Econ 302 Assignment 4 — Solution

advertisement

Econ 302

Assignment 4 — Solution

These three games are sequential games of perfect information. We solve them by backward

induction: start at the nodes/information sets one level above the terminal nodes, and solve

for the best responses; after solving those best responses, move up one more level and solve

for the best responses there; and so on.

1. In the subgame (in stage 2) in which firm 1 had produced q1 units, firm 2’s best response

is to solve:

max(a − b(q1 + q2 ))q2 − cq2 .

q2

The first-order condition is:

a − bq1 − 2bq2 − c = 0,

or

a − c − bq1

a−c 1

=

− q1 .

(1)

2b

2b

2

Equation (1) is the equilibrium strategy of firm 2; it specify firm 2’s best-responding

action after every contingency (which is a quantity of firm 1, q1 ).

Given that player 2 is playing according to the strategy (1), firm 1 in the beginning of

the game (stage 1) solves:

q2∗ (q1 ) =

a−c 1

max a − b q1 +

− q1

q1 − 2cq1 .

q1

2b

2

The first order condition is:

a − bq1 −

a−c

− 2c = 0,

2

or

a − 3c

.

(2)

2b

Equation (2) is the equilibrium strategy of firm 1, and together with the strategy of firm

2 in (1) they form the subgame-perfect equilibrium of this game.

In this equilibrium firm 1 produces q1∗ = a−3c

units, and firm 2 produces q2∗ (q1∗ ) = a+c

2b

4b

a+5c

a+c

units. The market price in this equilibrium is P = a − b a−3c

+

=

.

2b

4b

4

q1∗ =

1

2. In the subgame (in stage 3) in which firm 1 had produced q1 units and firm 2 had

produced q2 units, firm 3’s best response is to solve:

max(a − b(q1 + q2 + q3 ))q3 − cq3 .

q3

The first-order condition is:

a − b(q1 + q2 ) − 2bq3 − c = 0,

or

a−c 1

a − c − b(q1 + q2 )

=

− (q1 + q2 ).

(3)

2b

2b

2

Equation (3) is the equilibrium strategy of firm 3; it specify firm 3’s best-responding

action after every contingency (which is a quantity of firm 1, q1 , plus a quantity of firm 2,

q2 ).

In the subgame (in stage 2) in which firm 1 had produced q1 units, and anticipating the

strategy (3) of firm 3 in stage 3, firm 2’s best response is to solve:

q3∗ (q1 , q2 ) =

a−c 1

− (q1 + q2 )

q2 − cq2 .

max a − b q1 + q2 +

q2

2b

2

The first order condition is

b

a−c

a − q1 − bq2 −

− c = 0,

2

2

or

a−c 1

− q1 .

(4)

2b

2

Equation (4) is the equilibrium strategy of firm 2; it specify firm 2’s best-responding

action after every contingency (which is a quantity of firm 1, q1 ).

Finally, in the beginning of the game (stage 1), firm 1’s best response, anticipating the

strategies (4) and (3), is to solve:

q2∗ (q1 ) =

a−c 1

a−c 1

a−c 1

max a − b q1 +

− q1 +

−

q1 +

− q1

q1 − cq1

q1

2b

2

2b

2

2b

2

3(a − c) 1

+ q1

q1 − cq1

= max a − b

q1

4b

4

2

The first order condition is

a−

3(a − c) b

− q1 − c = 0,

4

2

or

a−c

.

(5)

2b

Strategies (5), (4) and (3) form a subgame perfect equilibrium.

In this equilibrium firm 1 produces q1∗ = a−c

units, firm 2 produces q2∗ (q1∗ ) = a−c

, and firm

2b

4b

3 produces q3∗ (q1∗ , q2∗ ) = a−c

units. Notice that firm 1 and 2 produce the same quantities as if

8b

there are only two firms. The market price in this equilibrium is P = a − 78 (a − c) = 81 a + 78 c.

q1∗ =

3.

Given the huge negative payoff (−1000000000) of death, each player wants to

minimize his probability of death. Conditional on being alive, the player wants to kill as

many opponents as possible: a payoff of 2 for two dead, 1 for one dead, 0 for zero dead.

Here is one subgame perfect equilibrium:

In the (last) subgame where Z (assuming that he is alive) is shooting, Z shoots randomly

at one of the alive players. That is, if only one other player is alive, Z shoots him; if both X

and Y are alive, Z plays the mixed strategy of shooting X with probability 1/2 and shooting

Y with probability 1/2. This is a best-response for Z, because he hates X and Y equally.

In the subgame where Y (assuming that he is alive) is shooting, Y shoots Z if Z is alive,

shoots X if Z is dead. This is a best response for Y, because if Z is alive he will be shot at

by Z.

In the subgame where X is shooting (the beginning of the game), X shoots shoots into

the air. The probability that X dies when he shoots into air is 0.4 × 0.5 = 0.2: Y misses

in his shot of Z (probability 0.4), and Z chooses to shoot X (probability 0.5) in the final

round. When X shoots Y, the probability that X dies is 0.3 × 1 + 0.7 × 0.2 = 0.44: if X’s

bullet hits Y, X dies for sure (shot by Z, who never misses, in the final round); if X’s bullet

misses Y, we are back to the scenario of shooting into the air. Likewise, when X shoots Z

the probability that X dies is 0.3 × 0.6 + 0.7 × 0.2 = 0.32. Therefore, shooting into the air

is the best response.

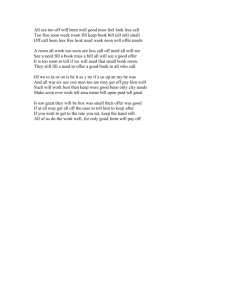

This completes the description of a subgame perfect equilibrium. The game tree in the

next page is produced by Haiyun Kevin Chen (notice that D = −1000000000).

3

Air

D

1

D D

2

1

X

Z

chance

D

D

D 1

2

1

Y

Air

[.6] Hit

Z

[.3] Hit

X

Y

Z

Miss [.4]

Air

X

Z

1

1

D

[.6] Hit

chance

Miss [.7]

X

Y

Z

Miss [.4]

Air

D

1

0

1 D 0

1

1

0

Y

Air

Y

Air

D

1

0

1 D 0

1

1

0

X

Z

Miss [.4]

Y

Z

Air

[.6] Hit

chance

D

D

D 1

2

1

1

1

D

Air

Y

Air

D

1

0

1 D 0

1

1

0

X

Z

Miss [.4]

X

Z

1

1

D

[.6] Hit

chance

Miss [.7]

X

Y

Z

Miss [.4]

Air

D

1

0

1 D 0

1

1

0

Y

Air

Y

Z

Air

Air

D

1

0

1 D 0

1

1

0

X

Figure 1: Extensive Form Representation of the Three-Way Duel in Assignment 4

D

1

2 1

D

D

[.6] Hit

chance

X

Y

[.3] Hit

chance

Z

Air

D

D

D 1

2

1

Y

Z

[.6] Hit

chance

Y

Air

D

1

0

1 D 0

1

1

0

X

Z

Miss [.4]

X

1

1

D

[.6] Hit

chance

Z

X

Y

Z

Miss [.4]

Air

D

1

0

1 D 0

1

1

0

Y

The black letters {X, Y, Z} denote the players who are shooting and the red letters {X, Y, Z, Air} denote the targets at which a player shoots. The blue letters represent chance and its

“moves”. Letter D in the payoff vector indicates a player is dead.

D

1

0

1 D 0

1

1

0

chance

Y

X

Air

Y

Air

D

1

0

1 D 0

1

1

0

X

Z