Service Areas Program Review Update 2012/13

advertisement

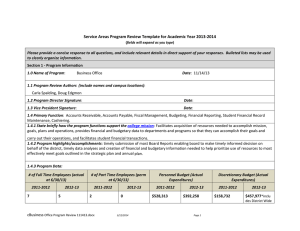

Service Areas Program Review Update 2012/13 (fields will expand as you type) Section 1 ‐ Program Information 1.0 Name of Program: Business Office Date: 01/07/13 1.1 Program Review Authors: Doug Edgmon, Carla Spalding 1.2 Program Director Signature: Date: 1.3 Vice President Signature: Date: 1.4 Primary Function: Accounts Receivable, Accounts Payable, Fiscal Management, Budgeting, Financial Reporting, Student Financial Record Maintenance, Cashiering, 1.4.1 State briefly how the program functions support the college mission: Facilitates acquisition of resources needed to accomplish mission, goals, plans and operations, provides financial and budgetary data to departments and programs so that they can accomplish their goals and carry out their operations, and facilitates student financial transactions. 1.4.2 Program highlights/accomplishments: Distribution and assessment of student and employee satisfaction surveys, timely submission of most Board Reports enabling board to make timely informed decision on behalf of the district, timely data analyses and creation of financial and budgetary information needed to help prioritize use of resources to most effectively meet goals outlined in the strategic plan and annual plan. 1.4.3 Program Data: # of Full Time Employees 2010‐2011 7 # of Part Time Employees 2011‐12 7 2010‐2011 1 2011‐12 2 Personnel Budget Discretionary Budget 2010‐2011 2011‐12 2010‐2011 2011‐12 $569,482 $528,313 $154,820 $158,732 Section 2 ‐ Data Analysis 2.0 List Service Area Metrics/Indicators and provide information on changes over time (Steady/Increasing/Decreasing, etc.) 2.1 Metrics/Indicators Business Office Program Review.docx 2010/11 1/24/2013 2011/12 Observations (steady/increasing/decreasing) Page 1 Not over Expenditures over budget? If so, did the budget overage result from poor budgeting or poor management of resources? Has the business office complete budget planning for 13‐14 Any Chancellor’s Office Reports over 10 days late? Yes Any Board Reports over 10 days late? No Are all business office Board policies and Administrative procedures up to date, having been reviewed and/or revised within the last 3 years? Have monthly budget‐to actual reports been reviewed and reported to Board? Has the business office reviewed last year’s: Program review? Needs addendums? BPC actions on needs addendums? No No Over budget 10‐11 expenditures remained within budget. 11‐12 expenditures were substantially over budget due to large bad debt expense. The remainder of expenditures remained under budget. In process Currently carefully assessing 12‐13 expenditures and trends so that 13‐14 funds can be used effectively Yes CCFS 311 and Financial Audit were late due to effort required to improve fund balances, and were late due to reduced staffing resulting from vacancies Yes CCFS 311 and Financial Audit were late due to effort required to improve fund balances, and were late due to reduced staffing resulting from vacancies Yes The business office made substantial progress in 2011‐12 in reviewing and updating board policies and procedures. Yes Yes Satisfactory Yes Yes Were all division employee evaluations up‐to‐ date during last year‐end? Were any Cal‐Cards unreconciled after the payment due date? Yes Yes Many items listed as goals in the most recent program review remain in progress, including document imaging, comprehensive procedure manual, revised CalCard procedures, reduction in rate of uncollectable student debt, and timeliness of budget upload. Satisfactory Yes Any lates were followed up on within 10 days The business office has been actively following up on any un‐ reconciled calcards. Has the division website been updated during the last year? Yes Yes Although updates have been made to the business office website, additional operational information intended to assist district employees in accomplishing business office related activities will be posted. This goal is related to the Business Office Program Review.docx 1/24/2013 Page 2 Has document imaging been implemented in the division? Are there any outstanding financial audit findings? Has the county auditor/controller’s office provided reports on schedule and as required by the district in order to complete the district’s annual fiscal reporting? Has unrestricted fund equity been maintained at 5% or better? Were Datatel budgets loaded for unrestricted general fund by 7‐31? No No No financial findings Yes No financial findings No Yes No No Were Datatel budgets loaded for all other funds by 8‐31? No Has a monthly cash reconciliation been completed in the last 45 days? Has a monthly Datatel reconciliation been completed in the last 45 days? Yes Were any accounts payable over 20 days late? Were any construction payments over 20 days late? Were payments over $100K made electronically? No No Has a monthly budget‐to‐actual report been Yes Business Office Program Review.docx Yes No 1/24/2013 completion of a comprehensive operations manual. Not implemented. Satisfactory 2011‐12 bank reconciliation data provided by the county was not forwarded to the district in time for the district to complete year in closing by the target completion date. At 6‐30‐2012, fund balance fell below 5.00%. District has a plan to increase the fund balance to 5.00% by 6‐30‐2013. No Due to Accreditation show cause, additional closing of the books work to improve the fund balance, and working around reduced staffing due to vacancies, loading of budgets were delayed. No Due to Accreditation show cause, additional closing of the books work to improve the fund balance, and working around reduced staffing due to vacancies, loading of budgets were delayed. No As part of the District’s recovery plan, a consultant is assisting with cash recons until a permanent replacement is hired. No Due to Accreditation show cause, additional closing of the books work to improve the fund balance, and working around reduced staffing due to vacancies, Datatel reconciliations were delayed. No Yes Some payments were delayed in the process of getting approvals. Need to improve processing speed. Yes, with VP VP approval is rare and based on the specific circumstances approval of the request. For example, HCOE cannot accept electronic payments at present. Will work to consolidate District checking accounts and setup EFTs to increase District‐to‐ District electronic transfers. Yes The Board level budget to actual report is distributed monthly Page 3 distributed across campus in the last 60 days? via the board packet. Individual program reports have not been distributed. Have accounts receivable been maintained or Increased by Increased RFP for account collection services completed and collection reduced relative to enrollment and tuition rates? $298,000 by $327,000 agency contracts signed to begin collecting on outstanding delinquent debts. Will work to tighten up on deregistration processes and evaluate delinquent date coming through payment plans. May need to tighten up on payment plans. However, tuition did increase by $10 during the year. 2.2 Describe how these changes affect students and/or the program: Substantial effort was required to reconcile accounts and close the 2012 fiscal year. Accreditation show cause and the need to close the District’s budget shortfall caused reorganizations and will change how the business office accomplishes its duties. The increased effort, coupled with staff shortages, and untimely delivery of reports from the county, resulted in year‐end closing activities taking more resources than planned which in turn pushed back the completion of many other business office activities like uploading budgets, processing monthly departmental charges for fuel and printing, and providing departments with budget verses actual reports. Effects on programs that the business office serves may include temporarily not having a clear picture of their financial condition, which could in turn cause them to hold back on expenditure of resources required to accomplish other programmatic goals. 2.3 Provide any other relevant information, or recent changes, that affect the program: The business office and CR administration met with the County financial officials in order to ensure timely delivery of reports needed by the District. The business office is seeking to fill vacant positions which will allow timely completion of tasks like reconciliations, charges to programs, development of the operational procedural manual, budget upload, updating website, and increased communication with programs. Section 3 –Critical Reflection of Assessment Activities (2011/2012) 3.0 Describe Service Area Outcomes Assessed or reviewed in the current cycle: The metrics indicted in section 2.1 were reviewed. Also, the business office’s staffing and expenditure levels were evaluated to determine how we could most effectively accomplish our goals as a department considering reduced resources available for personnel and other expenditures. 3.1 Summarize the conclusions drawn from the data and the experience of staff working to achieve the outcomes: The District continues to work through two major issues; accreditation show cause and a large structural budget deficit. The implications of addressing both Business Office Program Review.docx 1/24/2013 Page 4 accreditation show cause and structural budget deficit, coupled with staffing vacancies and untimely delivery of reports from the county caused the business office to fall back on progress in meeting and improving on the indicators outlined in 2.1. Once vacant positions are filled, the business office plans to improve on indicators noted in 2.1. 3.2 Summarize how assessments have led to improvement in Service Area Outcomes (top three.): 1. Assessment of bad debt expense has led to many efforts to reduce this indicator. The District has stopped the practice of failing to collect on debts and has taken steps to implement deregistration, to update related policies and procedures and to engage the services of outside collection agencies. 2. Assessment of calendar date of fiscal year closing (timeliness) has resulted in an effort to increase communications and our working relationship with the county financial units 3. Assessment of the number of days to pay vendors has led to an effort to streamline the contract, requisition and invoice approval process 3.3 (Optional) Describe unusual assessment findings/observations that may require further research or institutional support: Section – 4 Evaluation of Previous Plans 4.1 Describe plans/actions identified in the last program review and their current status. What measurable outcomes were achieved due to actions completed. Actions Current Status Outcomes Delinquent debts In process Amounts due are being more aggressively pursued. Balance the budget and address the structural deficit In process 2012‐13 budget is balanced and work is ongoing to balance the budget in subsequent years. Business Office Program Review.docx 1/24/2013 Page 5 4.2 (If applicable) Describe how funds provided in support of the plan(s) contributed to program improvement: Section – 5 Planning 5.0 Program Plans (2012/2013) Based on data analysis, service area outcomes and indicators, assessment and review, and your critical reflections, describe the program’s Action Plan for the 2012/13 academic year. If more than one plan, add rows. Include necessary resources. (Only a list of resources is needed here. Provide detailed line item budgets, timelines, supporting data or other justifications in the Resource Request). 5.1 Program Plans Action to be taken: Relationship to Institutional Plans Fill vacancies IIIB.1. The institution Update business office website to include all forms and descriptions of all business office operations relevant other departments. provides safe and sufficient physical resources… SP 3.2 Improve Operational Efficiencies. SP 3.2 Improve Operational Efficiencies. Convert storage and filing of contracts and insurance docs to electronic format. SP 3.2 Improve Operational Efficiencies. Dispose of old documents that are SP 3.2 Improve Operational Efficiencies. Business Office Program Review.docx 1/24/2013 Relationship to Assessment Expected Impact on Service Area Outcomes Resources Needed After the reorganization, vacancies will have a stronger negative impact on meeting Administrative Services’ mission. Will allow for improved outcomes No additional resources Making forms and process descriptions available online will reduce number of calls and visitors to business office and will increase staff time to work on other duties Will allow for improved outcomes No additional resources Improving overall efficiency in the business office will allow us to be more responsive to student and programmatic needs Improve access to old Will allow for improved outcomes Financial Will allow for improved outcomes Financial Page 6 documents and free up space currently used for storage. Electronic storage is more secure. no longer needed, or scan and destroy documents that are needed 5.2 Provide any additional information, brief definitions, descriptions, comments, or explanations, if necessary. Filling vacancies in business office will greatly impact all indicators outlined in 2.1. Our overall action plan for 2012‐13 is to improve all indicators in 2.1. Section 6 – Resource Requests 6.0 Planning Related, Operational, and Personnel Resource Requests. Requests must be submitted with rationale, plan linkage and estimated costs. Request Check One Amount Recurring Rationale $ Cost Y/N Linkage Planning Operational Personnel Report writer add‐on to Datatel X $11,000 $2000 Each month substantial time is required in order to prepare the BOT financial statement. This software would reduce that time required to write financial statements for the board, but would also allow the business office to create and send frequent reports to programs and divisions Check printer and softdocs X $25,000 4,000 The district’s current check implementation in Datatel printer is beyond service life. In order to install the new check printer, softdocs needs to be implemented Business Office Program Review.docx 1/24/2013 Page 7 Fixed Asset/depreciation maintenance software X $12,000 $2,000 Document Imaging and Scanning and destruction of business office archives X $15,000 $1500 Temporary employee to document business office practices X X X $15,000 No Fill vacant budget / fiscal analyst position X $80,000 ? $80,000? Fill vacant PT account clerk II X $30,000? $30,000 Business Office Program Review.docx 1/24/2013 Page 8 in the business office Maintaining the fixed asset database and calculating and reporting on depreciation each year requires substantial human resources. Automating the process would free up personnel time to accomplish other tasks. The business office has many old files that either need to be destroyed or scanned and destroyed. Having electronic access to files will improve services to students. The business office needs a comprehensive operations manual to ensure continuity. The task would be accomplished more quickly and effectively with a dedicated person working on its creation Position has been vacant since June 2012 and has negatively impacted indicators in 2.1 Position will be vacant as a result of the re‐org and will need to be filled in order to process student financial transactions Computer station in lobby for student use X $5,000 $500 Student ambassador to help students use lobby computer X X $12,000 $12,000 Labor compliance officer for construction projects/certified payroll X $20,000 $20,000 Significant human resources are required to serve students who could be paying online. Having a computer here in the lobby where staff could direct students would cut down in time needed to serve each student. Simple financial transactions could be completed at the computer station with help of the student ambassador, therefor cutting down on time required to service students by cashiers The district is required to ensure contractors comply with prevailing wage laws. The process requires substantial human resources and could be done more efficiently by a third party who specializes in that area Section 7‐ PRC Response 7.0 The response will be forwarded to the author and the supervising Director and Vice President Business Office Program Review.docx 1/24/2013 Page 9