DRAFT: 29/05/2016 re: Hydro Quebec Application Docket No. R3398-98

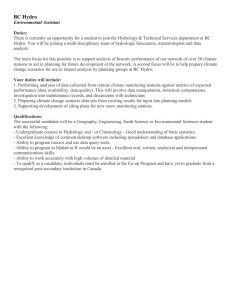

advertisement

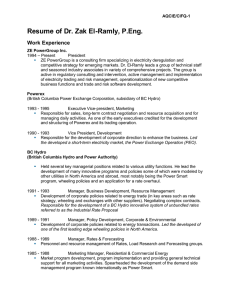

DRAFT: 29/05/2016 1 Testimony of K. G. Peterson 2 re: Hydro Quebec Application 3 Docket No. R3398-98 4 5 6 I am President and Chief Executive Officer of the British Columbia Power Exchange 7 Corporation (“Powerex”), a wholly-owned subsidiary of the British Columbia Hydro and Power 8 Authority (“B.C.Hydro”). Powerex is a power marketer, actively competing in electricity 9 markets in regions outside of BC. Powerex has received power marketing authorization from 10 the US Federal Energy Regulatory Commission (“FERC”), and holds export authorizations from 11 the National Energy Board (“NEB”) and the Province of BC for exports to the US Powerex also 12 holds export permits from the US Department of Energy for exports to Mexico and to Canada 13 over all major interconnection points. Powerex has an application pending at the NEB for 14 exports to the US over all major interconnection points. 15 16 I am also President of the Western Regional Transmission Association (“WRTA”), the first 17 Regional Transmission Group (“RTG”) to receive approval from FERC, and am Chair of the 18 Western Interconnection Coordination Forum, an association of reliability councils and RTGs in 19 the west of North America. My C.V. is attached as Appendix A. 20 21 Powerex is an active competitor in markets in the west, including Alberta, and has sold energy as 22 far east as Wisconsin and as far south as Mexico. Powerex has a 24 hour a day, 7 day a week 23 trade operation in Vancouver. For the fiscal year ending March 31, 1998 Powerex’s revenues 24 exceeded $330 million (CAD) on sales volumes of approximately 13,000 GWh. Forty percent 25 of these sales were supplied from non-B.C.Hydro energy, a figure which is projected to increase 26 to 75% for the current fiscal year. 27 28 Powerex conducts real-time (next hour) sales, and daily and monthly block sales at various 29 trading hubs including the California-Oregon Border (“COB”), Mid-Columbia and Palo Verde. 30 Real-time sales accounted for about 25% of sales volume, daily sales were 20%, and monthly Testimony of K.G. Peterson 1 Powerex DRAFT: 29/05/2016 1 block sales were 45% of sales. Powerex also makes longer term customized energy 2 transactions, and has a number of multi-year contracts, some of which were the result of 3 successful bids in requests for proposals. These transactions accounted for 10% of Powerex’s 4 sales. 5 6 While the majority of Powerex’s sales are to wholesale customers (utilities and other power 7 marketers), Powerex does have some sales to large industrial retail customers in the US. 8 Powerex is participating in the retail access pilot programs under way in the US Pacific 9 Northwest. 10 11 There are at least two distinct trends in the manner of electricity trading that Powerex has 12 observed. The first is clearly a trend to shorter duration transactions. Five years ago, the split 13 between the categories of sales noted above was reversed, with over half of all sales under long 14 term contracts and only a fraction of total sales made under real-time. 15 16 The second trend is towards greater use of contract pricing linked to markets. This occurs in two 17 ways. The first is a direct link between the contract price and a market index; for example COB 18 plus x $/MWh. The second is a fixed contract price but to have a contract re-opener if the 19 contract price gets too far above or below the market price over time. Either way, the contract 20 price is influenced by changing market conditions. 21 22 B.C.Hydro has, as does Hydro Quebec, a predominantly hydroelectric generation system, with 23 substantial storage capability. Over 90% of B.C.Hydro’s production on average is from 24 hydro-generators, and under most stream flow conditions there is surplus generation available 25 that can be exported. 26 low, approximately $5/MWh, thus ensuring these facilities can be dispatched under all but the 27 most extreme market conditions. The low variable cost of these facilities together with the 28 water storage capability, allows B.C.Hydro to choose when to sell surplus electricity on the 29 export market. It also allows B.C.Hydro to import electricity during low price periods (light Testimony of K.G. Peterson The variable cost of B.C.Hydro’s hydroelectric generation is extremely 2 Powerex DRAFT: 29/05/2016 1 load hours and spring/early summer) to serve load in BC, and save the water in reservoirs for 2 later high price periods in the export market. 3 4 B.C.Hydro’s transmission interconnection North to South with the US is rated at 3,150 MW or 5 about 30% of its generating capacity. Because B.C.Hydro is in more or less load resource 6 balance and therefore B.C.Hydro’s generation is mostly committed to domestic load, the intertie 7 limits only rarely constrain trade between BC and the US. Because of this lack of constraints, 8 B.C.Hydro has been able to use a US market index (the Mid-Columbia index reported by Dow 9 Jones) in its Real-Time Pricing Program for industrial customers. The same or a similar index is 10 being considered for a B.C.Hydro virtual access program for industrials, recently announced by 11 the BC Government. 12 13 Powerex’s export sales occur in a highly competitive market, where the price is set by 14 competition amongst suppliers without regard for average cost of production. Certainly 15 B.C.Hydro’s historic (average embedded) cost has no influence or impact on the market price 16 Powerex is able to get for export sales. B.C.Hydro’s Fully Allocated Cost of Service Study 17 (“FACOS”) has been made publicly available for many years through the BCUC regulatory 18 process and to the best of Powerex’s knowledge this disclosure has not harmed Powerex in the 19 export markets. Testimony of K.G. Peterson 3 Powerex