EC989 Behavioural Economics Sketch solutions for Class 1 Neel Sagar

advertisement

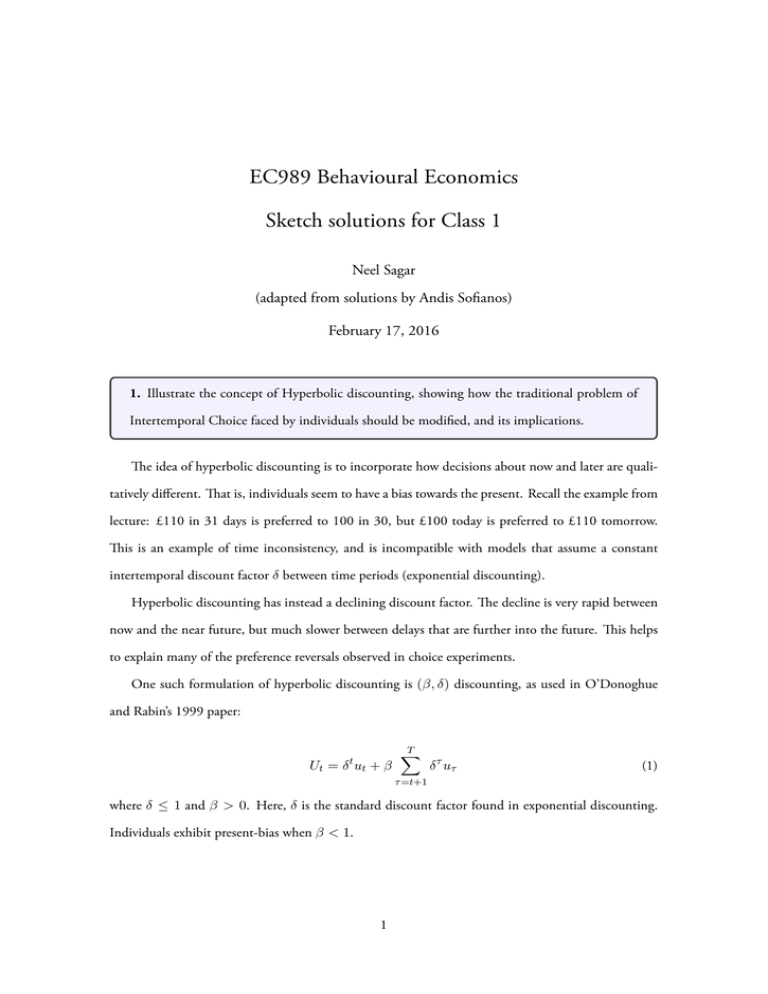

EC989 Behavioural Economics Sketch solutions for Class 1 Neel Sagar (adapted from solutions by Andis Sofianos) February 17, 2016 1. Illustrate the concept of Hyperbolic discounting, showing how the traditional problem of Intertemporal Choice faced by individuals should be modified, and its implications. The idea of hyperbolic discounting is to incorporate how decisions about now and later are qualitatively different. That is, individuals seem to have a bias towards the present. Recall the example from lecture: £110 in 31 days is preferred to 100 in 30, but £100 today is preferred to £110 tomorrow. This is an example of time inconsistency, and is incompatible with models that assume a constant intertemporal discount factor δ between time periods (exponential discounting). Hyperbolic discounting has instead a declining discount factor. The decline is very rapid between now and the near future, but much slower between delays that are further into the future. This helps to explain many of the preference reversals observed in choice experiments. One such formulation of hyperbolic discounting is (β, δ) discounting, as used in O’Donoghue and Rabin’s 1999 paper: Ut = δ t u t + β T ∑ δ τ uτ (1) τ =t+1 where δ ≤ 1 and β > 0. Here, δ is the standard discount factor found in exponential discounting. Individuals exhibit present-bias when β < 1. 1 2. When is an individual naive, and when is she sophisticated with respect to her intertemporal preferences (you can use an example if you prefer)? The aforementioned ODR paper splits (β, δ) discounters into two types: Naifs, and Sophisticates. Both are present-biased. The key difference is that Sophisticates are aware of their susceptibility to present bias in the future. Naifs, on the other hand, believe (incorrectly) that they will behave like a time consistent (TC) individual in future periods. One example from the ODR paper involves choosing when to do a report out of 4 possible weeks. The reward v is fixed, but the costs c increase over time: δ = 1, β = 1/2, v = (v̄, v̄, v̄, v̄), c = (3, 5, 8, 13) (2) We solve the problem by backwards induction. Table 1 shows the decision at each time period by each type of individual (I have omitted the v̄ from the utilities to save space). TC’s do it immediately, Sophisticates do it in week 2, and Naifs procrastinate until week 4 and incur the maximum cost. TC Naif Sophisticate t 4 3 2 1 4 3 2 1 4 3 2 1 U from doing report -13 -8 -5 -3 -13 -8 -5 -3 -13 -8 -5 -3 (Exp) U from waiting -13 -8 -5 -6.5 -4 -2.5 -6.5 -6.5 -2.5 Do report now? Yes Yes Yes Yes Yes No No No Yes No Yes No Table 1: Example of procrastination for naifs and sophisticates from ODR 1999. 3. Using the evidence provided by Ariely and Wertenbroch, discuss whether individuals have preferences for commitments. (see lecture slides) The students impose costly deadlines upon themselves, which is an indication that they have a 2 preference for commitment devices. They could potentially have set far looser public deadlines (i.e. all at the end) and impose intrinsic private deadlines to themselves. 4. Using the evidence provided by Ariely and Wertenbroch, discuss whether students set deadlines optimally. Students that set their own deadlines in the free-choice condition performed on average worse than their classmates that were in the no-choice (but evenly spaced) condition. Recall that the mean grade in the no-choice condition was 88.76 while in the free-choice condition it was 85.67 and the two values are statistically different (p-value=0.003). Therefore, the deadlines were not set optimally in the free-choice condition. 5. Can you mention and briefly describe other field experiments aimed to test individual’s preferences for commitments? See the end of the lecture slides. Examples include: • DellaVigna and Malmendier 2006 - paying monthly subscriptions for the gym, even though the frequency of visits does not justify the cost • Ashraf et al 2005 - people commit to costly restrictions on their savings accounts • Gine et al 2010 - smokers willing to put money in holding (and potentially forfeit it) to help them quit • Royer et al 2015 - offering costly commitment contracts to incentivise exercise at a company All of these behaviours violate predictions based on exponential discounting. TC’s would be able to choose their optimal course of action without falling into any present-bias traps, and so incurring a commitment cost would only have a negative effect on utility. 3