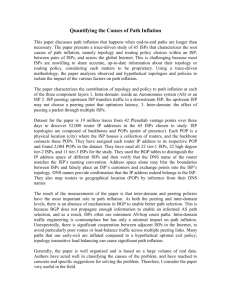

Interconnection, Peering, and Settlements Abstract

advertisement