Takeovers with Resistant Boards, Political Pressure and Risk-Arbitrageurs Guillem Ord´ o˜

Takeovers with Resistant Boards, Political Pressure and

Risk-Arbitrageurs

Guillem Ord´ nez-Calaf´ı

University of Warwick

∗

John Thanassoulis

University of Warwick

†

January 30, 2016

Abstract

Managerial resistance plays an important role in the market for corporate control.

Such resistance is often reinforced by government pressure. Yet the ability of a Board to resist a takeover offer is tempered by share sales to arbitrageurs during the offer period. Using a global games approach we document how changes in market fundamentals (bid premium, external pressure, and shareholder voting rights) affect the main takeover outcomes: probability of takeover success, the market price during the offer period, and the volume of shareholders who choose not to wait for the Board’s recommendation but rather sell early to risk-arbitrageurs.

JEL: C72, G34, G38.

Keywords: Takeovers, takeover resistance, shareholder coordination, risk arbitrage, political pressure, global games.

∗

Department of Economics, University of Warwick. g.ordonez-calafi@warwick.ac.uk

†

Warwick Business School, University of Warwick; Oxford-Man Institute, University of Oxford, Associate

Member; and Nuffield College, University of Oxford, Associate Member.

1 Introduction

In 2009 Kraft Foods, a US company, launched a hostile bid for Cadbury, the UK-listed chocolatier. Cadbury’s managerial board declared the offer “unattractive”. Moreover, the

British government and some unions publicly stood against the takeover, with the business secretary warning Kraft that it could meet “huge opposition” from the British Government.

Despite the evident political distaste for the deal, Kraft eventually won the Cadbury’s board’s blessing. The agreement was acknowledged to be unpopular amongst many Cadbury’s shareholders, but the board’s approval led to 72% of the stock being tendered – sealing the deal.

Sir Roger Carr, Cadbury’s Chairman, admitted that the increase in the proportion of the company held by short-term investors during the bidding period (from 5% to 31%) led him to close the deal: 1

“In the final analysis of the deal, it was the shift in the shareholder register that lost the battle for Cadbury.” Roger Carr, former Chairman of Cadbury

(emphasis added).

2

Managerial resistance is acknowledged to play an important role in the market for corporate control. The ability of a Board to resist a takeover offer is tempered however by share sales during the offer period – as noted in the quote above. After a hostile takeover offer is made, the trading volume of the target company’s stock rises, typically dramatically. This is due in large part to the activity of risk-arbitrageurs.

3 The arbitrage community often comes to control 30-40% of the stock and therefore becomes a crucial element in determining whether a Board can credibly recommend against a takeover as it is perceived to be in the interests of arbitrageurs to tender their stock (Hillier, Grinblatt and Titman (2012)).

The strength of managerial resistance is often reinforced by external pressure exerted by the political system, labour, the media and other stakeholders whose interests are aligned with those of the incumbent managers (Hellwig 2000). Governments in particular use both formal and informal instruments to oppose takeovers for the sake of their interpretation of the public interest.

4 In numerous countries the takeover legislation is considered to be

1

Press coverage includes: Wiggins, J. (2010). The inside story of the Cadbury takeover.

Financial Times ,

[online]. Available at: http://www.ft.com/cms/s/2/1e5450d2-2be5-11df-8033-00144feabdc0.html [Accessed

17 Jan. 2016]; or Moeller, S. (2012). Case Study: Kraft’s takeover of Cadbury.

Financial Times , [online].

Available at: http://www.ft.com/cms/s/0/1cb06d30-332f-11e1-a51e-00144feabdc0.html#axzz3xVfEY4Dk

[Accessed 17 Jan. 2016]

2 ‘UK takeover threshold should be raised, says ex-Cadbury chairman Roger Carr,’ Daily Telegraph, 10

February 2010.

3 For example see the numerous HBS cases cited in Cornelli and Li (2002).

4 The motive “public interest” provides flexibility to governments for intervening in takeovers. In the

UK, the competition authorities are required to assess whether a merger should be prohibited on the basis

1

protectionist as it provides legal tools for governments to block takeovers. Furthermore, the government is in a position to use moral persuasion to stop an acquisition. The threat for acquirers is to have to deal with a hostile government on many regulatory issues if the acquisition goes through (see Dinc and Erel (2013) for a classification of government instruments to oppose takeovers).

This paper formally analyses the takeover process from a novel perspective allowing for strategic Boards who have a reluctance to sell, and whose reluctance is in part a function of external pressure and shareholder sales during the offer period. The shareholders are themselves strategic and evaluate the trade-off between selling during the takeover process to lock in gains, against the benefits of holding on in the hope the pressure created by the sales of other shareholders will be sufficient to counter the expected external pressure on the

Board.

The fundamentals of our analysis will be the bid premium, the expected Board resistance to takeovers, and the influence of new owners of the stock – many of whom will be arbitrageurs during a takeover process.

We study how changes in these parameters affect the main outcomes of our analysis: the probability a takeover succeeds, the market price during the offer period, and the volume of shareholders who choose not to wait for the Board’s recommendation but rather sell early to risk-arbitrageurs.

The relationship between these fundamental and outcome variables is unclear without further analysis. For example, if the bid premium rises it seems natural that the probability of a successful deal will rise, and so too will the market price of the stock in the offer period. It is not however clear whether the volume of shareholders selling during the offer period should rise or fall; both the benefits of selling early and of waiting to the Board’s decision have risen and so which dominates is not clear. Similarly, if a government should increase the pressure on a Board to resist a sale then one can anticipate that the probability of the deal and so the interim share price will decline. The former may therefore make shareholders more likely to sell early, though the latter force works against this. However, a third possibility exists: if enough shareholders sell early then it may be possible for the force of the new shareholders (mostly risk-arbitrageurs) to overturn the effectiveness of the government’s intervention and increase the probability of the deal being consummated. We will offer answers to such questions.

Our analyses are in some cases relevant for current policy debates concerning shareholder voting rights and the merits of political interference in the market for corporate control.

of whether it can be expected to lead to a substantial lessening of competition . Furthermore, since the

Enterprise Act 2002, the Secretary of State is allowed to intervene in mergers where they give rise to certain public concerns other than competition. These are: national security, media quality, plurality & standards, and financial stability.

2

There is a long tradition of scholarship arguing that shareholders are too short-term and can distort managerial decision making (see Thanassoulis and Somekh (2016) and references therein).

In response to these concerns there have been prominent calls for the voting power of new shareholders to be curtailed. This would particularly affect the ability of riskarbitrageurs to influence takeovers. In the U.S. the Alpen Institute propose that shareholders should be able to vote only after a minimum holding period. In the EU the European

Commission are looking into increasing the voting weight of shareholders who are long-term holders of the stock.

5

In the UK the takeover panel also considered disenfranchising new shareholders following the Cadbury takeover. As these proposals, designed to encourage long term shareholder ownership, have the effect of diminishing the power of risk-arbitrageurs, it is conceivable that they will in fact encourage more shareholders to sell early during an offer period to maintain selling pressure on the Board; exacerbating not correcting the alleged problem. We will show that this can indeed be the case and offer a characterization of when it is.

This paper formally studies the coordination problem of target shareholders deciding whether to sell their stock before the end of the offer period and the Board’s decision. A

Bidder makes an acquisition offer to the target company. For the takeover to succeed, i.e.

for enough shareholders to tender, it requires the acceptance of the target Board. Thus, the takeover premium needs to outweigh the Board’s resistance. However, the resistance is alleviated by the effect of the risk-arbitrageurs. During the offer period ( interim ), arbitrageurs take long positions in the target stock in the hope that the takeover will go through. Hence, they put pressure on the Board to reach an agreement with the Bidder. A target shareholder has to decide whether to hold her stock or to sell it at the interim. If enough shareholders sell, the internal pressure of risk arbitrageurs yields the takeover success. Conditional on a takeover’s success, a shareholder prefers to hold her shares so as to gather the full takeover premium. In contrast, when many shareholders hold the takeover fails due to the low pressure of arbitrageurs relative to the Board’s resistance. Then, the stock price returns to its original value, leaving those shareholders who held with no gain. Therefore, selling becomes a “public good” to which no one wishes to contribute, but everyone hopes others will.

In equilibrium both the interim stock price and the order flow are determined endogenously. This generates multiple equilibria and impedes discrimination between takeover outcomes. To deal with multiplicity, we introduce the information structure of a global game. This global games analysis is itself novel as shareholders’ actions are strategic substitutes, not complements, which arises because of the public good nature of the early sale decision. The Board’s type, which represents its resistance to the takeover, is not known with

5 See Brussels aims to reward investor loyalty , Financial Times, Jan 23, 2013.

3

certainty by the shareholders. Nonetheless, the shareholders share a common prior about its distribution. Moreover, each shareholder receives an independent private signal about the

Board’s type. Hence, current shareholders have an information advantage over arbitrageurs.

Finally, the interim stock price at which trade between shareholders and arbitrageurs takes place is set by market makers with zero expected profits. This setting pins down a unique equilibrium as a function of the fundamental variables, where all agents are rational and trading arises due to informational asymmetries.

We characterize the equilibrium and conduct comparative statics to study the effects of the model fundamentals on the main outcomes. Our goal is to better understand the consequences of government pressure and policy making in a takeover setting. Our model is extended to evaluate the effectiveness of different policy measures against takeovers. We show that marginal increases in political pressure have the greatest impact on the deal success probability when the counterfactual takeover probability of success and failure are equally likely. Furthermore, we show that in jurisdictions which have strong respect for shareholder rights – including new shareholders – the marginal impact of increases in political pressure on the Board are most pronounced. Finally we extend the model to consider a strategic bidder and so study how typical bid levels themselves are influenced by the political and shareholder regime existing in a given jurisdiction.

1.1

Related Literature

This paper contributes to the literature analysing shareholders’ coordination issues in takeover offers. The seminal work of Grossman and Hart (1980) described a free-riding incentive in shareholders’ tendering decision. Shareholders would rather not sell and gain from holding shares in an improved company, conditional on enough other shareholders selling to ensure sufficient incentive for the acquirer to monitor the target firm. Since then, numerous studies characterized mechanisms mitigating the coordination problem so as to explain why takeovers succeed (see Tirole 2006, and references therein). In line with recent evidence, we propose a different coordination problem: During the offer period, shareholders decide whether to sell their shares to arbitrageurs that make the takeover more likely, or whether to wait to sell to the acquirer at the end of the offer period if the deal is successful.

Our work allows for managerial resistance to a value-enhancing takeover in this setting.

The economic literature mainly focused on the agency problems between ownership and control to explain takeover defenses (see Tirole 2006 for a systematic approach). While not neglecting this approach, we also put emphasis on the pressure against takeovers exerted by the broader stakeholders. This is in line with Hellwig (2002), who reviews the alliance

4

between incumbent managers and the political system (see, e.g., Jensen (1991) and Roe

(1994)). In a similar spirit, Dinc and Erel (2013) find evidence of widespread economic nationalism by governments who oppose takeovers of domestic firms by foreign acquirers.

The effects of risk arbitrage on takeovers has been previously analysed. In an early study,

Larcker and Lys (1987) find that takeovers in which arbitrageurs bought shares have a higher probability of success. Relatedly, numerous studies find that risk arbitrage generates excess returns (see e.g. Baker and Savasoglu 2002). Nonetheless, while there is consensus on the existence of excess returns, less is known about their sources. Most notably, Mitchell and

Pulvino (2001) offer evidence that some of the excess returns reflect a premium paid to risk-arbitrageurs for providing liquidity to the market.

An alternative explanation for the excess returns is that risk arbitrage makes a takeover more likely. Since arbitrageurs are keener to tender, they are typically perceived as favouring the acquirer (see Hillier, Grinblatt and Titman 2012). Cornelli and Li (2002) suggest that risk-arbitrageurs have an information advantage in making inferences from the order flow because they know they will tender with certainty. This leads them to accumulate more stock and in turn, to increase the probability of a takeover. Our model is close Cornelli and

Li (2002) on the positive impact of arbitrage in the probability of a takeover. Nonetheless, it differs on the mechanism. In particular, we assume that arbitrageurs put pressure on the

Board to accept the offer and that existing shareholders are strategic in deciding whether to sell early or sell late.

We use global games techniques and take an approach similar to Bebchuk and Goldstein

(2011). Nonetheless, our setting differs from most literature in global games in that agents’ actions are strategic substitutes. This has not been as thoroughly studied as the case of strategic complements. Hence, while the properties of equilibria are analysed in Morris and Shin (2005) and Harrison (2005) among others, we find little application of this case.

Last but not least, we use the information asymmetries of a global game to motivate trade.

This relates our work to other frictions proposed in the literature, such as Kyle (1985) who introduces a proportion of noise traders. In our model all agents are rational and have the same reservation value, which makes information asymmetries the unique rationale for trade.

This paper is structured as follows. Section 2 presents the benchmark model and describes the information structure of the global game. In Section 3, we characterize the equilibrium and the main outcomes. We also study the insights of the information structure which is compatible with equilibrium uniqueness. Section 4 describes the main results and presents the comparative statics. Section 5 examines the effectiveness of political pressure. In section

6, we study the offer of a strategic bidder. Finally, Section 7 concludes. The appendices contain two extensions. Appendix A studies the robustness of the results to the setting in

5

which some target shareholders are also holders of the bidder’s stock. Appendix B studies a perturbed model in which the information structure is altered to give arbitrageurs an informational advantage over existing shareholders. The third and final appendix collects all the technical proofs.

2 The Model

Consider a target company which has a market value V.

The target company is owned by a continuum of shareholders of mass one. At t = 0, the target receives an offer P ≥ V from a company that we call the Bidder . In the core model this price P is exogenous. This captures, for instance, the highest bid from an auction process and so represents the maximum value which can be extracted from the target’s assets. We consider the case of a single bidding firm and so strategically chosen P in Section 6.

We assume that the target’s Board is influential enough that their advice will determine whether the acquisition can be completed. Typically, perhaps due to the dispersion of shareholders in publicly traded firms, the managerial team is expected to use its information advantage and advise shareholders as to whether tendering their shares is in their long-term interests. As a consequence, the Board’s verdict is usually deterministic for the takeover outcome. More systematically, Baker and Savasoglu (2002) in their study of 1,901

US takeover offers between 1981 and 1996 report that in approximately 80% of cases, the outcome was in line with the Board’s advice. We model the Board’s decision is being made at t = 2. Both shareholders and external investors understand that if the Board accepts, the share value will move to P . Instead, if the offer is rejected, the value will return to V . In the interim period t = 1, before the Board decides whether to accept the offer, shares are traded at a market price M . This price is endogenously set by market makers with zero expected profits. We denote by ρ the proportion of shareholders selling at t = 1.

We assume that the Board causes the offer to be accepted at t = 2 if

P ≥ V + θ − κρ.

(1)

The parameter θ ∈

R represents the Board’s resistance to accept the offer. This can capture political pressure or managerial rents. The Board’s type θ is private information. It is drawn from a normal distribution with mean y and precision τ

θ

.

The parameter y measures the expected Board resistance to a takeover. The resistance could be due to the perks of control or to political pressure. If the realised Board’s resistance, θ , is high then the Board will only be willing to sell if the offer price P exceeds the stand alone value of the firm, V ,

6

by a sufficiently large margin. Both θ and y are permitted to take negative values.

The variable ρ ∈ [0 , 1] is determined by equilibrium play and measures the proportion of stock acquired by risk-arbitrageurs at t = 1, which we assume is proportional to the trading volume or order flow. As shareholders sell out, ρ increases so the pressure on the Board to accept the offer grows. This effect is scaled by the parameter κ ≥ 0, which represents the effectiveness of risk-arbitrageurs on influencing the takeover’s outcome. Hence, higher ρ increases the range of values of θ at which the Board accepts the offer.

2.1

Shareholders’ game

To explain this game succinctly, suppose for the moment that at the interim t = 1 everyone observes the Board’s type θ . Then, each shareholder decides whether to hold her share or to sell it for a price M , which is simultaneously set by market makers. Selling to outside investors gives a payoff M . Instead, holding the share has a payoff of V if the Board rejects the offer at t = 2 , and a payoff P > V if the takeover goes through. There are two key features driving the equilibria in this game. First, whether the Board accepts the takeover bid may depend on the number of shareholders selling. Second, the interim stock price M is set by market makers with no profits. We characterize the symmetric mixed strategy Nash

Equilibria so as to provide a neat exposition of the main mechanisms in this game.

Let h ( θ ) ≡

θ − ( P − V )

κ represent the proportion of shareholders selling that makes the Board indifferent between accepting and rejecting the offer. Hence, the takeover fails if ρ < h ( θ ) and succeeds otherwise. Then, shareholders’ payoff can be represented as follows:

Sell

Hold

ρ ≥ h ( θ ) ρ < h ( θ )

M

P

M

V where both the stock price M and the order flow ρ are endogenous. There are a continuum of equilibria to this game that can be of two types. First, market makers set M = P , shareholders sell with probability h ( θ ) or higher and the takeover succeeds. Second, market makers set M = V , shareholders sell with probability lower than h ( θ ) and the takeover fails.

Notably, in all equilibria shareholders are indifferent between selling and holding their shares and risk-arbitrageurs make zero profits.

Finally, note that shareholders face a coordination problem when θ ∈ θ, θ where

θ ≡ P − V and θ ≡ P − V + κ.

(2)

7

The Board always accepts the offer (and M = P ) if θ ≤ θ and rejects it (and M = V ) when θ > θ , no matter shareholders’ selling decisions - formally, note that h ( θ ) ∈ [0 , 1] when

θ ∈ θ, θ . Therefore, multiplicity of equilibria arises for realizations θ ∈ θ, θ . Then, the decision of the Board depends on the strategic interaction of shareholders and the simple full information setting does not allow us to make predictions about the takeover’s outcome.

Furthermore, in contrast to the results here, evidence shows that the stock price at the interim assigns positive probabilities to both a takeover success and a failure: V < M < P .

To analyse takeovers more fully we introduce the information structure of a global game so as to obtain equilibrium uniqueness and to provide more plausible predictions about both the interim price and the order flow.

2.2

Global game

Our goal is to conduct comparative statics to better understand the effects of policy making in takeovers under the presence of risk-arbitrageurs. To this end, we address the problem of multiplicity of equilibria by introducing the information structure of a global game. Recall that the Board’s type θ is a normally distributed random variable with mean y and precision

τ

θ and its realisation is only observable to the Board. Thus τ

θ represents the precision of the public information about the Board’s resistance to a takeover (and the pressures they face). In Section 5 we will analyse the efficacy of political pressure on the Board which we will interpret as a shift in the Board’s expected type: y.

Market makers have zero expected profits. Therefore, M equals the expected value of a share conditional on the common prior.

Shareholders obtain additional information about the Board’s type through a private noisy signal. This may come, for instance, from private knowledge of Board members, access to investor calls, or from exposure to discussions and views of company employees. More specifically, each shareholder i receives an iid signal x i

= θ + ε i where ε i is distributed according to a normal of mean 0 and precision τ

ε

. A shareholder sells her shares when she receives a sufficiently large signal, which indicates that the board is likely to reject the offer.

6

For clarity we bring together the entire timeline of the model: At t = 0 the target company receives an offer P from the Bidder that everyone observes and θ is privately realised. During the interim t = 1, market makers set a price M which is a function of the probability that the takeover succeeds. Furthermore, each shareholder receives a private signal x i

, updates her beliefs about θ and then decides whether to sell or to hold her share. Finally, at t = 2

6

Market makers do not receive these signals. Thus, shareholders are at least as well informed as riskarbitrageurs as to the type of the Board. Appendix 1 shifts the information structure to represent the situation where arbitrageurs are weakly better informed. We show that the main results are robust to the new assumption.

8

the Board decides whether to accept the offer after observing the proportion of shareholders who have sold during the interim period, ρ . We ignore temporal discounting between periods for the sake of simplicity. Figure 1 depicts the sequence of events: t = 0 t = 1 t = 2

The Bidder makes an offer P and θ is privately realised

Market makers set M and shareholders receive private signals of

θ and either sell or hold

The Board either accepts or rejects the Bidder’s offer

Figure 1: Time line

3 Equilibrium Analysis

We solve the model using global-games techniques. Before presenting our results, it is convenient to define a term that captures the effect of information in numerous expressions of our analysis:

∆ ≡

τ

θ

√

τ

ε r

1 +

τ

ε

− 1

τ

θ

(3)

Recall that τ

θ and τ

ε represent the precision of public information and private signals respectively. The impact of the relative precision of public and private information in equilibrium outcomes is one of the most studied issues in global games. However, our setting differs from most applications in that agents’ actions are strategic substitutes rather than strategic complements. We present the study of information in our model in subsection 3.2.

We derive a critical Board type θ

∗ such that the takeover succeeds if an only if θ < θ

∗

.

We also determine a critical signal x

∗ such that shareholders sell their shares when they receive a signal x > x

∗

. Proposition 1 states the basic equilibrium result.

Proposition 1 Suppose the influence of new shareholders is not too great, κ <

√

2 π

. There

∆ exists a unique Bayesian Nash Equilibrium in which all shareholders sell their shares to the market if they observe a signal above x

∗ and hold them otherwise. The takeover succeeds if, and only if, the Board’s takeover resistance is below the threshold θ

∗

. The thresholds are characterized implicitly by the following equations:

θ

∗

= P − V + κ · Φ (∆ ( θ

∗

− y )) x

∗

= θ

∗

−

∆

√

τ

ε

( θ

∗

− y ) where Φ( · ) is the cumulative distribution function for the standard normal.

9

(4)

(5)

Proof.

See Technical Appendix

The fundamental variables of the model { P − V, κ, y, τ

ε

, τ

θ

} determine the critical Board’s type θ

∗ and in turn our main outcomes, namely the probability that the takeover succeeds, the interim stock price and the order flow. First, note that the decision of the Board depends on the value of its type θ with respect to the threshold θ

∗

. Hence, for a given prior distribution

θ ∼ N ( y, 1 /τ

θ

), the equilibrium threshold θ

∗ determines the probability of a takeover, which we denote as β . The characterization follows immediately:

β = Pr[ θ ≤ θ

∗

] = Φ (

√

τ

θ

( θ

∗

− y )) (6)

Now recall that the interim stock price M is set by market makers with no profits in expectation. As their valuation is based on public information, M equals the expected value of a share conditional on the common prior:

M = βP + (1 − β ) V (7)

Finally, we derive the proportion of shareholders selling during the interim period t = 1 or equivalently, the order flow. Assuming a continuum of shareholders implies that they do not consider the possibility of being ”pivotal,” i.e., affecting the takeover’s outcome through their selling decision. As a consequence, shareholders take M as given by their expectations of others’ actions. The next Corollary characterizes the order flow:

Corollary 2 For a given realization of the Board’s type θ , the order flow is

ρ = Φ (∆ ( θ

∗

− y ) −

√

τ

ε

( θ

∗

− θ )) (8)

Proof.

See Technical Appendix.

The shareholders selling received a high signal ( x > x

∗

) and thus they believe there is a high probability that the Board will reject the offer. Hence, such a shareholder sells because the value offered by the market is higher than her expected value of a share.

3.1

Uniqueness

In Proposition 1, κ <

√

2 π/ ∆ is an equilibrium existence and uniqueness condition that limits the influence of new shareholders on the Board. In other words, it restraints the externality of players’ actions. This result is in line with previous studies analysing global games where actions are strategic substitutes (see, for instance, Morris and Shin 2005) .

√

The condition can also be interpreted in terms of information precision: ∆ < 2 π/κ . We

10

require the combination of public and private signals to be noisy enough.

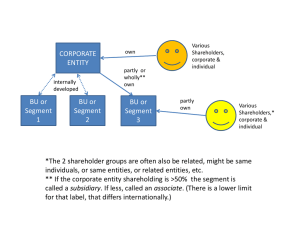

7 To see this, it is convenient to plot ∆ as a function of both τ

θ and τ

ε

:

τ

θ

10

8

κ = 3

↑ κ ↓ κ

6

multiplicity

4

2

uniqueness

0

0 2 4 6 8 10

τ

ε

Figure 2: The solid line delimits the regions of uniqueness (∆ <

√

2Π

√

2Π

κ

) and multiplicity

(∆ > ) when κ = 3. The dashed lines depict the same regions for both higher and lower

κ values of κ ( κ = 3 .

25 and κ = 2 .

75 respectively)

Figure 2 shows that public and private information are substitutes on delivering uniqueness. Hence if, for example, private signals are highly precise (large τ

ε

), we require a relatively uninformative common prior (small τ

θ

). The condition differs from most applications of global games, where actions are strategic complements. There, uniqueness is guaranteed for relatively precise private signals (Morris and Shin, 2003), so the colored area corresponds to the region below an upward sloping line. By contrast, here if agents can predict with high accuracy what signals others received, then the uniqueness of the pure strategy equilibrium breaks down. The reason is that they wish to mis-coordinate, selling (holding) if enough other shareholders hold (sell).

3.2

Information Structure

To better understand the effects of the information structure imposed by global games, we present the intuition provided by the model at the limiting values of the private information precision, τ

ε

. First, the next corollary identifies the limits of the term capturing the effects of information precision:

7

Limitations on the uniqueness result are studied in Angeletos, Hellwig and Pavan (2006, 2007) and

Angeletos and Werning (2006).

11

Corollary 3 The limits of ∆ as a function of τ

ε are as follows: lim

τ

ε

→∞

∆ =

√

τ

θ and lim

τ

ε

→ 0

∆ = 0 (9)

Proof.

See Technical Appendix.

As private signals become infinitely precise, i.e. as τ

ε approaches infinity, shareholders’ beliefs on θ converge to the true value. Hence, while there is an information advantage of shareholders with respect to market makers, the heterogeneity of beliefs among shareholders vanishes. As a consequence, they all take the same action. Furthermore, since their signals reveal the true value of θ , their decision threshold converges to the critical Board’s type x

∗ →

θ

∗

- see the expression in (5) with τ

ε

→ ∞ . Therefore, as revealed by the characterization of the order flow (8), all shareholders hold ( ρ = 0) when θ ≤ θ

∗ and sell ( ρ = 1) if θ > θ

∗

.

In contrast, when private signals are completely uninformative, i.e. as τ

ε approaches zero, all information asymmetries disappear. Hence, shareholders and market makers share the same belief about the realisation of θ . In equation (4) it is possible to see that information precision does not affect the critical Board type, which equals the mean of the interval where the strategic interaction of shareholders determines the takeover outcome: θ

∗

= θ + θ / 2 =

P − V + κ/ 2. As with fully revealing signals, here all shareholders have the same information.

Furthermore, now market makers have the same information, so they set a price that makes shareholders indifferent about their selling decision. Thus, both selling and holding become dominant and the model predicts that exactly half of the shareholders will take either action

( ρ = 1 / 2), which follows from (8).

4 Comparative Statics

We conduct comparative statics to study the reaction of the main outcomes in our model to changes in the fundamentals: namely the Bidder’s offer, the influence of new shareholders, and the Board’s expected type. However, it is first convenient to describe the effect of these variables on the strategic game. The following lemma describes the reaction of the critical threshold θ

∗ to changes in the fundamentals.

Lemma 4 The threshold θ

∗ new shareholders’ pressure, and negatively related to the Board’s expected type, i.e.

0 ,

∂θ

∗

∂κ

> 0 and

∂θ

∗

∂y

< 0 .

is positively related to both the Bid premium and the extent of

∂θ

∗

∂ ( P − V )

>

Proof.

See Technical Appendix.

12

Lemma 4 establishes that a higher bid premium P − V increases the critical Board’s type

θ

∗

. Furthermore, note from expression (2) that it also has an impact on the range of values where shareholders face a coordination problem, θ, θ . In particular, it shifts the interval up without affecting its size. We find that the bid premium has a larger effect on the decision threshold θ

∗ than on the boundaries of the strategic game, θ,

¯

. As a consequence, a higher offer increases the range of realizations of θ at which there is a takeover driven by the presence of risk arbitrage, θ

∗ − θ . The influence of arbitrageurs on the Board’s decision κ also has a positive impact on the critical type θ

∗

. Furthermore, it is possible to see in (2) that raising κ also increases the range of values where incumbent shareholders face a coordination problem. While new shareholder pressure κ has no effect on the lower bound θ , it raises the upper bound θ , thereby increasing the region where an acquisition can take place due to the pressure of risk-arbitrageurs. Finally, the expected Board’s type y is negatively related to the decision threshold θ

∗ but has no impact on the strategic interval θ, θ .

The effect of fundamentals on the critical type θ

∗

(Lemma 4) only captures partially their impact on the main outcomes. Importantly, fundamentals affect the outcomes both directly, as well as indirectly - through θ

∗

. Hence, we must account for the interaction of both effects to study the overall response. The results of this analysis are summarized by the next proposition.

Proposition 5 Responses of the main outcomes to marginal increases of the model fundamentals are as follows

Fundamental

Bid premium: P −

New-shareholder pressure:

Expected Board resistance:

V

κ y

Effect on outcomes

Pr. Takeover β Interim Price M Order Flow ρ

+

+

−

+

+

−

−

−

± where dρ dy

= sign

√

τ

ε

κϕ (∆ ( θ for the standard normal.

∗ − y )) − 1 with ϕ ( · ) denoting the probability distribution function

Proof.

See Technical Appendix.

Takeover Premium . In expression (6) it is clear that the bidder’s offer only affects the probability of a takeover indirectly, i.e. through the critical Board type θ

∗

. Furthermore,

Lemma 4 shows that the decision threshold θ

∗ is positively related to the takeover premium.

Hence, a higher premium increases the range of realisations of θ such that θ < θ

∗ and thus raises the probability of a takeover. The bid premium also has a positive effect on the interim

13

price. It is possible to see in (7) that the effect operates through two channels working in the same direction. First, a positive direct impact

∂M

∂ ( P − V )

> 0 occurs because a higher premium increases the target’s value if the takeover succeeds. Second, there exists a positive indirect effect

∂M

∂β

∂β

∂θ ∗ dθ

∗ d ( P − V )

> 0 caused by the increase in the probability that the takeover takes place already established above. Hence, both mechanisms contribute to raising the price of shares. Finally, equation (8) shows that the order flow is only affected indirectly by the bid premium. In particular, a higher offer raises θ

√ shareholders selling - note τ

ε

∗

, which in turn reduces the proportion of

− ∆ > 0. Thus, even though the interim stock value increases, less shareholders are willing to sell. The reason is that shareholders are better informed than outside investors about θ . As a consequence, the price adjustment by market makers does not compensate the increase in shareholders’ expected value. Notably, the better informed shareholders are with respect to market makers, the bigger is the effect:

∂ (

√

τ

ε

− ∆)

∂τ

ε

> 0.

Arbitrage Pressure . The parameter κ accounts for the influence of risk-arbitrageurs on the Board’s decision. The probability of a takeover is higher when the Board is more sensitive to the pressure exerted by these investors. The Bidder benefits from their influence as it pushes up the decision threshold of the Board, which in turn becomes more likely to accept the offer. The interim stock value is also positively related to the extent of the new-shareholder pressure κ . When the latter rises, the probability of a takeover increases and therefore so does the expected value of shares. Despite this, the order flow is negatively affected by the influence of risk-arbitrageurs κ . The mechanism is similar to the one described for the takeover premium. To see this, note in expression (8) that κ only affects the order flow indirectly through the decision threshold θ

∗

. Moreover, according to Lemma 4, κ is positively related to θ

∗

. Hence, higher influence of arbitrageurs increases θ

∗ and makes the takeover more likely. Finally, since shareholders are better informed than market makers, this has a negative impact on the order flow.

Takeover Resistance . The parameter y represents the expected Board resistance to takeovers. It captures the expectation of market makers as well as the common prior shared by all shareholders. In equation (6) it is clear that y has a direct negative effect on the probability of a takeover. However, an indirect effect operating in the same direction exacerbates the overall impact. More specifically, Lemma 4 shows that a bigger y also diminishes the critical type θ

∗

, lowering the range of values θ at which the transaction takes place. Hence, more resistance to deal leads to both higher expected realizations of θ (direct effect) and a lower range of values θ at which the Board accepts the offer (indirect effect). As can be seen from (7), the negative effect is transmitted to the interim stock price. Thus, increases in y make the takeover less likely, which in turn lowers the expected value of shares.

14

Despite the previous results, the Board’s expected type y has ambiguous effects on the order flow. Equation (8) shows that the proportion of shareholders selling is negatively related to the Board’s reluctance to accept in a direct manner

∂ρ

∂y

< 0. Increasing y lowers the probability of a takeover and in turn the interim stock price. Thus, shareholders have less incentive to sell, which affects the order flow negatively. However, an indirect effect works in the opposite direction. A higher y reduces the critical type (

∂θ

∗

∂y more shareholders to sell (

∂ρ

∂θ

∗

<

< 0) which in turn induces

0), thereby increasing the the order flow:

∂ρ

∂θ

∗

∂θ

∗

∂y

> 0.

In the Proof of Proposition 5 we show that the dominating effect is determined by the relation between the expected Board’s type y and the threshold θ

∗

. If the two values are considerably different, the probability that the takeover takes place is either high ( y << θ

∗

) or low ( θ

∗

<< y ). Then, the marginal effect of y on the decision threshold

∂θ

∗

∂y is small and as a consequence, the direct effect dominates, leading to a negative impact of y on the order flow. In contrast, when the values of y and θ

∗ are close, the critical type θ

∗ becomes more sensitive to changes in the common prior. As a result, the indirect effect is bigger and drives the sign of the overall response.

4.1

Alternative Settings and Robustness

To illustrate the main drivers of our analysis most simply, we have proposed a setting that omits some relevant characteristics of the market for corporate control. Hence, the reader might be concerned about the effects that accounting for these features have on the main insights of the model. This section considers two variations of the benchmark model.

Target Shareholders With Bidder’s Stock . In numerous cases target shareholders own stock of the bidding firm. If the takeover succeeds, these shareholders receive an additional payoff (either positive or negative) that accounts for the effect of the takeover on the bidder’s stock. Notably, this is independent of whether they personally sold their target shares or not at the interim. Appendix I considers this setting. We show that despite the change in the payoff function, the strategic interaction between shareholders is not affected.

As a consequence, results in both Proposition 1 and Proposition 5 remain unchanged.

Informed Arbitrageurs . We assume that shareholders are better informed about the value of their assets than other investors. As a result, risk-arbitrageurs make zero profits in expectation whereas shareholders have positive expected returns. However, risk arbitrage commonly invokes images of informed funds that appear to make substantial profits (see

Mitchell and Pulvino 2001 and references therein). Appendix II reverses the information structure. It characterizes a setting where risk-arbitrageurs are better informed than existing shareholders and thus, they have positive expected profits. In particular, it is assumed

15

that outside investors receive private signals about the Board’s type whereas shareholders’ selling decisions are only based on the common prior. Notably, this is a game of strategic complementarities for arbitrageurs, whose expected payoff from acquiring stock increases with the stock owned by other arbitrageurs. Despite the new information structure, both the probability of a takeover and the interim stock value react to changes in the fundamentals as in Proposition 5. In contrast, the relation between order flow and fundamentals is changed.

Increases in the expected resistance of the Board to sell lower the probability of the Board agreeing to sell and lower the interim stock price. The potential benefits to arbitrageurs grow if enough arbitrageurs buy shares. The better information of the arbitrageurs implies that the reduction in the stock price over-states the reduction in the probability of sale allowing the expected profits of the arbitrageurs to grow. Thus with this reversed information structure a greater expected reluctance of the Board to sell is associated with a greater proportion of risk-arbitrageurs buying, conditional on any given Board type.

5 Political Pressure and Shareholder Voting Rights

As noted in the introduction, the pressure the British government was willing to exert did not manage to block Kraft’s takeover of Cadbury. In contrast, analysts argue that it was important in the failure of Pfizer’s attempt to acquire AstraZeneca in 2014. The case, which was characterized by prominent political grandstanding, even lead politicians to publicly interrogate Pfizer executives in a manner that, according to some observers, bordered on vilification.

8 More recently, after the rumors of a potential offer of ExxonMobil for BP, the

British oil and gas company, the government said it would oppose any potential takeover even if it involved Royal Dutch Shell, the Anglo-Dutch oil major - because it wants Britain to have two big global oil companies.

9

The previous examples, though drawn from the UK, highlight a common phenomenon in the market for corporate control across the world: the frequent opposition of governments and other lobbying groups to takeovers. Scholars have sought to clarify why governments should wish to oppose a free market in corporate control. For example Roe (1994) identifies a systematic alignment of the politicians’ interests with those of corporate management. In the same spirit, Hellwig (2000) argues that the political system can be seen as a stakeholder in

8 Press coverage includes: Bogdanor, A. (2014).

The regulators were right to force Pfizer’s hand.

Financial Times , [online].

Available at: http://www.ft.com/cms/s/0/a476fdf0-e5bc-11e3-a7f5-

00144feabdc0.html#axzz3xbkC23LC [Accessed 17 Jan. 2016]

9 See Parker, G.

and Christopher, A.

(2015).

UK government warns BP over potential takeover.

Financial Times , [online]. Available at: http://www.ft.com/cms/s/2/06a3207e-e901-11e4-87fe-

00144feab7de.html#axzz3xbkC23LC [Accessed 17 Jan. 2016]

16

its own right. First, because there is an immediate financial interest ranging from corporate taxation to campaign contributions. Second, because politicians represent other stakeholder concerns. In contrast, Jensen (1991) regards the treatment of corporate control by the political system as a reaction to populist rhetoric without understanding of the systemic implications.

Here we do not take a stand on why government should wish to influence a Board’s decision. Instead our focus is on understanding when political pressure is likely to be most effective. Thus this section considers the case of a government that seeks to alter y by exerting political pressure. Nonetheless, actions aiming to block a takeover usually carry some costs, e.g. lower reputation or erosion of diplomatic relations. As a consequence, political pressure against a takeover is only worthwhile if it has a sufficiently large impact.

We evaluate the effectiveness of such pressure by analysing its impact on the probability of a takeover. Hence our analysis studies when governments are most likely to be willing to incur the costs of increasing the pressure exerted on target Boards.

Suppose that after a bidding offer is made at t = 0, there exists a time t =

1

2 where the government can increase y at some cost before the Board type θ is privately drawn. Thus a government can encourage a Board to reject takeover bid, but they cannot compel them to do so. From t = 1 the game continues as in the benchmark setting. The next result relates the effectiveness of political pressure with the takeover premium:

Proposition 6

∂β

∂y

≤ 0 is quasiconvex in P and reaches a minimum when β =

1

2

. Therefore, political pressure is most effective when the premium makes the takeover’s fail and success equally likely.

Proof.

See Technical Appendix.

The proposition indicates that increases in political pressure have the greatest impact on the takeover’s outcome when the probability of a success is otherwise close to a half. Hence, a government is most likely to find the cost of increasing political pressure in opposition to a bid worthwhile if the bidding offer is competitive, but not overly so that the success of the deal hangs in the balance. In contrast, extreme takeover premiums make the Board likely to either accept or reject the offer. Then, it is unlikely that a marginal increase in government pressure can change the takeover’s outcome thus raising the bar to political intervention. A graphical intuition is provided by Figure 3, where we plot

∂β

∂y as a function of P . The dashed line represents an arbitrary marginal cost of increasing y and hence, it delimits the corresponding range of takeover premiums for which the government is willing to exert political pressure. Finally, it is possible to see that political pressure reaches a highest impact when the bidder’s offer is such that β =

1

2

.

17

∂β

∂y

0 example marginal cost of political pressure

-1

β =

1

2

-2

V = 10 12

P

region of pressure

Figure 3: Effectiveness of marginal increases in political pressure y as a function of the takeover bid P . When

∂β

∂y overcomes the marginal cost, the government would be willing to increase pressure on the Board. The dot indicates P = V + y − κ 1

2

, which satisfies β =

2

.

Parameter values are V = 10, y = 2, τ

ε

= 4, τ

θ

= 5 and κ = 1 .

5

Governments are also repeatedly urged to take advantage of more formal instruments to oppose takeovers. In the UK, for example, the case of Kraft and Cadbury reopened the debate about the voting rights of short term shareholders. After the takeover, Mr. Carr, then

Cadbury’s CEO, argued that he was forced to recommend shareholders to tender due to the dramatic increase in the proportion of stock held by opportunist investors. The unpopularity of the case led regulatory bodies to consider the implementation of disfranchisement rules, which aim that only the shareholders that are registered at the start of the offer period are eligible to ”vote” on the takeover proposal. A significant goal was ”to ensure that the outcome of takeover bids is determined by the core shareholder base, not by short term speculative investors who may acquire shares in order to facilitate the takeover.” 10 Once again the UK is not unique in this respect. As noted in the introduction, in the both the US and EU there have been prominent calls for shareholders of longer standing to be privileged while newer shareholders, including arbitrageurs, it is argued should be disadvantaged in their ability to influence the Board. From a political analysis (e.g. Hellwig 2000), this might be viewed as an other measure to protect the incumbent corporate management.

10 See: The Takeover Panel (2010).

Review of certain aspects of the regulation of takeover bids.

Consultation paper issued by the Code Committee. London: 1 June 2010; and Department for Business & Innovation

Skills (BIS), (2014).

Practical and legal issues related to limiting the rights of short-term shareholders during takeover bids.

Note of BIS roundtable, October 2014.

18

We have already established in Proposition 5 that reductions in the influence of new shareholders (and so of arbitrageurs) will reduce the probability of a takeover for any set of fundamentals ( ∂β/∂κ > 0) .

However it will also increase the order flow – so more existing shareholders will sell to try and compensate for the reduced pressure from the Board

( ∂ρ/∂κ < 0) .

Thus favouring long-term owners will not lead to greater long-term ownership in a takeover setting.

Next, we examine the effectiveness of political pressure against a takeover, i.e. the incentives to marginally increase y , as a function of the influence allowed for risk-arbitrageurs,

κ . The parameter κ accounts for the weight that the interests of those shareholders that acquired stock at the interim have in the Board’s verdict. Thus, the goal of disfranchisement rules can be represented in our setting with a reduction of κ . Suppose that before a takeover offer is made, there is a time t = − 1 at which the government can set κ . Then, the game continues as in the benchmark model. The following partial result is available:

Proposition 7

∂β

∂y

≤ 0 is monotonically decreasing in κ when public information is sufficiently noisy, i.e. small τ

θ

. Hence, political pressure is most effective when risk-arbitrageurs have voting rights.

Proof.

See Technical Appendix.

The proposition shows that in jurisdictions which have strong respect for shareholder rights – including new shareholders ( κ large) – the marginal impact of increases in pressure on the Board are most pronounced: | ∂β/∂y | is large in magnitude. If new shareholders have strong influence then deal success is sensitive to the actions of the existing shareholders. A small impact on the proportion of the shareholders selling can therefore achieve a substantial reduction in the deal probability. Thus the incentive for the government to intervene rises.

6 Strategic Bidder

Thus far we considered an exogenous takeover premium, and we suggest that this is helpful in capturing a contested takeover in which the bid price is forced above the level an individual bidder would bid in the absence of competing buyers. Nonetheless, numerous takeover offers are characterized by only one bidder. For instance, in the Kraft-Cadbury case, Hershey and the group Ferrero contemplated teaming up to try and trump Kraft’s offer, although they never came forward with a formal bid of their own.

This section studies the case of the takeover premium being strategically set by a Bidder with no competitors. Hence, the Bidder makes an offer maximizing its expected profit, which is the product of the surplus from the takeover and the probability that the takeover takes

19

place. Suppose that the Bidder’s value of the target company is W > V . The game proceeds as in the benchmark setting with the only difference that, at t = 0, the offer P solves the following bidder optimisation problem:

= max

P ∈ [ V,W ]

{ Π = ( W − P ) β ( θ

∗ max

P ∈ [ V,W ]

( P

{ Π = ( W − P ) Φ (

√

τ

θ

[

))

θ

∗

}

( P ) − y ]) }

(10) where θ

∗

( P ) is implicitly characterized by equation (4). We assume P ∈ [ V, W ] for analytical simplicity and for realism. Nonetheless, in principle an offer P < V can be optimal if the

Board have y < 0. This would be the case after political pressure urging a sale for example.

We omit those cases where the target Board is keen to be replaced. The takeover offer determines both the Bidder’s surplus if the takeover succeeds and the probability that this occurs. Furthermore, in Section 3 it was shown that P is directly related to the Board’s decision threshold (

∂θ

∗

∂P

(

∂β

∂P

) and as a result, increasing P raises the probability of a takeover

). Therefore, increasing the takeover premium lowers the Bidder’s surplus but makes the takeover more likely. The following Lemma characterizes the solution to the Bidder’s problem:

Proposition 8 Suppose the Bidder’s value for the target company is sufficiently large, i.e.

W − V > y − κ

2

+ p

π/ 2 τ that at the optimal bid P

∗

θ

. Then, Π in (10) is quasiconcave and has an interior maximum is implicitly characterized by:

P

∗

= W −

[1 − κ ∆ ϕ (∆ [ θ

√

τ

θ

∗

( ϕ

P

∗

√

) − y ])] Φ

τ

θ

[ θ ∗ ( P ∗

√

τ

θ

) − y ]

[ θ

∗

( P

∗

) − y ]

(11)

Furthermore, at the optimal bid the probability of a successful deal, β ( θ

∗

( P

∗

)) >

1

2

.

Proof.

See Technical Appendix.

For analytic solutions we restrict to the case in which the surplus available is large enough. This allows us to show that the Bidder’s profit function is quasiconcave. Notably, the Proposition implies that the optimal bid always satisfies θ

∗

( P

∗

) − y > 0 and therefore, the probability that the takeover occurs is above one half.

We are interested in the effects of takeover resistance when the bidder is strategic. The following proposition relates the parameter y with both the bidding offer and the probability of a takeover:

Proposition 9 With a strategic Bidder, higher expected Board takeover resistance y increases the takeover premium P , but reduces the probability that the takeover goes through β , i.e.

∂P

∂y

≥ 0 and

∂β

∂y

≤ 0 .

20

Proof.

See Technical Appendix.

The Proposition indicates the Bidder responds to increases in the expected takeover resistance with bigger premiums. Nonetheless, the positive effect of a higher bid on the probability of a takeover (Proposition 5) is insufficient to outweigh the negative impact of greater resistance. Hence, the takeover becomes less likely. The result suggests that corporate management and governments achieve two goals through their campaigns against takeovers: first, they make the acquisition less likely; but second, they increase the surplus of target shareholders if the takeover finally takes place. An additional feature of takeovers with strategic bidders is the ambiguous response of interim stock prices to takeover resistance.

W = 15

14

P

∗ spread

13

12 premium

11

M

V = 10

0 2 4 6 8

y

Figure 4: Optimal takeover bid P

∗ and the corresponding interim stock price M as a function of takeover resistance y . The takeover premium is P − V whereas the spread from which risk-arbitrageurs aim to make profit is P − M . Parameter values are W = 15, V = 10,

τ

ε

= 4, τ

θ

= 5 and κ = .

3.

Corollary 10 With a strategic Bidder, higher resistance y has ambiguous effects on the interim stock price, M .

Figure 4 plots both the takeover offer P

∗ and the interim stock price M as a function of the Board’s type y . It is possible to see that the takeover premium increases monotonically in response to higher expected Board resistance. The concavity of P

∗ implies that when expected Board resistance is relatively low, a marginal increase in the takeover premium has a large impact on the probability that the takeover goes through, which allows the interim price M to track the bid P . This effect diminishes as y increases. It is possible to see that the interim stock price presents an inverted-U shape relationship with expected Board takeover resistance. Intuitively, when the probability of a takeover is high (small y ), an increase of the takeover premium in response to additional resistance compensates for the

21

lower probability of a takeover. As a consequence, the stock price rises. This is in contrast to when the takeover is less likely (large y ). Then, a small premium rise is overcome by the lower probability of a takeover and thus, the stock price falls.

7 Concluding Remarks

Takeover offers are often characterized by managerial resistance and frequently also political pressure against the takeover. This paper formally studies a novel coordination problem of the target shareholders. Once an offer is made, before the tendering decision there is a speculative period where the takeover outcome is uncertain. Shareholders have to decide whether to hold their stock in the hope that the takeover goes through or to sell it to risk-arbitrageurs that in turn, increase the probability that the takeover is consummated.

As a consequence, each shareholder wants to sell her stock when other shareholders hold it, but to hold it when other shareholders sell. Hence, selling becomes a public good to which no one wants to contribute. In equilibrium, selling decisions and takeover success are determined by the bid premium, the external pressure against the takeover and the influence of risk-arbitrageurs.

It is shown that, even though political pressure against a takeover reduces the probability that the takeover succeeds and reduces the stock price during the speculative period, it may contribute to an increase in the volume of stock brought to market in the interim period and purchased by arbitrageurs. Whether it does so depends on the expected Board resistance and its relationship to the critical level needed to block the takeover. Moreover, marginal increases in the pressure on Boards is most effective, and so most likely to exceed its marginal cost, when takeover success and failure are otherwise equally likely. Additionally, we show that limiting the voting rights of risk-arbitrageurs (disfranchisement rules) makes marginal increases in political pressure against a given takeover less effective. Finally, the takeover offer of a strategic bidder is examined. Results suggest that bidders increment takeover premiums in response to additional external resistance. Hence, political pressure not only reduces the probability that the takeover succeeds, but it also contributes to an increase in the surplus of target shareholders if it occurs.

22

A Appendix I: Target Shareholders With Bidder’s Stock

Suppose that a proportion γ of the target shareholders own stock of the Bidder. These shareholders obtain an additional payoff B ∈

R if the takeover succeeds. Denote common shareholders those that own stock only in the target company and bidding shareholders those who also own stock of the Bidder. Then, the order flow reads ρ = γρ

B

+ (1 − γ ) ρ

C and the shareholders’ payoff is:

Sell

Hold

ρ ≥ h ( θ )

Common Bidding

M

P

M

P

+

+

B

B

ρ < h ( θ )

Common/Bidding

M

V

We derive the equilibrium as in Proposition 1. However, we initially assume that the two groups of shareholders (common and bidding) have different decision thresholds: x

∗

C and x

∗

B

.

The failure threshold reads

θ

∗

= P − V + κ

(1 − γ ) [1 − Φ (

√

τ

ε

[ x

∗

C

| {z

ρ

C

− θ

∗

])]

}

+ γ [1 − Φ (

√

τ

ε

| {z

ρ

B

[ x

∗

B

− θ

∗

])]

}

(12)

Furthermore, the signal thresholds for the common shareholders satisfies

V Pr[ θ > θ

∗

| x

∗

C

] + P Pr[ θ ≤ θ

∗

| x

∗

C

] = M

Pr[ θ ≤ θ

∗

| x

∗

C

] =

M − V

P − V whereas for bidding shareholders it must hold

(13)

V Pr[ θ > θ

∗ | x

∗

B

] + ( P + B ) Pr[ θ ≤ θ

∗ | x

∗

B

] = M Pr[ θ > θ

∗ | x

∗

B

] + ( M + B ) Pr[ θ ≤ θ

∗ | x

∗

B

]

Pr[ θ ≤ θ

∗

| x

∗

B

] =

M − V

P − V

(14)

Expressions in (13) and (14) imply that x

∗

C is possible to see that ρ

C

= ρ

B

= x

∗

B

= x

∗

. Moreover, in equation (12) it

= ρ . Hence, the two types of shareholders have the same decision threshold and in turn, a proportional order flow. As a result, the fact that some shareholders own stock of the bidding company has no effect in equilibrium. The derivation of the thresholds θ

∗ and x

∗ follows as in the proof of Proposition 1.

23

B Appendix II: Informed Investors

The common prior about the Board’s type is θ ∼ N ( y, 1 /τ

θ

). While shareholders do not have additional information, there is a continuum of risk-arbitrageurs of mass one where each arbitrageur i receives an iid signal x i

= θ + x i with ε i

∼ N (0 , 1 /τ

ε

) and updates beliefs accordingly. The interim stock price M is set as in (7) by market makers with zero expected profits. Arbitrageurs acquire stock at the interim if their value is higher than M , i.e. if they receive a sufficiently low signal of the Board’s type. The expected payoff of acquiring stock is increasing on the number of arbitrageurs that follow the same strategy because these exert higher pressure on the Board and thus, make the takeover more likely. Hence, arbitrageurs’ actions are strategic complements. Their payoffs are as follows:

Don’t buy

Buy

ρ ≥ h ( θ ) ρ < h ( θ )

0 0

P − M V − M where V − M ≤ 0 by construction.

The equilibrium analysis is analogous to that of Section 4. As a result, the next proposition follows:

Proposition 11 There exists a unique Bayesian Nash Equilibrium in which all investors buy shares if and only if they observe a signal below x

∗

. The takeover succeeds if, and only if, the takeover resistance is below the threshold θ

∗

. The thresholds are characterized implicitly by the following equations:

θ

∗

= P − V + κ [1 − Φ (∆ ( θ

∗

− y ))] (15) x

∗

= θ

∗

−

∆

√

τ

ε

( θ

∗

− y ) (16)

Proof.

Analogous to the proof of Proposition 1. Note that the expressions for the probability of a takeover (6) and the interim stock price (7) remain unchanged. Instead, the order flow now reads ρ = Φ

√

τ

ε

( θ

∗ − θ ) − ∆ ( θ

∗ − y ) .

Comparing the threshold θ

∗ with the expression in (4) it is possible to appreciate that reversing the information structure switches the mass of strategic decisions influencing the takeover, i.e. 1 − Φ (∆ ( θ

∗ − y )). In particular, the proportion of shareholders selling now corresponds to the probability that an arbitrageur receives a signal x < x

∗

. This is in contrast to the benchmark model, where the order flow equals the probability that x > x

∗

.

As a consequence, while the effect of the fundamental variables on both the probability of

24

a takeover and the interim stock price has the same sign than in the original setting, their effect on the order flow is different:

Proposition 12 Responses of the main outcomes to marginal increases of the model fundamentals are as follows

Fundamental

P −

κ y

V

Effect on outcomes

Pr. Takeover β Interim Price M Order Flow ρ

+

+

−

+

+

−

+

+

+

∂θ

∗

∂y

Proof: An analysis analogous to the proof of Lemma 4 yields

∂θ

∗

∂ ( P − V )

> 0 ,

∂θ

∗

∂κ

> 0 and

∈ [0 , 1) . Then results are obtained with an analysis analogous to the proof of Proposition

5.

A higher premium incentivizes both arbitrageurs to acquire stock and shareholders to hold it, thereby raising the interim price M . Nonetheless, due to the information advantage of arbitrageurs, the former effect is bigger and hence, there is a higher order flow. An analogous intuition applies to the influence of arbitrageurs on the Board’s decision κ , which increases the probability that the takeover goes through. Finally, takeover resistance has a positive impact on the order flow. Intuitively, since arbitrageurs beliefs are more accurate than those of shareholders, the decrease of the stock price M outweighs the decrease of the stock value for arbitrageurs. As a result, arbitrageurs have higher incentives to acquire stock.

25

C Technical Appendix

Proof of Proposition 1 . A shareholder receiving a signal x i updates beliefs so that θ | x i is normally distributed with mean

τ

θ y + τ

ε x i

τ

θ

+ τ

ε and precision τ

θ

+ τ find an equilibrium threshold represented by a fixed point { θ

∗

ε

. Two equations allow us to

, x

∗ } such that shareholders sell their shares when they receive a signal x ≥ x

∗ and the takeover succeeds if θ ≤ θ

∗

.

The signal threshold computes the signal x

∗ that at a given critical θ

∗ makes a shareholder indifferent between selling and holding:

V Pr[ θ > θ

∗

| x

∗

] + P Pr[ θ ≤ θ

∗

| x

∗

] = M

Pr[ θ ≤ θ

∗

| x

∗

] =

M − V

P − V

Introducing the belief updating we obtain

Φ

√

τ

θ

+ τ

ε

θ

∗

−

τ

θ y + τ

ε x

∗

τ

θ

+ τ

ε

=

M − V

P − V which we can rearrange as

θ

∗ − x

∗

= −

τ

θ

τ

ε

( θ

∗ − y ) +

√

τ

θ

τ

ε

+ τ

ε

Φ

− 1

M − V

P − V

(17)

The failure threshold defines the θ

∗ that at a given critical x

∗

, the Board declines if and only if θ > θ

∗

.

θ

∗

= P − V + κ Pr[ x ≥ x

∗ | θ

∗

]

| {z }

ρ = % SHs selling which, after considering the information structure, reads

θ

∗

= P − V + κ [1 − Φ (

√

τ

ε

[ x

∗

− θ

∗

])] (18)

By plugging (17) into (18) we obtain an equilibrium expression in terms of θ

∗

:

θ

∗

= P − V + κ 1 − Φ

τ

√

θ

τ

ε

θ

∗

− y −

√

τ

θ

τ

θ

+ τ

ε

Φ

− 1

M

P

−

−

V

V

(19)

Now, recall that outside investors do not receive private signals and so for them θ ∼

N ( y, 1 /τ

θ

). Hence, the probability of the Board selling is equal to the probability that θ lies below the critical θ

∗

, Φ

√

τ

θ

( θ

∗ − y ) . Therefore, the value achieved by shareholders when

26

they sell to outside investors is given by the Market Maker’s zero profit condition as

M = P Φ (

√

τ

θ

( θ

∗

− y )) + V [1 − Φ (

√

τ

θ

( θ

∗

= ( P − V ) Φ (

√

τ

θ

( θ

∗

− y )) + V

− y ))] (20)

Substituting this into the equilibrium threshold we obtain the expression in (4), where we already use the definition ∆ and the fact that Φ ( x ) = 1 − Φ ( − x ).

For uniqueness, note that if P > V , the Right Hand Side (RHS) in expression (4) is positive when θ

∗

= 0. Hence, uniqueness is guaranteed if the slope of the RHS is strictly lower than one. Note that d dθ ∗

[ RHS (4)] = κ · ∆ · ϕ (∆ ( θ

∗

− y )) and that a normal pdf reaches a maximum at 1 /

√

2 π .

For the signal threshold, use equation (17) to define x

∗

= θ

∗

= θ

∗

τ

θ

1 +

−

∆

√

τ

ε

τ

ε

( θ

∗

−

−

τ

τ y

θ

ε

) y −

√

τ

θ

+ τ

ε

Φ

− 1

τ

ε

M − V

P − V

(21)

Where in the second line we used (20).

Proof of Corollary 2 : The proportion of shareholders selling their shares is

ρ = Pr[ x > x

∗

| θ ] = Pr[ θ + ε i

> x

∗

| θ ] = 1 − Φ (

√

τ

ε

[ x

∗

− θ ]) (22)

Plug the expression for x

∗ in (5) into that of ρ and obtain the equation in (8).

Proof of Corollary 3 that lim

τ

ε

→∞

∆ =

: First, note that ∆ =

√

τ

θ q

1 +

τ

θ

τ

ε

− τ

θ

τ

ε

√

τ

θ

. Second, use L’Hˆ f ( τ

ε

) = τ

θ

, where it is clear hq

1 +

τ

ε

τ

θ

− 1 i and g ( τ

ε

) =

√

τ

ε

. Then f

0

( τ

ε

) g 0 ( τ

ε

)

= q

τ

θ

τ

ε

τ

θ

+ τ

ε and clearly lim

τ

ε

→ 0 f

0

( τ

ε

) g 0 ( τ

ε

)

= 0.

Proof of Lemma 4

(a) Bid Premium.

Define F ( θ

∗

, P − V ) = θ

∗

Theorem (IFT) so that

∂θ

∗

∂ ( P − V )

− RHS (4) and use the Implicit Function

= −

∂F ( θ

∗

,P − V ) /∂ ( P − V )

∂F ( θ

∗

,P − V ) /∂θ

∗

. Then,

∂θ

∗

∂ ( P − V )

=

1

1 − κ ∆ ϕ (∆ [ θ ∗ − y ])

> 0 (23)

27

where denominator is positive under uniqueness, i.e. when ∆ < maximum value at 1 /

√

2 π . Furthermore, note that

∂θ

∗

∂ ( P − V )

>

∂θ

√

2

∂ ( P − V )

π/κ

=

, as

∂θ ϕ

∂ ( P − V )

( · ) takes

= 1.

(b) Internal Pressure.

Use the IFT so that dθ

∗ dκ

= −

∂F ( θ

∗

,κ ) /∂κ

∂F ( θ

∗

,κ ) /∂θ

∗

. Then, dθ

∗ dκ

Φ(∆ [ θ

∗ − y ])

=

1 − κ ∆ ϕ (∆ [ θ ∗ − y ])

> 0 (24)

Note from (2) that

∂θ

∂κ

= 0 and

∂θ

∂κ

> 0.

(c) Board’s Expected Type.

Use the IFT so that

∂θ

∗

∂y

= −

∂F ( θ

∗

,y ) /∂y

∂F ( θ

∗

,y ) /∂θ

∗

. Then,

∂θ

∗

∂y

κ ∆ ϕ (∆ [ θ

∗ − y ])

= −

1 − κ ∆ ϕ (∆ [ θ ∗ − y ])

< 0 (25)

Notice also that

∂θ

∂y

=

∂θ

∂κ

= 0.

Proof of Proposition 5

(a) Bid Premium.

Note in (6) that

- see (23). Furthermore,

Finally, dρ d ( P − V )

=

∂ρ

∂θ

∗

∂θ d ( P − V )

∗ dM

∂ ( P − V )

= where d ( P − V )

∂M

∂ ( P − V )

∂ρ

∂θ

∗ dβ

<

+

=

∂M

∂β

∂β ∂θ

∗

∂θ

∗

∂β

∂θ

∗

∂ ( P − V )

∂θ

∗

∂ ( P − V )

0 because

√

τ

ε where with

− ∆ >

∂β

∂θ

∗

∂M

∂ ( P − V )

0.

> 0 and

>

∂ ( P − V )

0 and

∂θ

∗

∂M

∂β

> 0

> 0.

(b) Internal Pressure.

see (24). Moreover, dM dκ

First, notice in (6) that

=

∂M

∂β

∂β

∂θ

∗

∂θ

∗

∂κ

> 0 since dβ dκ

∂M

∂β

=

>

∂β

∂θ

∗

∂θ

∗

∂κ where

0. Last, dρ dκ

∂β

∂θ

∗

=

>

∂ρ

∂θ

∗

0 and

∂θ

∗

∂κ

<

∂θ

∗

∂κ

> 0 -

0 because

∂ρ

∂θ

∗

< 0.

(c) Board’s Expected Type.

The effect on β is

∂β

∂θ

∗

> 0 and

∂θ

∂y

∗

< 0. Furthermore, dM dy

=

∂M

∂β dβ

∂β

∂θ

∗ dy

∂θ

∗

∂y

=

∂β

∂y

+

∂β

∂θ

∗

∂θ

∂y

< 0 because

∗

<

∂M

∂β

0 because

>

∂β

∂y

< 0;

0. Finally, note in (8) that

= dρ dy

√

τ

ε

= sign

∆

∂θ

∂y

∗

− 1 −

√

τ

ε

∂θ

∗

∂y

κ ∆ ϕ (∆ [ θ

∗ − y ])

− ∆

1 − κ ∆ ϕ (∆ [ θ ∗ − y ])

κ ∆ ϕ (∆ [

= [

√

τ

ε

κϕ (∆ [ θ

∗

= sign

− y ]) − 1]

√

τ

ε

κϕ (∆ [ θ

∗

− y ]) − 1

∆

1 − κ ∆ ϕ (∆ [ θ ∗ − y ])

θ

∗ − y ])

1 − κ ∆ ϕ (∆ [ θ ∗ − y ])

+ 1

Hence, if | θ

∗

− y | is small (large) then ϕ (∆ [ θ

∗

− y ]) is large (small) and

However, note that ϕ ( · ) ≤ √

1

2 π

. As a consequence, if κ < q

2 π

τ

ε dρ dy it always holds

> ( < )0.

dρ dy

< 0.

28

Furthermore q

2 π

τ

ε

<

√

2 π

∆

, where the term in the RHS is the condition for uniqueness.

Therefore, we conclude that if κ ∈ h p

2 π/τ

ε

,

√

2 π/ ∆ i the sign of dρ dy h

0 , p

2 π/τ

ε i

, then dρ dy depends on the value of | θ

∗

< 0. Instead, when κ ∈

− y | .

Proof of Proposition 6: The relation between θ

∗ and y is crucial to characterize the effect of fundamentals. In expression (4) it is possible to see that θ

∗

= y ←→ y =

θ + θ

=

κ

2

. Hence,

2

P − V + ∂θ

∗

∂y

< 0 from Lemma 4 implies that θ

∗

Furthermore, notice in (6) that β >

1

2

←→ y < P − V +

> y ←→ y < P − V + κ

2

.