Legal and Regulatory Provisions Related to

advertisement

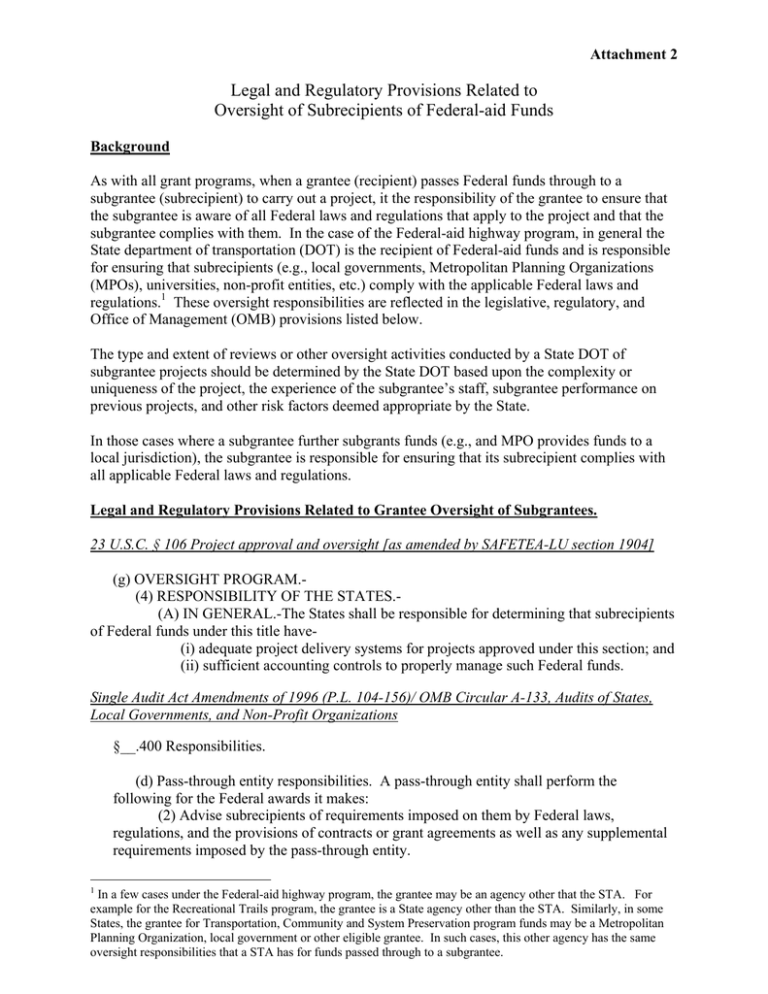

Attachment 2 Legal and Regulatory Provisions Related to Oversight of Subrecipients of Federal-aid Funds Background As with all grant programs, when a grantee (recipient) passes Federal funds through to a subgrantee (subrecipient) to carry out a project, it the responsibility of the grantee to ensure that the subgrantee is aware of all Federal laws and regulations that apply to the project and that the subgrantee complies with them. In the case of the Federal-aid highway program, in general the State department of transportation (DOT) is the recipient of Federal-aid funds and is responsible for ensuring that subrecipients (e.g., local governments, Metropolitan Planning Organizations (MPOs), universities, non-profit entities, etc.) comply with the applicable Federal laws and regulations.1 These oversight responsibilities are reflected in the legislative, regulatory, and Office of Management (OMB) provisions listed below. The type and extent of reviews or other oversight activities conducted by a State DOT of subgrantee projects should be determined by the State DOT based upon the complexity or uniqueness of the project, the experience of the subgrantee’s staff, subgrantee performance on previous projects, and other risk factors deemed appropriate by the State. In those cases where a subgrantee further subgrants funds (e.g., and MPO provides funds to a local jurisdiction), the subgrantee is responsible for ensuring that its subrecipient complies with all applicable Federal laws and regulations. Legal and Regulatory Provisions Related to Grantee Oversight of Subgrantees. 23 U.S.C. § 106 Project approval and oversight [as amended by SAFETEA-LU section 1904] (g) OVERSIGHT PROGRAM.(4) RESPONSIBILITY OF THE STATES.(A) IN GENERAL.-The States shall be responsible for determining that subrecipients of Federal funds under this title have(i) adequate project delivery systems for projects approved under this section; and (ii) sufficient accounting controls to properly manage such Federal funds. Single Audit Act Amendments of 1996 (P.L. 104-156)/ OMB Circular A-133, Audits of States, Local Governments, and Non-Profit Organizations §__.400 Responsibilities. (d) Pass-through entity responsibilities. A pass-through entity shall perform the following for the Federal awards it makes: (2) Advise subrecipients of requirements imposed on them by Federal laws, regulations, and the provisions of contracts or grant agreements as well as any supplemental requirements imposed by the pass-through entity. 1 In a few cases under the Federal-aid highway program, the grantee may be an agency other that the STA. For example for the Recreational Trails program, the grantee is a State agency other than the STA. Similarly, in some States, the grantee for Transportation, Community and System Preservation program funds may be a Metropolitan Planning Organization, local government or other eligible grantee. In such cases, this other agency has the same oversight responsibilities that a STA has for funds passed through to a subgrantee. (3) Monitor the activities of subrecipients as necessary to ensure that Federal awards are used for authorized purposes in compliance with laws, regulations, and the provisions of contracts or grant agreements and that performance goals are achieved. 49 CFR Part 18-Uniform Administrative Requirements for Grants and Cooperative Agreements to State and Local Governments § 18.3 Definitions. Grantee means the government to which a grant is awarded and which is accountable for the use of the funds provided. Subgrantee means the government or other legal entity to which a subgrant is awarded and which is accountable to the grantee for the use of the funds provided. § 18.26 Non-Federal audits. (b) Subgrantees. State or local governments, as those terms are defined for purposes of the Single Audit Act Amendments of 1996, that provide Federal awards to a subgrantee, which expends $500,000 or more (or other amount as specified by OMB) in Federal awards in a fiscal year, shall: (1) Determine whether State or local subgrantees have met the audit requirements of the Act and whether subgrantees covered by OMB Circular A–110, “Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher Education, Hospitals, and Other Non-Profit Organizations,” have met the audit requirements of the Act. Commercial contractors (private for-profit and private and governmental organizations) providing goods and services to State and local governments are not required to have a single audit performed. State and local governments should use their own procedures to ensure that the contractor has complied with laws and regulations affecting the expenditure of Federal funds; (2) Determine whether the subgrantee spent Federal assistance funds provided in accordance with applicable laws and regulations. This may be accomplished by reviewing an audit of the subgrantee made in accordance with the Act, Circular A-110, or through other means (e.g., program reviews) if the subgrantee has not had such an audit; § 18.37 Subgrants. (a) States. States shall follow state law and procedures when awarding and administering subgrants (whether on a cost reimbursement or fixed amount basis) of financial assistance to local and Indian tribal governments. States shall: (1) Ensure that every subgrant includes any clauses required by Federal statute and executive orders and their implementing regulations; (2) Ensure that subgrantees are aware of requirements imposed upon them by Federal statute and regulation; § 18.40 Monitoring and reporting program performance. (a) Monitoring by grantees. Grantees are responsible for managing the day-to-day operations of grant and subgrant supported activities. Grantees must monitor grant and subgrant supported activities to assure compliance with applicable Federal requirements and that performance goals are being achieved. Grantee monitoring must cover each program, function or activity.

![AGREEMENT [ENTER PO NUMBER] BETWEEN THE BOARD OF REGENTS OF THE](http://s2.studylib.net/store/data/017923844_1-647fcd2384b663cd5d0300427709d759-300x300.png)