Simon Fraser University S. Lu ECON 302

advertisement

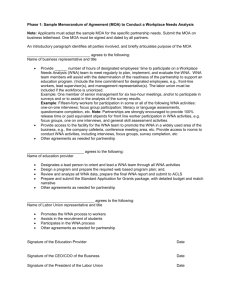

Simon Fraser University ECON 302 S. Lu Practice Problems on Risk Aversion, Moral Hazard and Externalities Not to be turned in 1. For each of the following utility functions over wealth w, compute the following: i) the expected utility and the certainty equivalent of the lottery: 10% chance of ending up with $100 and 90% chance of ending up with $10,000; ii) x, where if you start with $10,000, you would be indifferent between winning $x for sure and a lottery ticket giving you a 1-in-1,000,000 chance of gaining $990,000 (and nothing otherwise). a) b) c) d) w0.5 log10(w) w w2 2. a) Johnny has a strictly increasing utility function over wealth u(.). Assume that u’(.) exists and is continuous everywhere. Show that even if Johnny is risk-averse, he will always take at least a small fraction of any bet where the expected gain is positive. You may restrict attention to bets with just two outcomes for simplicity. (Hint: Another way of stating what you’re asked to show is the following: “If Gp>L(1-p), with G > 0 and L > 0, then Johnny will take a lottery offering him a gain of xG with probability p and a loss of xL with probability 1-p for some x > 0.”) b) [OPTIONAL] Show by example that the above result may not hold if Johnny’s utility function is not differentiable everywhere. 3. Let 𝑈 be a strictly concave differentiable function. Show that if 𝑥 > 𝑥 ′ > 𝑦 ′ > 𝑦 and: 𝑝𝑈(𝑥) + (1 − 𝑝)𝑈(𝑦) = 𝑝𝑈(𝑥 ′ ) + (1 − 𝑝)𝑈(𝑦 ′ ), then 𝑝𝑥 + (1 − 𝑝)𝑦 > 𝑝𝑥 ′ + (1 − 𝑝)𝑦′. Hint: Start by rearranging the above equality and rewriting it using the Mean Value Theorem. (Do not ask us what the Mean Value Theorem is. You should have learned it in MATH 157. If you forgot what it is, you can find the statement of the Mean Value Theorem on the internet in a few seconds.) Note: The above implies that when a risk-averse agent bears more risk (note that outcome pair (𝑥, 𝑦) is riskier than outcome pair (𝑥 ′ , 𝑦 ′ )), then to make sure her expected utility stays the same, her expected income must increase. This observation will be useful when we study moral hazard. 4. You are hired as a consultant by We-Need-Advice Inc. (WNA). If you work hard (e=1), WNA makes $1,000,000 with probability 0.2, and $0 with probability 0.8. If you slack off (e=0) or if WNA hires someone else, the probabilities are 0.1 and 0.9 respectively. You have utility function 𝑢(𝑤, 𝑒) = √𝑤 − 100𝑒. You would make a fixed $40,000 and slack off if hired by another firm. If WNA doesn’t hire you, it would hire someone else at $40,000. First suppose that your effort is observable. a) If you work for another firm, what is your utility? How about WNA’s expected profit? b) If you work for WNA, but slack off, how much would WNA pay you? Why wouldn’t it pay you more? Why can’t it pay you less? What is your utility? How about WNA’s expected profit? c) Suppose WNA offers you a fixed wage and requires effort. Find the range of wages such that both you and WNA are be strictly better off (in expectation) than in parts a and b. d) What is WNA’s first-best? Now suppose that WNA can observe its profit, but not your effort. e) Write down your IR and IC constraints for working hard. f) Find WNA’s maximum profit if it requires effort. Why are both the IR and IC constraints binding? g) Does WNA hire you and require effort in its second-best? Explain. [Hint: Compare WNA’s profit from part f to its profit from alternative courses of action.] 5. Suppose that effort is a continuous variable: the agent can choose any real number 𝑒 ≥ 0. The probability 𝑝(𝑒) that a project is successful depends on 𝑒, with 𝑝(0) = 0, 𝑝′ (𝑒) > 0, 𝑝′′(𝑒) < 0 and lim𝑒→∞ 𝑝′ (𝑒) = 0. Suppose also that the agent is risk-neutral, with utility 𝑢(𝑤, 𝑒) = 𝑤 − 𝑒. Her outside option gives utility 0. What is the principal’s first best? Is it achievable when the principal cannot observe 𝑒? If so, how? If not, find the second best. [Hint: Is it costly for a risk-neutral agent to bear risk?] 6. Consider a market with demand Q=50-2P and supply Q=3P-5. Suppose that there is a negative externality of $5/unit. a) Find the efficient quantity and the deadweight loss. b) How much money would the government raise from a Pigouvian tax that leads to the efficient quantity? c) If the government instead auctions off the efficient quantity of permits to the highest bidders on the supply side, what would be the price of permits? What if the permits were auctioned off to the demand side? d) A lobbyist asks you, a member of the Cabinet, to give the permits to his clients for free instead of auctioning them off “in order to avoid hurting the economy.” Should you follow his advice? e) Instead of tradable permits, the Prime Minister wants to regulate the industry through non-tradable quotas. Explain why this would likely cause a deadweight loss within the market even if the quotas for each firm exactly add up to the efficient quantity. 7. [Exercise 6.3.2.1 in McAfee*] What is the relationship between the tax revenue from a Pigouvian tax and the damage produced by the negative externality? Is the tax revenue sufficient to pay those damaged by the external effect an amount equal to their damage? You can assume that the marginal external effect is either increasing or decreasing. 8. Your neighbor has utility w+kx, and you have utility w-cx, where c and k are constants, w is money and x is an indicator variable that is 1 if your neighbor listens to loud music and 0 if not. Assume that w can be any real number. a) Suppose you don’t interact with your neighbor. When is the outcome efficient? What is the deadweight loss when it isn’t? b) Suppose your neighbor does not have the right to listen to loud music. Could you always reach an efficient outcome? Explain. c) Suppose your neighbor has the right to listen to loud music. Could you always reach an efficient outcome? Explain. d) Assume now that w cannot be negative. Suppose you are broke (start with w=0) and your neighbor is rich, so w>c. Do your answers and/or explanations to b and c change? Why? 9. [Exercises 6.4.2.4 and 6.4.2.5 in McAfee*] Suppose two people, person 1 and person 2, want to produce a playground to share between them. The value of the playground of size S to each person is S , where S is the number of dollars spent building it. a) Show that under voluntary contributions, the size of the playground is ¼ and that the efficient size is 1. b) Now suppose person 1 offers “matching funds,” that is, offers to contribute an equal amount to the contributions of the person 2. How large a playground will person 2 choose? 10. [Exercise 6.4.4.1 in McAfee*] Consider a baby-sitting cooperative, where parents rotate supervision of the children of several families. Suppose that, if the sitting service is available with frequency Y, the value placed by person i is vi Y and the costs of contribution y is ½ ny2, where Y is the sum of the individual contributions and n is the number of families. Rank v1 v2 … vn. a) What is the size of the service under voluntary contributions? [Hint: Let yi be the contribution of family i. Identify the payoff of family j as v j y j i j yi ½n y j 2 . What value of yj maximizes this expression?] n n n b) What contributions maximize the total social value v j y j ½n y j 2 ? i 1 j 1 j 1 [Hint: Are the values of yi different for different i?] *These exercises are taken from McAfee, Introduction to Economic Analysis, http://www.introecon.com/