ECON 383 Practice Problems from Chapter 9 1, 3, 5, 6

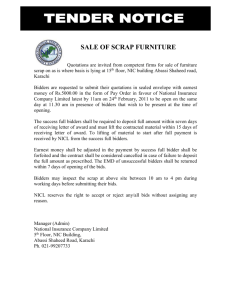

advertisement

ECON 383

Practice Problems from Chapter 9

1, 3, 5, 6

H. K. Chen (SFU)

ECON 383

1 / 10

Chapter 9 — Ex.1

1. Consider a second price sealed-bid auction with an unknown number of

bidders. You know there will be either two or three other bidders (besides

your firm) participating in the auction. All bidders have independent,

private values for the good. Your value is c. What bid should you submit,

and how does it depend on the number of other bidders in the auction?

H. K. Chen (SFU)

ECON 383

2 / 10

Chapter 9 — Ex.1

1. Consider a second price sealed-bid auction with an unknown number of

bidders. You know there will be either two or three other bidders (besides

your firm) participating in the auction. All bidders have independent,

private values for the good. Your value is c. What bid should you submit,

and how does it depend on the number of other bidders in the auction?

You should bid c, your true value, regardless of the number of other

bidders

H. K. Chen (SFU)

ECON 383

2 / 10

Chapter 9 — Ex.1

1. Consider a second price sealed-bid auction with an unknown number of

bidders. You know there will be either two or three other bidders (besides

your firm) participating in the auction. All bidders have independent,

private values for the good. Your value is c. What bid should you submit,

and how does it depend on the number of other bidders in the auction?

You should bid c, your true value, regardless of the number of other

bidders

Two things are important in a second price auction:

H. K. Chen (SFU)

ECON 383

2 / 10

Chapter 9 — Ex.1

1. Consider a second price sealed-bid auction with an unknown number of

bidders. You know there will be either two or three other bidders (besides

your firm) participating in the auction. All bidders have independent,

private values for the good. Your value is c. What bid should you submit,

and how does it depend on the number of other bidders in the auction?

You should bid c, your true value, regardless of the number of other

bidders

Two things are important in a second price auction:

Your bid, which influences your chance of winning

H. K. Chen (SFU)

ECON 383

2 / 10

Chapter 9 — Ex.1

1. Consider a second price sealed-bid auction with an unknown number of

bidders. You know there will be either two or three other bidders (besides

your firm) participating in the auction. All bidders have independent,

private values for the good. Your value is c. What bid should you submit,

and how does it depend on the number of other bidders in the auction?

You should bid c, your true value, regardless of the number of other

bidders

Two things are important in a second price auction:

Your bid, which influences your chance of winning

The second highest bid, which determines how much you pay if you win

H. K. Chen (SFU)

ECON 383

2 / 10

Chapter 9 — Ex.1

1. Consider a second price sealed-bid auction with an unknown number of

bidders. You know there will be either two or three other bidders (besides

your firm) participating in the auction. All bidders have independent,

private values for the good. Your value is c. What bid should you submit,

and how does it depend on the number of other bidders in the auction?

You should bid c, your true value, regardless of the number of other

bidders

Two things are important in a second price auction:

Your bid, which influences your chance of winning

The second highest bid, which determines how much you pay if you win

There’s only one second highest bid, regardless the number of bidders

H. K. Chen (SFU)

ECON 383

2 / 10

Chapter 9 — Ex.1

1. Consider a second price sealed-bid auction with an unknown number of

bidders. You know there will be either two or three other bidders (besides

your firm) participating in the auction. All bidders have independent,

private values for the good. Your value is c. What bid should you submit,

and how does it depend on the number of other bidders in the auction?

You should bid c, your true value, regardless of the number of other

bidders

Two things are important in a second price auction:

Your bid, which influences your chance of winning

The second highest bid, which determines how much you pay if you win

There’s only one second highest bid, regardless the number of bidders

Therefore, in a second price auction, bidding truthfully is a weakly

dominant strategy regardless of the number of bidders in the auction

H. K. Chen (SFU)

ECON 383

2 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

H. K. Chen (SFU)

ECON 383

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob

1/4

1/4

1/4

1/4

selling price

ECON 383

expected revenue

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob

1/4

1/4

1/4

1/4

selling price

0

ECON 383

expected revenue

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob

1/4

1/4

1/4

1/4

selling price

0

ECON 383

expected revenue

0

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob

1/4

1/4

1/4

1/4

selling price

0

0

ECON 383

expected revenue

0

0

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob

1/4

1/4

1/4

1/4

selling price

0

0

0

ECON 383

expected revenue

0

0

0

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob

1/4

1/4

1/4

1/4

selling price

0

0

0

1

ECON 383

expected revenue

0

0

0

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob

1/4

1/4

1/4

1/4

selling price

0

0

0

1

ECON 383

expected revenue

0

0

0

1/4

3 / 10

Chapter 9 — Ex.3(a)

3. All bidders in a second price auction have private independent values

vi ∈ {0, 1}, each value realizes with equal probability.

(a) Suppose i ∈ {1, 2}. Show that the seller’s expected revenue is 1/4.

Consider all four possible pairs of bidder values:

( v1 , v2 )

(0, 0)

(0, 1)

(1, 0)

(1, 1)

H. K. Chen (SFU)

Prob selling price

1/4

0

0

1/4

1/4

0

1/4

1

Total

ECON 383

expected revenue

0

0

0

1/4

1/4

3 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

H. K. Chen (SFU)

ECON 383

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

ECON 383

expected revenue

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

ECON 383

expected revenue

0

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

0

ECON 383

expected revenue

0

0

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

0

0

ECON 383

expected revenue

0

0

0

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

0

0

1

ECON 383

expected revenue

0

0

0

1/8

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

0

0

1

0

ECON 383

expected revenue

0

0

0

1/8

0

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

0

0

1

0

1

ECON 383

expected revenue

0

0

0

1/8

0

1/8

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

0

0

1

0

1

1

ECON 383

expected revenue

0

0

0

1/8

0

1/8

1/8

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob

1/8

1/8

1/8

1/8

1/8

1/8

1/8

1/8

selling price

0

0

0

1

0

1

1

1

ECON 383

expected revenue

0

0

0

1/8

0

1/8

1/8

1/8

4 / 10

Chapter 9 — Ex.3(b)

3(b) What is the seller’s expected revenue if there are three bidders?

There are eight possible combinations of bidder values:

(v1 , v2 , v3 )

(0, 0, 0)

(0, 0, 1)

(0, 1, 0)

(0, 1, 1)

(1, 0, 0)

(1, 0, 1)

(1, 1, 0)

(1, 1, 1)

H. K. Chen (SFU)

Prob selling price

1/8

0

0

1/8

1/8

0

1/8

1

0

1/8

1

1/8

1/8

1

1/8

1

Total

ECON 383

expected revenue

0

0

0

1/8

0

1/8

1/8

1/8

1/2

4 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

H. K. Chen (SFU)

ECON 383

5 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

As the number of bidders increases, it becomes more likely that the

second highest value among them is 1 instead of 0

H. K. Chen (SFU)

ECON 383

5 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

As the number of bidders increases, it becomes more likely that the

second highest value among them is 1 instead of 0

As a general observation, when the number of bidders increases, it is

less likely for all bidders except one to have a value of 0

H. K. Chen (SFU)

ECON 383

5 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

As the number of bidders increases, it becomes more likely that the

second highest value among them is 1 instead of 0

As a general observation, when the number of bidders increases, it is

less likely for all bidders except one to have a value of 0

In other words, it becomes very unlikely for the second highest bid to

be 0 as there are more and more bidders

H. K. Chen (SFU)

ECON 383

5 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

As the number of bidders increases, it becomes more likely that the

second highest value among them is 1 instead of 0

As a general observation, when the number of bidders increases, it is

less likely for all bidders except one to have a value of 0

In other words, it becomes very unlikely for the second highest bid to

be 0 as there are more and more bidders

Consequently, the selling price of 1 occurs more frequently, which

results in a higher expected revenue for the seller

H. K. Chen (SFU)

ECON 383

5 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

Formally, for any n bidders, selling price is 0 only if the profile of

values (v1 , . . . , vn ) has no more than one 1.

H. K. Chen (SFU)

ECON 383

6 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

Formally, for any n bidders, selling price is 0 only if the profile of

values (v1 , . . . , vn ) has no more than one 1.

There are 2n possible profiles of bidder values, among them, n + 1

profiles have no more than one 1

H. K. Chen (SFU)

ECON 383

6 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

Formally, for any n bidders, selling price is 0 only if the profile of

values (v1 , . . . , vn ) has no more than one 1.

There are 2n possible profiles of bidder values, among them, n + 1

profiles have no more than one 1

Thus, the expected revenue (as a function of number of bidders) is

n+1

R(n) = 1 − n

×1

2

|

{z

}

Pr(selling price6=0)

H. K. Chen (SFU)

ECON 383

6 / 10

Chapter 9 — Ex.3(c)

3(c) Explain why the seller’s expected revenue increases as the number of

bidders increases.

Formally, for any n bidders, selling price is 0 only if the profile of

values (v1 , . . . , vn ) has no more than one 1.

There are 2n possible profiles of bidder values, among them, n + 1

profiles have no more than one 1

Thus, the expected revenue (as a function of number of bidders) is

n+1

R(n) = 1 − n

×1

2

|

{z

}

Pr(selling price6=0)

It is obvious to see that limn→∞ R(n) = 1

H. K. Chen (SFU)

ECON 383

6 / 10

Chapter 9 — Ex.5

5. One seller and two bidders interact in a second price auction. Seller

values the object at s while buyers 1 and 2 value it at v1 , v2 , respectively.

All three values are independent and private. Suppose both buyers know

that the seller will submit his own sealed bid of s, but they don’t know the

value of s. Is it optimal for the buyers to bid truthfully?

H. K. Chen (SFU)

ECON 383

7 / 10

Chapter 9 — Ex.5

5. One seller and two bidders interact in a second price auction. Seller

values the object at s while buyers 1 and 2 value it at v1 , v2 , respectively.

All three values are independent and private. Suppose both buyers know

that the seller will submit his own sealed bid of s, but they don’t know the

value of s. Is it optimal for the buyers to bid truthfully?

This is the same as having a third buyer entering the auction.

H. K. Chen (SFU)

ECON 383

7 / 10

Chapter 9 — Ex.5

5. One seller and two bidders interact in a second price auction. Seller

values the object at s while buyers 1 and 2 value it at v1 , v2 , respectively.

All three values are independent and private. Suppose both buyers know

that the seller will submit his own sealed bid of s, but they don’t know the

value of s. Is it optimal for the buyers to bid truthfully?

This is the same as having a third buyer entering the auction.

Based on the reasoning in Ex.1, both buyers 1 and 2 should still bid

truthfully.

H. K. Chen (SFU)

ECON 383

7 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

Since loser’s payoff is 0, maximizing joint payoffs is the same as

maximizing the winner’s payoff

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

Since loser’s payoff is 0, maximizing joint payoffs is the same as

maximizing the winner’s payoff

.

Since vi is given, winner’s payoff vi − p is maximized when

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

Since loser’s payoff is 0, maximizing joint payoffs is the same as

maximizing the winner’s payoff

Since vi is given, winner’s payoff vi − p is maximized when p = 0 .

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

Since loser’s payoff is 0, maximizing joint payoffs is the same as

maximizing the winner’s payoff

Since vi is given, winner’s payoff vi − p is maximized when p = 0 .

Given the objective, the winner should be

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

Since loser’s payoff is 0, maximizing joint payoffs is the same as

maximizing the winner’s payoff

Since vi is given, winner’s payoff vi − p is maximized when p = 0 .

Given the objective, the winner should be bidder with higher vi

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

Since loser’s payoff is 0, maximizing joint payoffs is the same as

maximizing the winner’s payoff

Since vi is given, winner’s payoff vi − p is maximized when p = 0 .

Given the objective, the winner should be bidder with higher vi

Therefore, the two bids should be

bL

and bH

where bL is the bid submitted by the bidder with lower value, and bH

the bid submitted by the bidder with higher value

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(a)

6. One object is being sold using a second price auction. There are several

bidders with independent private values drawn from a distribution on

[0, 1]. Consider the possibility of collusion between two bidders who know

each others’ value for the object. The objective of the colluding bidders is

to maximize their joint payoffs. All bids should be within the [0, 1] range.

(a) Suppose there are only two bidders. What bids should they submit?

Since loser’s payoff is 0, maximizing joint payoffs is the same as

maximizing the winner’s payoff

Since vi is given, winner’s payoff vi − p is maximized when p = 0 .

Given the objective, the winner should be bidder with higher vi

Therefore, the two bids should be

bL = 0

and bH > 0

where bL is the bid submitted by the bidder with lower value, and bH

the bid submitted by the bidder with higher value

H. K. Chen (SFU)

ECON 383

8 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

bH to influence the probability of winning; and

bL to minimize the payment, conditional on winning

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

bH to influence the probability of winning; and

bL to minimize the payment, conditional on winning

What should be the third bidder’s strategy?

H. K. Chen (SFU)

ECON 383

.

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

bH to influence the probability of winning; and

bL to minimize the payment, conditional on winning

What should be the third bidder’s strategy?

Bid truthfully

.

Bidding truthfully is still a dominant strategy for the third bidder.

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

bH to influence the probability of winning; and

bL to minimize the payment, conditional on winning

What should be the third bidder’s strategy?

Bid truthfully

.

Bidding truthfully is still a dominant strategy for the third bidder.

What should be the optimal bL ?

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

bH to influence the probability of winning; and

bL to minimize the payment, conditional on winning

What should be the third bidder’s strategy?

Bid truthfully

.

Bidding truthfully is still a dominant strategy for the third bidder.

What should be the optimal bL ?

If won (bH > v3 ), then any bL ∈ [0, v3 ] is optimal: colluders have to

pay more if bL > v3

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

bH to influence the probability of winning; and

bL to minimize the payment, conditional on winning

What should be the third bidder’s strategy?

Bid truthfully

.

Bidding truthfully is still a dominant strategy for the third bidder.

What should be the optimal bL ?

If won (bH > v3 ), then any bL ∈ [0, v3 ] is optimal: colluders have to

pay more if bL > v3

If lost (bH ≤ v3 ), then any bL ∈ [0, bH ] is optimal: payoff is zero

anyway

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

We can treat the two colluding bidders (L and H) as a single player

with two choice variables:

bH to influence the probability of winning; and

bL to minimize the payment, conditional on winning

What should be the third bidder’s strategy?

Bid truthfully

.

Bidding truthfully is still a dominant strategy for the third bidder.

What should be the optimal bL ? bL ∈ [0, min{v3 , bH }]

If won (bH > v3 ), then any bL ∈ [0, v3 ] is optimal: colluders have to

pay more if bL > v3

If lost (bH ≤ v3 ), then any bL ∈ [0, bH ] is optimal: payoff is zero

anyway

H. K. Chen (SFU)

ECON 383

9 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

Given truthful bidding of bidder 3, what is the optimal bH ?

H. K. Chen (SFU)

ECON 383

10 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

Given truthful bidding of bidder 3, what is the optimal bH ?

bH = vH

The auction is essentially between bidders H and 3. So the usual

argument for truthful bidding being weakly dominant applies

H. K. Chen (SFU)

ECON 383

10 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

Given truthful bidding of bidder 3, what is the optimal bH ?

bH = vH

The auction is essentially between bidders H and 3. So the usual

argument for truthful bidding being weakly dominant applies

In summary, with a non-colluding bidder, the two colluders should bid

bL ∈ [0, min{v3 , bH }]

H. K. Chen (SFU)

ECON 383

and bH = vH

10 / 10

Chapter 9 — Ex.6(b)

6(b) Suppose there is a third bidder who is not part of the collusion. Does

the existence of this bidder change the optimal bids for the two colluding

bidders?

Given truthful bidding of bidder 3, what is the optimal bH ?

bH = vH

The auction is essentially between bidders H and 3. So the usual

argument for truthful bidding being weakly dominant applies

In summary, with a non-colluding bidder, the two colluders should bid

bL ∈ [0, min{v3 , bH }]

and bH = vH

Note that bL = 0 and bH = vH are an optimal colluding strategy

regardless of whether there exists a non-colluding bidder.

H. K. Chen (SFU)

ECON 383

10 / 10