State of Oklahoma FY-2011 Revenue Certification March 31, 2010

advertisement

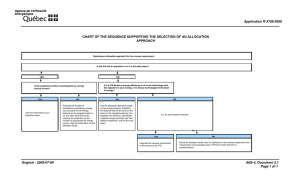

State of Oklahoma FY-2011 Revenue Certification March 31, 2010 Contents • Economic Outlook • FY-2010 Projection Changes • FY-2011 Estimate Changes • Budgetary Context Forecast of United States Real GDP Growth FY-2009 FY-2010 Source: Oklahoma State Econometric Model / Bureau of Economic Analysis Update 2/12/10 FY-2011 Comparison of United States vs. Oklahoma Employment Growth FY-2009 FY-2010 OK U.S Source: Oklahoma State Econometric Model / U.S. Growth Update: Bureau of Labor Statistics FY-2011 OK U.S FY-2010 General Revenue Fund Projection (December) vs. Projection (February) $ in millions • FY-2010 December Projection • FY-2010 February Projection $4,415.0 $4,475.8 • $60.8 million or 1.4% above December *For more detail, see Schedule 11, page 11. Fiscal Year 2010 GR Projection (December) vs. Fiscal Year 2010 GR Projection (February) FY-2010 December ($M) Gross Production – Gas FY-2010 February ($M) Difference Difference ($M) (%) $195.2 $273.5 $78.4 40.2% 87.7 113.8 26.1 29.8% Individual Income Tax 1,652.6 1,647.2 (5.3) (0.3%) Corporate Income Tax 172.4 153.6 (18.9) (10.9%) Motor Vehicle Tax 124.9 142.2 17.3 13.9% 1,512.0 1,477.7 (34.3) (2.3%) $3,744.8 $3,808.0 $63.2 1.7% 670.2 667.8 (2.4) (1.4%) $4,415.0 $4,475.8 $60.8 1.4% Gross Production – Oil Sales Tax Subtotal Other Total *For more detail, see Schedule 11,page 11. Fiscal Year 2010 GR Estimate (June) vs. Fiscal Year 2010 GR Projection (February) FY-2010 June ($M) FY-2010 February ($M) $427.5 $273.5 ($153.9) (36.0%) 0.0 113.8 113.8 0.0% Individual Income Tax 2,044.1 1,647.2 (396.9) (19.4%) Corporate Income Tax 307.3 153.6 (153.7) (50.0%) Motor Vehicle Tax 141.4 142.2 0.8 0.6% 1,754.1 1,477.7 (276.4) (15.8%) $4,674.4 $3,808.0 ($866.4) (18.5%) 741.0 667.8 (73.2) (9.9%) $5,415.4 $4,475.8 ($939.6) (17.4%) Gross Production – Gas Gross Production – Oil Sales Tax Subtotal Other Total *For more detail, see Schedule 10, page 10. Difference Difference ($M) (%) FY-2011 GR Estimate (December) vs. FY-2011 GR Estimate (February) FY-2011 December ($M) Gross Production – Gas FY-2011 February ($M) Difference Difference ($M) (%) $225.1 $320.1 $95.0 42.2% 71.0 114.0 43.0 60.6% Individual Income Tax 1,661.4 1,663.5 2.1 0.1% Corporate Income Tax 182.3 157.2 (25.1) (13.7%) Motor Vehicle Tax 108.5 128.9 20.4 18.8% 1,555.9 1,542.9 (13.0) (0.8%) $3,804.2 $3,926.6 $122.4 3.2% 644.4 653.4 9.0 1.4% $4,448.6 $4,580.0 $131.4 3.0% Gross Production – Oil Sales Tax Subtotal Other Total *For more detail, see Schedule 12, page 12. Contents • Budgetary Context Comparison of Authority 2010 Session (December) vs. Proposed Authority 2010 Session 2010 Session 2010 Session Authority Authority Dec. ($M) Feb. ($M) Certified Difference ($M) Difference (%) $4,306.9 $4,431.6 $124.7 2.9% 1017 Fund 547.3 541.6 (5.7) (1.0%) GP – Oil Education Funds 142.1 142.1 0.0 0.0% Tobacco Fund 18.2 18.2 0.0 0.0% Judicial Revolving Fund 38.0 38.0 0.0 0.0% 0.2 0.2 0.0 0.0% 210.7 211.6 0.9 0.5% 0.0 0.0 0.0 0.0 31.5 31.9 0.4 1.3% $5,294.9 $5,415.2 $120.3 2.3% Prior Certified State Transportation Fund Bond Funds Cash Total *For more detail, see Appendix A-2, pages 16 & 17. Totals may differ, due to rounding. Comparison of Actual Expenditures 2009 Session vs. Proposed Authority 2010 Session 2009 Session 2010 Session Difference Actual Authority ($M) ($M) ($M) Certified Difference (%) $5,222.8 $4,431.6 ($791.2) (15.2%) 633.6 541.6 (92.0) (14.5%) GP – Oil Education Funds 99.6 142.1 42.5 42.7% Tobacco Fund 24.2 18.2 (6.0) (24.8%) Judicial Revolving Fund 34.0 38.0 4.0 11.8% 0.1 0.2 0.1 100.0% 208.7 211.6 2.9 1.4% 0.0 0.0 0.0 0.0% 393.6 31.9 (361.7) (91.9%) $6,616.6 $5,415.2 ($1,201.4) (18.2%) 1017 Fund Prior Certified Transportation Fund Bond Fund Cash Total *For more detail, see Appendix A-1, pages 14 & 15. Totals may differ, due to rounding. *FY-2011 data reflects February projections only. • NCSL REPORTS SHOW THAT STATES CLOSED BUDGET GAPS IN EXCESS OF $145 BILLION IN ORIGINAL FY-2010 BUDGETS ONLY FOR A NEW ROUND OF SHORTFALLS TO OPEN TOTALING $28.2 BILLION 41 states reported new mid-year shortfalls in addition to gaps originally closed by FY-2010 enacted budgets. 14 states reported additional mid-year cuts of 7% or greater. Sources: Center on Budget and Policy Priorities; Article “Recession Continues to Batter State Budgets: State Responses Could Slow Recovery”, February 25, 2010 and the National Conference of State Legislatures GAP REPORTED ($) % OF BUDGET CUTS ENACTED OR PROPOSED ARIZONA $1.9 Billion 19.7% 7.5% + Targeted ARKANSAS $162 Million 3.6% 2.2% COLORADO $601 Million 8.0% Targeted KANSAS $459 Million 7.5% 3.3% + Targeted MISSOURI $690 Million 7.7% 2.5% + Targeted NEBRASKA $155 Million 4.4% 2.5% + Targeted NEW MEXICO $650 Million 11.8% 10% + Targeted TEXAS $3.3 Billion 7.6% Not Reporting STATE BUDGET AGREEMENT FY-2011 Compared to FY-2010 If Budgeted at FY-2010 Levels (In Billions)