Simon Fraser University Carbon Tax Calculation Form 2010

advertisement

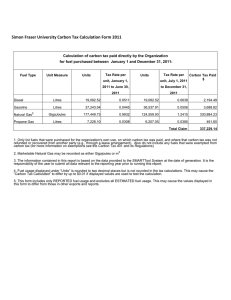

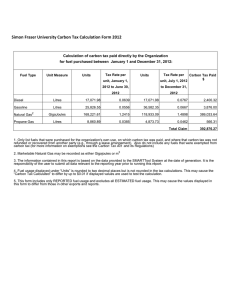

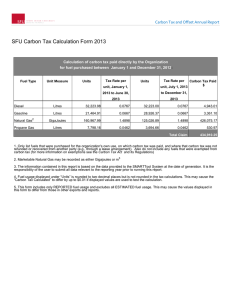

Simon Fraser University Carbon Tax Calculation Form 2010 Calculation of carbon tax paid directly by the Organization for fuel purchased between January 1 and December 31, 2010: Tax Rate per Fuel Type Unit Measure Units unit, January 1, 2010 to June 30, Tax Rate per Units 2010 Diesel Gasoline Natural Gas 2 Propane Gas unit, July 1, 2010 to December 31, Carbon Tax Paid 2010 Litres 15,000.00 0.0384 15,000.00 0.0511 1,342.50 Litres 44,109.82 0.0333 44,429.13 0.0445 3,445.95 GigaJoules 164,446.84 0.7449 120,213.27 0.9932 241,892.27 8,309.81 0.0231 5,460.54 0.0308 360.14 Total Claim 247,040.86 Litres Notes: 1. Only list fuels that were purchased for the organization's own use, on which carbon tax was paid, and where that carbon tax was not refunded or recovered from another party (e.g., through a lease arrangement). Also do not include any fuels that were exempted from carbon tax (for more information on exemptions see the Carbon Tax Act and its Regulations) 2. Marketable Natural Gas may be recorded as either Gigajoules or m3 3. The information contained in this report is based on the data provided to the SMARTTool System at the date of generation. It is the responsibility of the user to submit all data relevant to the reporting year prior to running this report. 4. Fuel usage displayed under “Units” is rounded to two decimal places but is not rounded in the tax calculations. This may cause the “Carbon Tax Calculated” to differ by up to $0.01 if displayed values are used to test the calculation. 5. This form includes only REPORTED fuel usage and excludes all ESTIMATED fuel usage. This may cause the values displayed in this form to differ from those in other exports and reports. Simon Fraser University Carbon Offset 2010 Burnaby Campus 2010 Scope 1 - Direct Emissions (tonnes CO2e) Stationary Combustion Mobile Fuel Combustion 13,592 279 Scope 2 - Indirect Emissions (tonnes CO2e) Purchased Electricity Purchased Heating 1,435 0 Scope 3 - Other Indirect Emissions (tonnes CO2e) Office Paper Emissions from Biomass1 299 9 Satellite Campuses Vancouver Campus (tonnes CO2e) 857 Surrey Campus (tonnes CO2e) 672 Kamloops Campus (tonnes CO2e) 37 Joint Properties2 Bamfield (tonnes CO2e) 26 GNW (tonnes CO2e) 85 TRIUMF (tonnes CO2e) 250 Total Emissions Total Offsettable Emissions3 Required Carbon Offset Payment 17,541 17,532 $ 438,312 Notes: 1. In alignment with the international reporting requirements, biogenic emissions (BioCO2) from biomass combustion, including wood, wood waste, ethanol, biodiesel and biomethane must be reported. However, SFU is only required to purchase offset for the CH4 and N2O emissions from biomass combustion. 2. SFU only requires to report part of the emissions. 3. Values may not sum to total due to rounding. SFU may make adjustment to the value as required.