A W E E K LY ...

advertisement

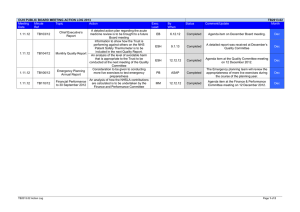

February 22, 2002 A W E E K LY F I N A N C I A L D I G E S T Economy Gathering Speed, Markets Gathering Dust Canadian Retail Sales Surge in Q4; GDP Likely Rose Leading Indicators Point North Low Expectations for Japan’s Coming Anti-Deflation Measures Sags Dr. Sherry Cooper 3 WEEKLY HIGHLIGHTS 4 RETURNING TO EQUITY RETURNS 7 KEY FOR NEXT WEEK CHIEF ECONOMIST Douglas Porter Dr. Russell Sheldon INSIDE SENIOR ECONOMISTS David Watt FINANCIAL ECONOMIST Jennifer Lee ECONOMIST Marco Fedele Ryan McGaw ECONOMIC ANALYSTS www.bmonesbittburns.com/economics 1-800-613-0205 A WEEKLY ECONOMIC NEWS GOOD NEWS Retail Sales +1.6% (Dec.)— and ex. autos +0.8% BAD NEWS Manufacturing Shipments -1.8% (Dec.) CANADA Trade Surplus widened to $4.5 bln (Dec.) Manufacturing New Orders -2.5% (Dec.) B.C. deficit projected to widen to $4.4 bln (FY03) Wholesale Trade +0.3% (Dec.) EconoPulse +1.9% (Jan.) Leading Indicator +0.9% (Jan.) Housing Starts +6.3% to 1.68 mln a.r. (Jan.) Building Permits +3.1% to 1.71 mln a.r. (Jan.) Initial Claims +10,000 to 383,000 (Feb. 16 wk) USA Consumer Prices +0.2% (Jan.) taking y/y rate to just 1.1% Redbook +0.8% (Feb. 16 wk) Trade Deficit narrowed to $25.3 bln (Dec.) Leading Indicator +0.6% (Jan.) Philly Fed Index +1.3 pts to 16.0 (Feb.) Retail Sales +2.0% y/y (Dec.) Jobless Rate +0.5 ppt to 3.0% (Jan.) MEXICO Wholesale Sales -8.8% y/y (Dec.) Tokyo Dept Store Sales -1.4% y/y (Dec.) JAPAN Euroland—Industrial Production +0.8% (Dec.) Euroland—Trade Surplus widened to €8.7 bln (Dec.) Germany—Wholesale Prices +1.2% (Jan.) EUROLAND France—Real GDP -0.1% q/q (Q4 P) Italy—Consumer Confidence +4 pts to 127.3 (Feb.) France—Consumer Spending -0.4% (Jan.) Italy—Industrial Orders -8.6% y/y (Dec.) Public Sector Budget Surplus £12.2 bln (Jan.) Retail Sales -0.3% (Jan.) U.K. Wage Costs slowed to +0.7% q/q (Q4) Germany—Construction Orders -9.8% (Dec.) Trade Deficit widened to £3.1 bln (Dec.) AUSTRALIA Indications of stronger growth and a move toward price stability are good news for the economy February 22, 2002 PAGE 2 of 10 A WEEKLY HIGHLIGHTS Dousing the Recession Flame Evidence continues to build that North American activity is on the mend, and economists are busily revising their forecasts for first-quarter growth higher. A resilient consumer, a red-hot housing sector, a steep yield curve, lower energy costs, and modest fiscal stimulus have all played a role in righting the economic ship. However, equity markets remain on stormy seas, with questions over the quality of earnings spreading further afield, and concerns over a possible credit crunch casting another dark cloud. All major stock markets retreated again this week, with particular weakness in the beleaguered tech and telecom sectors. The Nasdaq fell nearly 5% on the week to its lowest level since Halloween. The renewed weakness in stocks threatens to undermine the budding revival in U.S. consumer confidence. It may also lend credence to the view that output growth will fade after a first-quarter pop, as consumer spending loses steam and capital spending fails to offer support. Still, most economic indicators are now on the way higher, with next week likely to see an upward revision to Q4 GDP from the initial +0.2% estimate and Q1 growth projected to be close to 3%. The housing sector remains on the boil, as starts jumped 6.3% in January, with a helping hand from warm weather. Early reports from February suggest that chain store sales remain healthy, jobless claims are still trending lower, and even manufacturing is recovering (according to the Philly Fed). The index of leading indicators is pointing to sustained healthy growth, posting a string of strong gains over the past three months. Canadian results are similarly painting a brightening picture. While not quite as real-time as the U.S. data, retail sales in Canada absolutely knocked the doors down in December, and soared at an astonishing 29.5% annual rate over the last three months of the year in volume terms. The merchandise trade picture also remained surprisingly healthy in Q4, despite soft U.S. demand and weaker commodity prices. The strong retail and trade results helped wash away a disappointing drop in manufacturing shipments and orders at the end of last year. Canada’s leading indicators have also taken a February 22, 2002 10:30 a.m. sudden turn for the good, with the 0.9% January jump a typical end-of-recession signal. While the economy is in the process of turning around, the rebound will not come quick enough to readily repair North American budget balances. Even without any new stimulus measures, the CBO now expects Washington to post a deficit of US$21 billion in the current fiscal year. In the first four months of the year, finances were already running about $70 billion behind last year, which saw a fullyear surplus of $127 billion. Ottawa now appears headed for a small surplus on the order of about $5 billion in the fiscal year that ends in March, but it will be very close to balance in FY02/03. The provinces are almost certain to move even more deeply into deficit in the coming fiscal year. British Columbia kicked off this year’s budget season with deep spending cuts and a sales tax hike, aimed at reeling in a projected $4.4 billion shortfall. Despite the deteriorating fiscal landscape and prospects of economic recovery, bond yields are drifting lower owing to lacklustre equity markets and receding inflation. Headline U.S. consumer price inflation slipped to just 1.1% in January, matching the slowest pace since 1965. Another source of support for Treasuries is the potential for even deeper problems in Japan. While the Nikkei rebounded 3.1% this week and the government plans to unveil measures to combat deflation next Wednesday, the latest 1% drop in the yen to almost ¥134/US$ is a more telling indicator of Japan’s prospects. Leading Indicators—A Double Jump (3-mnth % chng) United States Canada 3 3 2 2 1 1 0 0 -1 -1 00 01 02 00 01 02 PAGE 3 of 10 A SPECIAL FEATURE Returning to Equity Returns Douglas Porter, David Watt “I would expect now to see long-run returns (in stocks) in the neighbourhood of 7% after costs. Not bad at all—that is, unless you’re still deriving your expectations from the 1990s.” Warren Buffett, December 2001. Chart 1 It has almost become conventional wisdom that future equity market returns will not replicate the performance of recent decades. While this may be true in nominal terms, the long-run historical record holds important lessons for expected real returns in Canada. There has been nothing particularly extraordinary about Canadian stock market returns in recent decades—indeed, total returns on the TSE have barely topped bond market returns over the past 30 years, with much greater volatility (Chart 1). While the TSE did have strong returns from 1995 to 2000, bonds dominated the early 1990s as yields fell sharply, and the economy struggled to recover from a deep and prolonged recession. 2,000 An Historical Look at Canadian Returns (1972 = 100) 3,000 Avg Annual % Returns TSE 10.3* Bonds 10.1 Bills 8.5 Inflation 5.2 2,500 1,500 TSE 300 Bonds 1,000 500 0 72 78 84 90 Dividend growth will be constrained by the outlook for corporate profits. While corporate profits have dropped sharply in the past year, they have just receded to around their long-run average as a share of GDP (Chart 3). Thus, profits across the entire economy are not particularly depressed on an historical basis and are not spring-loaded for a major snapback in the years February 22, 2002 02 * Based on geometric mean. The arithmetic mean return was 12.2%. Chart 2 Yields Trending Lower (percent) 10 TSE 300 Real Earnings Yield* 8 Real Return Long-term Bond Yield 6 Between January 1972 and January 2002, an investment of $100 in stocks would have returned an average of 10.3%, compared to 10.1% in bonds, or about 5% in real terms. To build an estimate of future long-term returns three things are needed: a risk free rate, the growth rate of earnings/dividends, and the dividend yield. Two of these are already in place. The risk-free rate of return can be derived from real return GoC bonds, which are currently yielding 3¾%. The dividend yield for the TSE 300 has risen recently, but remains quite low by historical standards at just under 1¾% (Chart 2). 96 4 2 TSE 300 Dividend Yield 0 92 94 96 98 00 02 * Projected earnings—one year ahead Chart 3 Canadian Profits in Line with Historical Norm (Pre-tax profits as a share of nominal GDP) 16 14 Average since 1970 = 9.9% 12 10 8 6 4 70 74 78 82 86 90 94 98 02 Shaded areas indicate periods of Canadian recession. PAGE 4 of 10 A SPECIAL FEATURE ahead. By the same token, dividends are also unlikely to grow much more strongly than the economy as a whole in the medium term. In a similar vein, despite the plus-30% drop in prices from the September 2000 peak, most standard measures do not suggest that the TSE 300 is currently undervalued. Price-to-earnings and price-to-book value are both at the upper end of their long-term trends, while the dividend yield is at the low end. And, applying the so-called Fed model (which compares 10year bond yields to the projected earnings yield), suggests that the TSE is currently slightly overvalued (Chart 4). Finally, the TSE 300 is currently a bit below its 200-day moving average. Starting with the assumption that equity prices and profits are not particularly depressed or inflated, assessing the medium-term outlook for equity returns can be based on standard considerations. One approach is to add an equity risk premium to expected bond returns. Since 1972, the backward-looking equity risk premium in Canada was near zero, as bond returns almost equalled total stock returns. However, this dismal performance was partly a function of extraordinarily high real interest rates over much of the period. The equity risk premium equals dividend growth less the risk-free rate of return plus the dividend yield. Under various scenarios and assuming that future dividend growth will be roughly in line with real earnings growth and our projection for long-term GDP growth of about 3%, a reasonable range for the future equity risk premium would be between 1¼%to-1¾%. Tacking this on to the real return bond yield of 3¾% yields a projected inflation-adjusted return on equities of between 5% and 5½%. Contrary to being wildly below the long-term average return for Canadian equities, this projected real return happens to be very close to the average over the past 30 or 40 years (Chart 5). Real returns did trend higher over much of the February 22, 2002 1990s, a fact that may have been obscured by the much lower average inflation in the decade. Even after the wild ride on equity markets over the past few years, it is therefore likely that real equity returns over the medium term will closely resemble their historical norm. For investors, the only major shift required in the years ahead is adjusting to the reality of sustained 2% inflation, and not an adjustment to expected real equity returns in Canada. As a result, we are left with the unglamorous, but not disheartening conclusion that in the future, equities are likely to return between 7% and 8%. This coincidentally matches Mr. Buffett’s projections for U.S. stock returns over the next decade—and who would argue with him? Chart 4 Stocks Still Not Cheap (percent : as of February 21, 2002) TSE 300 Valuation Model 60 Overvalued 40 20 13.7% 0 -20 Undervalued 90 92 94 96 98 00 02 10-yr Bond Yield ÷ Equity Index Projected Earnings Yield -1 Shaded areas indicate periods of Canadian recession. Chart 5 Real Stock Returns—Close to Average TSE 300 (annualized total real returns, 5-yr avg : percent) 25 20 Average since 1965 = 5.6% 15 10 5 0 -5 -10 65 70 75 80 85 90 95 00 PAGE 5 of 10 A ECONOMIC & FINANCIAL MARKET OUTLOOK 2001 I 2002 II III IV I II Annual III IV 2000 2001 2002 CANADA Real GDP (q/q % chng : ar) 1.7 0.6 -0.8 Consumer Price Index (y/y % chng) 2.8 3.6 2.7 1.0 1.8 2.6 2.2 3.0 4.4 1.5 1.5 1.1 1.1 0.4 0.8 1.8 2.7 2.5 1.0 Unemployment Rate (%) 6.9 7.0 7.2 7.7 8.1 8.4 8.2 8.1 6.8 7.2 8.2 Housing Starts (000s : ar) 161 165 156 172 171 155 158 157 153 163 160 Current Account Balance ($blns : ar) 54.5 36.0 22.1 22.5 11.7 10.2 12.0 14.1 26.9 33.8 12.0 BoC Bank Rate 5.66 4.87 4.37 2.92 2.29 2.25 2.25 2.50 5.73 4.46 2.32 3-month Treasury Bill 4.98 4.37 3.80 2.31 1.93 2.00 2.05 2.15 5.44 3.87 2.03 10-year Bond 5.38 5.70 5.55 5.28 5.35 5.30 5.40 5.45 5.94 5.48 5.38 90-day 4 63 51 37 27 30 25 25 -55 39 27 10-year 33 43 57 51 35 40 35 30 -9 46 35 Real GDP (q/q % chng : ar) 1.3 0.3 -1.3 0.2 3.0 2.5 1.5 2.9 4.1 1.1 1.5 Consumer Price Index (y/y % chng) 3.4 3.4 2.7 1.9 1.3 1.1 1.4 1.9 3.4 2.8 1.4 Unemployment Rate (%) 4.2 4.5 4.8 5.6 5.8 6.2 6.2 5.9 4.0 4.8 Housing Starts (mlns : ar) 1.63 1.62 1.60 1.57 1.57 1.54 1.57 1.55 1.57 1.61 Current Account Balance ($blns : ar) -447 -430 -380 -407 -422 -418 -427 -433 -445 -416 -425 Interest Rates (average for the quarter : %) Canada/U.S. Interest Rate Spreads (average for the quarter : bps) UNITED STATES 6.0 1.56 Interest Rates (average for the quarter : %) Fed Funds Target Rate 5.60 4.33 3.55 2.08 1.75 1.75 1.75 2.00 6.24 3.89 1.81 3-month Treasury Bill 4.94 3.74 3.29 1.94 1.66 1.70 1.80 1.90 5.99 3.48 1.77 10-year Note 5.05 5.27 4.98 4.77 5.00 4.90 5.05 5.15 6.03 5.02 5.02 Exchange Rates (average for the quarter) US¢/C$ 65.5 64.9 64.7 63.3 62.6 62.4 63.3 64.4 67.4 64.6 63.2 C$/US$ 1.527 1.540 1.545 1.581 1.597 1.602 1.580 1.552 1.485 1.548 1.583 118 123 121 124 134 136 133 132 108 121 134 ¥/US$ US$/Euro 0.92 0.87 0.89 0.90 0.88 0.90 0.91 0.89 0.92 0.90 0.90 US$/£ 1.46 1.42 1.44 1.44 1.43 1.43 1.45 1.42 1.52 1.44 1.43 Note: Blocked areas represent BMO Nesbitt Burns forecasts Up and down arrows indicate changes to the forecast February 22, 2002 PAGE 6 of 10 KEY FOR NEXT WEEK CANADA UNITED STATES Real GDP—Q4 A big rebound in consumer spending and a blazing housing market are likely to produce a small increase in Canadian GDP in Q4. Following the first quarterly decline in nine years in Q3 (down 0.8%), it now appears that GDP rose at around a 1% annual rate in Q4. Growth for all of 2001 is expected to have slipped to just 1.5% from 4.4% in the prior year. Acting as a restraint on growth, business investment probably fell sharply and inventories likely plummeted, as firms cut stockpiles aggressively. The combination of robust final sales growth and a deep drop in inventories sets the stage for a broader recovery in 2002. However, it is unlikely that consumer spending can maintain the blistering pace of Q4, especially with employment trends cooling and auto incentives now less generous. The GDP deflator is expected to retreat for the third quarter in a row, although not as deeply as the Q3 decline of 4.8% annualized. Lower energy prices are projected to pull the deflator down at an annualized 3.2% rate in Q4. However, final domestic demand prices are expected to continue edging higher. Current Account Surplus—Q4 A surprise widening of Canada’s trade surplus in the fourth quarter points to a slight increase in the current account surplus for Q4. While tourism inflows were hit hard in the wake of Sept. 11, net interest payments are also dropping sharply as interest rates tumble. On the merchandise front, imports fell even more steeply than exports, bumping up the surplus to an annualized $50.5 billion in the quarter. We look for the current account surplus to edge up to a $22.5 billion annual pace in Q4, bringing the full-year surplus to a record of around $33 billion. Our Forecast Real GDP (a.r.) +1.0% GDP Deflator (a.r.) -3.2% Current Account Surplus (a.r.) $22.5 bln Consensus Call Q3 +0.8% -1.0% $23.2 bln -0.8% -4.8% $22.1 bln February 22, 2002 A Fed Chairman Greenspan is back before Congress this week. The testimony should continue to walk the fine line Greenspan has maintained since he “corrected” the market’s initial negative interpretation of his view a few weeks ago. He is likely to stress a recovery has taken firm root, but that financial problems and lagging capital spending will keep the pickup from overheating anytime soon. The message will be the economy is doing okay, but is not out of the woods, leaving markets to stew over how long it will be before they tighten policy. (Quite a while, in our view.) As far as economic data go, the week is likely to focus upon the mystery of the misplaced recession. GDP might be massively restated higher in Q4, with growth possibly topping the 1% mark. The trajectory into Q1 makes 3% growth possible this quarter. This will leave the folks at the National Bureau of Economic Research, who rushed into a recession call, in a quandary. If the slowdown was a recession, it was certainly the mildest on record. ISM Index—February The other highlight of the week could be the healing of the manufacturing sector. ISM (NAPM) seems likely to toy with the breakeven 50 mark. And, especially if Boeing’s big Irish order shows up in this month’s statistics, we may get a sizable rise in durable goods bookings to boot. All told, we are happy we were calling for lower bond yields early this year but have to confess that we were right for the wrong reasons. The economy is looking better. Our Forecast Consensus Call January 50.5 45.0 51.0 41.5 49.9 43.9 ISM Index Prices-Paid JAPAN The government will unveil its plans to combat 2½ years of deflation on Wednesday. The plan will focus on boosting equity values, disposing of bad loans on the banks’ balance sheets and tax reform. Given the history of the government’s actions, we do not expect any radical changes. PAGE 7 of 10 A FINANCIAL MARKETS UPDATE Change from: (basis points) 4 weeks ago Dec. 31/01 Feb. 22 * Feb. 15 Week Ago 2.00 2.25 3.75 2.00 2.25 3.75 0 0 0 0 0 0 -25 -25 -25 1.77 1.25 4.75 1.81 1.25 4.75 -4 0 0 -3 0 0 25 0 0 2.03 1.75 0.00 3.36 4.05 2.03 1.73 0.00 3.35 4.05 0 2 0 0 0 6 5 0 -2 3 11 3 -1 6 -4 5.28 4.84 1.53 4.93 4.94 5.30 4.87 1.50 4.92 4.92 -2 -4 3 0 2 -19 -24 6 -5 -7 (% change) -7 -22 16 -7 -12 62.82 1.592 133.78 0.88 1.43 51.37 62.90 1.590 132.56 0.87 1.43 51.75 -0.1 — 0.9 0.2 -0.1 -0.8 1.2 — -0.4 1.1 1.5 -0.6 0.0 — 1.6 -1.5 -1.7 0.9 191.64 20.77 293.35 191.58 21.50 300.40 0.0 -3.4 -2.3 0.9 5.3 5.1 0.5 4.7 6.1 7423 1082 1718 423 10357 4763 5035 4244 30061 7515 1104 1805 428 10048 4863 5183 4377 30709 -1.2 -2.0 -4.8 -1.1 3.1 -2.0 -2.8 -3.0 -2.1 -3.1 -4.5 -11.3 -4.0 2.1 -7.6 -3.0 -5.4 -6.2 -3.4 -5.7 -11.9 -4.5 -1.8 -7.7 -3.5 -8.2 -6.8 Canadian Money Market Call Money Bank Rate Prime Rate U.S. Money Market Fed Funds (effective) Discount Rate Prime Rate 3-Month Rates Canada United States Japan Germany United Kingdom Bond Markets 10-year Bond Canada United States Japan Germany United Kingdom Currencies US¢/C$ C$/US$ ¥/US$ US$/Euro US$/£ US¢/A$ Commodities CRB Futures Index Oil (latest contract) Gold Equities TSE 300 S&P 500 Nasdaq S&P/TSE 60 Nikkei Frankfurt DAX London FT100 France CAC40 Italy Milan MIB30 * as of 10:20 a.m. February 22, 2002 PAGE 8 of 10 ECONOMIC AND FINANCIAL RELEASES JAPAN MONDAY FEBRUARY 25 FEBRUARY 25 – MARCH 1 TUESDAY FEBRUARY 26 Merchandise Trade Balance Jan. 02 (e) +¥500 bln Jan. 01 -¥96 bln A WEDNESDAY FEBRUARY 27 THURSDAY FEBRUARY 28 FRIDAY MARCH 1 Large Scale Retail Sales Jan. (e) -2.9% y/y Dec. -2.5% y/y Industrial Production Jan. P (e) +1.0% Dec. +1.5% Unemployment Rate Jan. (e) 5.7% Dec. 5.6% Housing Starts Jan. (e) -4.8% y/y Dec. -12.9% y/y Consumer Price Index Jan. (e) unch -1.5% y/y Dec. -0.1% -1.2% y/y EUROLAND BoJ Policy Board Meeting GERMANY Consumer Price Index* Feb (e) +0.5% +2.0% y/y Jan. +0.9% +2.1% y/y GERMANY Ifo Industry Survey Feb. (e) 86.6 Jan. 86.3 GERMANY Real GDP Q4 (e) -0.3% q/q Q3 -0.1% q/q FRANCE Unemployment Rate Jan. (e) 9.1% Dec. 9.0% EUROLAND Purchasing Managers’ Index Feb. (e) 47.0 Jan. 46.2 Producer Price Index* Jan. (e) +0.2% -0.5% y/y Dec. -0.3% +0.1% y/y FRANCE Consumer Price Index Jan. (e) +0.2% +1.9% y/y Dec. +0.1% +1.4% y/y EUROLAND M3 Money Supply (Smoothed) Jan. (e) +8.0% y/y Dec. +7.8% y/y ITALY Producer Price Index Jan. (e) +0.1% Dec. -0.1% Retail Sales Dec. (e) -0.5% Nov. +1.2% FRANCE Producer Price Index Jan. (e) +0.2% Dec. -0.3% EUROLAND Consumer Price Index Feb. P (e) +0.2% +2.2% y/y Jan. F (e) +0.3% +2.5% y/y Dec. +0.2% +2.1% y/y -0.2% y/y +0.3% y/y -1.1% y/y -1.6% y/y OTHER U.K. ITALY Retail Sales Dec. (e) +1.8% y/y Nov. +1.5% y/y Real GDP Q4 R (e) +0.2% q/q +1.9% y/y Q3 +0.5% q/q +2.2% y/y MEXICO Merchandise Trade Deficit Jan. R (e) $1.3 bln Dec. $1.7 bln -1.2% y/y -1.3% y/y GERMANY Real Wholesale Sales Jan. Dec. -1.6% -10.2% y/y +1.1% y/y +1.3% y/y ITALY Real GDP Q4 (e) -0.1% q/q +0.9% y/y Q3 +0.2% q/q +1.9% y/y Consumer Price Index Feb. P (e) +0.4% +2.5% y/y Jan. +0.5% +2.4% y/y Purchasing Managers’ Index Feb. (e) 47.1 Jan. 46.4 AUSTRALIA Goods & Services Trade Deficit Jan. (e) A$250 mln Dec. A$358 mln * date approximate ECONOMIC AND FINANCIAL RELEASES Bold = BMO Nesbitt Burns Forecast Italics = Consensus * date and time approximate MONDAY FEBRUARY 25 TUESDAY FEBRUARY 26 WEDNESDAY FEBRUARY 27 THURSDAY FEBRUARY 28 8:30 am 8:30 am 8:30 am 8:30 am Dec. (e) Nov. International Securities Transactions +$3.0 bln +$6.8 bln Jan. (e) Dec. Department Store Sales* +0.5% +2.4% Dec. (e) Nov. CANADA 8:30 am Jan. (e) Cons. Dec. 8:30 am 10:00 am Existing Home Sales Jan. (e) 5.00 mln a.r. Dec. 5.19 mln a.r. UNITED STATES 3 & 6-month T-bill auction $30.0 bln (New cash $1.0 bln) Raw Materials Prices +1.5% +0.1% -1.4% Capital Spending Intentions 8:30 pm Q4 (e) Q3 Corporate Profits -10.0% q/q -14.4% q/q 8:55 am Feb. 23 Feb. 16 Jan. (e) Cons. Dec. +0.8% Industrial Product Prices +0.3% +0.2% -0.8% +6.3% 8:30 am Redbook Average Weekly Earnings +2.0% y/y +1.9% y/y 02 01 12:45 pm 3, 6 & 12-month T-bill auction $8.0 bln (New cash $0.2 bln) 10:00 am Conference Board Consumer Confidence Index Feb. (e) 96.0 Cons. 96.5 Jan. 97.3 1:00 pm A FEBRUARY 25 – MARCH 1 Durable Goods Orders +1.8% +1.4% +2.0% Ex. Transport +0.4% +0.9% +1.4% 10:00 am New Home Sales Jan. (e) 930,000 a.r. Dec. 946,000 a.r. 10:00 am Fed Chairman Alan Greenspan testifies on Monetary Policy and the Economy to the House Financial Services Committee 1:00 pm 2-year note auction $25.0 bln (New cash $0.7 bln) Q4 (e) Cons. Q3 Real GDP ** +1.0% +0.8% -0.8% FRIDAY MARCH 1 Chain Prices ** -3.2% -1.0% -4.8% ** chain-weighted basis 8:30 am Q4 (e) Cons. Q3 Current Account Surplus $22.5 bln a.r. $23.2 bln a.r. $22.1 bln a.r. 8:30 am Real GDP at Basic Prices +0.1% +0.3% +0.2% Dec. (e) Cons. Nov. 2-year note auction announcement 8:30 am Q4 P(e) Cons. Q3 Q2 Real GDP +1.5% a.r. +0.4% a.r. +0.2% a.r. -1.3% a.r. GDP Deflator -0.3% a.r. -0.3% a.r. -0.3% a.r. +2.3% a.r. 8:30 am Jan. (e) Cons. Dec. Personal Income +0.1% +0.1% +0.4% Personal Spending +0.3% +0.3% -0.2% 8:30 am Jan. (e) Dec. PCE Deflator +0.1% -0.2% 9:45 am University of Michigan Consumer Sentiment Index Feb. F (e) 91.0 Cons. 91.4 Feb. P 90.9 Jan. 93.0 8:30 am Initial Claims Feb. 23 (e) 385,000 (+2,000) Feb. 16 383,000 (+10,000) 10:00 am Construction Spending Jan. +0.2% Dec. +0.2% 10:00 am Chicago PMI Feb. (e) 47.0 Jan. 45.1 10:00 am Feb. (e) Cons. Jan. ISM 50.5 51.0 49.9 Prices-Paid 45.0 41.5 43.9 Feb. Jan. Auto Sales 5.4 mln a.r. 5.3 mln a.r. Truck Sales 6.9 mln a.r. 7.0 mln a.r. 10:00 am Help-Wanted Index Jan. (e) 45 Dec. 46 The opinions, estimates and projections contained herein are those of BMO Nesbitt Burns Inc. ("BMO NBI") as of the date hereof and are subject to change without notice. BMO NBI makes every effort to ensure that the contents herein have been compiled or derived from sources believed reliable and contain information and opinions, which are accurate and complete. However, BMO NBI makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions which may be contained herein and accepts no liability whatsoever for any loss arising from any use of or reliance on this report or its contents. Information may be available to BMO NBI, which is not reflected herein. This report is not to be construed as, an offer to sell or solicitation for or an offer to buy, any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. BMO NBI may act as financial advisor and/or underwriter for certain of the corporations mentioned herein and may receive remuneration for same. BMO NBI is a wholly owned subsidiary of BMO Nesbitt Burns Corporation Limited, which is a majority-owned subsidiary of Bank of Montreal. To U.S. Residents: BMO Nesbitt Burns Corp. and/or BMO Nesbitt Burns Securities Ltd., affiliates of BMO Nesbitt Burns Inc., accept responsibility for the contents herein, subject to the terms as set out above. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. and/or BMO Nesbitt Burns Securities Ltd. To U.K. Residents: The contents hereof are intended solely for the use of, and may only be issued or passed on to, persons described in Article 11(3) of the Financial Services Act 1986 (Investment Advertisements) (Exemptions) order 1995, as amended. ® "BMO" is a registered trademark of Bank of Montreal, used under licence. "Nesbitt Burns" is a registered trademark of BMO Nesbitt Burns Corporation Limited, used under licence. ™ The "M-bar roundel symbol" is a trademark of Bank of Montreal, used under licence.