Working Paper Number 167 March 2009 The End of ODA:

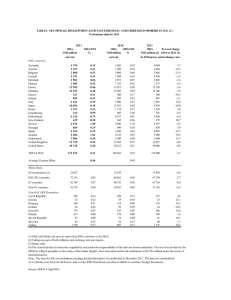

advertisement