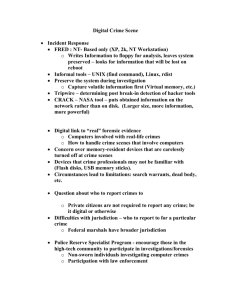

The Effect of Stolen Goods Markets on Crime: ’Este

advertisement