Sugar Insight Sugar: Technical Recommendation

advertisement

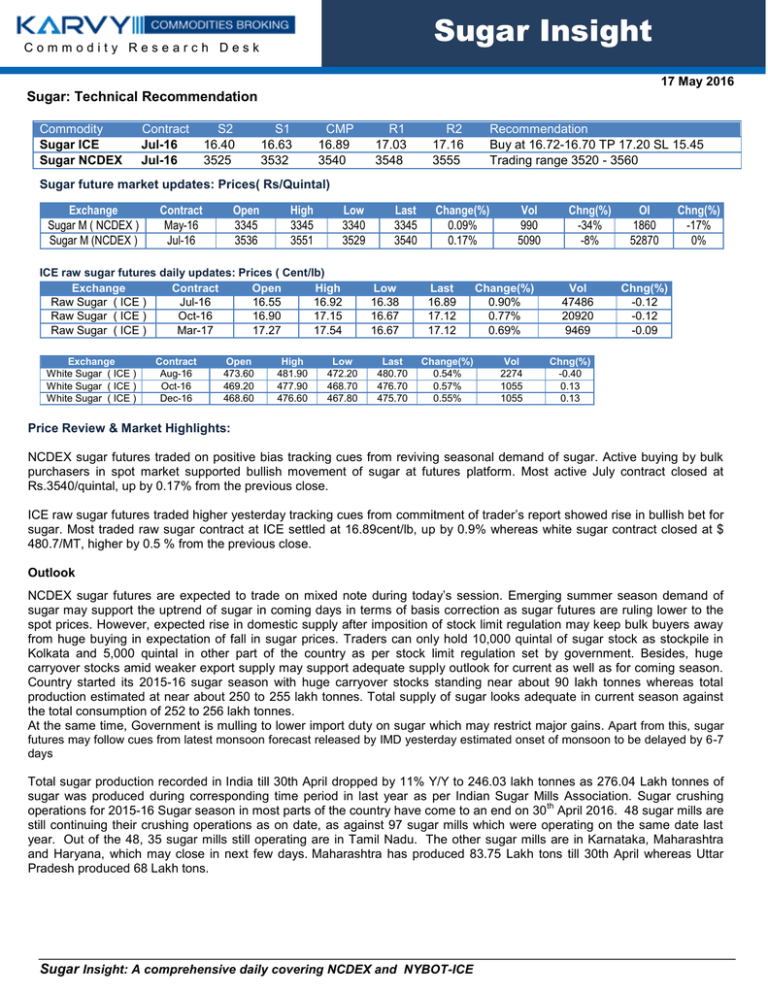

Sugar Insight Commodity Research Desk 17 May 2016 Sugar: Technical Recommendation Commodity Sugar ICE Sugar NCDEX Contract Jul-16 Jul-16 S2 16.40 3525 S1 16.63 3532 CMP 16.89 3540 R1 17.03 3548 R2 17.16 3555 Recommendation Buy at 16.72-16.70 TP 17.20 SL 15.45 Trading range 3520 - 3560 Sugar future market updates: Prices( Rs/Quintal) Exchange Sugar M ( NCDEX ) Sugar M (NCDEX ) Contract May-16 Jul-16 Open 3345 3536 High 3345 3551 Low 3340 3529 ICE raw sugar futures daily updates: Prices ( Cent/lb) Exchange Contract Open High Raw Sugar ( ICE ) Jul-16 16.55 16.92 Raw Sugar ( ICE ) Oct-16 16.90 17.15 Raw Sugar ( ICE ) Mar-17 17.27 17.54 Exchange White Sugar ( ICE ) White Sugar ( ICE ) White Sugar ( ICE ) Contract Aug-16 Oct-16 Dec-16 Open 473.60 469.20 468.60 High 481.90 477.90 476.60 Low 472.20 468.70 467.80 Last 3345 3540 Low 16.38 16.67 16.67 Last 480.70 476.70 475.70 Change(%) 0.09% 0.17% Last 16.89 17.12 17.12 Change(%) 0.54% 0.57% 0.55% Vol 990 5090 Change(%) 0.90% 0.77% 0.69% Vol 2274 1055 1055 Chng(%) -34% -8% Vol 47486 20920 9469 OI 1860 52870 Chng(%) -17% 0% Chng(%) -0.12 -0.12 -0.09 Chng(%) -0.40 0.13 0.13 Price Review & Market Highlights: NCDEX sugar futures traded on positive bias tracking cues from reviving seasonal demand of sugar. Active buying by bulk purchasers in spot market supported bullish movement of sugar at futures platform. Most active July contract closed at Rs.3540/quintal, up by 0.17% from the previous close. ICE raw sugar futures traded higher yesterday tracking cues from commitment of trader’s report showed rise in bullish bet for sugar. Most traded raw sugar contract at ICE settled at 16.89cent/lb, up by 0.9% whereas white sugar contract closed at $ 480.7/MT, higher by 0.5 % from the previous close. Outlook NCDEX sugar futures are expected to trade on mixed note during today’s session. Emerging summer season demand of sugar may support the uptrend of sugar in coming days in terms of basis correction as sugar futures are ruling lower to the spot prices. However, expected rise in domestic supply after imposition of stock limit regulation may keep bulk buyers away from huge buying in expectation of fall in sugar prices. Traders can only hold 10,000 quintal of sugar stock as stockpile in Kolkata and 5,000 quintal in other part of the country as per stock limit regulation set by government. Besides, huge carryover stocks amid weaker export supply may support adequate supply outlook for current as well as for coming season. Country started its 2015-16 sugar season with huge carryover stocks standing near about 90 lakh tonnes whereas total production estimated at near about 250 to 255 lakh tonnes. Total supply of sugar looks adequate in current season against the total consumption of 252 to 256 lakh tonnes. At the same time, Government is mulling to lower import duty on sugar which may restrict major gains. Apart from this, sugar futures may follow cues from latest monsoon forecast released by IMD yesterday estimated onset of monsoon to be delayed by 6-7 days Total sugar production recorded in India till 30th April dropped by 11% Y/Y to 246.03 lakh tonnes as 276.04 Lakh tonnes of sugar was produced during corresponding time period in last year as per Indian Sugar Mills Association. Sugar crushing th operations for 2015-16 Sugar season in most parts of the country have come to an end on 30 April 2016. 48 sugar mills are still continuing their crushing operations as on date, as against 97 sugar mills which were operating on the same date last year. Out of the 48, 35 sugar mills still operating are in Tamil Nadu. The other sugar mills are in Karnataka, Maharashtra and Haryana, which may close in next few days. Maharashtra has produced 83.75 Lakh tons till 30th April whereas Uttar Pradesh produced 68 Lakh tons. Sugar Insight: A comprehensive daily covering NCDEX and NYBOT-ICE Sugar Insight Derivative Analysis : Spread Analysis - Oct - July Sugar - NCDEX PVOI 6000 3660 5000 4000 3000 3650 100 3640 80 3630 60 3620 3610 2000 3600 1000 3590 0 120 40 20 0 3580 0-Jan 6-May 9-May OPEN_INT 10-May 11-May Volume 12-May 13-May Price To unsubscribe please mail us at commodity@karvy.com Disclaimer The report contains the opinions of the author, which are not to be construed as investment advices. The author, directors and other employees of Karvy and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above mentioned opinions are based on the information which is believed to be accurate and no assurance can be given for the accuracy of this information. There is risk of loss in derivatives. The author, directors and other employees of Karvy and its affiliates cannot be held responsible for any losses in trading. Commodity derivatives involve substantial risk. The valuation of underlying assets may fluctuate, and as a result, clients may lose entire value of their original investment. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Karvy Comtrade that the reader/client will profit or that losses can or will be limited in any manner whatsoever. Past results are no indication of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The Information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and not to be construed as investment advices. For Detailed disclaimer please go to following URL’s; http://www.karvycomtrade.com/v3/ContentPages/Disclaimer.htm ; http://www.karvycomtrade.com/v3/ContentPages/RiskDisclaimer.htm Sugar Insight: A comprehensive daily covering NCDEX and NYBOT-ICE Mail Us at Commodity@karvy.com