PS4 - Term 1

advertisement

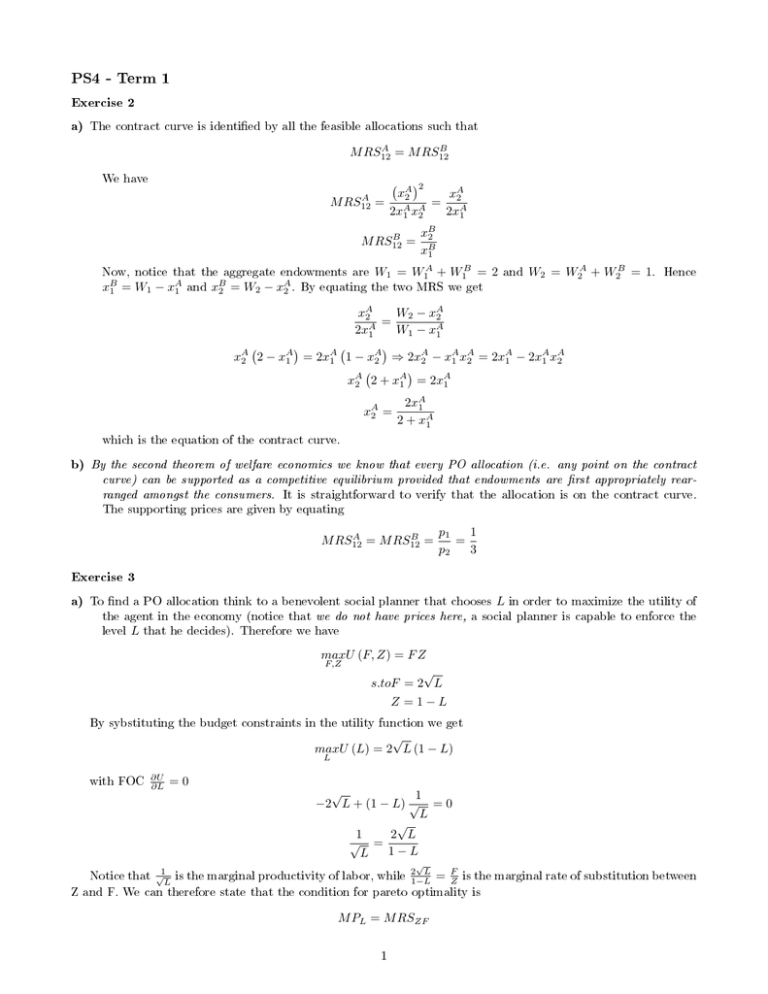

PS4 - Term 1 Exercise 2 a) The contract curve is identied by all the feasible allocations such that A B M RS12 = M RS12 We have A M RS12 2 xA xA 2 = A A = 2A 2x1 x2 2x1 B M RS12 = xB 2 xB 1 Now, notice that the aggregate endowments are W1 = W1A + W1B = 2 and W2 = W2A + W2B = 1. Hence A B A xB 1 = W1 − x1 and x2 = W2 − x2 . By equating the two MRS we get W2 − xA xA 2 2 = A 2x1 W1 − xA 1 A A A A A A 1 − x2 ⇒ 2x2 − xA 1 x2 = 2x1 − 2x1 x2 A A xA 2 2 + x1 = 2x1 A A xA 2 2 − x1 = 2x1 xA 2 = 2xA 1 2 + xA 1 which is the equation of the contract curve. b) By the second theorem of welfare economics we know that every PO allocation (i.e. any point on the contract curve) can be supported as a competitive equilibrium provided that endowments are rst appropriately rearranged amongst the consumers. It is straightforward to verify that the allocation is on the contract curve. The supporting prices are given by equating A B M RS12 = M RS12 = p1 1 = p2 3 Exercise 3 a) To nd a PO allocation think to a benevolent social planner that chooses L in order to maximize the utility of the agent in the economy (notice that we do not have prices here, a social planner is capable to enforce the level L that he decides). Therefore we have maxU (F, Z) = F Z F,Z √ s.toF = 2 L Z =1−L By sybstituting the budget constraints in the utility function we get √ maxU (L) = 2 L (1 − L) L with FOC ∂U ∂L =0 √ 1 −2 L + (1 − L) √ = 0 L √ 1 2 L √ = 1−L L √ Notice that √1L is the marginal productivity of labor, while 21−LL = FZ is the marginal rate of substitution between Z and F. We can therefore state that the condition for pareto optimality is M PL = M RSZF 1 M RSZF tells how much output should I receive in order to renounce to one unit of leisure (working one hour more) and getting the same utility. M PL tells me how much output I can obtain if I renounce to one unit of leisure. Assume that M RSZF > M PL , this cannot be PO, because I can work less and get more utility: the gain of utility I get from producing (and so consuming ) more is not enough to compensate for the loss of utility I get from working (which means less leisure). Assume that M RSZF < M PL , this cannot be PO, because I could work more and get more utility: the gain of utility I get from producing more, more than compensate the loss of utility I get from working. (b) We need to nd a competitive equilibrium of the economy, hence a decentralized equilibrium which is supported by market prices. Assume that the agent is at the same time the sole employee and the sole owner of the rm: his income is given by the salary ωL and by the prot π of the rm. Now: let ω be the cost per unit of labor (wage rate) and p the market price of the sole good produced in the economy. The rm decides how much labor L to hire in order to maximize prots taking as given p and ω : √ max π = p2 L − ωL L FOC is ∂ ∂L π = 0 which implies p √ −ω =0 L ω 1 √ = p L that is, the rm equates the marginal productivity of labor √1L to the price ratio. Consumers maximize their utility between consumption C and leisure Z , subject to two budget constraints: income ωL + π should be equal to consumption expenditure, and Z = (1 − L) . max U (C, Z) = CZ C,Z √ √ s.toC = ωL + p2 L − ωL ⇒ C = 2 L Z =1−L Notice that prices ω and p simplify in the budget constraint and therefore the problem pins down in the problem of the Social Planner. This means that our solution will be PO (solution to point c). We procede as before by substituting the budget constraint inside the utility function √ max U (L) = 2 L (1 − L) L with FOC ∂ ∂L U (L) = 0 √ 1 (1 − L) √ − 2 L =0 L √ 1 √ − 3 L = 0 ⇒ 3L = 1 L 1 L= 3 By substituting in the optimality condition for the rm we get 1 ω ω √ √ = ⇒ = 3 p p L (c) We have already solved this point, if you still have doubt substitute L = and verify that it holds. 2 1 3 in the condition M RSZC = M PL Exercise 4. a) Insurance is fair i the premium p is equal to the expected value of coverage x. If coverage is conditional on the state of nature, in general it must be: p = πA xA + πB xB + πC xC Now, in our case πA = πB = πC = 31 ; moreover, full coverage implies xA = 0, xB = 4, xC = 8, and p = 4. In this part of the exercise you are not require to solve the maximization problem (it would be quite messy), but you should use your knowledge to claim that if the premium is fair and it oers full insurance contingent to the state of nature, than a risk averse agent is always willing to buy full insurance. If you want you may notice that EU N I = EU I = 1 1 1 ln (10) + ln (10 − 4) + ln (10 − 8) = 1.595830.... 3 3 3 1 1 1 ln (10 − 4) + ln (10 − 4) + ln (10 − 4) = ln(6) = 1.791759... 3 3 3 however, this does not prove the claim, it just says that you are better o buying full insurance that not buying insurance at all. b We need to consider again the case of actuarially fair insurance, with the dierence that now the coverage is not anymore contingent to the state of nature, but it is the same in both states B and C , that is xB = xC ≡ x. As you may see, actually we are putting a restriction on the kind of insurance contracts available. The point of the exercise is to show that this restriction creates a Pareto inecient outcome where the agent is not anymore willing to buy full coverage. Now, in this case the premium is given by p = (πB + πC ) x = 2 x 3 The agent has to choose which amount x of coverage he is willing to buy, hence he maximizes his expected utility with respect to x: 1 1 1 ln (10 − p) + ln (10 − 4 + x − p) + ln (10 − 8 + x − p) 3 3 3 1 2 1 1 1 1 = ln 10 − x + ln 6 + x + ln 2 + x 3 3 3 3 3 3 maxEU I (x) = x 1 1 − 32 ∂EU 3 3 + + =0 = 2 1 ∂x 3 10 − 3 x 3 6 + 3x 3 2 + 13 x 2 1 1 + + =0 30 − 2x 18 + x 6 + x −2 (18 + x) (6 + x) + (30 − 2x) (6 + x) + (30 − 2x) (18 + x) = 0 − 216 + 48x + 2x2 + 180 + 18x − 2x2 + 540 − 6x − 2x2 = 0 − 504 − 36x − 6x2 = 0 x1,2 −x2 − 6x + 84 = 0 √ 6 ± 36 + 336 = = −3 ± 9.64365.. −2 We consider only the positive root (in this case does not make sense to buy a negative amount of insurance, so we get x = 6.6436.. The agent is willing to buy only a partial coverage, indeed x is not enough to fully compensate for the loss of 8 in state C . c. It is not pareto ecient : we could make the agent better o by oering a coverage contingent on the state of nature (case a), leaving the insurance agency as well o. Notice that the agency is risk neutral and as long the premium is fair (it does not make prot in any case) is indierent between the two contract. However, there are still gains from trade, indeed the agent is still better o by buying a partial coverage rather than no insurance at all. 3 Exercise 5 a) Agent A is entitled to clean air C , this means that agent A is endowed with one unit of C while agent B is endowed with 0 units of S . However, given a price pC for clean air, agent A can decide to sell the right to smoke to agent B. ∂ U A = 1, while marginal utility of clean air is Consider agent A. Marginal utility of income is 1 since ∂M ∂ 1 A √ ∂C U = 2 C . 1 M RSCM = √ 2 c At an optimum 1 √ = pc 2 c The intuition is as follows: if I sell one unit of C I get utility pc from extra income, at the same time I get disutility of 2√1C from lower consumption of clean air. In equilibrium the two eect must oset. Let's consider agent B. If he buys one unit of C he can increase his consumption of S of one unit, getting disutility B 1 √ pc from the loss of income, and getting utility ∂U ∂S = 2 S from the extra smog he can produce. At the optimum therefore 1 pC = √ 2 1−C At a Pareto Optimum 1 1 = √ ⇒C= 2 2 1−C 2 C 1 √ Now, we want to nd the price pc which support C = S = to see that 1 2 as a competitive equilibrium. It is straightforward 1 1 pC = q = √ 2 2 12 Now: agent A is endowed with one unit of income and one unit of C . However, he sells B for a price of √12 per unit. Therefore 1 2 units of C to agent 1 MA = 1 + √ 2 2 It follows that 1 1 3 UA = 1 + √ + √ = 1 + √ 2 2 2 2 2 Agent B instead is endowed with one unit of income and 0 units of S . However, he buys agent A for a price of √12 per unit. This way he gets the right to produce produce S = 21 . 1 MB = 1 − √ 2 2 1 1 1 UB = 1 − √ + √ = 1 + √ 2 2 2 2 2 Hence, even though C = S , utility levels are dierent. b) This case is specular to the rst one. In this case C=S= 1 2 1 UA = 1 + √ 2 2 2 UB = 1 + √ 3 2 4 1 2 units of C from