Marketing Mix and Brand Sales in Global Markets:

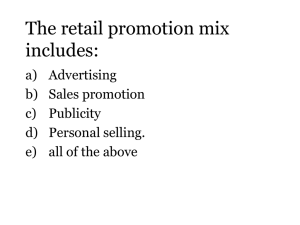

advertisement