A

advertisement

A

Hydro-Québec

Requête R-3401-98

DOCUMENTS DE PRÉSENTATION À L’AGENCE DE NOTATION DE

CRÉDIT MOODY’S INVESTORS SERVICE – AVRIL 2000

RÉPONSE D'HYDRO-QUÉBEC À L'ENGAGEMENT NUMÉRO 23

Original : 2001-05-01

HQT-8, Document 3.10

(En liasse)

CONFIRMATION

RENCONTRE

AVEC L'AGENCE

D'ÉVALUATION

DE CRÉDIT

MOODY'S

DATE:

Jeudi, le 27 avril 2000

HEURE:

10 h 30 à 14 h 30

LIEU :

Salle du Conseil d'administration

PARTICIPANTS

-20e

étage

À LA RENCONTRE

HYDRO-QUÉBEC

MOODY'S

Emily Eisenlohr

Vice President I Senior Credit Officer

Daniel Leclair

Stephen Gutkowski

Vice President I Senior Credit Officer

Michelle Toulouse

Paul Robillard

Susan Abbott

Managing Director of the Electric Utilities

Lucie Beaudoin

Renée Arsenault

Li Iy Chan

Assistant Portfolio Manager

Jacques

Régis

13hOO

Ordre du jour

-

10h15

Accueil

10h30 à 12h30

Voir Agenda ci-joint

12h30 à 14h30

Déjeuner

et suite des présentations

Président

-20e

étage

à la salle à manger du

u

April 27th, 2000

Hydro-Québec, 20thFloor

SPEAKER

SUBJECTS

TlME

Hydro-Québec

Information

Package

Section

1999 -Financial

2.

3.

Results

Lucie Beaudoin

IOhJO

Financial Framework 2000-2002

Lucie Beaudoin

IOh40

2

lnvestment

Lucie Beaudoin

lOhSO

3

Program over the next few

years

4.

Borrowing Program 2000-2004

Paul Robillard

IlhOO

4

5.

Strategic Plan 2000-2004

Roger Lanoue

IlhlO

5

6.

International Affairs and Projects

PaulRobil!ard

Ilh25

6

7.

Energy Board Update

Michel Bastien

Ilh40

7

8,

Customer Services

Ghislaine Larocque

Ilh55

8

12hOS

x

-

END

of moming

session

Lunch will be served in the president's dining room at 11h30

9.

10.

Wholesale market (electricity and gas)

and portfolio of projects

Transmission Network Optimization

END

of

Daniel Garant

12h30

9

JacquesRégis

IhOO

10

presentations

Discussions

END

Aiso included

8

2h15

in the binder

Financial Framework 2000-2002

(8

t-J

~

Q

;

,

~

~

5]

a:

~

~

o

(.)

~~~~

,..J~i~

~

o

.~

::::

.~

~

~ .::i

~:.;]

~.~~

,~ i

~-I~

;

..'

0ic .(

'If..;j

.

;

.

~-:1

'o-~j

*.

~

.-c

..c

'

..c'

~

~

~

.!

e

~

~

~

~

5

ro

c:

.-o

"'5

'::).g'fJg ~c:

(/)

UJ

o

~ 8

1\.- C/) ~ a>

O)

O)

:§.af~

O)e~o.

=

ca

.!!

3

.

~

~

-

~

)(.20

~

C.'IU

~8.~

~18-g

.o.

w

w

.c

c

"iO:

~

m

W

:)

:lU.U.

§:E§:

10.

§:

~

II.. ~

~

~

SB:§:~

~

o

.

(')

~

§:

e

.-\I)

NO

.-0»

Cf)

..

U)

U)

.Q

a1

CI

iii

c:

lU

c

Q) ()

C X

-W

~

~

ô~

---

.t..

:)

:)

IL

M

=

In

01

...O

1Z

>

!

w

~

1(1)

N

O

N

N

~

.

.-O

fO

O

c

Z

w

C

-w

~

C

~

fO

N

.-

Cf)

CQ

w

~

o

C,)

~

tw

z

0»

~

0»

N

\I)

..-~

N

<,>

Z

o

Z

~

z

:3

..J

o

~

1Z

o

1(/)

w

~

w

1~

M

O)

.V)

Mo

~

~

I()-r

COM

O>~

~ ~

..

M)

o

N

N

cn

w

cn

z

w

Q.

><

w

..J

~

-Q)

U

Z

~

Z

LLLL

~

~

(O)

o

i!

.-

0»

N

..

Cf)

O)

N

CQ

M

<CO)

OM

ON

M

~

«

w

Q.

o

w

~

o

(.)

~

u

z

M

.

N

.

y-y-

t

o

E

c

.Q

..

o

o

cg

M

-a;

:J

-cv

"O

c

cv

"O

c

Q) cv

(/) c

cv o

.c

.u...cv

:J .-N

a.

O)

c

.c

o

.rn

.~

E

E

o

u

Q)

"O

"O

~oC)

MU)~

Or--a>

~~

O)Y-O)

OMCX)

y-","","

Q)O)O

,

:>u.u.

t-.

iL

~

N

T""

C') ~ ~

;:);:)iL;:)

~N{')O

a){')0)<O

N

~

O)

~

(/)

w

(/)

z

w

1l)..-a)1l)

~1l)a)0)

~O<OM

,

(/)

w

(/)

z

w

Bo

x

W

O)

~

O)

~

a.

'-

o.

Q.

.2:'ro

)(

.ü .ü

w

.-= Q) (/)

~

t)C.Q)

w~Q)~

~WOI.-

<-'

Z

~

~

~

W

Bo

O

0)C")1l)1l)

NCOo)ll)

Il)OIl)Il)

,...~

<.>

Q)

.D

oQ)

:3

(J)

<.>

E

o

Q)O

.D

(J)

(/)

~:2

a

CO

'-

<.>

c: :3

c:

.-o

(/) .(/)(/)~OI

Q)Q)COc:

ro""(0(/)~

(/) (/) (/) ~

'-

;?;O;?;0~Q)

<.><.>-O

'-

Z

ÜÜ:3Q)

w~~ro:5

>wwzO

W

~

~

al E

E o

o

(J

(J .!:

c .-~

-c

al c

o

-.

o

E

"'

..

E .!

2?.!:

.5

~

Q) :o

-"

.o

..

cu o

..>

o

> -"

cu c

11.::>

Il

.

11.::>

el

10/-.

'!

!

~

B

~

u

~

~

c

iï:

~~

l

-;i

.c

!I~

~~

1999 Results

campared ta budget

Notes (in $ millions)

-

(1) Electricity sales in Québec

84

u

~

Temperatures

~

Residential

.larger

~

and farm :

U

33

F

12

U

80

F

volume (31 F) at higher average prices (2 F).

General and institutional :

.larger

~

144

above normal.

volume (51 F) at Iower average prices (1 U).

Industrial :

.larger

volume (19 F).

.Exchange

rate (24 U). aluminium piice (1 U) and olher factors related

to prices (20 U).

~

Other :

.larger

(2) Electricity sales outside

Québec

32

u

~

Firm sales :

.Lower

.Impact

~

volume (2 F) at higher average prices (1 F).

sales volume (99 U).

of ex change rate (16 U) a~

Shor1-term sales :

.Larger

.Impact

93

(3) NaturaJ gas sales

F

sales volume (123 F).

of ex change rate (28 U) a~

(4)

Other

operating

income

160

u

olher factors related to prices ( 15 U).

-=> Revenue from Noverco and H.Q. Energy Marketing and from Hydro-Québec's

brokerage

"

other factors related to prices (3 F).

~

activities.

Income from operations of U1ecompany:

.Revenue

from energy storage and from fuel-oil tolling and sales Iower

130

U

than forecasted (107 U); other (23 U).

(5) Operating

expenses

7

F

~

Elimination

for intercompany accounts and consolidation.

=)

Gross expenses of Ihe company:

.Pension

.Labor

expenses(172

(6)

Electricity

and

fuel

78

U

33

U

40

F

19

U

59

U

F).

and bonuses (57 U).

.Capitalized

.Olher

U

conflicl (51 U).

.Over1ime

.Salary

30

expenses lower Ihan forecasled (76 U).

increases (19 U).

(2 U).

=)

Subsidiaries

and eliminalion for inlercompany accounls and consolidalion.

~

Purchases made by the company:

.Higher

volume of short-term purchases due 10favorable business

purchased

opportunities (57 U).

.Firm

purchases lower than forecasted (5 F).

.Purchase

of fuel (21 D). gas for resale (3 F) and fuel oil (48 F).

~

Subsidiaries

and elimination for intercompany accounls and consolidation.

8 ~

Q.~

P&RG

-DPCC

-Finance

00nd3-2000.xls

Printed 00-{)4-17

1999 Results campared

ta budget

Notes (in $ millions)

(7)

Depreciation,

and

amortlzatlon

19

F

~

Expenses

incurred

.Write-off,

decommissioning

.Lower

(8)

30

Taxes

F

amol1izing

~

Subsidiaries

~

Expenses

capital

.lower

Financial

expenses

126

F

of fixed assets

guarantee

for intercompany

~

projects

F

~

8

U

39

F

9

U

161

F

( 1 F)

coosoIidation.

:

and school

taxes

(5 F).

fee (4 F). tax on gross

~

Expenses

incurred

by subsidiaries

~

Expenses

incurred

by the company:

.Interest

(9 F) arxj of ma~eting

by Ihe company

27

( 17 F).

tax (25 F).

municipal

.Loan

and olhers

and elimination

incurred

.lower

(9)

by Ihe company:

decommisioning

revenue

unde(estimated

(5 F).

.

rates (12 F).

.Impact

of ex change

.Derivalive

rate (192 F).

instruments

.Capitalized

borrowind

.Capital

(3 F).

costs

( 17 U).

(29 U).

~

Subsidiaries

o)

Lower

and elimination

for intercompany

accounts

a 00 consolidation.

35

-40

(10) Dividend

(11) Grass investments

.422

investments

of assets

o)

Lower

and other

investments

developement

Hal

o)

( -112) for projets

types

of continuing

in development

of Québec's

that ensure

investments

: Eastrnain,

hydroelectric

the continued

-162

of the

-433

( -222).

the compietion

potential,

reliability

projects

planned

by

and others.

Investments

by subsidiaries

and impact

of consolidation.

.211

~,

Q.~

P&RG

-DPCC

-Finance

~-2{XX).xls

Printe!:~27

U

~

,c-~'

~:d

r

~j

;':.'1

-~.

t~'r

,

~';\

";,,,

O)

O)

~

O

'~:;1i

1'~

.!

i

)(..Q~

~"':=

c: ~

~

Q)

Q)

-

O)

O)

O)

~

fA.

~

~CI~

~!V"C

"'

o.

i

.§

..L..1,

f.;.

~

a:

~

~

0

U

~

~-~-.~

Q

-..CV"0ro

':)'::Q):2

(/)0"00

UJ

lt-Q)o

"O~~

g.

C/)c:~

:I..

Q)

a.

",O'-()

~

O

'-

~

.Q

O)

,9

o

.~

0)~-cC~~

~

O)

E

--~

s

S5§:~

O

§:E§:

:>:>IL

§:

~

..,

N

..

..

..

::>:Ju.

1&.1&.1&.1&.

~

.

u.

ONO

..~~~

u.u.u.u.

~

C')

N

,..-

,...

co

,...

.-~

O>~O>

OMa)

.-,

:J

N

<V

o.--e

-oQ)

(/) .2

w

o.

E

tV

c

..

...

,...

o>

w

.~ Q) (/)

~

ÜO.~

w.9!.Q)tV

~UJOI...

tV o

w ,.,.=

Q. .o;.. tV

)( .ü u

"O

c

-

"O

Q)

(/)

tV

.c'(.)

c

tV

c

o

E

E

o

(.)

Q)

-o

-o

C)

c

c

o

""Ui

g)

~

0>0>0>

o>

a>

a)\l)'...

N~

lt)r--fDO)

It)MIt)~

NN~~

.-

~

=

CQ

~

N

.~

E

o

Q)

Q)

(/)

z

Q)

,...

In

1t>~Q)1t>

-q-1t>Q)0)

-q-OIO(")

,...~

<n

<.>

Q)

.c

oG)

~

O'OtNCO

m.-Mr-..

.-<X)It)N

r-..

<.>

Q)O

.CQ)

(/)

w

(/)

z

w

Q.

)(

w

~:g

o

c -<.>

~

c

.-o

(I) .<n<n~OJ

Q)Q)IVC

roro(1):;:::

<n<n(1)~

~

z

~

~

w

Q.

o

o.

o

Z'.?;-~Q)

W

.~ .~ ïO

~

'-'-,-'z

üü~Q)

w~.P.~=

>WL1JzO

w

~

~

..

~

II..

~

~

~

~

O>~

CX)C')

II)

N

~

(/)

(/)

.Q

Q)

I

§:

...

~

:

1U)

w

~

w

1~

~

z

:ï

..J

o

~

1Z

o

~

Z

o

Z

~

u.. j

~

~

C/)

w

C/)

z

w

Q.

><

w

..

-C>

(/) c:

m

c:

Q) (.)

c

x

-w

C")

.J

<

-Q)

u

z

<

z

M

~

t'-.t'-.

.-M

0.-

.

i

M

~

M

O

N

~

M

at

N

fQ

M

,...

~

N

t')

w

~

o

u

~

<-'

z

~

w

o.

o

...~

too

~

N

G

=

QI

O

N

N

o

..

ô

.-

M

In

~

CD

N

f#)

>

~

w

~

1(/)

1Z

N

N

IQ

o

O)

O)

too

N

c

Z

w

C

-w

?;

C

O)

,...

IQ

w

~

o

u

~

tw

z

G)

G) E

E o

8~ c:

.-G)

-c:

G) c: o

E

...

!?

c:

-lU

c:

:J

Il

-~

o

~

E

~

-.5

~

-lU

.c

lU

...>

O

>

lU

u.

Il

:J

~

:c

...

O

u.

w~

:1*

~8

-;~

~c

~if

I

~

!

'2

9

eJ

1~

a~

a>

~

10

I:

ü:

U

~

.

1999 Results campared

Notes (in $ millions)

(1) Electricity

(2)

Electricity

sales in Québec

sales

outside

ta 1998

255

237

F

F

~

Growth

~

Temperatures

~

Consequences

above

of 1998 events

.Rate

of May 1, 1998 (39 F).

increase

price.

~

Ex change

rate.

~

Average

~

Finn sales :

80

F

ice storm

111

F

31

u

(72 F).

1

u

F

2

u

206

F

slonT1 (8 F).

.Volume

(2 U).

.Average

price effect (8 U).

Shor1-lenT1sales:

.Exchange

rate (1 F).

.Average

price effect (20 U).

.Higher

.lce

F

price effect.

.lce

~

:

ofthe

Aluminium

~

normal.

.Non-recurring

~

Québec

95

in demand.

volume (221 F).

slonT1 (4 F).

Intemational sales:

increase of activities of subsidiaries in Panama a~

33

Cosla Rica.

(3)

Natural

gas

sales

(4) Other operating

156

income

119

F

F

~

Increase

in revenues

from

Noverco

~

Elimination

~

Increase

~

Energy slorage ( 42 U). fuel-oillolling

for intercompany

and H.O.

accounts

in Hydro-Ouébec's

Energy

Ma~eting.

159

and consolidation.

activities.

and sales (22 F). renling ( 11 F)

F

9

U

6

F

2

u

and olhers (7 F).

~

Increase in olher revenue generaled by subsidiaries (159 F) aOO

eliminalion for inlercompany

(5)

Operating

expenses

231

u

c)

Expenses

incurred

.Pension

.Labor

conflict

.Extemal

.Salary

.Bonuses

(6)

Electricity

and

fuel

purchased

210

u

122

u

109

U

F).

(105 U).

expenses

increases

Subsidiaries

(110

F

(51 U).

services

.Capitalized

c)

by Ihe company:

expenses

121

accounls and consolidation (38 U).

Iower

lhan

forecasted

(26 U).

(18 U).

(20 U).

and elimination

for intercompany

accounts

and consolidation.

"f> Purchases made by the company:

7

u

203

U

.Electricity

(23 F).

.Fuel (20 U).

.Gas

for resale (2 F).

.Fuel

oil pour tolling and sales (12 U).

"f> Purchases made by subsidiaries and elimination of intercompany

accounts and consolidation.

~

Q.Hyd~

P&RG-DPCC-Finance

bond3-2000.xls

Printed OO.()4-17

1999 Results compared

to 1998

Notes (in $ millions)

8

(7)

Depreciation.

and

amortization

142

u

c!)

decommissioning

Increase

in expenses

of fixed

.Amortization

of majol'

.DecommissOOing

.Amortization

.Other$

(8) Taxes

10

F

expenses

35

F

projects

of markeling

Increase

in expenses

c)

E.xpense

incurred

.Lower

capital

canceled

generaling

programs

124

U

or IX>Stponed (19 F).

stalK>n (1 U).

( 15 F).

on gross

N"lCurred by su~iaries.

by the company:

revenue

guarantee

13

F

3

U

(5 F).

c)

Increase

in expenses

.)

Expenses incurred by the company:

.Impact

U

fee (8 U)

municipal,

.Interest

18

tax (15 F).

.Lower

school

taxes

incurred

arMj others

(1 F).

by subsidiaries.

54

rates ( 18 F).

of exd1ange rate (45 U).

.Derivative

.Capitalized

.)

:

(141 U).

(16 U).

.Loan

Financial

assets

of nuclear

c!)

.Tax

(9)

N"lCurred by the oompany

.Depreciation

instruments

(34 U).

borrowind costs (34 F).

.Capital

(81 F).

Subsidiaries (20 U) and elimination for intercompany accounts and

19

consolidation (1 F).

-,10)

Gross investments

-228

~

Decrease of investments

~

Increase of olt1er investments.

~

Increase of investments

in fixed assets.

-527

+ 272

by the subsidiaries arK! elimination for intercompany

+ 27

accounts and consolidation.

8

Q..~

P&RG-DPCC-Finance

bond3-2000.xls

Printed

()0.{)4-17

U

~

N

o

o

N

o

9

N

~

o

.2~

~~

o.g

-~

ca

o

-

(,) Co

c:.2ca~

.c: E

at.s

u

tc

-.

...o.

~

.

.

.c

c 8

-o:

~

~

8

.

~

N

o

o

N

...

o

o

N

o

o

o

N

at

at

at

...

OCOIr>'...

MCONfD

~MfDlr>

CO~

O) <O il)

NMMN

o)N<O'O"

,...~

(X)

01 (,)NO

(')aJIl)O

,

CO..,.

,

U')~a)U')

~U')a)0)

~OCOM

,...~

Q)

C.)

Q)

.Q

-Q)

='

E

Q)O

C.)

.QQ)

ca

o

C.)

~:2

O

"'

'5

.50",.5

ctlctI~~

Q)Q)CVC:

""iV""iV"'=

"' "' "'

.2;-.2;-CV~

--O)a.

W

C.)C.)""iV°

~:S:S1-1Z

C.)C.)=,IP

w~~iV:5

>wwzO

w

~

NOIl)I

N.'.-I

a) a)

a)

I

~

~

..

.,

N

N

..

N

..,

o

N

Olt>a>

,...'a>a>

o

~

o

~

o

O')

01

~

w

Co

o

w

~

o

(J

~

o

z

~

o

.

e

N

N

o

..

CI

C

.C

O

ïii

!I)

Ë

E

c

IV

o

(.)

~

-c

-c

"t:

O

..

!I)

.2

~

W

-C

.

!I)

C C

Z

IV O

W

?:-;

Q.-~

)(

(.) (.)

W"t:~!I)

~

(.)a.~

W~~IV

~WOI1-

~

IV

C

.c

.Q

(.)..IV

;)

a.

.-N

~

!I)

0>.-0>

OC')a)

.-,...,...

..,

~

~

..

N

...

O!

...

~oo

OON

Na>a>

O.

o

CD

at

.

...

~

~

~

~

In

w

In

z

w

O><

w

o

z

~

w

0o

N

o,...

'...ID

~...

.'>~

a>N

N

(')

CON

In,,""

0.-

~~

m.N

(/)

w

(/)

z

w

~

)(

w

-J

<

-Q)

U

Z

<

..

$

C

~

~

..Q

~

-a

CIl C

IV

r.

U

X

Z-W

~

,

I')

o

I')

...O

~

~ N

...~ ~

...

~

...~

~

..~

I')

O

M

ID ...

I')

N

~

~

z

w

~

o

u

~

~

~

1&1

~

~

~

~

z

:;j

.J

o

~

1Z

o

f.f

Z

o

Z

W)

o

O)

~...

~

.G

"'

N

o

,..

N

N

~

O)

O

1z

w

~

1I/)

>

~

~-

~.

~N'..GGG

N -~~mGG

co~mNDD

~co"co".,.-.,..,..-N

N

W) O)

I')

..I')

"'

W)

,..

..N

M

V)

~

o

w

~

~

s

(.)

w

o

w

m

o

-l

~

o

(.)

x

1o

z

w

o

-w

~

o

D

~

o.

O

w~

.

'9

!8

-;i

~'E

~{

i

.

I

B

c

.

c

ü:

u

j~

I~ ~

&~

~

00

t')ID

~~

NN

Olt)

N

M

M

a;)M

MIt)

N

It).MM

O

N

N

a;).COM

0

N

C')V

N<O

C')

1t)CX)

r-..<o

~

N

N

1'--~

01'-CO

<Oln

T""

N

r-..1t)

.N

I'--lt)

.N

MCO

~N

~

co,...

MN

N

~,..

~N

(O)

..J

w

~

-ID

U

«

I-.C

u~

wF

..J

c(

cn

u

w

~

-w

:;)

a

w

o

ü)

1:;)

o

cn

w

~

(!)II)

~

~In

InN

O

.-

...

~

~1tI

NItI

~~

t--

N

00

T""C')

0

MM

ON

mIn

T""

MO

M(!)

N

N

(!)M

O)

.-

.N

C')

M

O

MO)

,...

~,...

..M~

,...

~

~~

t')1n

,...~

~

~ ~

-O

!"CO

"'

NO>!"-NON(o

N.-N~

Q)B

---U)

"0

"O==CaI:J-:J

~mwC(u.Ot/)

.'-

Q)

.-

IV

.v

VI

U)

f:.

o

~

Q)

a.

O

'-

.-C

O)

~

C

Q)

>

'-

N

N

!"-CO

M

In

N

fD

IDID

NV

Il)N

.-

No)ll)OONO

N~N~

ION

M

N

~

N

..N

(l)N

~N

0)

on

,.,

cg

(I)~

(I)

N

~In

N

In

co

NNa)OOIn~

NN~~

r--a)

a).r--

o

O

~

IDa)

0>

M

~

Q)

E

O

-Q)

VI

:JU)

iVQ)

W

~

C

O

U

Z

-0)"0

~

-§m

c.üQ)~"0

U

Q)

U

O .--~

VlQ)

Q)U)

z

~

IV

'-

~

IV

O

-C

0-U)IV~

.-°>--IVU)'5

.S 0) 0) IV

IV

'-

.-U)

o°O)Q)C

-U)

W

-

Q.

O

w

X

O

O)

C

=

NC").-(D.-(D(D

NN.-C")(DC")O

=

=

tD

~

:>

'<

z

'-

on

~

C")

~ID

N.ID

C/)

.9?

ro

C/)

E

'-

-

-t=:.c

o~

.c~

U)

(I)

w

..J

<

(I)

(I)

<

<'

..J

t--0>

N

~

C/)

-ID

ro

C/).c

E~

.=~

u.

~

N

o

o

N

~

o

o

N

o

o

o

N

0»

0»

0»

Y-

~

c

.2

~

-cn

.~

-o

c

ro

-ro

ro

,~

"

E

.!i.

g'c

...~

IV..Q.

...

U)

Ut

Ut

~ c

c ~

"Vin:

~

m

"i

$

~

(J

w

m

-w

~

a

E

'~

"O

c

~

~

cn

w

.J

c(

cn

~

E

"O.c

.~ ~

Ct:

ü

-C!)

a:

t> ~

wF

.J

w

=alCaI.c.C

~

o

o

~

o

o

o

~

~o

!I)

o

~

~==

.-~

-,~~

UJ :J.g

~0

~-o

c;.caCI)

Il.

~Uo

'"

.;a

u.::::..

UJ~E

"'

.-~

c'---alU)

.

wc

.

m I~ .

<o

1-0

:;~

~ .C

~~

i

"i

1

c

"

"

~

"

iï:

()

!1 ~

&~

(/)

LU

ffi

~

~

~g

~~

o

~8

~:

~

~

.~

'ù

~

~-8

~

-JO

a.~

~

~~

~

~c

-IV

IV...Q.

<I>

VI

VI

~ C

C ~

ïnD:

~

m

ï;

~

~

N

o

o

N

o

o

N

o

o

o

N

O)

O)

O)

-

~

~M-.rlt)

O)N..'.-~

II)

N~

:3

-;;;(/)

e

E:

u

Q)

.o

.-

(D

N

~o

-<I>"C

:3 .-

O

(/)

:g

EE"'6.J

-.:

.~ .c

uu.u.(/)...

~

w

ï;-;;(/)E CI> ...

-Q)

~roroJ!.

(/) (/) ,

-Osro

~

c

E

~0-5

E..oQ)o

o-<1>"C(/)

>

:3 .;n CI>

~

--.OQ)

~

0,...0,...

'..:a5co"..:

..,

.-,...

It)cno.

o'..:co"co"

It)

.-,..

..'..'..'N

",..tNN

Ii)

N~

~

~

--<I>

.c

(O)

N

.N

rn

M

~

.

:§.

Go

Q

<-'

u

~

.c

~

~

a

ô

oC

i

e

C»

o

.!

10

~

oc(

O

.(.)

.Q)

-.o

~

fi

~~~~

o

o

cx>r

N'..:a>N

"f

"fN

~~~

o

o

MM~M

M..t..tM

o

o

-OJ

='

1/)

--

E

o

~

o

1-

O

..J

~o

o~

o

-c;;I/)

e

EJ

C')

o

~~~~

o

o

o

"tM"ttNO)NN

.~

Nlrilrico"

~~o~

o

o~

0)t-.(C).-

0

Q)

~

~o

-.OQ)

u

-OJ"O

"C

=' .u

Q) 0

"5

1/)

-(.)

o

E

..OQ)o

"i-OJ"O1/)

=' .-

o

O

cc(

(/)

=' 10

.c

.S O I/)

i

I/) I/) E

o

Q)Q)---"i6"i6$

a

I/) I/) I

"t:

~u.u.

~...1-

OCQ

o.:

QIn

ô.':

o~

o..:

0o~

';i:

o

.

,

:§..

..

>-

-fQ.

-

-

~--.

~~

c

c

o::.

.lU

.'O

~ ~

.C

..lU

~U

-C

..u

ac

~

..~

..

>

<~

.-~

tri~

O~

tDtD

CM

<6<6

C")1t>

(1)'...

<DIt>

NO

Oa)

'...1!)

~

~

.

(t)~

t-.M

COCO

00

00

<O1()

r<0<0

00

00

II)

...

IIilIi

~(f)

I"-.

al

\Q

..'.I')

<a"

0

i:

.o

.:J

::>w

<

(,)

..

)(

.(J)

Mz

a

c

~

~u .,.

~

.

.5

.

~

~

..

.

>

~

"'i

~

c

c

.!.

.

~

~

u

~

c

.

.

>o

.-

.,'g

c

o

D

U

.

D

..

~

q

e

'g

>X

C

O

~

.

:§.

f

ro

<a"

<D'..:

c

ID. ID.

ID ID

~

:o

(t)

N

~

~

~

~

~

f

...

>~

"9

o

Q)

c

o

~

.ro

-"O

C(/)

10

"O

~

2..

~

U

't:

o.

>

Ü

I

.o

..

IV

~

>-

..t ~-

.

t-an

CD

~

o

c

-

.

...10

e

.

...10

~

~

..

..c:(/)

.ro

eU::>

.

..l>::>

~

...

.Ë

.E

..

E

~

c

E

~

<

..

c

Q

CO

.É

in

w

w-

I

0-.1 ...

mC

<x

1--"1:

.C

.'c:

~~

!

~

~

g~

=

%

!

Q

:.)

'

~'

o,

-:

..,

#.

ca:

-.,

"

..

.;

l

,

,

I&.;

.,

.-:

~-

'

"

f

4

'"

rf :,

c'"

t 'Ci:'~

'~\~

Y'1

f,;"

tJ

ij

~

~

:::

o

II)

c:

o

,~

:::

,e

c:

~

-8

c:

e

~

~

CJ

,;

,

,

.

,

..1--CI)~

~~

lIJ

a:8

f.2~

I---~

~.,g

UJ~

~o

c:

.ù

.-

~

-

8

.

~~

~

~~

~

--u:

~

o

o

N

.

O

O

O

N

~

o

o

N

r)

o

o

N

N

o

o

N

.o

o

N

o

o

o

N

O)

O)

O)

~

O

C

-O

E

~

C

Q)

~

~

II)

~

CD

N

N.-NaI<Q

ln<QalOIn

t-.

II)

<X)

ID

M

NM==CQ

=O=aI\t)

.-0

.(O)

.O~CQQ)

,...

o

CQ

M

.-

M

CD

M

CD

II)

al

al

II)

...

O)

O)

M

01

In

.C')

<O

.-

o

~

,...

In

V

Ir)

<X)

0)

OID.ID

(0

o

OOIt)

o

co

M

~

II)

o

N

M

Cf)

- (;)

~

c

o

IV

..

~

C

~

c"

ii

o

1-

.II)

ll;m

.N

--,...

~

,...

C

.-

t-.

-

II)

al

N

.-

II)

~

<O

.~

~

CW)

Nm

~

~

<X)

~

N<X)O

M

..,

o

N

N

~

o

N

C')

M

M

...

~

~

~

N

,...

N

o

CX)

.-

~

~

co

N

\I)

Q)

~

...

...

~

9CW)

o

CD

N

N

&I)

M

N

N

~

o

at

at

M

In

o

too

N

N

~

o

1-

1Z

w

~

1cn

w

>

~

..J

N

In

~

~

N

CD

N

=

tN

.

~

'O

c

IV

CIl

Q)

"t:

IV

:c

.Ui

.o

~

(/)

.o

.Q)

oC

-

~

f;

~

~

Q)

>

~

O)

o

~

co

"O

C

(/)

III

~

O

al

C

..!

-;

(.)

III

~

O;

O

1-

In

M

N

..

N

N

o:>

.-

(0

~

N

co

o

r--N

CX) v

Ln

N

o:>

(/)

...

o:>

0)

C')

(/)

co

u

c

~.ECO

c-(/)

~Q)(/),- ~

c

Q)

'-CO.c

CO

O

-

~

111...~

111

...

.c

~a.~

o

~

O)

o

E

Q)

E

...

(/)

..CI

.D

~

'O

c

o

-c

~

.!

E

~

o

~

.-c

C/)

-'-Q)

-O)

.D

c

.-Q.

.-~

-'""

-=

~

c

~

111

c

o

-c

~O~

~-~

-..(/)..

E

c-EQ.~u~-IO

~

111

I-O<tnO~

'O

~

c

~

...(/)

~

.D

.;:

..'...'.OCQt-..'.NNt--M

InM

..=o~

o

CD

o

M

N

.~

~

t-.

In

~

t--

~

~

N

(0

o

~

C') ,...

o

o

NNC')

In

o

M

o

I/)

~

Cf)

Cf)

X

Q)

C

O

O

10

O

O

.o

...

IOQ) .c.

.c.

Q)-

-

-ro

c.

C)

C

N

<X:)

N

N

-C

C")

I

.i::

Q)

;:,

C)

'I

Q)

."

>-~

10

U)

~

-~

...Q)

Q)

"O

C

:J

!I)

-~

(;)

Q)~~Q)

.~

O

ro

.~

U)

c.C=c.

...

.~

10

~

-g

-u;

J

'6'

10

C

10

a:

U

9

~

~

.

-.,

C

-E

g:

>

S

~

Q)

.c

-Q)

'O

C

10

C

~

a:

;

.c

o

C

1.

O

'O

~

>8'

~

.~

o

.,

>.

.,

~

Q) ~

S

~

.'Q)C

J

'O

m

C

O

J

8

C

Q)

N

-

~

"Q;

E

o

J

~

.-

.,

C

O

~

Q)

~

O

~

.c

-.Q

O

-.c

O)

C

-C

~

=

'E

O.'

8

~

-'0'E

.,

~

~

~

~

.Q.

o

~

U.~I-

~-;-,!

~8

t:.i

.x c

8~

("0

o

.

~

u

o

"

c

~

c

ü:

1

!

"0

~

~

e

'iO

&~

z.oo!!.

~

~

~

Net borrowing *eeds

-284

-299

-674

-528

26

Maturities

2351

3345

2152

2246

1076

Sinking fund

17

14

18

22

24

Discounts and qommissions

~

J..1.

2..1

~

l.Q

2109

3095

1521

1765

1136

QQQ

Q

15

4-15

Q

Net financing

Refinancing of Fallable debt

Borrowing

ne~ds according to

the 2000 tinanfial

plan

lli2

~

~

~

~

~

(in millions of dollars)

Issue

Market

1995

Forecast

I

~

~

~

I

44.3%

N

1996

27.8%

1997

6.4%

48.6%

45.0%

1998

3.0%

69.5%

The analysis

spe<ifically

financing

27.5%

deals

with

the

activities

o

of Hydro-Québec.

excluding

its

subsidiaries

joint

and

venture,

represents

1999

which

almost

aIl the activities

of

the enterprise.

.

,..

"

~

f

!

.Gross

..

.

!

!

..

I

§

..

i

..

!

.Canaâ~

borrowi~

.~an

.Net

Wrowings

.Global

.Other

Th. -I...

"",., "'. ,ony""",n

.fI"", 01OU'"","","y.d.oomin,'od

d.b. :1~ 101". y"i,,~

~

.

~

~

:~

~

~

~

~

ui

~

{1}

:::i

ui

:::i

~

~

~

tii

::5

(\I

~

I t.

~

z

\01

QI

..Q

o'QI

~~

~a

&

M

co

~

I

9

I

O

O

O

N

v

.8

o'QI

10;,:'

~o

&

.

fn'tG)

~

U)

~

"C

.-c

U)

cu

Q)

E

<

.c

~

o

z

.c

Q)

c

cu

u

't-Q)

o

E

c.

Q)

E

<

.c

~

o

z

.c

Q) c

c

cu

u

C)

o

Co

Q) E Q)

c.~

.2-c

Q)-;

o

c

.-Q)

C E

JQ.

~.2

OQ)

>c

Q)

cu

c

>

Q)

Q)

c.

c

Q)

.c

.5

c."C~"C~

O

Q)~

.c v,

.-c

Q) .-Q)

v,

#A. c "C

~

fn

G)

cu.!

cu

o

~~~~Q)

.-c..u

Q. ~

fn

~

u ..u

.-c

~~u~c

~

I.W

...

G)a..Q)a..u

.~

It)

c.o t-G)

U)

.

"'t'

co

~

I

~

I

O

O

O

N

v

QI

oC

Q'QI

~~

~o

a

.

co

I

00

~

I

~

O

O

O

O

N

e

'i.~

~

-

a

%

E

~

u

I

-.

~

)(

l

.

'"0 "0

I-c I-c

.

.

I~

o!

-.

~

E

~

u

I

L

u

,

CX)

~

I

~

9

o

o

o

('\I

v

~

oC

2~

~o

~

t".

..

0)

O)

~

I

..q-

9

o

o

o

N

~

~~

'g.O

a

~ ,"

C,c",

C)

.-c

~

o

-G)

.E

E

G)

..,

U)

~

cn

...=c.

C

O

..

E

.s

cn

~

#,

~

...O

G)

..,

N

c

-Q)Q)

~

...'-

G)

=C

~ ..E

O

O cn o .-N

CUCDC.

.cG)G) ~

~

,

..,

c.

G)

C

.W

(I)

G)

(J

.-Q)

C M

.!

G)

..,C)..'

.cG) cn

CU Q)

'- .-tV

C

..,

C)

C

j

o

=

VI

C

cu

(I) m

'-jj I;;

O .A

.c.cCU

Il)Me

~ ~

..

..(I)

.C

...

tV ~

(l)tVCU

.-'-

O

cn

W

.5

o

.-#88

"C

O

C)

't-

00

N N

O

~

-A~

j

Q.

C) "'C

Q)Q)C

tV

(,)

'-

o

~

C

.2

G)

U)

O

~~ .G)

E ~

..e- ~

~'tC" C)

G) c

.M

..,

OCU

..'G)

~

C

..,

'tO

:aG)

...C)

,.".

.-.!l

Q)

c

C

O .-~

~

Q)

,." .

c

~

E

't-

G)Q)'-'-C

.c

(,) O

~

\V

cu

~

»-":~

'G)

,.".

O

E

.c

cocuG)

G)

'-

.c

..::)Q.(/)~

C)

...~

~ O .c.--....~

Q)

O (,) (,)

Q)Q)

't: .-.~

C

cu

:::,

cn

e.cc~~E8...,

..,

i!

cn O t-

.~

=

o

Q)

Q)~~ O

~

..,

~

It)

C) G) .E-o

.-.c

cn... G)

G)

~

't-

o

't- .c j

Q)

.., !/!,

o M (,) ~

-occcn~=Q):a

G) G) .2 ...M

tV "'C

c > =

~ ..''-

~.cr

~ ..,

C

O

.-tV

A~

c.

Cm

CU ~

-~

><

G) .-A'

...'-w

.., ...C)

E

~

.c

M

+,w...~

#88

G)

E

+'

~G)c...o.o°-c~~=

>G)

~

c.c

.A.

-..,

~

~

m

E

.c:

>

m

00

~

o

o

o

N

o

-

D

I

~

o

o

N

m

m

m

~

~

o

o

N

O)

O)

O)

~

,

~

+

c1

~

~

,

.qo

~

-cnc~

.c

~

C

~

r

I

N

I

Il)

<D1l)

~

(/)

...

C

Q)

E

...C

.-Q)

cn

cu Q)

E

E

o

CJ

"C

~

...cn

CG

~

o.J

~

C...OC/)Q)

+

(W')

I

~

+

(W') ~

<D

.

I

::

.:.

~..

."

,;;.;.""'

"..:.*

.:"1 i

~,.~

,:,.~

.1

'

:;;

~

w

C

~

+

l

+

(I)

C

o

.U)

...

Q)

>

.-c

.~

~

o.

I

C

O

o. -Q)

...a

Q) E

S

o

~

CJ cu

c

(W')

M

M~~M

I

M~~~M

I

...

~M.qo

It)

~

C)C

cn E

.9! ~

~...

=C)

CJ CG

~...

Q)

.-C

(I)

C

.c

e

cn

...Q)0.~~

-CJ ~

...C

~

Q) Q)

"Q. ~(I) .~ t:

o. a

"'Q) ~

~J:C(JO(J

(/)

~

~

..."'C

(/)

Q)Q)Q)CO)

c>cncncu

Q) .--Q)

C)Q):Ccn

~

~~

-';

E

!

~

cu

I

(I)

-.c:

CG Q)

>

=

cQ)

t-

-'v

CJ

!!.

E ~ ~

C

c

Q)CJCGc

~~ C o

E

E.Q...CJ...C/)C)

Q) 'Q) .!

...G)

Q)

.~

~

>< C 'tt -=

~ a

G) e ~

'v

C"

Q)

O ,~ '- ",

.c

~ (I) cn '-' VI

C) Q) Q) ..O

'Q) -; "i

c(/)(/)

w

+

-~

.c

~

1fD

~

+

U

!J

~

~

~

~

E

~

'O

j

~

o

'O

c

ca

e

u

~

'O

e

c.

t

~

~

O

~

c.

~

...~

...C

e

~

~

'O

Q,.,C

Ec~

~oc.o

...~~

-;'-5-g

~ c .-

~

~

E

o

~

~

c o u

o u

c~.a

-o~

~ c

~~a

G)

...'

e

G)

~a~

Q,ca~

E

Nc.)

S~.,

-..ca

~G).C

~-u

...v~

u

c

<~D.

~

~

I

I

"""

~

~

O

o

o

N

v

Q/

~

e~

'iO

o

~

ca

Q)

~

o

!

L.

Q)

>

o

~~

(.) o

.-Q.

~

"'C .-E

~

E

o ~

c~

j~

~

L.°"'0

.c.Cc

I

~U)Rca

-.cQ)

,..,. .Q)

<D

~

E

"'O

N

I

Q)aE

-L.

.c

Q) ..-"'C

'1(/) .-'1(/)So

O~~

.-ca

caQ..Oo U)

RQ)

>-O

Oca...

(.)(J...

O

Q)cao

U) ~

R

...Q)~ L.Q)

.->

...

(J

C...~C

Q)...

..

Q..

ca

u

E

cCl)Q) Q) ca

Q) .-~

(.) L .->

C') .-Q)

j

ca=(/)ac

j

e

Q)

ca (/) ~

..

E ..Q)

~

ce>;~~

.-Q)

~c.

cW

.ca

~

.

..

U)

Q)

...,

..u

.!

~

Q)

C

C

o

.-

U)

N

.-U)

E

E

o

U

"'C

C

tU

U)

C

.-o

...

~

Q)

c.

o

Q)

.-

.-E

...

c.~

00

..o

CN

.2 >.

cn

c

o

....,

CJ

Q)

c

c

o

CJ

'-

.!

c

.'1o

c

.-o

...,

'-ca

Q)

Q.

o

o

Q) .c

-cu

.c..."

.-c

><o

Q)

~

I

..

.! s:

C)~

'Q)o

CIl)

f-'-

c

~.c

~~

~~

.

.

'W N..

cn~

C +

ca

.

cn

G)

-

Q)

CG

cn

!

G)

cn

CG

.c

u

...

~

Q.

I

.-f

O

~

G)

cn

~

"C

C

CG

cn

C

O

...,

U

Q)

C

C

O

u

...

G)

..,

C

.-

cu

Q)

~

'tO

-

>

Q)

.

U.c

,

~

G)

G) .~

cn E

~~

C)Q.

...o

G)

c

W

.

N

~

o

o

o

N

"ï=

>

co

co

~

~

m

E

c:J

v

.!

2~

'io

a

.

Li..

.

\J

.!

2~

'io

&

8

.

"'

Qj

oC

2~

~o

(1

-

8

.

.

<O

co

~

,

.q-

c;>

o

o

o

N

~

..a

o~

-50

~

&

8

8

.

""""

~

00

~

I

~

I

O

O

O

N

~

~

2~

~o

G

.

00

~

co

~

I

~

I

O

O

O

N

~

~

e~

'iO

G

o

II)

O)

In

N

0")

=

.

.

O)

t--

=

.

.

, .

,

~

,

=

.

CD

~

CD

M

N

M

O)

Q

M

II)

.

.

.

.

.

.

Q)

N

N

=

N

o

N

~

CD

N

O)

,-

,

00

~

,

v

o

o

o

o

N

t

:2

e~

~o

&

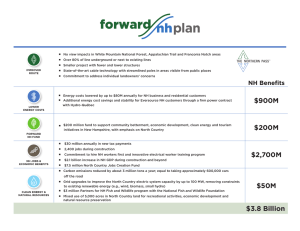

Promising, Innovative Projects

.In

Australia,

HQI has become, in partnership

with the Québec Federation

ofLabor

(QFL) Solidarity Fund and the Australian company North Power, co-owner in a project

for a 180-MW underground interconnection linking the power systems of the states of

Queensland and New South Wales. This initial project in Australia positions HQI in a

deregulated market with a number of interconnection projects to be carried out in the

near future.

.In

Panama, HQI holds a 49% stake in EGE Fortuna, a hydroelectric generating

company, in partnership with the QFL Solidarity Fund and Coastal Power. The

generating station' s installed capacity is 300 MW, and its output meets 40% of

Panama 's electricity requirements.

.These

investments bring HQI's portfolio to $279 million in some eight projects with a

total value of $2.8 billion.

A. General

:

AIl provisions

of the Act tespecting

the Régie de l'Énergie

du Québec (the Board) are now in force (dIe onJy exception

being section 167(3) whichideals with the possible opening of the retail market).

I

However two detennining ~Iementsprevent the Board to exercise fully its rote andjurisdiction.

First, the Québec Govemm~nt bas to determine by order in council, under section 167(2), a procedure for the detennination

and irnplementation Ofth ~ tes for the generation of electric power (commodity rate). This order in council will detennine

if the generation activity o Hydro-Québec will be regulated based on its cost of service or on the basis of a fixed price as

proposed by Hydro-Québ

Secondly, the following

a) Regulation

conceming

regplations have to be authorized by order in council of the Governrnent

the ~onn, contents and periodicity,

(section 72) ;

C) Regulation

Québec

detennining

(section

for the approval by the Board of Hydro-Québec's

t conditions and under which

l

the conditions

73) ;

and under

which

cases the Board will authorize Hydro-Québec's investrnents

cases the Board

applications

will

authorize

exports

of electric

outside

of

projects are still

being subject to the Government's

:

1) Rate for the 1!.eneration of electric DOwer (Comrnoditv

rate)

ln August 1998, the Board bas issued its opinion to the Govemment regarding Hydro-Québec's

procedure for the deterrnination and irnplementation of rates for the generation of electric power .

I

ln its opinion, the Board h~ rejected the proposaI of Hydro-Québec

price, preferring

power

"r

ln awaiting the second regulations mentioned above, investments

approval as prescribed in section 29 of Hydro-Québec's Act.

B. Specific

resource plan

I

b) Regulation detennining th

projects (section 73) ;

.

:

proposaI conceming

a

to regulate the generation activity by way of a fixed

instead a c~st of service regulation.

This opinion was sent to thelGovemment which will decide according to section 167 (2) of the Board's act on the method of

regulation that will apply to ~e generation activity ofHydro-Québec.

2) Regulatorv principles related to transmission rates :

In July, 1999, the Board adopted four regulatory principles

related to the setting of transmission rates: use ofprojected

test

year to set rates; establishment of the rate base and the capital structure using an average of 13 mon1h!y balances ; use of

Hydro-Québec's

fiscal year jts the rate period ; and determination of the main criteria to be used in identif):'ing and

segregating regulated versusl non-regulated activities.

~"

1

8

3) Transmission

rates :

The Board rendered a decision in November 1999 on the procedure to follow in setting b'ansmission rates. First, HydroQuébec bas conducted infomlation sessions on February and Marcb, 2000, for stake-bolders and for the regulator. An

arnended request win be submitted in July 2000 for the irnplementation of a new rate policy to be in operation starting

January I 51,2001. This arnended request will be prepared according to the prevailing regulatory rules establisbed by the

Board as explained on item 2.

Next, public hearings will be held during the fall of2000. The Board will then render a decision on transmission rates

effective January l, 2001.

4) Windrnill Qower :

At the request of the minister of Natural Resources, the Board bas issued an opinion in October 1998 conceming the place

windmill power should play in Québec's energy mix.

The Board recommends implementation of 450 MW of windwill power capacity over a period of nine years. The price paid

by Hydro-Québec would result from a calI to tender but the Board recommends that the price should not exceed 5,8~/kWh

(Can$).

..The

~

Board concludes that only the Governrnent, being the beneficiary of the economical impacts, should assume the

tinancial consequences resulting from the difference between the cost of generating windmill power and the cost of

generating hydraulic power .

The Board estimates this difference at 3 million dollars (Can$) the fust year and over 19 million dollars (Can$) per year for

the total projected installations.

The govemment of Québec bas now to render its decision in response to the Board's opinion.

5)

suQQlied

:

The Regroupement national des conseils régionaux de l'environnement du Québec (regional environmental councils) have

filed this application in November 1998 asking the Board to hold public hearings on the status of Hydro-Québec's hydraulic

reserves.

The Board decided to wait for the govemrnent's decision on electricity generation rates before ruling on this application

concerning the monitoring of Hydro-Québec operations aimed àt ensuring an adequate power supply for Québec consumers.

Following this decision by the Board, the Regroupement filed a petition witb Québec Superior Court. The Court decided to

refer the matter back to the Board for further study. Hydro-Québec bas appealed this decision.

It should be noted that since September 1998, several administrative meetings were held between Hydro-Québec and the

Board and several documents have been filed on a confidential basis, showing that hydraulic reservesare adequate.

""

.

2.

6) Small p.Qwerstations ness than 50 MM :

On June Il dl 1998, the minister of Natural Resources has asked the Board for an opinion regarding the details of

implementation on the contribution of smal1power stations to the resource plan of Hydro-Québec.

After holding public hearings, the Board submitted in December, 1999, its opinion on ways to establish the contribution of

small-scale hydropower production to Hydro-Québec's resources plan. The government of Québec has now to render its

decision in response to the Board's opinion.

After hearing the parties' statements,the Board suspended study of this case.

Régie de l'énergie

Commissioners

President : Mr Jean A. GUÉRIN

Vice-President

: Me Lise LAMBERT

Mr André DUMAIS

Mr

Mr

Me

Mr

Pierre DUPONT

Anthony FRA YNE

Catherine RUDEL- TESSIER

François TANGUA y

Supemumerary

Me Marc-Antoine

PATOINE

Mr Jean-No~1 V ALLIÈRE

-'"'"

3.

Bill no 116 (Proposed Legislation)

Amendments to the Loi sur la Régie de l'énergie (Energy Board Law)

and other legislative dispositions

Summary of a press release issued by the

NaturalResources Department, May II,2000

.Preservation

of the social compact

.protection

of electricity rates cross-subsidization

.competition

for new load

.new powers for the Régie de l'énergie

.compliance

with Québec's energy policy

through a patrimonial

contract

The legislation proposed today by Natural ResourcesMinister JacquesBrassard aims at

preserving the existing social compact and guaranteeingQuébec consumers,especially those in

the residential category, that they will continue enjoying low electricity rates. To that end, the

government enters into a patrimonial contract with Québec consumersrespecting Hydro-Québec's

hydroelectric generation and existing long-term purchasing contracts, for an annual 165 TWh of

energy, at a set price of2.79 cents/kWh. This price will not be allowed to increasein the future.

Hydro-Québec's transmission and distribution costs are in addition to this patrimonial generating

cost. Consumers' electricity rates which already cover these three elements will not be modified.

Indeed, the government confirmed the rate freeze in effect until at least 2002. New load projects

would be allocated through public calls for tenders.

The proposed bill confirms the Régie de l'énergie's role as economic regulator. The Régie will

still establish transmission and distribution rates. It is also gaining new powers, becoming

responsible for supervising the calI for tenders processfor new load projects and for approving

Hydro-Québec's code of conduct for this process.

Highlights

-New powers for the Régie de l'énergie

-Compliance with the 1996 energy policy

-Patrimonial contract average price of 2.79 cents/kWh and annual volume of 165 TWh

-Preservation of cross-subsidization of electricity rates to the advantageresidentiaI customers

-Competition for new load projects and supervision of calI for tender processby the Régie

-Government empowered to establish set-asideand maximal price of energy sourcesit wishes to

encourage (wind power, small hydraulic, etc.)

-MRCs (RegionaI County Municipalities) authorized to create partnerships for development of

under-50 MW hydroelectric sites

-Government of Québec to be sole responsible for lossesor benefits related,to existing special

contracts and export sales contracts.

The average patrimonial price set at 2.79 cents/kWh takes into account expensesrelated to alI

existing generating facilities used by Hydro-Québec as weIl as return on equity .This patrimonial

price for 165 TWh per year will not be allowed to increase.It could only be reduced and this

would have to be at the government's request. This price compares favorably with the

3.8 cents/kWh established by the government of Ontario and by Northeastem United States

distributors' prices, which are in excess of 5 cents/kWh.

The proposed legislation confinns the existing cross-subsidization of electricity rates which

benefits residential customers. Future rate modifications detennined by the Régie wil1 not be

allowed to modify interfinancing.

The proposed legislation also conf1rInSthe principle of rate uniformity acrossthe territory of

Québec.

-rt,I.J..,U

.u

.,?:tcn

C.o>

c.~

:J

O>

~

~

I

(/)~

~

Q)

~

o

0..

>a(/)

-Q)

~C>

a.rn"'CQ)

rn

~::J

""C~c(/)

Q)Q)

o:S:~O

o

c..c:

rnu

OC

m

u

""C

~

:J

""C

c

(/)

c

~

::J

a.

o.ga.

C "3

(/)

Q)

~

o

~

~C>~

Q)C

u .>

.-

.-;>

.-o

'+-

~o

Q)

~

.-

Q)

:s:

o

~

-o

c:

co

E

o

u

=-=

+J

a>

o.

a>

>

(/)

a>

+J

co

'-

Q)

.5

(1)

LQ)

"'O

c

rn

w

E:5

0,+- o

+-'

(1)

::}O>

(..) c:

L---a

~c:

+-'

ro

(..)o+J

w ~

c.Q)"'0

(1)"'Cw

w c:

~:Jc

(1)

-.-C o(/)~

~

-~0 C- u

cn

Q)

..o

co

0+-1

:3

O'"

Q)0+-1

-oC

c

Q)

co E

~0+-1

.-co

co Q)

L1.~

Q)

.c:

ro

\to

-+J

c

.--+J

ro

c

~

a.

§-

-+J

Lo

\tQ)

Q)Q)

-+J >

ro Q)

~Q)

(,).c:

(,)-+J

ro .~

~

-Cc~<n

o

c

~

,v

Q)

c:

."'C o

c:..C

roa.

L-Q)

ro"'Q)

u(/)

-::]

o

a.Q)

Et

o

::]

L- o

u

Q)

<n

c:

o

o.

<n

Q)

L-

c:

o

"'C

0}

..Cc

0}

,u

<0':J

o

o

«

,

c

o.>

..c:

~

~

t

o.>

O.-c

e

o.>

o..=

L- :J

a

c

o.~

00

o.>

~

La

~

o.>

Lu

00

o.> .-

~

u

rn

rn

:J

o

c:

E

==:J

=

cn

C')a.

cn c:

<O o

..c".+:;:

-+Jro\t-Q)

a. E L- .E L- Q).2

~

o

o

~~

:J

'-~o

:J-+J

C- .~

a. cn 2

C

.-o

a.

't-- E

o::]

(/)(/)

CC

roO

Q)U

EC)~

Q)c

-.L:

..c ::]

ro(/)

~ro

Q) Q)

~

E

C-

",.

I

I

r~

~

O

O

O

O

N

I

C':>

<.)

..J

«

C/)

~

>

Q)

u

c

Q)

"O

.U5

Q)

~

a.

I

Q)

U

>

.-

(/)

wt-'

O)

~

~

rn

E

~

O>

~

O)

t:

O)

.-t:

O>

(.)

t:

0>

(.)

(/)

O)

c

~

LU

.

~

I

"'""

~

I

~

O

O

O

O

N

I

..qI

C,)

-J

«

00

~

>

Q)

(J

c

Q)

-o

°in

Q)

'o.

I

Q)

(J

>

ca

~

O'"

'",

I

t-..

~

I

v

O

I

I

O

O

O

N

L()

()

-J

~

w

~

>

~

c:

Q)

oc

.ü)

Q)

..o..

I

Q)

U

>

.

In

~

N

)

.

Il

,

l

o

~

~

c

,II)

c:

Q)

"'0 Q)

~CV

Q)-e

~

~

~~~

Q '~N

~~~

~

Q

~

8

Q

~

~

O)

O)

~

.

(/)

(/)

Q)

c:

.(/)

:J

..c

-c

Q)

u

-Q)

Q)

(/)

'Q

~

o

"'C

.-c:

~

Q)

.-u

~

Q)

(/)

Q)

O)

"'C

Q)

.-

>

.-(/)

'-

'-

a

c.Q)

rn E

'o

&w

o

.

~

,

~

O

O

O

O

N

I

CD

I

I

I

u

-J

«

C/)

~

>

O>

u

c:

O>

"'O

.in

O>

'o..

I

O>

U

5

-

."'=

c:

~

c

Q)

E

o.

.Q

Q)

>

Q)

"C

(J

Q)

.o

o.

(J

c:

~

(/)

c:

o

"..J

-

ro

c

.-

C)O

.5 :I:

"Cro o

~-.-

"CC

c

~

ro (/)

O>~

c: ro

"..J(/)

Q)~

m

~ c:

m ~

E.!

Q) x

..c: Q)

"C

c:

m

(/)

Q)

~

.~

~

o

c

~m

roO

~:I:

c-

(/)Q)â)

"' c:~

-~

..c:

-m

-U)

.9l

o.

E

(/)

2:'

O>

>

~

o

c:

(/)

O>

1::3

t)

::3

1-

fr

(/)

.c: ::)

O>

..c:

1--

fi

~O~

Q)IO>

.c

c

1- o .0

E

"C(/)§

Q)~mo>

2Q)c

u "C ."C

2"Cro

-Q)~

(/)~Q)~"C

~-c

c

9 m

Q)~o>

Q)û)c ...c

ro O

Jc: .c: .Z"

.-~

-E

-~

o Q)

'-Q)t

E>o

Q)..c:

E (/)

-Q)

0..C:

00"C

NC

o

o.

~

o

'-

m

E

Q)

m

(/)

Q)

o

.c:

~

Q)

.c:

--a

~:I:

0)~

Q)

..c

E

o

Q)<.9

>

c:

o

o

z:;:;

c

~

.-Q)

"C c:

Q) Q)

rn<.9

Q) Q)

L-..c

(J

Q)1-

(j)

~

Q)

..a~

(J m

2

o.

z

ft

C)

c

~

Q)

~

~

m

E

"C

c

m

C)

c

;:c;

~

...

~

C)

'Q)

c

a.>

I

c:

Q)

E

Q)

C)

m

c:

m

E

~

(/)

.t:

-c

c:

m

(/)

-

(/)

m

u

Q)

I...

.E

C)

c:

.u

.t:

c.

I

W

(/)

c.

o

""B

c

:J

't-

Q)

>

~

~

.i

c

.E

-c

(U

-c

c

tU

C)

c

:c

I

~

(J

<

m

W

(.)

u..

u..

O

-Q

~

.

W

(.)

i:L

LL

O

1Z

O

a:

LL

.

(J

LL

LL

O

I

.

Q)

E

Q)

E:

E

Q)

E:

o~

J:

:J

(J

.~

E

't-'o

~

C)Q)

tUC)

E:

tU

tU

E:

E

tU

o

E:=

'-

Q)

.-

E:

.-t'O

t'O"'C

'-~

Q)..C.

E:"'C

Q)

Q)

C)tU

Q)

..E:

E:

(/)

C)

~

..E:'.~

~w

E:

'-

.in

l

.-c

-tU

o~

(/)~

Z:-=

t=(/)

~~

D.'C:

wtU

OQ)

C~

z'<5

z

o.~

-E

t-(/)

~E:

-tU

~~

-'t-:J

00

D.°

.

~

~

~

r,..

tr,..

==

..

~

~

"

"

~

là

&

-

-

~

(,)

w

m

'w

~

a

w

-c

(/)

1~

o

(/)

w

..J

c(

(/)

>

~

It

w

z

w

~

-

m

m

m

~

=

D)

D)

~

u

""

~

~

(,)

~

~

~

(W)

"'

"'

~~

(f)

O)

,

CD

.,O

.,-

.

.

~

~

N

N

,~

N

..~

.

~

co

(0

O)

(0

O)

(0

~

~

000

~

(W)

ca:

~

-

In

~

,..

"O

O)

.~

c:

,::)

(1)

O)

1ü

(/)

~

U)

,-

tU

oc

tU

c

as

u

g)

~

.c

c

~

o

(,)

...

~

.c

o

.E

c

~

.Ë

N

fJ9...

O

.c

-

~

.qo

O

ci

O

CI)

~

m

CI)

C)

C

~

~

U

x

W

~

-

o

~

~

~

Q.

~

~

~

,

To

o

{\1

~

(f)

o

o

,.

o

o

v

.qo

o

N

O)

O)

O)

~

00

..

~..-

C\JN

00

00

C\JN

~~

0)0)

EJ...C

CO

c-

..-

I

;?d'

'o

~

Q.<C

--'.2

Q)

t

~

CO O

-'C

.~

G.A.

~~

c~

E~

~

..

~

.r.e

t-.2

c.Q

o.

:5

"i

~

.G

o

'G

.o

E

G

E

..:

~

~

~

~

u

-c

.

8-u ~

=

'C c

; 8

G

0!J.

c

G

E

G

~

Q.:

<.c

-.=m-

e

!

o

~

G

G

~

:

~

O

C

O

!

~

c

c

-

~

-

"i

'g

i=

~-8

.G

=.0-8

c ~

8iE

eEc

-!

E~

oG..Q

-~

c

:5"

~~

...~

-w

~

"i

.OQ.

c

~'C'g

c

~

;m

~m

cG.O

~I

.-.=

:5!

"iG

.!

~

Q.

:

.~G

.r.

a

6

r.

-:2

st.

ce

G.r.

i=

G.S;

Q.

~8

~~

G..

e,N

-~~.c

>-

!;

~

..2

~e

.r.'C

.Q

'G

~

Ga'-

~=

.r.~"'C

-'CG

a

..~

.-E.~

~

C

Q..

0 -Ü

.-ow;

~N2:'..!

E

0

Q.N

2~

~e

Q.Q.

-~

.!'S

c.o

.-

EO

G~

"Q.> O .E

Q.

")(

~É..'~~Q.~~

m~>E"'CBc

O

.r.

o.x-gQ)

Q)~~-G

~'-

-ü-~c(E~.c

.5!"ig=~c~c~~cEc"2

'-~ 8

S

c"ie-uE-~

~-

G~~

(O)...U)

> J--

~.5Q.o~~~ë->

.., -G

°.2l

c

~...o

.c

o>

E -v,

;

-e°..'>-~Se~

~G!.Qo'C~:::0

O:5:~..Q~~~

.~

G

o~~Q)C);'C~

~u.Sc~>

c

...~

-g."'8

-r-

--.5

-N

.E~~~~~65

Z...t:;:o~G~

>Gcüo~;..'

o~~~~ec

'-~ooU)~o~

~~>cN.--'g

.Qc.5~..:~e~

E~>--~~~~

-

--Q.

m

c~o...

~O~c

.A.

N

-

(W)

(\1(\1

dc\Ï

&l)&l)

.q-(W)

0)0

T-N

00

C\JN

o

0>

0>

..-

:in'

~

Q)

E

.

::..

00

om

om

('\1..-

~

--:9

~

~

m o

"'C,

~

c

o

c

0~

o~

~

c

o

~

0-

~

c: