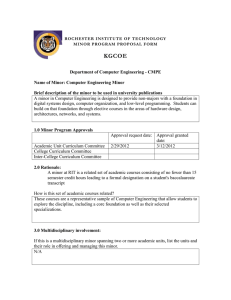

Simon Fraser University Carbon Tax Calculation Form 2012

advertisement

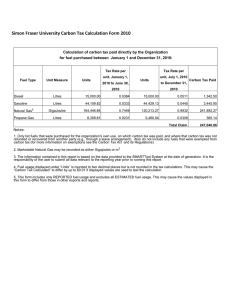

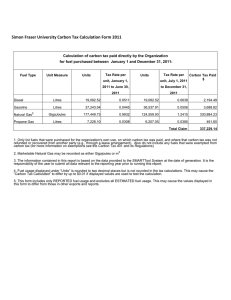

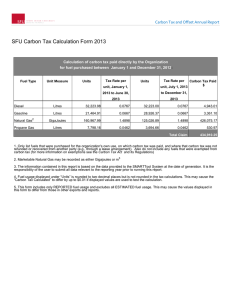

Simon Fraser University Carbon Tax Calculation Form 2012 Calculation of carbon tax paid directly by the Organization for fuel purchased between January 1 and December 31, 2012: Fuel Type Unit Measure Units Tax Rate per Units Tax Rate per unit, January 1, Carbon Tax Paid $ unit, July 1, 2012 2012 to June 30, to December 31, 2012 2012 Diesel Litres 17,071.98 0.0639 17,071.98 0.0767 2,400.32 Gasoline Litres 25,826.55 0.0556 36,582.35 0.0667 3,876.00 Natural Gas2 GigaJoules 168,221.61 1.2415 118,933.09 1.4898 386,033.64 Propane Gas Litres 8,860.89 0.0385 4,873.73 0.0462 566.31 Total Claim 392,876.27 1. Only list fuels that were purchased for the organization's own use, on which carbon tax was paid, and where that carbon tax was not refunded or recovered from another party (e.g., through a lease arrangement). Also do not include any fuels that were exempted from carbon tax (for more information on exemptions see the Carbon Tax Act and its Regulations) 2. Marketable Natural Gas may be recorded as either Gigajoules or m3 3. The information contained in this report is based on the data provided to the SMARTTool System at the date of generation. It is the responsibility of the user to submit all data relevant to the reporting year prior to running this report. 4. Fuel usage displayed under “Units” is rounded to two decimal places but is not rounded in the tax calculations. This may cause the “Carbon Tax Calculated” to differ by up to $0.01 if displayed values are used to test the calculation. 5. This form includes only REPORTED fuel usage and excludes all ESTIMATED fuel usage. This may cause the values displayed in this form to differ from those in other exports and reports. Simon Fraser University Carbon Offset 2012 Burnaby Campus 2011 2012 % Change Scope 1 - Direct Emissions (tonnes CO2e) Stationary Combustion Mobile Fuel Combustion 14,323 274 13,588 237 -5.1% -13.6% Scope 2 - Indirect Emissions (tonnes CO2e) Purchased Electricity Purchased Heating 1,516 0 1,534 0 1.2% 296 9 171 8 -42.4% -13.4% 1,228 1,231 0.3% 763 788 3.2% 0 0 Bamfield (tonnes CO2e) 23 23 1.1% GNW (tonnes CO2e) 98 72 -26.6% TRIUMF (tonnes CO2e) 221 196 -11.5% 18,751 17,846 -4.8% 18,742 17,838 -4.8% $ 468,542 $ 445,959 -4.8% Scope 3 - Other Indirect Emissions (tonnes CO2e) Office Paper Emissions from Biomass1 Satellite Campuses Vancouver Campus (tonnes CO2e) Surrey Campus (tonnes CO2e) Kamloops Campus (tonnes CO2e)2 Joint Properties3 Total Emissions Total Offsettable Emissions Required Carbon Offset Payment4 Notes: 1. In alignment with the international reporting requirements, biogenic emissions (BioCO2) from biomass combustion, including wood, wood waste, ethanol, biodiesel and biomethane must be reported. However, SFU is only required to purchase offset for the CH4 and N2O emissions from biomass combustion. 2. The Kamloops Campus is closed in 2011. 3. SFU only requires to report part of the emissions. 4. Values may not sum to total due to rounding. SFU may make adjustment to the value as required.