ECON 383 Applied Game Theory Tutorial 4 Equilibrium Bidding in First-Price Auctions

advertisement

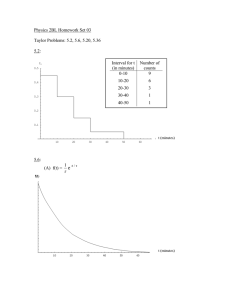

ECON 383 Applied Game Theory Tutorial 4 Equilibrium Bidding in First-Price Auctions ● Finding equilibrium bidding in first­price auctions is simply another form of optimization problems. ● Any optimization problem follows three steps ● Step 1: Set the objective function in term of (a) choice variable(s). ● Step 2: Find the First­order condition by differentiate the objective function with respect to the choice variable(s). ● Step 3: Solve for the equilibrium. ● For example, ● In a utility maximization problem, the objective function is a utility function in term of consumptions on good X and good Y. We derive the F.O.C by differentiating the utility function with respect to X and Y. ● To find a Cournot equilibrium, the objective function is a firm’s profit function in term of the firm’s output. We derive the F.O.C., which is also called “the Best Response function”, by differentiating the profit function with respect to output. ● We can break the process of finding the first­price, or any kind of, auctions into 3 steps. ● Step 0: Assumption ● Step 1: Set the Bidder’s expected profit function in term of value. ● Step 2: Find the F.O.C. by differentiating the expected profit function with respect to value ● Step 3: solve for the equilibrium by a trick called “guess and verify” Step 0 ● ● ● There’re n , where n > 2 , bidders in the auction We focus only on symmetric equilibrium. (All the bidders use the same strategy) Notation ○ b∈[0, 1] for “bid” ○ v∈[0, 1] for “any value in general” ○ vj ~ U [0, 1] , j = 1, 2, 3, ..., n for “bidder j’s value”, where v1, v2 , v3, ..., vn are independent. Step 1 ● Choice Variable: “v” for “value” ● It’s natural to think that the choice variable should be “bid”, which is b = s(v) where s is a function mapping value v to bid b . For example, (take note) ● ● However, b is not a convenient choice variable since it’s difficult to differentiate with respect to a function. ● Under the assumption that s in strictly increasing, choosing b is to maximize profit is equivalent to choosing v to maximize profit at the point v = vi .( vi is bidder i’s true value). ● This is easier to do calculus later since v is a variable, not a function. Expected profit function = vn−1(vi − s(v)) ● Why? ● By intuition, Bidder i’s expected profit = Prob(bidder i win)x(Profit if win) 1) Profit if win = vi − s(v) 2) Prob(bidder i win)= vn−1 ● Why? ● Since bidder i win if his bid is higher than any other bidders, Prob(bidder i win) = Prob( s(v) > s(v1) and s(v) > s(v2) and..... and s(v) > s(vn) ) ● Since s is a strictly increasing function, Prob(bidder i win) = Prob( v > v1 and v > v2 and..... and v > vn ) ● Since v1, v2 , v3, ..., vn are independent, Prob(bidder i win) = Prob( v > v1 )Prob( v > v2 ).....Prob( v > vn ), and there are n­1 term of these. ● Consider Prob( v > vj ), for any j =/ i . ● ● ○ For any j , vj ~ U [0, 1] . ○ Therefore Prob (v > vj) = v . (See the graph) Since there are n­1 terms of Prob (v > vj) , finally we get Prob(bidder i win) = vn−1 In conclusion, our problem is to maximize bidder i’s expected profit function = vn−1(vi − s(v)) by choosing a choice variable v. Step 2 ● Differentiate vn−1(vi − s(v)) with respect to v , evaluated at the point where v = vi and set it equal to zero. ● F.O.C is (n − 1)(vi − s(vi)) = vis′(vi) Step 3 ● ● ● ● Guess that s(vi) = cvi k . We have to solve for c and k. Substitute our guess in the F.O.C. Then the F.O.C is (n − 1)(vi − cvi k) = vickvi k−1 (n − 1)(vi − cvi k) = ckvi k Only k=1 satisfies this equation. Therefore (n − 1)(vi − cvi ) = cvi (n − 1)vi = c(1 + n − 1)cvi c = (n − 1)/n Since k = 1 and c=(n­1)/n, s(vi) = [(n − 1)/n]vi Homework (D.I.Y) 1) How the equilibrium change if vj ~ U [0, 3] ? 2) Why in the All­pay auction the object function is vn−1(vi) − s(v) instead of vn−1[vi − s(v)] ?