Closing the Small Open Economy Model: A Demographic Approach

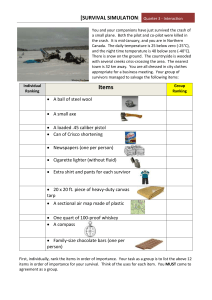

advertisement