Banks and Development: Jewish Communities in the Italian Renaissance Luigi Pascali

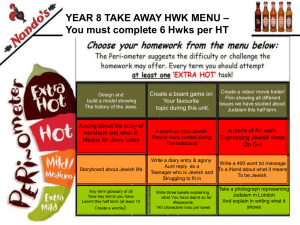

advertisement