Financial innovations and political development: evidence from revolutionary England Saumitra Jha Stanford University

advertisement

Financial innovations and political development:

evidence from revolutionary England

Saumitra Jha∗

Stanford University

August 25, 2010

Abstract

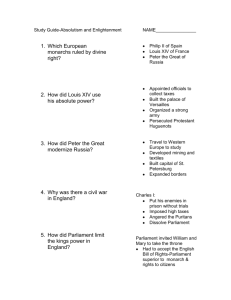

The English Parliament’s struggle for supremacy in the seventeenth century was

crucial for the development of representative government in the English-speaking

world, yet its lessons continue to be debated. This paper provides the first systematic evidence on the determinants of individuals’ decisions to join the coalition

for revolutionary reform. The paper employs a novel micro-dataset on the endowments of each member of the Long Parliament (1640-60) that initiated England’s

institutional transformation and finds that the key determinants of support for

reform were overseas interests and other factors over which the executive enjoyed

discretion under the existing constitution. Further, investment in newly available

shares in overseas companies appears central in fostering support for reform, chiefly

among those lacking prior overseas interests. The paper argues that the innovation

of shares allowed new investors to take advantage of emerging economic opportunities overseas, aligning their interests with overseas traders. However, since

these shared opportunities were heavily exposed to executive discretion, financial

innovation broadened support for parliamentary control of government.

JEL codes: O10, F10, K00, P10, N23

Keywords: Institutions, Civil War, Conflict, Constitutional Reform, Economic

Growth, Financial Markets, Trade, Political Economy, Revolution

∗

Address: saumitra@gsb.stanford.edu; Graduate School of Business, 518 Memorial Way, Stanford CA

94305. I owe particular thanks to Susan Athey and Avner Greif as well as Ran Abramitsky, Amrita

Ahuja, Ken Arrow, Dan Bogart, Ernesto Dal Bo, Ann Carlos, Mauricio Drelichman, Jeffry Frieden,

Sean Gailmard, Oscar Gelderblom, Claudia Goldin, Luigi Guiso, Eric Hilt, Kimuli Kasara, Timur Kuran,

David Laitin, Jessica Leino, Kris Mitchener, Aprajit Mahajan, Noel Maurer, Ted Miguel, Pedro Miranda,

James Robinson, Matthias Schündeln, Carmit Segal, Jordan Siegel, David Stasavage, Nathan Sussman,

Barry Weingast and seminar participants at Clio, PacDev, Berkeley, Harvard, NYU, Princeton and

Stanford. Zac Peskowitz provided excellent research assistance. This research benefits from articles

made available prior to publication by the History of Parliament Trust.

1

Electronic copy available at: http://ssrn.com/abstract=934943

1

Introduction

The Father of Parliaments, which first rendered Parliaments supreme, and

has since set the world upon the chase of Parliaments . . .

- Thomas Carlyle (1845, pg.316), referring to the Long Parliament.

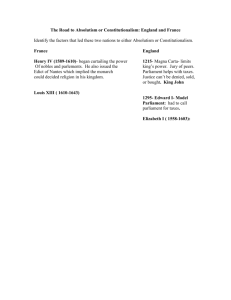

The seizure of executive authority by Parliament from the Crown in the years spanning

England’s Civil War (1642-48) was arguably central for the development of representative

government in the English-speaking world.1 Before the Long Parliament of 1640-1660,

the king of England enjoyed independent sources of finance and possessed “sovereignty”

rights over foreign policy, including rights to declare war, to collect customs and to charter

monopolies on most goods and innovations introduced from abroad. The king called and

dismissed Parliament at will. Between 1629 and 1640, no parliament sat in England.

The summoning of parliament in 1640 initiated a remarkable process of institutional

change. Through both legislative and ultimately violent means, the “Long” Parliament

acquired rights to convene without royal approval, to control state finance and to direct

foreign policy and war: in other words, Parliament acquired the Crown’s sovereignty

rights (Howat, 1974, Smith, 2003). These institutional changes have been since recognized

as the beginning of a path of experimentation that left England with the one of the world’s

most enduring, and most commonly imitated, traditions of representative government.2

With the acquisition of executive authority, the Parliamentary victors of the Civil

War instituted dramatically new policies. Large investments in a particular set of public

goods– the Navy– supported the expansion of England’s international trade. These

policies are credited with London’s emergence as the most important trading hub of

Europe by the early eighteenth century and Britain’s acquisition of an empire that spread

the influence of its institutions– including the common law, parliamentary paramountcy

in government, and the Bill of Rights– around the world (Rodger, 2004, de la Escosura,

ed, 2004, Ormrod, 2003, Ferguson, 2002).

Given the importance of this episode for political development in Britain and elsewhere, the key puzzle, among the most famous and enduring in political economy–

1

For example, Friedrich Hayek (1960, pg.160) suggests:“Out of the extensive and continuous discussion . . . during the Civil War, there gradually emerged all the political ideals which were thenceforth to

govern English political evolution.” See also Murrell (2009).

2

The transfer of the rights over state finance and foreign policy to Parliament was intermittently challenged following the Restoration of the monarchy in 1660, until being consolidated following the Glorious

Revolution of 1688. This has led to debate about the relative importance of the Civil War and Glorious Revolution in England’s subsequent development (see e.g. Murrell, 2009). However it is relatively

uncontroversial that the activities of the Long Parliament made subsequent reforms possible (Pincus,

2009).

2

Electronic copy available at: http://ssrn.com/abstract=934943

how a novel, broad and ultimately successful coalition in favor of representative government was formed in seventeenth century England– has been a focus of much debate

ever since (Hobbes, 1682, Hayek, 1960, Moore, 1966, Acemoglu, Johnson and Robinson, 2005b). Contemporary explanations for England’s revolutionary reforms include the

Protestant ethic, the emergence of a commercial “middle” class seeking to protect its new

wealth or a coalition formed to defend property rights in response to excessive executive

greed (North and Weingast, 1989, World Bank, 2002, Acemoglu, Johnson and Robinson,

2005b, Rajan and Zingales, 2003, de Lara, Greif and Jha, 2008, Murrell, 2009).

This paper provides the first direct evidence on the importance of different endowments on individuals’ decisions to join the coalition in favor of Parliamentary control

of government during the English Civil War. It uses a novel micro-dataset collected by

the author on the economic and social endowments of each of the 548 members of the

Long Parliament (1640-1660) that initiated England’s revolutionary reforms, and finds

that a range of domestic wealth endowments show little effect on support or opposition to Parliamentary takeover of executive authority. This suggests that constituencies

formed around the defence of existing domestic property, whether old or newly acquired,

do not appear to have played a major role in the initiation of England’s transition to

representative government.

Instead, the paper documents that, consistent with a simple theoretical framework,

support for Parliamentary control of government was most impacted by those areas over

which the executive had greater discretion under the existing constitution, and thus were

most likely to change with a change in regime. These included the Crown’s “sovereignty”

rights over foreign policy, overseas trade and colonies, which governed the return on new

opportunities for wealth that accompanied the discoveries of direct sea routes to the New

World and Asia.

Further, the paper shows that a financial innovation–the introduction of shares in

new overseas joint stock companies– played a significant role in transforming fragmented

interests into a broad coalition. The paper finds evidence of an alignment effect– that

shares, while having little effect on those with existing mercantile endowments, had a

robust influence on the propensity to support constitutional reform among non-merchants

(who were mainly sedentary landowners). In fact, shares appear to have been pivotal in

swaying non-merchants in favor of reform, changing support for Parliamentary control of

government from a minority position to one enjoying majority support. Non-merchant

shareholders encompass a number of the central organizers of the Parliamentary rebellion,

who far from being extremists, would have been slightly more likely to support the Crown

had they not invested in overseas ventures.

3

Electronic copy available at: http://ssrn.com/abstract=934943

The paper uses two complementary means to assess the causal effect of shares. First,

the paper compares shareholders to non-investors matched along a rich range of those

endowed characteristics that might plausibly lead to departures from the mean-variance

efficient financial portfolio where every agent invests in shares (Markowitz, 1959). The

paper finds that even under a lower bound estimate, the effect of shares was sufficient

to push the support of the majority of MPs from Crown to Parliament. The second

approach exploits a plausibly exogenous shock to the propensity to invest overseas: the

spike in nationwide enthusiasm for foreign expeditions among agents who became free to

control their finances just after Francis Drake’s successful circumnavigation and raid on

Spain’s silver fleet. This regression discontinuity design also shows consistent increases

in the propensity to support parliamentary control of government among shareholders.

Beyond the stark choice to support Crown or parliamentary control of government

during the violence of the Civil War, the paper traces a direct link between overseas

shareownership and support for constitutional reform throughout the lifecycle of the

early struggle for parliamentary supremacy, exploiting surviving records that indicate

support for reform during the initial attempts to change the constitution through legislative means, at the eve of the outbreak of violent hostilities, and in the parliament

of post-Civil War victors that implemented dramatic investments in England’s navy in

defence of trade. A consistent picture emerges: the introduction of shares appears to

lead non-merchants to make similar political decisions to those with prior overseas trade

interests, creating a majority coalition that favored revolutionary reform.

The paper interprets these results as reflecting the role played by shares in aligning

the interests of sedentary non-merchants, who otherwise had few opportunities to invest

overseas, with merchants, who already had access to such opportunities, in favor of constitutional reforms to acquire the Crown’s newly valuable overseas rights. Because the

rights needed to profit from overseas investment belonged to the executive, the introduction of shares aligned the incentives of a broad coalition in favor of constitutional reforms

aimed at seizing control of these rights. These rights were then used to increase England’s

public investments in favor of policies, such as an expanding Navy, that enhanced the

value of overseas investments and placed England at the center of world trade.

Beyond shedding light on a pivotal moment in England’s political and economic development, this paper relates to a number of important literatures in finance, institutional

and development economics. Much blame for under-development around the world has

been attributed to a failure to align the incentives of disparate interest groups or “constituencies” in favor of political reform and beneficial public policies such as the reduction

of barriers to entry in education, accessing credit and engaging in trade (Benmelech and

4

Moskowitz, forthcoming, Rajan, forthcoming). A growing body of evidence suggests

that societies with different pre-existing ethnic and social interests are more prone to

civil conflict, provide fewer public goods and suffer diminished growth trajectories (e.g.

Alesina, Baqir and Easterly, 1999, Alesina and La Ferrara, 2005). An important “political

economy” tradition has emerged that emphasizes the role played by disparate economic

constituencies in impeding development and instead harnessing institutional reforms and

regulations to create barriers to entry and protect rents (e.g. Benmelech and Moskowitz,

forthcoming, Haber and Perotti, 2010, Rajan and Ramcharan, 2008, Perotti and von

Thadden, 2006, Acemoglu, Johnson and Robinson, 2005a).

Looking within one country does not allow the relative importance of England’s preexisting institutions to be assessed, however the use of detailed individual data does

permit measurement of the relative importance of different constituencies in a process of

institutional change that proved crucial for England’s development. Unlike a number of

papers in this literature, where interests form around differences in wealth, and shocks to

existing wealth provide the impetus for change, this paper argues that an important role

appears to have been played by shocks to future opportunities for wealth, in combination

with financial mechanisms that allowed disparate groups to share in those opportunities,

in building coalitions for reform. With the introduction of financial mechanisms to share

in future opportunities for growth and wealth potentially much easier to influence through

policy than attempting to reshape long-lived institutions driven by historical accidents or

existing distributions of wealth and capital, the paper provides a more hopeful message

for policymakers than many existing lessons drawn from England’s experience.

This paper also relates to an important literature on privatization.3 The potential

role that can be played by financial instruments in creating broad constituencies in favor of private property rights has found significant resonance in theoretical and policy

circles, most notably motivating voucher privatization in the post-transition Czech Republic and in Russia (Boycko, Shleifer and Vishny, 1994). These theories are backed by

some evidence that underpricing of privatized assets is used by right-wing governments to

consolidate domestic support in favor of lower taxation (Biais and Perotti, 2002, Jones,

Megginson, Nash and Netter, 1999) and that allocating shares may shift political allegiances in favor of less redistribution (e.g. Duca and Saving, 2008, Kaustia and Torstila,

2008). This paper complements this work by examining an environment where the introduction of shares created access to new opportunities for future wealth, rather than

implying an increase in individuals’ current assets. In England, the introduction of shares

appears to have actually led to support for higher taxation, funding policies, such as the

3

Megginson and Netter (2001) and Haber and Perotti (2010) provide useful overviews.

5

expansion of the Navy, that favored these new investment opportunities.4

Similarly, this paper builds upon an important literature on the role of news and

attention in mitigating the extent of the “stockholding puzzle”– deviations in individuals’

investments from the optimal market portfolio, which should include shares (e.g. Guiso

and Jappelli, 2005, Barber and Odean, 2006). In common with the mature stockmarkets

that are the main focus of this literature, the paper finds that in a nascent market, a

“news” shock common to elites generated significant increases in share ownership that

in turn led to the strengthening of representative political institutions.

The paper also contributes to a prominent debate, beginning with La Porta, Lopez-de

Silanes, Shleifer and Vishny (1998), on whether countries with common law legal origins

enjoy better investor protections that encourage diffuse corporate ownership (Haber and

Perotti, 2010). This paper documents that in England, the originating nation of the

common law tradition, the causal relationship went in the opposite direction: the diffusion

of share ownership encouraged both constitutional reform and improved legal protections

for investors. The potential positive feedback seen in England between diffuse corporate

ownership, representative government and legal protections suggests an answer to why

nations that transplant only one of these institutions, such as the common law, often

develop along very different trajectories.

Section 2 provides a brief background and a simple theoretical framework to understand the relation between endowments and choices that motivates the empirical

methodology. Section 3 introduces the new micro dataset on each member of Parliament

collected for this study (with further details in a Data Appendix). Section 4 presents the

results and Section 5 concludes. A detailed Historical Appendix draws on new statistical

evidence to document the relevant historical and constitutional context.

2

Background and empirical strategy

The English Civil War began as a struggle between the monarch and members of the Long

Parliament over the “prerogative”: the rights of the executive (see Historical Appendix

for details). As a major turning point in the political development of England and of

parliamentary supremacy in government, the lessons of the English Civil War have been

debated by many of the most prominent political economists ever since. For Karl Marx

and his intellectual successors, England’s Civil War was the “First Bourgeois Revolution”

4

Effective taxation in fact rose considerably after the Civil War and Glorious Revolution. This

difference is consistent with agents funding increased military action in support of their new interests

overseas, rather than a broad attempt to limit redistribution, as one might expect if a coalition of

wealthholders was driving institutional change (Brewer, 1989).

6

and as such an inspiration for revolutions in France and beyond (Stone, 1985).5 Among

modern economists, the seminal contribution of North and Weingast (1989) argues that

the Civil War and the Glorious Revolution of 1688 took place to protect the existing

wealth and property rights of property owners who were faced by the unusual avarice

of Stuart monarchs. The successful removal of kings in both cases yielded a credible

threat that then allowed future rulers to commit not to expropriate property, leading

to dramatic financial and fiscal development in England. Alternative interpretations by

Rajan and Zingales (2003) and Acemoglu, Johnson and Robinson (2005b) also stress

the importance of property rights, contending that the struggle was instigated by newlyenriched groups, whether a newly commercialized gentry in the former case, or merchants

who had benefited from the rise in Atlantic trade in the latter.6

In all three modern interpretations, a constituency of wealth holders emerged for

institutional reform that was able to obtain improved protection of domestic wealth

and property rights, leading both to representative government and to economic growth.

However, these theories have proven difficult thusfar to reconcile with a body of indirect

empirical evidence that suggests that domestic property rights were already relatively

secure in seventeenth century England, at least for the wealthy, and did not experience

much change thereafter. For example, Clark (1996) finds no appreciable reduction on

the interest rates on land due to the Glorious Revolution, as might be expected with

a lower risk of expropriation. In fact, he shows that property rights over freehold land

had been relatively strong throughout the seventeenth century. Similarly, examining the

lending history of a London financier, Quinn (2001) fails to find a fall in interest rates

on private capital over this period. Sussman and Yafeh (2002) reveal that the interest

rates on government debt responded more to Dutch capital markets and England’s wars

than to any reduced political risk from the Glorious Revolution.7

Since the central contest in the Civil War was between King and Parliament, theories

5

On the role of the English Revolution on inspiring the French, see Pincus (2009). A prominent

alternative to the Marxian view, associated chiefly with Whig historians, sees England’s revolution in

the seventeenth century as being a response to challenges to liberty and property rights by an increasingly

absolutist executive rather than about class struggle (Macaulay, 1898). A third “Revisionist” perspective

has pointed to particular episodes of amity between King and Parliament in the years leading up to the

Civil War to challenge the notion of broad economic or political struggle, and instead revives old views

that religious differences, such as Protestant ideology, were central in what was once called the “Puritan

Revolution” (Gardiner, 1883, Morrill, 1993).

6

The hypothesis that newly commercialized rural landowners were the major supporters of reform

finds resonance with interpretations by Barrington Moore (1966) and Tawney (1941). See also Brenner

(1993), who emphasizes the role of new merchants.

7

See also de Lara et al. (2008) and Murrell (2009). These effects may not have been uniform,

however. Once Parliament consolidated its control, charters for England’s transport infrastructure and

organization became more secure (Bogart, 2009).

7

about the identity, motivation or organization of groups responsible for England’s constitutional development should find validation in the observable history of who supported

and opposed the monarchy among England’s elected representatives. A particularly valuable feature of using these data is that the political allegiances of virtually all members

were publicly revealed by their actions during the Civil War. Parliamentary fence-sitters

on the eve of the Civil War were forced to choose between accepting the conflicting summons of the King to Oxford and of Parliament to Westminster. By 1644, every living

parliamentarian could be associated with one side or another (Brunton and Pennington,

1954) (see also Data Appendix).8

2.1

A simple theoretical framework

A simple theoretical framework can shed light on how to interpret the relationship between endowments, property rights and political choices. Suppose that the expected

utility for a member of parliament (MP) can be summarized by the following additive

relationship:

X

Ui =

βj xij + ur

(1)

j

where xij are predetermined individual endowments, βj represent the rates of return to

xij and ur contains other orthogonal factors that influence expected utility in a state of

the world r. Suppose that the support of an individual agent increases the chances of

victory by an amount s > 0. Suppose that each agent believes that with probability µ,

Parliament (P) will win the struggle against Royal authority (R).9 Let βz , z ∈ {P, R}

denote the rate of return on endowment j in the state of the world where either the

monarchy (R) or Parliament (P) won. Then the agent’s problem is to choose to support

8

The well-documented allegiances of Parliamentarians differs from other public figures. The loyalties

of local leaders were confounded by both local power politics and the presence of occupying armies. Even

London, often seen as the epicenter of Parliamentary power, initially had a strong Royalist presence

among its leadership, including a Royalist Lord Mayor.

9

Naturally, we expect µ to be affected by other agents’ choices. For plausible specifications of the

multi-agent game, we would expect multiple values of µ to be consistent with equilibrium. However, as

shown below, the specific realisation of µ is irrelevant for an agent’s decision, as long as µ ± s is interior.

This condition: that there is some uncertainty about whether Parliament or monarchy wins regardless

of an individual agent’s choices– makes sense in the historical context.

8

parliamentary or monarchical control:

"

max

!

(µ + s)

X

z∈{P,R}

!

+ (1 − µ − s)

xij βj|P + uP

X

j

xij βj|R + uR ,

!

(µ − s)

X

,

j

xij βj|P + uP

!#

+ (1 − µ + s)

j

X

xij βj|R + uR ,

j

The optimal choice implies a cut-off strategy: an agent will choose to support Parliament

if the value from supporting Parliament exceeds that of supporting the monarchy. Subtracting the values above reveals that an agent will choose to support political reform

if:

!

X

s

xij [βj|P − βj|R ] + (uP − uR ) > 0

(2)

j

The inequality (2) establishes that, given the linear utility specification above, a

sufficient condition for an agent’s decision to support political reform to be invariant

to the agent’s exposure to any particular endowment xij is that βj|P = βj|R . In other

words, support for political reform will be unaffected by an endowment if the value of

that endowment is the same regardless of regime. This will occur when there are believed

to be secure property rights for that endowment.

Furthermore, in this formulation, the condition above is in fact also necessary for

irrelevance of an endowment if MPs believe that their choice will have a non-zero effect

on the outcome (s > 0). This condition lends itself to an empirical test: if s = 0, it

implies that all endowments are irrelevant at the same time, and thus a joint test of

the significance of all endowments should be zero. The regressions below are sufficiently

significant to reject this test.

The inequality (2) also implies that those endowments that play the biggest role in

determining an MP’s support or opposition to political reform will be those most subject

to change in value based on the identity of the regime. These are likely to be endowments

that fell within the “prerogative” rights of the king under the existing constitution–

including those linked to overseas opportunities, trade, religion and royal patronage (see

Historical Appendix). All of these could be expected to change with Parliament’s seizure

of control over these rights.

Inequality (2) further yields an implicit condition on the minimum uP − uR required

9

for support for Parliamentary control. The probability of supporting Parliament is:

!

P{P } = F

X

sxij [βj|P − βj|R ]

(3)

j

where F (·) is the cumulative density function of uP −uR . Assuming that uz are normal or

uniform, Equation (3) can be estimated using standard probit or OLS respectively. The

coefficients γj from such a regression identify γj = s(βj|P − βj|R ). Note that s cannot be

identified, but must be non-negative.10 Thus, the sign of expected changes in the value

of the endowment can be inferred by inspecting the coefficients, but marginal effects are

necessary to assess the relative magnitude of such changes.

2.2

Estimating the effect of shareholding

One class of assets that might sway an individual’s propensity for constitutional reform

are shares in overseas joint stock companies. Joint stock companies were introduced into

England in the late sixteenth century to take advantage of new opportunities in the New

World and Asia. Prior to the joint stock company, traders were organized in “regulatory

companies” that were similar to medieval merchant guilds. Merchants in regulatory

companies gained the freedom, often after long apprenticeships, to engage in a particular

trade on their own account or in small partnerships. In contrast, agents of a joint-stock

company traded on behalf of that firm, which had a unified management, and ownership–

and thus risk– distributed among its often numerous shareholders.11 Thus, for the first

time, joint stock companies enabled sedentary agents to take advantage of potentially

10

In this simple specification, s is assumed to be the same for each agent. In a more general specification, we could imagine that an agent’s effect on the outcome of political struggle is a function of his

endowments, and make s a function of Xij . As long as the effect of support does not depend on whether

the agent supports the royalists or parliament and is distributed independently conditional on Xij , this

generalisation would change the structural interpretation of the coefficients γj , but not effect the sign or

irrelevance conditions described above, and we can still make inference on the marginal effects.

11

A near-contemporary account describes the motivations behind the founding of the mysterie and

companie of the Merchants adventurers for the discoverie of regions, dominions, islands and places

unknown in 1552:

And whereas many things seemed necessary to bee regarded in this so hard and difficult a

matter, they first made choyse of certaine grave and wise persons in maner of a Senate or

companie, which should lay their heads together, and give their judgements and provide

things requisite and profitable for all occasions: by this companie it was thought expedient

that a certaine summe of money should publiquely bee collected to serve for the furnishing

of so many shippes. And lest any private man should bee too much oppressed or charged, a

course was taken, that every man willing to bee of the societie, should disburse the portion

of twentie and five pounds a piece: so that in a short time by this means the sume of six

thousand pounds being gathered, the three shippes were bought (Hakluyt, 1589)[pp.267].

10

highly lucrative overseas opportunities, without themselves specializing in navigation and

commerce. Shares therefore may have aligned the interests of a broad coalition in favor

of political reforms aimed at enhancing the value of overseas investments.

The empirical section will provide estimates of Equation (3) and, in particular, measure the effect of prior shareholding in overseas companies on support for political reform.

If, as is suggested by the historical record, investments overseas were highly subject to

executive discretion (see Historical Appendix), and these investments were also likely to

be encouraged under the new regime, then a relatively larger effect of shareholding on

the decision to support increased parliamentary control should be expected.

Equation (3) will be estimated under two sets of assumptions. First, if the selection of investors into investment in shares was uncorrelated with subsequent political

decisionmaking, estimates can be made of the average effect of shareholding on support

for political reform among shareholders. In fact, this condition would be satisfied in

the benchmark canonical model of portfolio choice (Markowitz, 1959, Sharpe, 1964): assuming that investors are aware of all assets, there are no transaction costs, and there

are no uninsurable risks (such as accumulated human capital), all agents seeking the

mean-variance efficient portfolio should choose to hold the market portfolio. The market

portfolio would include shares in joint stock companies, as soon as they are introduced.

Differences in risk preference will affect the allocation of assets between risky and nonrisky assets, but not the particular set of risky assets, such as shares in joint stock

companies (Guiso and Jappelli, 2005). Thus in a frictionless environment, there should

be no systematic selection bias among those who choose to invest in shares, and OLS will

provide unbiased estimates of the average effect of the introduction of shares on support

for parliamentary reform among investors.12

Relaxing the strong assumptions underlying the canonical model allows us to delineate the relevant channels through which selection biases may occur and motivates the

identification strategy. First, it is plausible, particularly in a nascent stockmarket environment, that even fully rational agents cannot invest in particular assets that they do

not know exist (Merton, 1987). If investors face fixed costs in gaining access to information about particular assets, or more generally, in purchasing them, there will be a

correlation between the possession of liquid assets, or wealth, and investment in stocks.13

This may also lead to local geographical concentrations among shareholders (Coval and

12

Furthermore, if investors’ utility functions obey constant absolute risk aversion, investors will invest

the same amount in stock. Even with constant relative risk aversion, asset shares will be independent of

wealth- the poor and rich will hold the same proportion of each asset, including stock, but in differing

amounts (Guiso and Jappelli, 2005).

13

Indeed, such a correlation appears empirically confirmed among modern US and European populations (Guiso, Haliassos and Jappelli, 2003).

11

Moskowitz, 1999, Zhu, 2002), motivating the inclusion of a rich set of controls for the

geographical constituency of the MP, including distance to London, already the major financial center, and fixed effects for each county. While shares were often divisible during

this period, so that a number of individuals could get together to buy a single share, liquidity constraints and fixed costs in acquiring information may also be an issue. However,

the rich historical and biographical records available for each MP allow the development

of a rich set of controls for wealth endowments. These include whether an agent was

the eldest son (and thus the heir, particularly important during this period during which

primogeniture was customary), whether the agent inherited land or manors and whether

the agent’s father had an aristocratic title, a baronetcy or a knighthood.

Differences in human capital endowments can present an important source of noninsurable risk. Prior to the introduction of shares in England, individuals seeking to invest

overseas had to join a regulatory company and trade on their own account or in small

partnerships. Those who possessed such human capital were naturally already exposed

to foreign opportunities, and risks from changes in Crown foreign policy. In contrast,

the introduction of shares allowed sedentary non-merchants to gain such exposure for

the first time. Thus to test whether shareholding aligned the incentives of disparate

groups, a comparison can be made of the effect for merchants and non-merchants. If

shareholding aligned incentives for non-merchants to support political reforms in order

to pursue overseas opportunities, then a greater effect of shareholding on reform for

non-traders should be expected than for those with mercantile backgrounds, who could

already invest overseas in the absence of shares.

3

Data

Surprisingly, despite the importance of this episode, this is, to the author’s best knowledge, the first paper to systematically gather, digitize and analyze the endowments and

political choices of the individual MPs who initiated England’s constitutional reforms.

As summarized in Table 1, these data were collected from a number of different

primary and secondary sources. First, biographies of each member of the Long Parliament, drawing in particular from compilations by Keeler (1954), Brunton and Pennington

(1954), the History of Parliament Trust (forthcoming) and the Dictionary of National

Biography, were used to construct a range of endowment measures, including inherited

wealth and rank and whether an individual was apprenticed into a merchant company.14

14

The House of Commons consisted of representatives of 249 constituencies including the chartered

boroughs, the 59 counties and the Universities of Oxford and Cambridge. The franchise was limited to

12

The Data Appendix includes an example of such an entry.

Each individual, and their father and father-in-law, were matched to the data on

trading interests from Rabb’s 1967 lists of all investors in overseas companies mentioned

in the founding charters, patent rolls and subsequent transfer books of the major overseas

trading companies founded in England between 1575 and 1630. In total, Rabb provides

names of 6,336 investors mentioned during this period.15 These investor lists were further

supplemented and extended to 1640, where possible, using biographical information and

the charters of the Saybrook and Providence Island companies.

A rich set of controls for other endowments that may have played a role in influencing

these political choices were also collected. For example, religion has played an important role in the historiography of the Civil War. A combination of two proxies can be

used to capture the effect of Puritanism. First, biographical data identifies individuals

who attended Puritan seminaries or colleges that had strong Puritan ties.16 An MP’s

education at such institutions may be interpreted as an indicator of Puritan preferences.

To capture religious preferences among those who did not attend such institutions, data

was gathered on active Puritan ministers and Catholic recusants in the area each MP

represented from diocesan records.17

Parliamentary constituencies were further matched to a rich set of geographical and

other historical data that capture the impact of royal and noble influence on particular

MPs, differences in the preferences of boroughs and counties, cities, towns and ports, as

well as other forms of regional preferences (see Data Appendix for further details).

4

Results

As the descriptive statistics in Table 2 reveal, shareholders constituted 21 percent of members of the Long Parliament, or 116 members. Of shareholders, 76 percent invested in

unprofitable companies, with 59 percent investing solely in unprofitable ventures. Shareholders had similar wealth endowments to non-shareholders, including similar proportions

of MPs who were heirs, inherited ties to the royal court, had fathers with titles or had

a relatively few affluent “burgesses” in towns and owners of freehold land worth 20 shillings a year in

the counties. Birth dates that were not known were imputed where possible from the individuals’ entry

into colleges, inns, completion of apprenticeships and dates of knighthoods.

15

Some uncertainties about identity faced by Rabb were resolved. Remaining uncertainties stem

mainly from common names–such as Thomas Smith– which should constitute pure measurement error.

See Rabb (1967, chp.3) and the Data Appendix for a detailed discussion of each company.

16

For example, Emmanuel College, Cambridge, was founded in 1584 in order to render “as many

possible fit for the administration of the Divine Word and Sacraments.” (Porter, 1958, pg. 238).

17

These were at the ancient diocese level (McGrath, 1967). To get estimates at the county level, a

uniform distribution of ministers and recusants per unit of area in a diocese was assumed.

13

inheritances of manors or any landed estate. MPs who had been educated in Puritan

colleges or seminaries do not seem to have been more likely to invest. Shareholders do

however differ in two salient dimensions. First, as expected, shareholder MPs came of

age on average eight years closer to the time of Drake’s voyages, which demonstrated

the potential profits and feasibility of direct English trade to the Indies. Second, 23 percent of shareholder MPs came from mercantile backgrounds, while those with mercantile

background represented 14 percent of the sample as a whole. As we shall demonstrate

however, the effect of shareholding is largest on those without existing mercantile backgrounds.

Despite the broad similarities between the endowments of shareholders and nonshareholders, there are large differences in their political decisions. Three in four shareholder MPs supported the expansion of Parliamentary control in the Civil War, compared

to around half of non-shareholders. Shareholder MPs also were more likely to support

Parliament against the Crown at other points in the lifecycle of the struggle for which

roll call evidence survives: they were around half as likely as non-shareholders to vote

against the conviction of the Charles’ chief advisor, the Earl of Strafford, in 1640, more

likely to offer a loan to defend Parliament in London at the beginning of the war in 1642,

and less likely to be purged for favoring compromise with the King, allowing them to sit

in the Rump Parliament.

The summary statistics also reveal important similarities and significant differences

between Royalists and supporters of parliamentary reform. First, virtually all measures

of endowed wealth appear similar both among both populations, suggesting that the Civil

War was not fought to protect domestic wealth. Secondly, supporters of reform appear

to disproportionately come from mercantile and Puritan backgrounds, and less likely

to possess inherited court connections. This is consistent with the model, as overseas

property, religion and court patronage were all areas under which the Crown had broad

discretion under the existing constitution and were most likely to change in value with a

change in regime (see Historical Appendix).

Figure 2 reveals that while the delegations from certain areas, most notably East

Anglia, seemed more inclined to support Parliament, there is also significant withincounty and constituency variation in support for reform among MPs, and there are

discernable differences in the geographical patterns of investment in shares and in support

for reform. This suggests that regional differences, while potentially important, are not a

complete explanation of the relationship between shares and support for reform (Figures 1

and 2).

Table 3 presents regression results on the propensity to invest in overseas shares

14

among MPs. Note that merchants, even with similar wealth endowments, were more

likely to invest. Further, there was an inter-generational persistence in propensity to

invest; these factors will be controlled for in all regressions. However, apart from some

non-robust evidence for a relative lack of investment among the children of nobles, a

range of measures of domestic wealth endowments appear to have little effect on an MP’s

propensity to hold shares. Religion too seems to have little effect across specifications.

Despite individual wealth endowments having little influence on shareholding, Table 3

suggests that the propensity to hold shares does appear to differ with the constituency

of the MP. MPs from more densely populated counties, from constituencies outside the

Crown lands and representing ports were more likely to invest, though the distance from

London appears to have little consistent effect. These results are consistent with the

literature on local biases of investors (Coval and Moskowitz, 1999, Zhu, 2002): that

shareholding occurred among groups more familiar with opportunities overseas, not just

in London, but across the country. A rich set of controls, including fixed effect specifications that compare MPs from the same county, will address this variation.

Table 4 presents regressions assessing the role of endowments and shares on the probability of support for Parliamentary control of government during the Civil War, sequentially adding controls for personal and constituency characteristics (columns 1-5),

omitting the county of Middlesex, which included London and its environs (column 6) and

comparing MPs representing constituencies within the same county (column 7). Share

ownership is associated with a twenty percentage point rise in the probability of support

for Parliament, an effect that is strongly significant and remarkably unchanged with the

addition of rich controls for wealth, religion and geographical features.

Consistent with the theoretical framework, the other individual endowments that

show strong effects on support or opposition to political reform are those over which

the executive wielded discretion before the Civil War: mercantile interests, religion and

inherited ties to court (Columns 1-7). Naturally, the value of inherited ties to the royal

court would be deeply affected with a change in regime and the table reveals consistent

evidence that those with such ties were more likely to support the Crown. Further, the

positive effects of the two proxies for Puritanism are also consistent with the theoretical

framework, since following the Reformation, the Crown possessed prerogative control

over the newly-formed Anglican Church.18

18

Recent accounts revive the view that the “Puritan Revolution” was motivated by religious differences,

seeing the Civil War as a skirmish in the broader Wars of Religion (Morrill, 1993). However, it is unlikely

that this provides a complete explanation. As the Grand Remonstrance, issued by Parliament on the

eve of hostilities, suggests, MPs favored a “profitable” war in the Spanish West Indies instead of direct

conflict with Catholic Spain. Religion was also seen as an effective propaganda tool. As the contemporary

lawyer and MP, John Selden, wrote:

15

In contrast, a range of measures of endowments of domestic wealth appear to have

little effect on support for reform, including the MP’s status as an heir or the inheritance

of a manorial estate, that would be a strong determinant of whether an MP was considered

a member of the “gentry”. Other wealth endowment measures appear to have no effect,

with one exception– that the sons of aristocrats were less likely to rebel. There is also

little evidence in these data to support the theory that MPs from families of newly

commercialized gentry who acquired land during and after the reign of the Tudors–

which spanned the dissolution of monasteries during the Reformation– were more likely

to support Parliamentary control as suggested by Tawney (1941),Moore (1966) and Rajan

and Zingales (2003). These results instead suggest that support for parliamentary control

of government was unaffected by endowments of new or old wealth, and thus that it is

unlikely the Civil War was fought primarily to defend domestic property.19

It could be that MPs’ support for Parliamentary control was shaped more by the

interests of their constituency than by their individual investments in shares. Indeed, it

may be that the effect of shareholding may be capturing the fact that shareholder MPs

were more likely to represent ports newly-enriched by Atlantic trade (Acemoglu et al.,

2005b). Another possibility is that the effect of shareholding is capturing the preferences of MPs who represented dense populated counties or regions, such as East Anglia,

that had different legacies of law and institutions from the medieval period that made

them more likely to support Parliamentary control (Fischer, 1989). However, adding a

range of controls for constituencies of representation has little effect on the coefficient of

shareholding, and there is no evidence that MPs representing towns or ports were more

likely to support Parliamentary control (Columns 2-7).20 Though MPs representing constituencies closer to London appear to be more likely to rebel, these MPs were not more

likely to invest in shares (Table 3). Even comparing MPs representing constituencies

from within each of the 52 historic counties in England and Wales does not appear to

diminish the effect of shareholding (Column 7).

Despite a rich set of wealth and geographical controls that address the main sources

the very Arcanum of pretending religion in all wars is that something may be found out in

which all men may have interest. In this the groom has as much interest as the lord. Were

it for land, one has one thousand acres and the other but one; he would not venture so far

as he that has a thousand. But religion is equal to both. Had all men land alike, then all

men would say they fought for land (Hill, 1961)[pg. 105].

19

It is interesting to note that, even though the lands of Royalists were confiscated during the hostilities,

the vast majority were able to regain their lands upon the payment of a “compounding” fine– a percentage

of a year’s income.

20

Controlling for measures of per capita county wealth gleaned from the Tudor lay subsidies (Sheail,

1998) also has no effect on the results, but contains gaps that significantly reduce the sample size (results

not shown).

16

of likely selection, there still might be an unobserved driver of shares, such as unobserved

wealth, that might impact both share ownership and the propensity to support Parliament. Following Altonji, Elder and Taber (2005), the bottom panel of Table 4 estimates

the potential bias due to selection under the assumption that the relationship between

shareownership and our rich set of controls is merely representative of the relationship

between shares and unobserved drivers of shareownership. Since the measures of wealth

and geographical factors were specifically gathered to reduce the bias on shares, the assumption that they are instead merely representative is likely to be weak, leading to a

lower bound estimate of the effect of shares. The estimated bias is significant at the 10%

level for the more parsimonious specifications, though becomes insignificant by adding

the large set of county fixed effects. Regardless, the implied lower bound on the effect of

shares appears to be quite stable: for the preferred specification with the richest control

set, including county fixed effects, the lower bound suggests that shareownership results

in a 12.5 percentage point increase in the probability of supporting Parliamentary control

of government. Further, the shift in shareownership due to unobservables would have to

be 2.5 times as great as the shift due to this richest control set to eliminate the effect of

shares, suggesting that at least part of this effect is real.21

Figure 3 provides a complementary approach to assessing the sensitivity of our results to selection bias, following Imbens (2003). The figure compares the partial correlations between the observed covariates, shareownership and support for Parliament,

relative to the thresholds necessary for an omitted binomial variable to reduce the effect of shareholding to insignificance at conventional levels. Consistent with Table 3 and

the robustness of the effect of shares across specifications in Table 4, the coefficient on

shareownership is largely insensitive to the inclusion or deletion of the wealth of included

observable covariates. The variables that are most correlated with shareholding are geographic constituency characteristics, such as population density and representation of a

port constituency which, however, show weak correlations with the propensity to support

Parliament. In fact, as the figure reveals, no observable covariate is sufficiently correlated

with either shareownership or support for Parliament to eliminate the effect of shares at

the conventional 5% significance level. Even at the more stringent 1% level, only the

positive correlation between shareholding and inherited court connections (which would

conversely imply stronger support for the Crown) is strong enough to have that effect.

Table 5 adds an interaction term between shareholding and mercantile endowments

21

These results are also consistent with that from nearest neighbor propensity score matching, with

estimated effects [and clustered bootstrapped standard errors] of shares on the propensity to support

Parliament among shareholders of 0.129 [0.084] and 0.217 [0.062], matching on personal and additionally

on constituency characteristics respectively.

17

to the specifications in Table 4. While the point estimates on shareholding show a

slight increase with the addition of this interaction term, there is also a robust, strongly

significant and offsetting negative interaction effect between shareholding and existing

mercantile interests. These results are consistent with an alignment effect: by providing

non-merchants with the opportunity to benefit from overseas trade and expansion, the

effect of shares on support for parliamentary control should be greater relative to those

with existing mercantile endowments, who already enjoyed such opportunities and a

relatively strong propensity to support Parliament.

Figure 4 illustrates this effect, plotting the distribution of predicted probabilities

by share investment and overseas trading interests. Notice that merchants who had

previously invested in overseas shares do not seem to be very different from merchants

who had not done so: both were later likely to support Parliament against the Crown.

However, while the median non-merchant was actually slightly more likely to support

the Crown in the absence of share investment, non-merchant shareholders reveal broad

support across the distribution for parliamentary control.

Even though there is no significant effect of a range of measures of domestic wealth

on support for political reform, it still might be the case that insecure domestic property

rights were crucial in the decisions of agents to support political reform and that the effect

of shareholding occurs not through the alignment of interests across groups in favor of

control over sovereignty rights, but rather due to a desire to protect newly acquired wealth

from investments in profitable overseas companies Acemoglu et al. (2005b). However the

accumulation of new wealth does not appear to be driving these results. Table 4(Panel

B) compares shareholders who only invested in companies that were unprofitable prior to

the Civil War to otherwise similar MPs. The effect of shares in unprofitable companies

appears to be actually slightly stronger, and once again the effect is mainly on those

without pre-existing mercantile interests. Though this result may appear somewhat

counter-intuitive, it is in fact consistent with the theoretical framework: those with

profitable overseas investments under the existing regime have something to lose (a −βj|R )

with constitutional change relative to those with non-performing investments under the

existing regime.

We can use the lower bound estimates of the effect of shares using the full set of

controls with county fixed effects in Table 4 and in Table 5 to perform a counterfactual

exercise. As discussed above, MPs were faced with the stark choice of supporting the

Crown or Parliament during the Civil War. Since this choice is symmetric– not making

a choice is not an option– those pushed over the 50% probability threshold of supporting

Parliament due to holding shares can be thought of as likely switchers of allegiance from

18

the Crown.

If we subtract the lower bound estimate of the effect of shares of a 12.5% increase

from the predicted probability that shareholders support Parliament, the median MP

had a probability of support for Parliament of 43.6%, and thus actually was more likely

to support the Crown rather than Parliament. In fact, a majority of 58.6% of MPs would

have been likely to support Crown authority. With the addition of the lower bound effect

of shares, the median MP had a 56.7% probability of supporting Parliamentary authority,

with an implied associated majority of 59.0% in favor of constitutional reform. While

such a majority would not of course have been a necessary condition for Parliamentary

reforms to take place, and these counterfactual exercises are at best suggestive, the extent

of these swings even assuming the lower bound effect of shares does indicate that shares

played an important, and likely pivotal, role in broadening the coalition for reform.

While the effect of shares does appear to generate a shift in the support of the median

MP towards Parliament, we can also extend our counterfactual exercise to examine the

extensive margin: those individual MPs that were likely to have been pushed over the

threshold towards support for constitutional reform due to shares. The number of those

pushed over the threshold ranges from 20 using the lower bound estimate to 29 (or 5.4%

of all MPs) using the conventional estimates derived from Table 4.

Table 6 further unpacks these figures by using the lower bound and conventional

estimates from Table 4 with the full set of controls and county fixed effects to isolate

the compliant switchers: shareholder MPs who ultimately supported Parliament but,

all else equal, were actually more likely to have supported the Crown in the absence of

shares. As the table suggests, the majority of these MPs appear to have otherwise lacked

mercantile interests. While a few were involved in the profitable new trading companies,

like the East India company and the Levant company, a large majority were invested in

unprofitable colonization projects, with shares bringing acres of land in the New World,

but whose charters and investments were subject to Crown appropriation (see Historical

Appendix). Close to half were also involved in companies, particularly the Providence

Island company, that made violent privateering incursions into profitable Spanish trade

routes in the West Indies.22

A remarkable feature of Table 6 is that despite looking at members who otherwise

would have supported the Crown in the absence of shares, the table contains three of

the famous “Five Members” that were identified by the King to be ringleaders of Par22

In fact, in 1643, the newssheet Mercuricus Civicus claimed that the struggle “was conceived (some

say) near Banbury and shaped in Gray’s Inn Lane, where the undertakers for the Island of Providence

did meet and plot it” (Kupperman, 1993)[pg.6]. Though an extreme interpretation, it is still indicative

of contemporary perceptions.

19

liament’s legislative challenges to his prerogative rights. The King’s illegal armed entry

into Parliament to arrest the Five for treason in January 1642, which later led to the

mobilization of the London militia in defense of Parliament, is often seen as a major step

towards the outbreak of violent conflict (Hexter, 1941, see also Historical Appendix). Of

the three MPs– Denzil Holles, John Pym and William Strode– John Pym in particular

is seen by historians as a major figure in initially organizing the coalition in favor of

Parliamentary control (Hill, 1961, Hexter, 1941).23 Yet even the lower bound estimates

suggest these leaders of the opposition might have actually favored support for the Crown

in the absence of shares. Instead of being radical extremists, it may be that the leaders

of the push for constitutional reform were instead effective at creating a coalition precisely because their interests were aligned with both sedentary landowners and overseas

traders. Shares may have played an important role in this.

Table 7 presents results using the same sets of controls to estimate the effect of

shares on other indicators of support for Parliamentary control of government over the

lifecycle of the struggle. The first panel provides evidence on the MP’s decision of the sole

legislative vote from the period on which individual roll calls survive: that of whether an

MP voted for or against the “attainder” of the King’s chief advisor, the Earl of Strafford,

in 1641.24 The second panel indicates support on the eve of hostilities, where evidence

exists of who subscribed to a loan for the defense of the London Parliament in 1642.25 The

third panel assesses whether the MP sat in the “Rump” Parliament of Civil War victors

that implemented many of England’s changes in foreign policy from 1648-53 (please see

Figure 8 and the Historical Appendix).

The broad picture that emerges is that at least as early as the peaceful legislative push

for reform in 1640-42, shareholders were consistently more likely than non-shareholders to

oppose executive authority. This continued across the lifecycle of the struggle. Further,

where merchants exhibit significant differences to non-merchants, shares appear to align

23

The remaining two of the Five were John Hampden and Arthur Haselrig, both proprietors of the

Saybrook Company, and apparently strongly connected to the Providence Island venture. Shareholding

does not however appear to be pivotal in shifting their support in these estimates. Another notable

name in the list is Oliver St John, John Hampden’s lawyer and Oliver Cromwell’s brother-in-law, who

played an key role in the Council of State under the Rump Parliament (See also Hillmann, 2008).

24

Unlike later in the seventeenth century, records of MP’s votes in Parliament were not systematically

kept, with one exception. In April 1641, Parliament voted to convict the King’s chief advisor and

architect of many of his policies, Thomas Wentworth, the Earl of Strafford. Those who voted against

the conviction were seen as supporters of royal authority and their names were anonymously posted in

Westminster Yard.

25

In June, 1642, claiming that the “King (seduced by wicked Counsel) intends to make War against

his Parliament”, the Long Parliament passed an ordinance soliciting a loan to “uphold the Power and

Privileges of Parliament”. Lists survive of the subscribers who were promised the return of their funds

with 8% interest, and that “no Man’s affection [to Parliament and its privileges] shall be measured by

the Proportion of his offer . . . ”, but rather by the act of participation (Firth and Rait, eds, 1911)[pg.6-9].

20

non-merchant choices with merchants. The fact that both non-merchant shareholders

and merchants were significantly more likely to sit in the Rump Parliament suggests a

direct link between the genesis of the coalition for reform and the subsequent dramatic

changes in England’s public investments in the Navy and its foreign policy that occurred

upon its success.

4.1

Drake’s voyage as an exogenous shock to investment

Next we consider the possibility that the OLS estimates, rather than being upper bounds,

are actually underestimates. This is due to the presence of a classic hold up problem–

with the Crown able (and as the Historical Appendix reveals, willing) to expropriate

the returns from overseas investments, some individuals may have been motivated by

the new access to overseas opportunities provided by shares to support reform, who also

faced incentives to wait until after the reform to actually invest. This would lead to a

downward bias in the measured effect. To assess whether this is the case, we can exploit

an arguably exogenous shock to information about the potential benefits from overseas

investments that resulted from Drake’s unlikely and remarkable feat of navigation.

In September 1580, the Pelican, the sole survivor of a fleet of five ships that had

sailed three years earlier, moored at Plymouth harbor in England.26 Her captain, Francis

Drake, had achieved an unlikely success– the circumnavigation of the world, direct trade

with the Spice Islands, and a raid on treasure ships in the Pacific that caught Spain

entirely unprepared. Drake’s voyage and the charts of ports, watering places and trade

routes that he constructed meant that for the first time English traders could break into

Portuguese and Spanish monopolies in Eastern trades (Andrews, 1967). Not only did

Drake’s voyage change the feasibility of English trade, it also amply demonstrated the

scale of profits to be had from trade and plunder. The details of Drake’s voyage, being

technically illegal, was kept a closely-guarded secret. This changed in 1585, when Drake

successfully raided Spanish ports in the Atlantic as well, demonstrating their vulnerability

to English attacks. Knighted by Elizabeth I, Drake’s extraordinary achievements made

him a national hero.27

Whereas previous English attempts for form joint stock ventures for overseas exploration, as late as Gilbert in 1583, had struggled to find outside financing (Williamson,

1946), suddenly a cohort of Englishmen and women were inspired by Drake’s voyages to

26

The Pelican later gained further fame under her new name: the Golden Hind.

The Spanish Ambassador, Bernardino de Mendoza, cautioned Philip II to destroy all English and

French ships that might enter the Pacific as: “. . . at present there is hardly an Englishman who is not

talking of undertaking the voyage, so encouraged are they by Drake’s return . . . everybody wants a share

in the [next] expedition. . . (Rabb, 1967)[pg.20]”

27

21

invest in endeavors overseas (Andrews, 1967).28 The effects were not confined to London.

As a clergyman in the West Country town of Exeter, Thomas Hooker, wrote in 1585,

Drake’s exploits:

inflamed the whole country with a desire to adventure unto the seas, in hope of

like success, [so] that a great number prepared ships, mariners and soldiers and

travelled every place where any profit might be had . . . (Andrews, 1964)[pg.4].

Research on the “stockholding puzzle” emphasizes a number of factors, beyond wealth,

that foster increased stockholding in contemporary stockmarkets. A common theme

is that individuals buy stock when they are paying attention. High profile events, or

stocks with extreme one day returns, attract new investors, both by advertising the stock

and by generating social feedback: individuals invest more if they know those around

them are investing as well (Hong, Kubik and Stein, 2004, Grullon, Kanatas and Weston,

2004, Guiso and Jappelli, 2005, Barber and Odean, 2006). Inexperienced investors are

particularly influenced by bursts of high returns (Greenwood and Nagel, 2006).

All of these features appear to parallel the nationwide enthusiasm that swept England

in 1585. There was a perception of extremely high returns to Drake’s voyages which were

ultimately high profile events that hit everyone at the same time (Andrews, 1967). This

may have created a “social effect”. Those coming of age in 1585, in particular, were

both inexperienced and free for the first time to deploy resources, thus more likely to be

paying attention to these new opportunities.

As Figure 5 reveals, Drake’s voyages did indeed act as a shock to the propensity

to invest in joint stock by the cohort of Long Parliament MPs who became adults at

this time. The effect diminishes almost monotonically among subsequent generations,

however, reflecting the failure of these ventures to make profits, due in large part to

Crown policy and predation (see Historical Appendix). Furthermore, as Figure 6 reveals,

other endowments, with one possible exception, show insignificant trends and do not

reveal significant jumps before and after 1585.29

Table 8 augments the regressions on the propensity to invest in shares to include

polynomial age controls, revealing a consistent zero direct effect of age on the propensity

to hold shares across specifications (Columns 1-5). However, consistent with Figure 5,

28

The women included Elizabeth I herself, who took her substantial proceeds from Drake’s voyage and

invested them in joint stock ventures rather than buying back Crown lands that she had been selling to

service debt.

29

That exception: that MPs who came of age after 1585 appear less likely to inherit land, would, if

anything be expected to result in a reduced incentive to support reform, if the property rights/ wealth

story is correct. Regardless, controls for these and other wealth endowments will be included in all

regression tables.

22

there is a jump in the propensity to invest among those that came of age after 1585, that

declines among those who came of age in the years thereafter (Columns 6-9). MPs that

came of age just after 1585 were around 30-45 percentage points more likely to invest in

shares compared to those who came of age just before.

We can use this jump in investment to compare support for political reform among

those investors who invested because they came of age just after Drake’s voyages and

otherwise would not have invested. This regression discontinuity is “fuzzy” as not everyone who came of age after this time deterministically invested, suggesting that two-stage

least squares estimates are appropriate. As the bottom panel of Table 8 reveals, the

instruments are robust and strongly jointly significant across a range of specifications.30

Table 9 presents regressions of our four different indicators of support for reform

on shares, both including quadratic controls for age (Cols 1-4) and implementing the

regression discontinuity design (Cols 5-9). First note that the quadratic controls for age

do not reveal an independent effect on any of our measures of support for reform. The

effect of shares is also robust to the inclusion of age controls. This suggests that age

effects are unlikely to be inducing the robust relationship we see between shareholding

and support for political reform.

Furthermore as the regression discontinuity results reveal, relative to those who came

of age just before Drake’s return, those who invested because they came of age just after

Drake’s voyage were, once again, more likely to support Parliamentary reform during the

Civil War and reveal consistent patterns across the early lifecycle of the struggle. As

the regression discontinuity depends on the relatively small number of MPs who came

of age prior to 1585 to identify a separate trend, some specifications are not precisely

estimated and the effects should be interpreted with caution. It is nevertheless reassuring

to find consistent point estimates across specifications, many of which are significant at

conventional levels.

It could be that those that came of age in 1585, instead of being motivated by nonperforming assets that they acquired overseas through shareholding were instead were

inspired by Drake to be ‘dreamers’ with strong tastes for risk that they managed to

maintain despite years of subsequent disappointment in the performance of their investments.31 However once again, the interaction effects suggest that the effects were mainly

30

We can also compare investment among those MPs from the cohorts most likely to be different:

those that came of age the same regime: comparing among Elizabethans, Stuarts, and those who came

of age under the “11 Years Tyranny” from 1629-1630 when no Parliament sat in England. The latter

cohort effect also allows us to assess whether increased shareholding came about due to attempts by

companies to “bribe” sitting MPs. However, the cohort effects are insignificant and do not substantively

effect the results (results not shown).

31

Such a possibility would run counter to work by Malmendier and Nagel (2007), who find that

23

on non-merchants, consistent with the role of shares in aligning interests, rather than

being reflective of a cohort-wide taste for risk.

4.2

Alternative channels

It is possible to implement further tests of the two key alternative channels– domestic

wealth and ideology– that have been mooted as explanations for the successful development of a coalition in favor of political reform in England. It could be, for example, that

our measures of endowed domestic wealth are simply not precise, and lack of precision,

rather than strength of property rights is responsible for a lack of an effect on support

for reform. Table 10 (Panel A) tests whether these endowment measures have any effect

on that subsample for which measures exist of an MP’s income at the time of the Civil

War. Though it appears that there are differences in contemporaneous income between

shareholders and non-shareholders, these are mainly due to merchant shareholders, and

the effect for non-merchants cease to be significant in the preferred specification with

full controls. There are also no discernable differences among shareholders who invested

because they came of age just after Drake’s voyages.

Further, Table 10 (Panel A) shows that inheritances of landed estates and titles are

all strong determinants of contemporaneous income. This suggests that our measures of

endowed wealth do capture important variation in contemporary income and it is not

imprecision that is leading to a lack of a domestic wealth effect.

A second possibility is that the effect of shareholding is capturing unobserved preexisting differences in political allegiances that led individuals to oppose the Court and

happened to also invest in shares. This “ideology” story would suggest that in the years

before the Civil War, anti-monarch shareholders would be also less likely to attend court

or work for the Crown. In contrast, if the theoretical framework above is correct, then

prior to the stark decision to support or oppose constitutional reform in the Long Parliament, individuals with endowments most subject to executive control, including shareholders, would paradoxically face a greater incentive to secure their property through

investing in client relations with the Royal court.

Table 10 (Panel B) examines the effect of shareholding on the acquisition of court

positions. Here the potential for endogeneity is significant: some courtiers may have

invested in joint stock since they had more access to royal charters and royal patronage,

or alternatively, the ruler may have attempted to buy off the most recalcitrant members

of his opposition. However, as the RD specifications suggest, shareholders who invested

investors weight more recent experiences more heavily.

24

overseas due to Drake’s voyages were more likely to acquire court positions, with a greater

effect for non-merchants than for those with existing trading interests. Thus, it appears

that shareholders did attempt to work within the existing constitutional system to secure overseas property: prior to the Long Parliament, shareholders were not consistently

opposed to the Court, and many assumed court roles.32 In contrast, there is no evidence that those endowed with greater domestic property cultivated more ties to court,

suggesting once again that domestic property rights were relatively secure.

5

Discussion

With English political institutions strongly influencing the institutional design of many

nations around the world, the question of how a novel, broad, and ultimately successful

coalition in favor of parliamentary supremacy in government emerged in England has

proved to be among the most enduring in political economy and institutional economics.

This paper provides the first direct evidence on the determinants of individuals’ decisions to join the coalition for revolutionary reform. The paper documents the contrast

between the relative lack of importance of domestic wealth and the significance of overseas interests in support for reform. By highlighting the empirical and constitutional

distinction between the relative security of domestic property rights and the executive’s

discretion over rights overseas, the paper reconciles theories that suggest that England’s

reforms were driven by those seeking to protect property (e.g. Acemoglu et al., 2005b,

Rajan and Zingales, 2003, North and Weingast, 1989) with a lack of evidence of change

in existing property rights in the seventeenth century (e.g. Murrell, 2009, Sussman and

Yafeh, 2002, Clark, 1996).

The paper also sheds new light on how a constituency in favor of parliamentary

supremacy was created. Through the innovative use of shares in joint stock companies,

access to new overseas opportunities expanded beyond traders to encompass other groups