be undermining the potential innovation advantages of limited liability status as

well as creating difficulties with customs and trade regulations.

5. Conclusions and Discussion

The proportion of firms reporting the introduction of new products or services in the

WBCs is broadly in line with that in the CIS countries, and above that in the other

CEEE economies. Our empirical analysis, however, suggests some unique features of

innovative activity in the Western Balkans both in contrast to the CEEE and CIS

countries considered here as well as more advanced economies. First, the weakness of

firms’ R&D and higher-level skills as drivers of innovation contrasts strongly with

both the other CEEE and CIS countries and more developed economies. Second, we

find no evidence of innovation benefits from urban locations in innovation in the

WBCs or effective public support. Again, this experience is at odds with that in the

CEEE and CIS countries reported here and other studies which report similar analyses

for more advanced economies. Third, innovation outputs in the WBCs are being

negatively influenced by the business environment which is both undermining the

innovation advantages of limited liability status and creating difficulties with customs

and trade regulations. Neither the internal weaknesses of firms identified here nor the

more systemic weaknesses are unanticipated, however. Svarc (2006) in her review of

innovation policy in Croatia emphasises similar concerns emphasising ‘low

technological capabilities of companies’ and the ‘lack of a stimulating environment’

for innovation.

Addressing either issue will require an acceptance that the development of national

innovation capability is a valid area for policy intervention alongside more traditional

concerns about macro-economic stability, public finance etc (Asheim et al. 2007).

This is something which Svarc (2006) argues may be particularly difficult in

transition economies where there is a danger that ‘innovation policy was perceived

not only as irrelevant but also as a relic of state interventionism inherited from

socialistic times’ (p. 157). However, the experience of Europe’s most successful

innovating economies suggests the value of an active and focussed approach to

13

innovation policy which addresses systemic failures in the innovation system

(Woolthuis, Lankhuizen, and Gilsing 2005), and potentially new institutional models

focussed on innovation system development (Fargerberg and Srholec 2008). Perhaps

the best developed example here is Vinnova - the Swedish Governmental Agency for

Innovation Systems. Established as an arms-length government body in 2001,

Vinnova has focused on developing a detailed understanding of the capabilities of the

Swedish innovation system, identifying system failures and then investing to support

collaborative innovation projects on either a network, sectoral or geographical basis10.

Recent discussion led by Serbia of establishing a collaborative innovation centre for

the Western Balkans (as a counterpart to the South East European Centre for

Entrepreneurial Learning) is potentially a positive first step in this direction.

More broadly, recent developments in enterprise policy in the WBCs since 2003,

reflected in the EU SME Charter process, have started to address some of the issues in

the business environment highlighted by our empirical analysis (OECD 2009). In

particular all of WBCs have made substantial progress in supporting export

development since the 2005 BEEPS survey was undertaken. AOFI, the export credit

and insurance agency for Serbia, for example, was formed in 2005. Such measures

may help to address the negative impact on innovation in the WBCs of customs and

trade regulation. As (OECD 2009) also notes, however, ‘most of the Western Balkan

governments are at a relatively early stage in introducing targeted policies for relevant

types of SMEs … For instance, few governments have introduced measures targeting

start-ups, targeting innovative enterprises, or supporting technological or nontechnological innovation’ (p. 15). Addressing the weaknesses in the innovation

capability of individual firms identified here – particularly the links between skills,

R&D and innovation – is likely to require policy development to support both

technological and non-technological (or hidden) innovation (NESTA 2007). The

benefits of support measures for technological innovation have been widely discussed

(Buiseret, Cameron, and Georgiou 1995; Hewitt-Dundas and Roper 2009; Martin and

Scott 2000) with a range of support mechanisms being discussed in the literature

including grants (Czarnitzki and Licht 2006), personnel subsidies, R&D tax credits

10

See Vinnova website www.vinnova.se, and review of activities in 2007 ‘Innovation and Leading

Research’ – Vinnova 2007.

14

(Mansfield 1986), innovation vouchers (Cornet, van der Steeg, and Vroomen 2007;

Cornet, Vroomen, and van der Steeg 2006) and credit guarantee schemes.

A key theme to emerge from the evaluation literature on these measures is the need to

structure such initiatives to increase innovative collaboration, something which Svarc

(2006) highlights as another key weakness of Croatian innovation system (LeskovarSpacapan and Bastic 2007). Collaboration between firms and the research-base might

also be usefully encouraged by developing Competence Research Centres (CRCs) in

the WBCs. Typically CRCs bring together enterprises and university-based research

centres in long-term collaborative relationship aimed at a particular technology. The

best established of these programmes (in Sweden) has provided overwhelming

evidence of the value of this type of initiative, a result echoed in early evaluation

results from Hungary and Estonia (Vinnova 2004). CRCs have also been seen as

contributing to internationalisation by acting as a focus for international R&D

collaboration which might also help WBC firms to overcome the barriers to trade

discussed earlier.

Public support for non-technological innovation is also likely to be important in the

future development of the WBCs both in the service and manufacturing sectors

(Czarnitzki and Spielkamp 2003; de Jong et al. 2003). Internationally, policy has

developed rapidly in this area in recent years although best practice remains less clear.

One potential policy model which might be considered by the WBCs to support the

development of non-technical innovation capacity is the Finnish ‘Serve’ scheme.

Operated by the Tekes agency this aims to encourage the development of innovative

service concepts and service business models in companies; strengthen and diversify

service related innovation activities, especially in SMEs; improve productivity and

quality of service activities in various industries; and boost academic research in the

area of service development. It does this by providing grant support to innovating

enterprises supporting a proportion of the cost of innovation projects.

Combining such targeted measures with more broadly based policies aimed at

improving the environment for innovation will both be necessary if the WBCs are to

maximise the potential economic benefits of innovation. Policy development for

innovation will also be important, however, as the WBCs work to move their policy

15

regimes closer to those operating within the EU, particularly as Europe steadily

implements the 2008 Small Business Act with its emphasis on innovation capability

in SMEs. Moving on from enterprise policy to innovation policy will therefore help to

advance both economic and political agendas for the WBCs and also mark another

phase in the transition from state socialism towards the free market.

16

Table 1: Descriptive Data: Locally-owned firms

Western Balkans

Countries (WBC)

N=1019

Mean

St. D.

CEEE (excluding

WBC)

N=4012

Mean

St. D.

CIS

Countries

N=3644

Mean

St. D.

Innovation Indicators

New product or service

Improved product or service

Process innovation

39.3

29.1

39.0

48.8

45.5

48.8

29.4

22.3

27.4

49.9

41.6

44.6

37.2

21.0

34.1

48.3

40.7

47.4

15.5

107.5

51.1

51.2

22.2

53.1

18.1

1.1

15.8

28.9

35.8

15.9

14.4

71.6

1.3

0.5

21.9

330.3

50.0

32.7

24.3

49.9

38.5

10.3

36.5

45.3

48.0

36.6

35.2

45.1

11.2

7.0

12.5

82.8

47.2

41.2

20.4

32.8

29.4

1.8

27.2

25.1

24.3

23.0

8.8

79.3

1.3

0.6

17.4

348.6

49.9

32.0

26.2

46.9

45.6

13.2

44.5

43.4

42.9

42.1

28.3

40.5

11.3

7.7

10.0

95.3

56.0

27.4

35.0

43.0

21.9

2.8

22.1

12.8

18.2

20.9

18.4

67.8

1.9

0.9

15.9

405.8

49.6

28.6

30.5

49.5

41.3

16.6

41.5

33.5

38.6

40.7

38.7

46.7

13.7

9.6

Location and Markets

Large city or capital

Medium-sized city

39.1

37.4

48.8

48.4

28.0

42.9

44.9

49.5

43.4

37.1

49.6

48.3

Public support

Subsidies from state

Subsides from region

Subsidies from the EU

5.7

2.4

0.4

23.2

15.2

6.3

6.0

3.4

3.1

23.7

18.0

17.4

1.2

1.1

0.3

10.9

10.3

5.7

Firm characteristics

Plant age in 2005

Employment (2003)

Research and development

Workforce with high school quals (%)

Workforce with graduate quals (%)

Single proprietor

Partnership

Cooperative

Limited company

Exporting firm

Part of multi-plant group

Women-led enterprises

Privatised state company

Private start-up

Private subsidiary of former state co.

Joint venture with external partner

Note: See data annex for variable definitions

Source: BEEPS 2005

17

Table 2: Descriptives: Operating Difficulties

Access to finance

Tax rates

Tax administration

Customs and trade regulations

Skills and education

Western Balkans

Countries (WBC)

N=1019

Mean

St. D.

22.6

41.8

23.5

42.4

15.3

36.0

12.2

32.7

7.4

26.1

CEEE (excluding

WBC)

N=4012

Mean

St. D.

20.2

40.1

39.8

49.0

26.8

44.3

8.8

28.4

12.4

32.9

CIS

Countries

N=3644

Mean

St. D.

16.0

36.6

28.5

45.1

22.3

41.6

10.6

30.8

9.5

29.4

32.6

46.9

28.5

45.2

20.1

25.6

43.7

14.5

35.2

9.6

Notes: Figures are the percentage of firms highlighting each factor as either a ‘very important’ or

‘fairly important’ operating difficulty. Variable definitions are in Annex 1.

Source: BEEPS 2005

Uncertainty about regulation

Functioning of judiciary

40.1

29.5

18

Table 3: Probit models for the probability of undertaking new or improved

product/service innovation in locally-owned firms

Western Balkans

Countries (WBC)

N=1019

dy/dx

CIS

Countries

N=3644

CEEE (excluding WBC)

N=4012

z

dy/dx

z

dy/dx

z

Firm Characteristics

Plant age in 2005

Employment (2003)

Research and development

Workforce with high school quals (%)

-0.002

-1.520

-0.001

-1.220

0.001

0.000

1.440

0.000

1.610

0.000

-0.017

-0.550

0.034

0.000

-0.550

0.000

Workforce with graduate quals (%)

0.000

-0.380

0.002

Single proprietor

0.984

0.400

0.093

Partnership

0.659

0.090

0.139

Cooperative

0.314

0.980

0.143

2.080

0.089

*

**

*

**

*

**

*

0.059

0.920

-0.001

5.140

0.000

1.090

0.151

1.670

0.168

1.580

0.035

2.660

0.192

4.420

0.149

3.350

-3.330

0.750

1.390

*

1.660

0.310

0.608

Exporting firm

0.079

Part of multi-plant group

0.098

2.830

0.069

3.460

Women-led enterprises

0.016

0.390

-0.027

-1.310

Privatised state company

-0.870

-0.240

0.022

0.270

-0.118

-1.070

Private start-up

-0.776

-0.080

0.000

0.000

-0.052

-0.490

Private subsidiary of former state co.

-0.721

-1.150

0.047

0.450

-0.183

-1.490

Joint venture with external partner

-0.710

-2.140

0.181

1.520

-0.044

-0.300

**

0.211

**

*

2.020

1.430

**

*

**

*

Limited company

**

**

*

0.090

**

0.760

1.960

0.121

**

**

*

**

*

-0.047

**

-2.120

5.680

5.560

Location and Markets

**

*

Large city or capital

-0.020

-0.490

0.023

1.010

0.070

Medium-sized city

0.055

1.340

0.000

0.020

0.038

2.870

1.570

-0.022

-0.310

0.052

1.390

0.055

0.640

2.750

-0.054

-0.630

3.560

-0.010

-0.060

Public Support

Subsidies from state

**

*

**

*

Subsides from region

0.089

0.960

0.131

Subsidies from the EU

-0.150

-0.600

0.171

Access to finance

-0.004

-0.100

0.017

0.780

-0.041

*

-1.670

Tax rates

-0.076

-1.550

-0.003

-0.140

0.060

**

2.530

0.021

0.390

0.008

0.370

0.023

-1.680

0.033

1.050

0.029

Operating Difficulties

Tax administration

Customs and trade regulations

-0.100

*

Skills and education

0.099

*

1.750

0.097

Uncertainty about regulation

0.090

**

2.340

Functioning of judiciary

0.077

*

1.950

Number of observations

Equation χ2

Log Likelihood

Pseudo R2

**

*

0.870

0.920

**

*

3.820

0.137

0.004

0.200

0.028

1.170

0.022

0.870

0.024

0.750

979

3886

3560

112.91

367.59

383.71

-557.791

-2507.6

-2228.6

0.0919

0.0683

0.0793

4.700

Notes and sources: Values reported are marginal values. All models include industry dummy variables

(not reported) and constant terms. Reference groups - rural enterprises, state-owned firms, other

services. See Annex 1 for variable definitions. * denotes significance at the 10 per cent level; ** at 5

per cent and *** at the 1 per cent level.

Source: BEEPS 2005

19

Annex 1: Variable definitions

Innovation Indicators

New product or service

Process innovation

Firm characteristics

Plant age in 2005

Employment (2003)

Research and development

Workforce with high school

quals. (%)

Workforce with graduate

quals. (%)

Single proprietor

Partnership

Cooperative

Limited company

Majority externally owned

Exporting firm

Part of multi-plant group

Women-led enterprises

Privatised state company

Private start-up

Private subsidiaries of former

state Company

Joint venture with external

partner

Firm ‘developed successfully or upgraded a major new product line or

service over the last 3 years’ (items 1312 and 1313)

Firm has ‘acquired new production technology over the last 36 months’ (item

1328)

Years since firm first began operations in this country (item 129)

How many full-time employees does your business have now – and how

many did it have three years ago (2003) (item 1355-1359)

Positive spending on R&D including wages and salaries of R&D personnel,

R&D materials, R&D education and R&D related training (item 1257-1263)

What percentage of the workforce of your firm has education levels up to

secondary school (item 1444-1446)

What percentage of the workforce of your firm has education levels up to

university level (item 1447-1449)

Legal status of firm: single proprietorship (items 134-135)

Legal status of firm: partnership (items 134-135)

Legal status of firm: cooperative (items 134-135)

Legal status of firm: corporation, privately held or listed on stock exchange

(items 134-135)

What percentage of the firm is owned by private foreign

individuals/companies/organisations (> 50 per cent ) (item151-153).

Does your firm currently sell its products or services directly to customers

outside the country (item 168)

How many establishments (separate operating facilities) does your firm have

in this country (item 173-174)

Is the principle owner (or one of the principle owners) female? (item 249)

How was your firm established: Privatisation of a state-owned firm (item 250)

How was your firm established: Originally private from the time of start-up

(item 250)

How was your firm established: Private subsidiary of a former state owned

firm (item 250)

How was your firm established: Joint venture with foreign partners; (item

250)

Location and Markets

EU plus region

Western Balkans location

Large city or capital

Medium-sized city

Mining

Construction

Manufacturing

Transport, storage and

communication

Wholesale and Retail trade;

repair of vehicles and

household goods

Real Estate, renting and

business services

Hotels and Restaurants

Other services

Includes: Turkey, Slovenia, Poland, Hungary, Czech Rep., Slovakia,

Romania, Bulgaria, Latvia, Lithuania, Estonia

Includes: Macedonia, Serbia, Montenegro, Albania, Croatia, BosniaHerzegovina

Located in capital city or other city with population greater than one million

(item city)

Located in city with population greater than 50,000 (item city)

Firm is in ISIC Section C: 10-14 (item ISIC DIVISION)

Firm is in ISIC Section F: 45 (item ISIC DIVISION)

Firm is in ISIC Section D: 15-37 (item ISIC DIVISION)

Firm is in ISIC Section I: 60-64 (item ISIC DIVISION)

Firm is in ISIC Section G: 50-52 (item ISIC DIVISION)

Firm is in ISIC Section K: 70-74 (item ISIC DIVISION)

Firm is in ISIC Section H: 55 (item ISIC DIVISION)

Firm is in ISIC Section O: includes motion picture and video activities, other

entertainment activities, news agency activities, washing and dry cleaning,

hairdressing, funeral and related activities, other service activities (item ISIC

20

DIVISION)

Public support

Subsidies from state

Subsides from region

Subsidies from the EU

Operating difficulties

Access to finance

Cost of finance

Access to land

Title or leasing of land

Tax rates

Tax administration

Customs and trade regulations

Skills and education

Uncertainty about regulation

Macro instability

Functioning of judiciary

Corruption

Over the last 36 months has your firm received any subsidies from the

national government? (item 1060)

Over the last 36 months has your firm received any subsidies from the

regional/local government? (item 1061)

Over the last 36 months has your firm received any subsidies from EU

sources? (item 1062)

Access to finance (e.g. collateral required or financing not available from

banks) either ‘moderate’ or ‘major’ obstacle to the operation and growth of

the business (item 1108)

Cost of financing (e.g. interest rates and charges) either ‘moderate’ or ‘major’

obstacle to the operation and growth of the business (item 1109)

Access to land either ‘moderate’ or ‘major’ obstacle to the operation and

growth of the business (item 1113)

Title or leasing of land either ‘moderate’ or ‘major’ obstacle to the operation

and growth of the business (item 1114)

Tax rates either ‘moderate’ or ‘major’ obstacle to the operation and growth of

the business (item 1115)

Tax administration either ‘moderate’ or ‘major’ obstacle to the operation and

growth of the business (item 1116)

Customs and trade regulations either ‘moderate’ or ‘major’ obstacle to the

operation and growth of the business (item 1117)

Skills and education of available workers either ‘moderate’ or ‘major’

obstacle to the operation and growth of the business (item 1120)

Uncertainty about regulatory policies either ‘moderate’ or ‘major’ obstacle to

the operation and growth of the business (item 1121)

Macro instability (inflation, exchange rates) either ‘moderate’ or ‘major’

obstacle to the operation and growth of the business (item 1122)

Functioning of judiciary either ‘moderate’ or ‘major’ obstacle to the operation

and growth of the business (item 1123)

Corruption either ‘moderate’ or ‘major’ obstacle to the operation and growth

of the business (item 1124)

21

References

Asheim, B , L Coenen, J Moodysson, and J Vang. 2007. Constructing knowledgebased regional advantage: implications for regional innovation policy.

International Journal of Entrepreneurship and Innovation Management, 7 (25):140-155.

Asheim, B T, and A Isaksen. 1996. Location, agglomeration and innovation: Towards

regional innovation systems in Norway? In Studies in technology, innovation

and economic policy, Report 13. Oslo.

Bleaney, M, and K Wakelin. 2002. Efficiency, innovation and exports. Oxford

Bulletin of Economics and Statistics 64:3-15.

Buiseret, T, H M Cameron, and L Georgiou. 1995. What differences does it make?

Additionality in the public support of R&D in large firms. International

Journal Of Technology Management 10 (4-6):587-600.

Chai, Z. X., and Z. H. Huang. 2007. Agglomeration, knowledge spillover and

provincial innovation - Evidences from Mainland China. Proceeding of China

Private Economy Innovation International Forum:119-128.

Cooke, P, and L Leydesdorff. 2006. Regional development in the knowledge-based

economy: the construction of advantage. Journal of Technology Transfer 31:515.

Cooke, P, and K Morgan. 1998. The associational economy: Firms, regions and

innovation. Oxford University Press.

Cornet, M, M van der Steeg, and B Vroomen. 2007. De effectiviteit van de

innovatievoucher 2004 en 2005 Effect op innovatieve input en innovatieve

output van bedrijven, edited by C. D. P. N. 140.

Cornet, M, B Vroomen, and M van der Steeg. 2006. Do innovation vouchers help

SMEs to cross the bridge towards science? In No 58 CBP Discussion Paper

Crepon, AD , A Hughes, P Lee, and J Mairesse. 1998. Research, Innovation and

Productivity: An econometric analysis at the firm level. Economics of

Innovation and New Technology 7:115-158.

Czarnitzki, D , and A Spielkamp. 2003. Business services in Germany: Bridges for

innovation. The Service Industries Journal 23 (2):1-30.

Czarnitzki, D., and G. Licht. 2006. Additionality of public R&D grants in a transition

economy. Economics of Transition 14 (1):101-131.

de Jong, J P, J Bruins, A Dolfsma, and J Meijaard. 2003. Innovation in service firms

explored: what how and why? In Strategic Study B200205. the Netherlands.:

EIM Business and Policy Research.

Fargerberg, J, and M. Srholec. 2008. National innovation systems, capabilities and

economic development Research Policy 37:1417-1435.

Filatotchev, I., M. Wright, K. Uhlenbruck, L. Tihanyi, and R. E. Hoskisson. 2003.

Governance, organizational capabilities, and restructuring in transition

economies. Journal of World Business 38 (4):331-347.

Freel, M S. 2005. Patterns of innovation and skills in small firms. Technovation 25

(2):123-134.

———. 2005. Patterns of Innovation and skills in small firms. Technovation 25:123134.

Gligorov, V. 2009. The Balkans: Problems and Prospects. In The Western Balkans:

Overcoming the economic crisis - from regional cooperation to EU

membership. Brussels.

22

Griffith, R, S Redding, and J Van Reenan. 2003. R&D and Absorptive Capacity:

Theory and Empirical Evidence. Scandinavian Journal of Economics 105

(1):99-118.

Griliches, Z. 1992. The Search for Research-And-Development Spillovers.

Scandinavian Journal of Economics 94:S29-S47.

———. 1995. R&D and Productivity: Econometric Results and Measurement Issues.

Edited by P. Stoneman, Handbook of the Economics of Innovation and

Technological Change. Oxford: Blackwell.

Harris, R I D, and M Trainor. 1995. Innovation and R&D in Northern Ireland

Manufacturing: A Schumpeterian Approach. Regional Studies 29:593-604.

Hewitt-Dundas, N , and S Roper. 2009. Output Additionality of Public Support for

Innovation: Evidence for Irish Manufacturing Plants. European Planning

Studies forthcoming.

Jensen, C. 2004. Localized spillovers in the Polish food industry: The role of FDI in

the development process? Regional Studies 38 (5):535-550.

Klette, T. J, and F Johansen. 1998. Accumulation of R&D Capital and Dynamic Firm

Performance: a not-so-Fixed Effect Model. Annales de Economie et de

Statistique 49-50:389-419.

Krammer, Sorin M. S. 2009. Drivers of national innovation in transition: Evidence

from a panel of Eastern European countries. Research Policy 38:845-860.

Krkoska, L , and K. Robeck. 2006. The impact of crime on the enterprise sector:

Transition versus non-transition countries. In EBRD Working paper No. 97.

London.

Lachenmaier, and Wobmann. 2006. Does innovation causes exports? Evidence from

exogenous innovation impulses and obstacles using German micro data.

Oxford Economic Papers 58:317-350.

Leiponen, Aija. 2005. Skills and innovation. International Journal of Industrial

Organization 23 (5-6):303-323.

Leskovar-Spacapan, G., and M. Bastic. 2007. Differences in organisations' innovation

capability in transition economy: Internal aspects of the organizations'

strategic orientation. Technovation 27:533-546.

Love, J H , and M A Mansury. 2007. External Linkages, R&D and Innovation

Performance in US Business Services. Industry and Innovation forthcoming.

Love, J H, and S Roper. 1999. The determinants of innovation: R&D, technology

transfer and networking effects. Review of Industrial Organisation 15 (1):4364.

Machacova, J , and Dall Elke. 2008. Innovation Infrastructures in the Western Balkan

countries. Information office of the steering platform on research for the

Western Balkan countries (see-science.eu).

Mamuneas, T P, and M I Nadiri. 1996. Public R&D policies and cost behaviour of the

US manufacturing industries. Journal of Public Economics 63:57-81.

Mansfield, E. 1986. The R&D tax credit and other technology policy issues. American

Economic Review (Papers and Proceedings) 76 (2):1190-1194.

Martin, S, and J T Scott. 2000. The nature of innovation market failure and the design

of public support for private innovation. Research Policy 29:437-47.

Metcalfe, S. 1997. Technology Systems and Technology Policy in an Evolutionary

Framework. Edited by D. Archibugi, Michie, J, Technology, Globalisation

and Economic Performance: Cambridge University Press.

23

Mutula, S. M., and P. Van Brakel. 2007. ICT skills readiness for the emerging global

digital economy among small businesses in developing countries: case study

of Botswana. Library Hi Tech 25 (2):231-245.

NESTA. 2007. Hidden Innovation – How innovation happens in six ‘low innovation’

sectors. London.

OECD. 1999. Managing National Innovation Systems Paris.

———. 2009. Progress in the implementation of the European Charter for Small

Enterprises in the Western Balkans. Paris: OECD/European Commission/

European Training Foundation/European Bank for Reconstruction and

Development.

Polenakovik, R, and TR Pinto. 2009. The National Innovation System and Its relation

to small enterprises – the Case of the Republic of Macedonia. World Review of

Science Technology and Sustainable Development forthcoming

Roper, S, and J H Love. 2002. Innovation and Export Performance: Evidence from

UK and German Manufacturing Plants. Research Policy 31:1087-1102.

———. 2006. Innovation and Regional Absorptive Capacity: the Labour Market

Dimension. Annals of Regional Science 40 (2):437-447.

Santarelli, E, and A Sterlacchini. 1990. Innovation, formal vs informal R&D and firm

size: some evidence from Italian manufacturing firms. Small Business

Economics 2:223-228.

Simonen, Jaakko, and Philip McCann. 2008. Firm innovation: The influence of R&D

cooperation and the geography of human capital inputs. Journal of Urban

Economics 64 (1):146-154.

Storey, D J 1994. Understanding the Small Business Sector. London: Routledge

Svarc, J. 2006. Socio-political factors and the failure of innovation policy in Croatia

as a country in transition Research Policy 35:144-159.

Uhlenbruck, K., K. E. Meyer, and M. A. Hitt. 2003. Organizational transformation in

transition economies: Resource-based and organizational learning

perspectives. Journal of Management Studies 40 (2):257-282.

Vinnova. 2004. Impacts of the Swedish Competence Centres Programme 1995-2003:

Summary Report.

Wakelin, K. 1998. Innovation and Export Behaviour at the Firm Level. Research

Policy 26:829-841.

Woolthuis, R K, M Lankhuizen, and V Gilsing. 2005. A system failure framework for

innovation policy design Technovation 25:609-619.

24