NBER WORKING PAPER SERIES TRADE BOOMS, TRADE BUSTS, AND TRADE COSTS

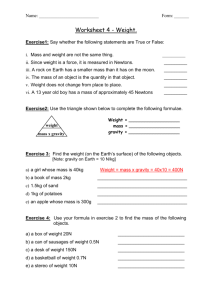

advertisement