MIDDLE TENNESSEE STATE UNIVERSITY FINANCIAL REPORT For Year Ended June 30, 2001

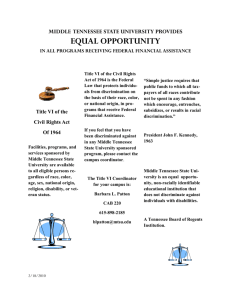

advertisement