WRITTEN TESTIMONY OF MR. ROBERT McCULLOUGH ON BEHALF OF

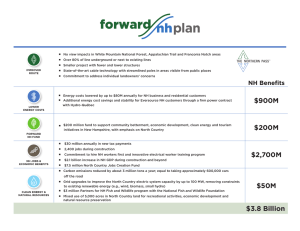

advertisement

WRITTEN TESTIMONY OF MR. ROBERT McCULLOUGH ON BEHALF OF THE GRAND COUNCIL OF THE CREES (EEYOU ISTCHEE) / CREE REGIONAL AUTHORITY before THE RÉGIE DE L’ÉNERGIE MAY 5, 1998 Mr. Robert McCullough’s written testimony Page 1 McCullough Research been retained by the Grand Council of the Crees (Eeyou Istchee) / Cree Regional Authority to review Hydro-Québec’s unusual new approach to regulation. McCullough Research has been active in Québec on Hydro-Québec issues for many years. We have also been active on behalf of Canadian utilities and consumers in other Canadian provinces including Ontario, Alberta, and British Columbia. We have worked on issues of bulk power supply and contracting in across the U.S. including active participation in restructuring across the U.S. McCullough Research has also exported energy for a Canadian utility (Edmonton Power) and purchased power for utilities and industrial customers. In twenty years of practice in the electric business, we have never reviewed a more primitive, inefficient, and inequitable proposal than that Hydro-Québec has put forward for this proceeding. We recommend that the Régie reject the proposal in its entirety and require Hydro-Québec to adopt standard rate making practices in use elsewhere in the United States and Canada. Hydro-Québec’s proposal is very, very simple. Hydro-Québec is asking the Régie to use the existing Rate L as the base for transfer prices from Hydro-Québec’s generation for distribution to its customers. While Hydro-Québec believes that this is new, the practice of gaining regulatory approval for the cost of generation is a common step in many, many jurisdictions. For utilities with a clear institutional division between the generation and distribution business, this step is a standard part of regulatory review. Many other utilities face regulation in their wholesale transactions. Hydro-Québec’s proposal is only innovative in one way. The proposal asks the Régie to abandon its regulatory responsibilities by accepting the price Hydro-Québec proposes without exercising due diligence or oversight. Hydro-Québec has refused to answer all questions that might provide information that would allow the Régie to judge whether the application of a retail rate, adopted without public review, and lacking any justification, should be used for this purpose. The proposal is primitive in that it neglects to consider the interests of the people of Québec. A wide literature exists concerning the appropriate level of costs and their application to rates. Hydro-Québec’s proposal fails to utilize a single tool developed anywhere over the past century. The word primitive is chosen carefully to make it clear that such a proposal would be viewed as amateurish if brought forward elsewhere in Canada or the United States. The two standard monographs on utility regulation, Alfred Kahn’s “The Economics of Regulation”, MIT Press, Cambridge, Massachusetts, 1988 and “Principles of Utility Rates”, James Bonbright, Public Utility Reports, Arlington, Virginia 1988 do not Mr. Robert McCullough’s written testimony Page 2 reference Hydro-Québec’s approach in whole or in part. The omission reflects the mature state of the regulatory debate. Hydro-Québec’s approach simply isn’t sophisticated enough to be present elsewhere in the regulatory, legal, or economic literature. The proposal is inefficient because it allows Hydro-Québec to continue with inefficient pricing in contravention to utility practice. Hydro-Québec has chosen arbitrary values for the prices – prices that may or may not reflect their actual economics. When Hydro-Québec asks consumers to pay the wrong prices, they make the wrong economic decisions – causing losses for society as a whole. The proposal is inequitable because it continues the process of overcharging Québec ratepayers for losses in the export and the subsidized aluminum markets. While Hydro-Québec admits that income is increasing over the next few years, rates will be kept fixed to cover the losses in other markets. In effect, Hydro-Québec plans to overcharge its own citizens to fund sales to the citizen’s of other provinces and countries and provide subsidized power to industries owned by companies from Europe, the United States, and Japan. Hydro-Québec’s responses to the parties’ discovery requests amply illustrates the fear Hydro-Québec has of an open and honest intellectual exchange. Since Hydro-Québec’s overall finances are readily available to investors – the only secrets that are being kept are being kept from the citizens of Québec. My testimony addresses three broad issues: 1. The overall purpose of regulation and the application of universally accepted tools to hydro-Québec’s costs and rates. 2. The appropriateness of keeping rates fixed when costs are falling. 3. The use of Hydro-Québec revenues to support losses in other markets – and the inclusion of these losses in cross-subsidies from Rate L to other customers. I will close with a few comments on Hydro-Québec’s continuing role as the continent’s most secretive utility and the relevance of their secrets in today’s business climate. The Origin and Application of Regulation The U.S. and Canada have a long history of public utility regulation. Regulation was a logical choice for society in industries where a single producer appeared to be more efficient than multiple, smaller, producers. In electricity, the logic was based on the expense of the Mr. Robert McCullough’s written testimony Page 3 infrastructure – competing electric utilities would each have to build distribution systems to serve the consumer. Logically, one utility could build the distribution lines and society would avoid the cost of duplicate distribution systems. Unfortunately, this efficiency came at a high price. Without the discipline of the market, the single monopolistic utility often asked for higher tariffs than were necessary. Also, and equally important, the utility tended to be inefficient and to have higher costs than were necessary – often because the costs could be passed on to the consumers. In both Canada and the U.S. regulatory boards were established to curb both the abuse of monopoly power and the inefficiency that comes from the absence of competition. Such boards are active in many Canadian provinces including Alberta and British Columbia and all U.S. states. Interestingly, regulation is often applied to both public and private utilities. The logic is straightforward. While a desire for excess profit is more likely with private ownership, inefficiency can occur whenever the discipline of the market is absent. In Hydro-Québec’s case, surplus profit is simply another form of taxes. The current proposal raises tax rates higher than they would be without the rate freeze. The issue of raising general government revenues through a tax on electricity is a policy decision. The public debate concerning this form of taxation should take place with complete information. Hydro-Québec’s proposal is inadequate because it attempts to choke off this discussion by keeping information concerning this tax from the public, the interveners and the Régie. Inefficiency is also an issue. With competition, rates for industrial customers in the western U.S. are now considerably lower than those in Québec. In states with industries competing with those in Québec, industrial rates have fallen to the 20 to 25 mill (US) range – corresponding to Canadian prices in the 26 to 33 mill range. Several McCullough Research clients are served at rates lower than these. The purpose of regulation is to allow an open and frank discussion of these issues. Given Hydro-Québec’s secrecy in this proceeding, it is impossible to know why Hydro-Québec rates are higher than those in the U.S. for comparable industries. Is Hydro-Québec’s allocation of costs biased against industry? Perhaps Hydro-Québec’s costs and subsidies for other markets are too high. Only an active investigation of the issue will reveal the answer. The basic approach to evaluate rates is a three step process. The first step is to evaluate the appropriate level of cost. The standard formula used throughout the industry is: Total Costs Equals Plus Return To Investors Depreciation Mr. Robert McCullough’s written testimony Plus Minus Page 4 O&M Costs Net Income From External Markets. For a publically owned utility, such as Hydro-Québec, the return to investors is equal to the cost of the debt issued to build the system and a margin above that cost required as a reserve against risk. Depreciation is the accounting cost corresponding to wear and tear on equipment over time. O&M – operations and maintenance costs include salaries, general expenses, and equipment that is expensed in the current year. The final component, Net Income From External Markets, reflects the net income that may be available from off-system sales. Since the system paid for by consumers provides the opportunity for such sales, the net income is netted against the costs to the benefit of consumers. The second step is to apportion the costs between consumers. The division of costs is usually undertaken on the basis of energy – the actual amount of kilowatt-hours used – and capacity – the maximum consumption of kilowatt-hours at any given moment in time. Hydro-Québec has always had a very simple cost allocation methodology. This has reflected the absence of a public discussion concerning the allocation of costs. Hydro-Québec has openly admitted the weakness of its current methodology: “Hydro-Quebec must periodically review the principles applied in the calculation of supply costs to ensure they adequately reflect the system's operating reality and customer consumption characteristics. It is also important to take into account the improvements in the methodology generally used by electric utilities. These improvements provide more accurate data on the specific supply costs for each market sector based on its use of the system. Hydro-Quebec is currently conducting a full review of its method of determining supply costs to ensure that cause-and-effect relationships are correctly reflected. The changes being contemplated at the present time concern, specifically the apportionment of costs between power demand and energy. as well as their allocation to the various rate categories. Demand costs would be associated with capacity to meet maximum demand. which is a determining factor for rate categories present during the system's peak period. An analysis of the method has confirmed and even strengthened the Conclusions for the domestic rate category. According to preliminary results obtained with the method currently used, which is by no means the most penalizing, the profit margin has swung to the negative side, reaching approximately -8% in 1995. Mr. Robert McCullough’s written testimony Page 5 The first step in the revision process has been completed and the principals concerned at Hydro-Quebec have been consulted regarding calculation method principles that need to be changed. Validation is now being conducted by independent experts who are evaluating the changes to be made to the method and comparing them with those that other electric utilities are planning. Meanwhile, Hydro-Quebec has begun an information-and-discussion process with the Natural Resources Minister and will then inform its external partners.”1 Unfortunately, Hydro-Québec has not taken the steps they proposed two years ago. The rate L proposed in this proceeding is based on the 1996 Rates Proposal. If the calculations behind Rate L were not secret, it would be possible for the Régie and the participants in this hearing to examine the cost allocation methodology and determine whether it is appropriate for Québec. The final step in traditional utility rate making is to take the allocated costs and to assign them to specific billing determinants. Again, Hydro-Québec maintains that this information is secret, and no clear evaluation can be made whether this step has been carried out appropriately. Overall, the problem with secrecy is simply that it defeats the purpose of regulation. Hydro-Québec’s arguments to the contrary, eliminating data from this proceeding simply removes the checks and balances that the Régie is supposed to set on Hydro-Québec. The losers are the citizens of Québec. They will certainly pay higher rates without an effective review. Another loser is Hydro-Québec. Since competition is not allowed in Québec, the only competitive discipline on Hydro-Québec comes from regulatory review. If this review is absent – or ineffective – Hydro-Québec will continue to impose rates that are increasingly uncompetitive with rates across the border in the U.S. Hydro-Québec’s Proposed Rate Freeze In this proceeding Hydro-Québec is arguing for a five year freeze. This step is unusual during a period when Hydro-Québec has announced rapidly increased earnings. Put simply, the standard regulatory approach would confer rate decreases over the next five years. Approval of a rate freeze will transfer hundreds of million of dollars from Québec’s citizens and businesses to Hydro-Québec. 1Hydro-Québec, 1996 Rates Proposal, Page 20. Mr. Robert McCullough’s written testimony Page 6 The Strategic Plan indicates that net income will more than double over the period of the freeze.2 The net income does not increase because additional investments have been made which require an additional return to investors. Assets net of depreciation only increase by 6% over this period. If the rates proposed in this proceeding are appropriate for 1998, the levels after 1998 reflect levels of return that are inappropriate and unjustified in this proceeding. If we assume that the use of Rate L the basis for rates was correct, and we adjust the transportation and distribution costs in a consistent fashion by load factor, total costs by rate class would be: 2Stategic Plan 1998-2002, Table2, Page 53. Mr. Robert McCullough’s written testimony Rate D Cost Rate G Cost Rate M Cost Rate L Cost Other Costs All Rates Bylaw Costs Exports Costs Special Contracts Costs All Sales Costs HQ Forecasted Revenues Total Cost Cents/kWh 7.04 6.31 5.82 3.79 4.50 5.60 4.33 3.67 Generation Cents/kWh 3.22 2.94 2.75 2.52 2.93 2.87 2.83 2.45 Page 7 Transmission Cents/kWh 1.79 1.58 1.44 1.27 1.57 1.53 1.50 1.22 Distribution Cents/kWh 2.03 1.79 1.63 1.20 Total Cost Millions 3,745 730 1,103 1,861 261 7,762 867 822 9,450 9,821 Source: Strategic Plan, pages 24 and 25, and Proposal To The Régie, Appendix F. 3 This table shows the costs that Hydro-Québec believes should be recovered from all of its customers. These costs contain all of the necessary components including return on investment, depreciation, and operating costs. Any revenues above these costs are surplus to hydro-Québec’s needs and would normally be returned to ratepayers. We can use the loads forecasted by Hydro-Québec in their Strategic Plan to estimate the forecasted costs in 2002, $9,450,000,000, and the revenues $9,821,000,000. The difference, $371,000,000, are earnings not required by Hydro-Québec and should be returned to ratepayers. This would be equivalent to a 4.78% reduction in rates for Québec customers. The exact level of the rate discount varies by year. Of course, Hydro-Québec’s insistence to maintain secrecy over numbers used to calculate costs make these calculations subject to adjustment when additional materials become available. It should be noted that this table reflects information that Hydro-Québec has traditionally made available to its customers in its Rate proceedings consultations, and through discovery meetings with Québec groups, like the Cree. From the materials presented by Hydro-Québec we cannot know whether this surplus profit is taken from overcharging Québec customers or speculative sales in export markets and Risk and Profit Sharing customers. Only a careful review based on the actual cost data will give us the answer to this question. If the additional income is the product of speculative undertakings, the ratepayers who bear the burden should expect recompense. Revenues from exports and the aluminum smelters are volatile. The ratepayers pay for the equipment that makes these speculations possible. It is manifestly unfair for the ratepayers to bear the risk of 3Transmission and distribution charges have been interpolated by capacity. Mr. Robert McCullough’s written testimony Page 8 the speculations but not to receive the benefits. If the extra revenues come from an incorrect assignment of costs to ratepayers, the costs should be applied to the correct areas and not surcharged to ratepayers. All of the above calculations are taken directly from Hydro-Québec materials. They presume that Hydro-Québec will make significant profits in serving aluminum smelters and the U.S. export market. If they do, the forecasts contained in the Strategic Plan show that the revenues will not be returned to ratepayers. If they don’t, as we discuss below, ratepayers are not insulated from the losses and the ratepayers may well bear the brunt of such losses. Subsidies To Exports And Risk And Profit Sharing Customers Since Hydro-Québec has chosen to hide materials that they traditionally made available to the public, it is impossible to precisely estimate the degree that losses in other markets have been added to Rate L. The following table shows the results for 1994. Rate Category Rate D Rate G Rate M Rate L Other Standard Rates Exports Special Contracts Total Sales Other Grand Total Source: TWh 46.6 12.2 20.0 34.8 4.5 118.1 19.2 20.9 % 29.4% 7.7% 12.6% 22.0% 2.9% 74.7% 12.1% 13.2% % 10.0% 32.9% 35.0% 17.2% -17.8% 18.6% -56.3% -69.9% 158.2 100.0% 8.8% Relative Contribution To Profits % 42.8% 47.7% 66.8% 35.1% -6.0% -46.6% -39.8% 100.0% Profit Margin Profits 2722.0 923.0 1216.0 1301.0 215.0 6377.0 527.0 363.0 272.6 303.9 425.4 223.8 -38.2 1187.5 -296.9 -253.6 7267.0 30.0 7297.0 637.0 30.0 667.0 Average Rate Mills 58.4 75.6 60.9 37.4 47.4 54.0 27.5 17.4 Revenue Cost Ratio 111.13% 149.09% 153.80% 120.78% 84.92% 122.88% 63.96% 58.87% 45.9 Internal McCullough Research estimates based on publically available materials The losses from the Risk and Profit Sharing program do not disappear. Since bond holders continue to be paid, rates must be raised to offset these losses. Over the years, Hydro-Québec has had to shoulder enormous losses. These losses have reduced Hydro-Québec’s liquidity and affected its financial health. Over time, these losses have forced Hydro-Québec to increase rates to all of its customers. The current proposal argues that ratepayers are to be protected against such losses because the rates will not be raised until 2002. Unfortunately, the losses do not go away. If Hydro-Québec loses $240,000,00 per year over the next five years, this will Mr. Robert McCullough’s written testimony Page 9 reduce Hydro-Québec’s retained earnings. The lower level of retained earnings will require future rate increases to maintain Hydro-Québec’s ability to finance future projects. Hydro-Québec has traditionally overestimated the potential revenues in both the export markets and the Risk and Profit Sharing Program. While most industry analysts feel that aluminum prices tend around the $.75 per pound level, Hydro-Québec has assumed that they will reach levels over 20% higher than that level. The importance of the $.75 per pound level is that this price will allow a producer to build a new greenfield smelter. Prices higher than that, held for any length of time, would be driven down by the construction of new smelters. The Strategic Plan indicates that aluminum prices will rapidly reach new highs and stay at those levels.4 The following chart shows the relationship between Hydro-Québec’s forecasts and actual prices for the 1997 and 1998. As can readily be seen, Hydro-Québec’s forecasts weren’t even very realistic when they 4Strategic Plan, Table 4, Page 56 Mr. Robert McCullough’s written testimony Page 10 were released – let alone today. Revenues from Hydro-Québec’s sales subject to the Rates policy will be $7,402,000,000 in 2002. Hydro-Québec estimates additional revenues from exports and the Risk and Profit Sharing contracts to contribute an additional $2,418,200,000 in 2002 – approximately 5.7 cents per kilowatthour. These are very, very high levels. Assuming aluminum prices are in the $.75 range (1998 U.S. dollars), Québec’s revenues from the 18.8 TWH aluminum load will be only $445 million. Hydro-Québec assumes that they will be receiving $509 million for the same load. 5 Similarly, Hydro-Québec assumes that export prices will be 125% of their 1997 levels by 2002. Hydro-Québec traditionally overestimates potential future revenues from the U.S. market. Preliminary 1997 figures indicate that 1997 prices received by Hydro-Québec are 38.41 mills.6 This would push 2002 revenues to 48 mills Canadian or 38 mills U.S. A full GE frame 7F combined cycle turbine is currently available at 25 mills U.S. including both capital costs and the cost of natural gas. In a world where recent McCullough Research long term purchases for the same period of ranged from 16 mills U.S. to 20 mills U.S. these values appear theoretical at best. It is straightforward to enter these prices into Hydro-Québec’s cost analysis. The following chart uses Hydro-Québec’s rate L methodology and applies it to reasonable export and aluminum forecasts for 2002. We have used the cost of a Frame 7F turbine as an indication of the potential prices in the export markets. Exports Aluminum Contracts TWH 20.0 18.8 % 11.05% 10.39% Revenue 712.5 445.5 Average Rate 3.6 2.4 Cost/Revenue Level 121.67% 154.79% Cost 4.33 3.67 Profits -154.4 -244.1 We have also conducted forecasts of the NEPOOL market using the Aurora model. The forecasts reflect a full analysis of New England power markets over the next five years. The following charts shows our forecasts on a month by month basis. of Hydro-Québec’s Risk and Profit Sharing contracts has indicated that the contracts receive revenues equal to 15% of smelter revenues. 5Coverage 61998 Third Quarter Hydro-Québec report. Mr. Robert McCullough’s written testimony Page 11 Using these forecasts, the table shows a smaller level of losses: Exports Aluminum Contracts TWH 20.0 18.8 % 11.05% 10.39% Revenue 712.5 445.5 Average Rate 4.1 2.4 Cost/Revenue Level 121.67% 154.79% Cost 4.33 3.67 Profits -38.9 -244.1 It should be noted that this table reflects the limited materials available in the Strategic Plan. Hydro-Québec now maintains that commonly available materials traditionally made available are subject to secrecy. These values assume, for example, that no additional Risk and profit Sharing loads have been added by 2002. Since several of the contracts have options, this assumption simply reflects the fact that Rate L is higher than comparable tariffs in the U.S. The cross-subsidy required to cover exports and sales to aluminum smelters in 2002 is an additional $398,500,000 dollars. If these sales were eliminated – or renegotiated to cost – Québec ratepayers would see an additional rate reduction of 5.38%. Unfortunately, these two rate reductions are not additive. If the rate reduction in 2002 from the excess earnings is 4.78% and the subsidy to exports and aluminum smelters would provide an additional 5.38% reduction, the total reduction would be in excess of Mr. Robert McCullough’s written testimony Page 12 10%. In reality, the substantial earning predicted by Hydro-Québec are based on the unrealistic sales assumptions described above. If Hydro-Québec realized its sales price predictions, it should return the surplus to Québec’s rate payers. If it does not, it should not pass on the losses. The critical issue is where these revenues and losses are coming from. Hydro-Québec has not provided any information on these issues. Moreover, it has refused to answer questions on these calculations. For the Régie to address the propriety of Hydro-Québec’s approach we need a full cost study to find out the source of the revenues and to justify the assignment of costs. The proposal by Hydro-Québec does not allow us to check whether there are cross-subsidies between Rate L and other markets. Cross-subsidization leads to inefficiency in the economy and does not lead Québecois to make the correct economic choices. For example, cross-subsidies between external markets and Québec consumers reduces the competitiveness of Quebec industry and creates incentives for industry to relocated to other regions where such cross-subsidies do not occur. In addition, the actual consumption decisions of ratepayers are driven towards choices that do not make the best use of available energy. Low costs for home heating in electricity tend to encourage consumers to heat with electricity instead of gas. Secrecy In Québec Unlike other major utilities in the U.S. and Canada, Hydro-Québec has always followed a path of secrecy in its business dealings with its ratepayers. The strong surmise is that this secrecy is designed to shield Hydro-Québec from its losses in speculative markets like exports and aluminum. Hydro-Québec now argues that the need for secrecy will be even more intense in a competitive environment. The theory seems somehow tied to the idea that export customers will take advantage of Hydro-Québec if they new Hydro-Québec’s information. This idea is made even more bizarre when one considers that Hydro-Québec releases detailed forecasts to Wall Street even while keeping them secret from this proceeding in Québec. Since the competitive U.S. market is very open, Hydro-Québec appears to be taking a path where their finances are known only to their competitors and the secrecy is reserved for the people of Québec. In truly competitive markets the price is set in the market. Competitors can observe the market and make a decision concerning their desire to buy or sell energy and capacity. McCullough Research represents both utilities (Canadian and U.S.) In the U.S. market as well as large customers. It is difficult to understand what our clients Mr. Robert McCullough’s written testimony Page 13 would do with Hydro-Québec’s secrets even if they were, in fact, secret. We have evaluated competitive bids to which Hydro-Québec has responded and the question of Hydro-Québec’s “secrets” has never been raised. In fact, in an extensive practice reviewing bulk power marketing issues from Québec to California, the question of the secrecy of accounting data has never been raised -- primarily because all of such data is publicly available -- as it is in a number of Canadian provinces. In part, it is possible that Hydro-Québec’s concerns simply reflect their inexperience with competitive markets. True competitive markets are transparent. Prices are reported publically and market participants have a very good idea of the behavior of both customers and suppliers. Hydro-Québec’s poor showing in contract negotiations has often been caused by their very desire to maintain secrecy -- allowing the other participants without these disadvantages to simply outmaneuver Hydro-Québec’s negotiators. This is one reason why the Risk and Profit Sharing contracts turned out to be so disadvantageous to Hydro-Québec. Almost every document requested by the Grand Council of the Crees (Eeyou Istchee) / Cree Regional Authority have been publically available in past proceedings, Hydro-Québec’s consultations with its customers, or within the context of negotiations. For example, rate design documents have been made available to Hydro-Québec’s customers on a number of occasions since the late 1980s. Detailed revenue/cost review information was part of every Rates Proposal. Detailed load forecast materials – including the Risk and profit Sharing customers – was made available in the context of each Development Plan. Specific financial information has been made available publically and directly to the Cree. Review of specific export information has also been made available directly to the Cree. Simply stated, Hydro-Québec’s current position is inconsistent with its own past policy and practice elsewhere in North America. As stated above, the current level of secrecy makes a mockery out of the responsibilities of the Régie and ignores the legitimate interests of the interveners. *****