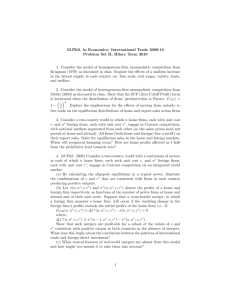

A Model of Market Power in Customer Markets Please share

advertisement