J-1 EXCHANGE VISITOR VISA INFORMATION

advertisement

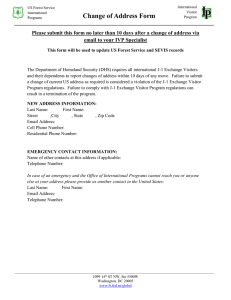

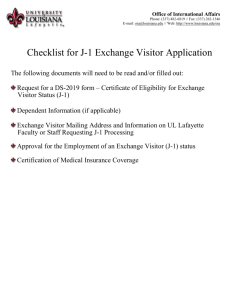

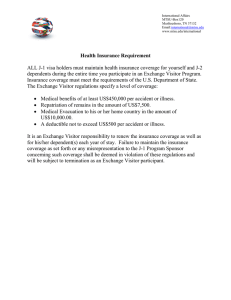

J-1 EXCHANGE VISITOR VISA INFORMATION An Exchange Visitor is a temporary alien who comes to the United States to teach, study, conduct research or receive training as a participant in an Exchange Visitor Program designated by the Office of Exchange Coordination and Designation, U.S. Department of State, SA-44, Room 734, Washington, DC 20547 (email: JVISAS@STATE.GOV). When accepted as a participant, the Exchange Visitor will be issued Form DS-2019 (Certificate of Eligibility) by the International Office in the Department of Human Resources. Visa The visa is issued and stamped in your passport by an American consul outside the United States. The visa authorizes you to enter -- but not to remain in -- the United States, and indicates your designated status, e.g., J-1 or J-2. The visa has an expiration date and may be valid for one, two, or an unlimited number of (multiple) entries. It is neither necessary nor possible to renew your visa while you remain in the United States. If you travel abroad, you must apply for a new visa at an American embassy or consulate outside the United States if your current visa has expired. The duration of a visa stamp has no bearing on one's authorization to remain in the United States. Permission to remain is designated on your DS-2019. J-1 Student Intern The University of Connecticut Health Center, through the Department of Human Resources, is authorized by the U.S. Department of State (DOS) to sponsor student interns under its J-1 Exchange Visitor program. The J student intern is a foreign national enrolled and pursuing a degree at an accredited post secondary institution outside the U. S. and participating in an internship program in the U. S. that will fulfill the educational objective of his/her current degree program at his/her home institution. Participants may be engaged in an internship program up to a maximum period of 12 months of degree or major. (Please note, there is no further extension beyond 12 months from the program date on the DS-2019) Arrival/Departure Record The Arrival/Departure Record (Form I-94) is the stamp in your passport issued to all non-immigrants by a U.S. immigration official at the port of entry to this country. This stamp does not give status, but is important in that it indicates that legal admission to the United States has been granted for D/S (duration of status). You must go to www.cbp.gov/I94 to submit your information and print out your I-94. (see information enclosed) If the I-94 has a date, rather than a D/S, written on the front or stamped on the back, this is the date to which you have permission to remain in the United States. If you wish to stay beyond this date, you must apply for an extension of stay and you must contact the International Office in the Department of Human Resources to determine your eligibility for an extension and the procedure for obtaining it. J-1 Exchange Visitor Visa Info. 2 The I-94 must be kept with your passport at all times. When you leave the United States for any purpose other than a visit to Canada, Mexico or an adjacent island for a period less than 30 days, your I-94 will be cancelled. A new I94 will be issued to you when you return if you have a valid DS-2019. DS-2019 A valid DS-2019 gives you a J-1 visa status and allows you to fulfill your objective in coming to the Health Center between the dates listed in number 3 on the form. If you wish to stay beyond this date, you must apply for an extension of stay. At least 60 days before this date, you must contact the International Office in the Department of Human Resources to determine your eligibility for an extension and the procedure for obtaining it. Mandatory Medical Insurance Federal regulations, effective September 1, 1994, require all exchange visitors and their J-2 dependents to have medical insurance in effect for the entire period of participation in our program. Minimum coverage is: 1. Medical benefits of at least $50,000 per accident or illness; 2. Repatriation of remains in the amount of $7,500; 3. Expenses associated with the medical evacuation of the exchange visitor to his or her home country in the amount of $10,000; and 4. A deductible not to exceed $500 per accident or illness. An insurance policy is necessary to fulfill the requirements of this section and must be underwritten by an insurance corporation having an A.M. Best rating of "A-" or above, an Insurance Solvency International, Ltd. (ISI) rating of "A-i" or above, a Standard & Poor's Claims-paying Ability rating of "A-" or above, a Weiss Research, Inc. rating of B+ or above, or such other rating service as the Agency may from time to time specify; or insurance coverage backed by the full faith and credit of the exchange visitor's home government. An exchange visitor who willfully fails to maintain the insurance coverage for the duration of participation in our program or who makes a material misrepresentation to us concerning such coverage on behalf of him/her and/or dependent spouse/children shall be determined in violation and subject to termination of program. For your convenience, we list some websites of medical insurance companies who offer policies to cover internationals. www.internationalstudentinsurance.com http://www.hthstudents.com/voluntary.cfm http://www.psiservice.com/ http://www.icsweb.org/ http://www.aifs.com/java/US/aifscisi/ http://www.hginsurance.com/individual.html www.foreignsure.com http://www.hginsurance.com/index.html J-1 Exchange Visitor Visa Info. 3 Two-Year Foreign Residency Requirement An exchange visitor is not eligible to apply for a change of status, immigrant status or non-immigrant H-1 until he/she has been physically established in his/her country for an aggregate of two years following his/her last departure from the U.S. if he/she has: 1. 2. 3. Received direct or indirect financial support from the United States Government or his/her country government; Come from a country “in need of the skills acquired by its national in the U.S." as determined by the U.S. International Communication Agency and published in the Exchange Visitor Skills List, March 17, 1997; or Received medical training. If an exchange visitor is subject to this requirement under Section 212(e), a preliminary notation may appear on the DS-2019 Form and on the J-1 visa page in your passport. Employment Student employment is permitted only if it is an integral part of the program for which the exchange visitor came to the U.S. (such as financial support received as a Visiting Instructor or Research Fellow), or is in the student's field of study and will not unduly delay his/her degree (such as a graduate assistantship). Permission for all employment must be obtained from the International Office in the Department of Human Resources. For more specific instructions on student or scholar employment, contact the International Office at (860) 679-4430. Social Security The United States, like many other countries, imposes a payroll tax on current employees to pay for pensions and certain medical benefits of the current population needing assistance. Most wages are subject to a tax and no exemptions or deductions are allowed. The tax is popularly known as the "social security tax", but its technical name is the Federal Insurance Contributions Act tax, abbreviated F.I.C.A. on the Form W-2 provided by employers. The employer is required to pay a matching amount to the government. Visiting faculty and students who are in the United States on "F" or "J" visas and whose income is earned to further the objectives for which they were admitted may not have F.I.C.A. taxes withheld from their pay unless they have been in the U.S. for two years for research scholar/faculty and five years for students. Family members authorized to work in the U.S. are not exempt from social security tax. J-1 Exchange Visitor Visa Info. 4 Social Security Number/Card International exchange visitors at the University may be issued a number for identification purposes only. This is not a Social Security number and may not be used outside the University. Everyone who has earnings in the United States must obtain a social security number, the number used by the U.S. government to identify wage earners for tax purposes. The number is printed on a card, referred to as the social security card. This card must be shown to a prospective employer before an individual may be hired. The social security number has also been a standard means of identification for anyone living in the U.S. Social security numbers are needed to obtain a driver's license, open bank accounts, employment and other instances which call for an identifying number. Those who need a Social Security number must apply in person with their passport, the I-94, form DS-2019, a letter of Employment Verification and a letter of Visa Status Verification to an office of the Social Security Admin. The two locations close to the Health Center are: Social Security Administration 2nd Floor 960 Main St. Hartford, CT 06103 Telephone: 860-493-1857 Social Security Administration 100 Arch St. New Britain, CT 06051 Telephone: 860-229-4844 Extension of Stay The Exchange Visitor may apply for an extension of stay two or three months prior to the expiration date of his/her stay by contacting the International Office. Degree students will be permitted to remain as long as they pursue substantial scholastic programs leading to recognized degrees or certificates as defined by the program description. Non-degree students are limited to twenty-four months. The maximum period of stay for professors, research scholars and specialists is five years. RESEARCH SCHOLARS or PROFESSORS: If you have been physically present in the U.S. as an exchange visitor (J-1 or J-2) within the 24 month-period preceding the date listed in #3 of the enclosed DS-2019 you are NOT ELIGIBLE to enter the U.S. as an exchange visitor and must communicate this fact immediately to our office. Visits to Canada, Mexico and Adjacent Islands (Contiguous Territory) For a visit of less than 30 days to Canada, Mexico or the islands adjacent to North America (except Cuba), your I-94 is not surrendered but used, together with a valid DS-2019 for re-entry into the United States. An expired J-1 Visa will be considered automatically revalidated upon re-entry from Canada or Mexico if the Visitor: 1. 2. 3. 4. Has maintained and intends to resume the J-1 status; Present valid form DS-2019; Has a valid passport; Is applying for re-admission within the authorized period of initial admission or extension of stay (as marked on the DS-2019). For additional information pertaining to travel outside of the United States, please see our website: http://employ.uchc.edu/employment/Travel_Advisory.html Dependents If sufficient financial support is documented, spouse and/or children may accompany the Visitor on the basis of an additional form attached to the Form DS-2019 issued to the J-1 Visitor. Dependents are classified as J-2. The Department of Human Resources must certify that sufficient funds are available to support the spouse and/or children for their first year in the U.S. J-1 Exchange Visitor Visa Info. 5 Employment of the dependent is permitted only if the Department of Homeland Security approves his/her application to work, and if the work is necessary for the support of the dependent only. Immigration form to request permission for employment authorization can be obtained from the International Office or downloaded from Department of Homeland Security’s website (http://uscis.gov/graphics/formsfee/forms/index.htm). J-2 dependents may enroll as students for full or part-time study without the approval of the International Office. Academic Training After obtaining a degree, an Exchange Visitor student may need a period of practical work experience in the field of study. Upon recommendation of the faculty advisor and with the approval of the program sponsor, such training may be granted for a maximum period of 18 to 36 months depending upon the program. The visitor should consult with Ms. Duggal in the Department of Human Resources concerning eligibility and application procedures. Departure The International Office requires you to complete a Notice of Departure form three weeks prior to final departure from the Health Center. Please call the International Office at the Department of Human Resources and the form will be sent to you. An international visitor notifies the Department of Homeland Security of his departure from the U.S. by surrendering his I-94 at the point of departure. Income Tax Information Foreign students and faculty who are studying, teaching or engaged in research activities and earning money in the United States may be subject to federal and state income tax and to Federal Social Security Tax (F.I.C.A.)* on wages earned by themselves or their family members. U.S. tax treatment of foreign students, faculty and their families depends chiefly on their status and the types of income which they receive. In some circumstances, country of origin may also play a part if a tax treaty exists. Use of a tax treaty exemption is for one time only per person. If you had been in the U.S. previously and used tax treaty benefits you can not use them again. It is important to remember that each person's tax liability is unique and should be analyzed individually by an agent of the Internal Revenue Service (IRS), an accountant, or a tax attorney. Only a small number of tax attorneys or specialists, however, are familiar with the tax problems peculiar to aliens and there will be fees for advice and assistance. The IRS is located at 135 High Street in Hartford, phone 1-800-424-1040. *See Social Security section. Filing Returns and Obtaining Refunds All non-immigrants must file an income tax return annually even if there was no U.S. income received. The return may be filed any time after receipt of W-2 form, or between January 1 and April 15. The United States Federal Government and the State of Connecticut, require employers to withhold tax on wages earned by employees. The amounts withheld may exceed the amount of tax due, especially for persons working only a portion of the year. In order to obtain a refund, use the W-2 form obtained from the employer which states the amount of tax withheld during the year. A copy of this form is submitted with the federal and state tax returns. If the amount withheld exceeds the tax liability, the IRS and/or the state will send a check for the balance to the address listed on the form submitted. Tax returns will be subject to mathematical verification by an IRS and/or State computer. If the deductions or exemptions claimed appear irregular, the return may be selected for an audit by IRS Review Agents. A person filing a false or fraudulent return is subject to fines and in severe cases, to criminal prosecution. An alien J-1 Exchange Visitor Visa Info. 6 filing a false return may lose his status and be precluded from returning to the U.S. Income tax return forms and instruction bulletins may be available from the following website: Internal Revenue Service website: http://www.irs.gov CT Department of Revenue website: http://www.ct.gov/drs/cwp/view.asp?a=1509&Q=277516&PM=1#NRPY IRS Publications pertaining to nonresident Aliens: Publication 519, “US Tax Guide for Aliens: http://www.irs.gov/publications/p519/index.html Publication 901, “US Tax Treaties” http://www.irs.gov/publications/p901/index.html Publication 17, “Your Federal Income Tax” http://www.irs.gov/publications/p17/index.html Additional Information The International Office has a legal obligation to the Office of Exchange Coordination and Designation, U.S. Department of State to report your continued attendance at this University. If for any reason you perform your objective less than full time, leave the University (withdraw, transfer, etc.) or apply for a change in visa status, it is your responsibility to notify the International Office in the Department of Human Resources of your plans before any attempt to change. You must inform the Department of Homeland Security and the International Office of any change in your address or telephone number, or of any change in registration form information. Whenever you have immigration questions concerning your stay in the U.S., please feel free to consult with the international Office at (860) 679-4430. When you change your address, you also need to file an address change form (AR 11) with the Department of Homeland Security which can be downloaded from the following website: http://uscis.gov/graphics/formsfee/forms/files/ar-11.pdf Because of long delays encountered in cashing foreign checks, an international credit card or U.S. travelers checks can be obtained prior to arrival in the U.S. A credit card, in addition to making purchases, is valuable as a credit reference when renting housing and opening a bank account. Another way of ensuring sufficient cash in the critical first few months of transition is to transfer funds to a U.S. bank prior to arrival. If children will accompany you to the U.S., or will join you at a later date, it is necessary to have their academic and immunization records. These records are required by the educational system to show achievement and proper inoculation for all children entering the school system. Since your International Driver's License is only valid for 60 days after your arrival in the U.S., it is necessary to obtain a Connecticut Driver's License if you intend to drive an automobile. For more information on obtaining a Connecticut driver’s license, please visit the State of Connecticut Department of Motor Vehicles’ website: http://www.ct.gov/dmv/site/default.asp If you are to receive payment from the University, a period of four weeks may elapse before you receive your first check. This is usual procedure, over which we have no control, for all State employees. You must make financial provision for yourself during this interim period. J-1 Exchange Visitor Visa Info. 7 Finding a place to live can sometimes be a difficult and time consuming experience. The Graduate Students’ organization at UCHC has very helpful information on its website. Please check it out at: http://grad.uchc.edu/prospective/housing/index.html http://grad.uchc.edu/prospective/hartford/index.html http://grad.uchc.edu/current/gso/guide/fun.html Transportation from the Airports If you are arriving at either LaGuardia or JFK International Airports in New York, Connecticut Limo will be able to provide you with shuttle service. Please keep in mind that you will need to make reservations at least 24 hours in advance with the shuttle company. You can make reservations at this website, http://www.ctlimo.com/. If you prefer bus, the MegaBus, http://us.megabus.com/Default.aspx provides transportation between Hartford and New York City. Buy your tickets online. In Hartford, the MegaBus picks up and drops off at the corner of Arch St. and Constitution Way. In New York City, the Megabus picks up and drops off at the corner of 7th Avenue and 28th Street. Also, Peterpan Bus Company – visit: www.peterpanbus.com. You can buy your ticket online. In Hartford, the Peterpan bus picks up and drop off at Union Station, bus depot and train station (One Union Place, Hartford, CT 06103) In New York City, the Peterpan bus picks up and drops off at the Port Authority Bus Terminal (8th Avenue and 42nd Street) If you will be arriving at Logan International Airport in Boston, Ma, there are instructions on how to get to from Logan Airport to Boston’s South Station in order to take a train to Hartford or New Haven. The information is located at the following link: http://www.massport.com/logan/getti_typeo_south.html. If you will be arriving at Bradley International Airport in Hartford, CT, transportation information is located at these websites, http://www.bradleyairport.com/Transport/taxi.aspx or http://www.bradleyairport.com/Transport/limo.aspx. 11/11