Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 R

advertisement

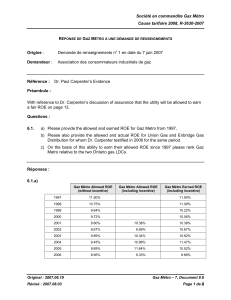

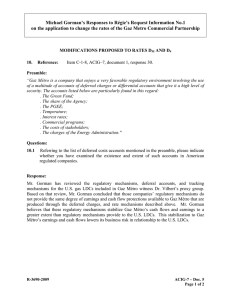

Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 RÉPONSE DE GAZ MÉTRO À UNE DEMANDE DE RENSEIGNEMENTS Origine : Demande de renseignements no 1 en date du 7 juin 2007 Demandeur : Association des consommateurs industriels de gaz Référence : Dr. Paul Carpenter’s Evidence Préambule : With reference to Dr. Carpenter’s discussion of the decline in average consumption of gas by Gaz Metro’s customers on page 23. Questions : 11.1. a) Please indicate why this is a risk factor if it can be predicted by the accuracy shown in the graphs on Page 23, that is why has it made the consumption for natural gas more difficult to forecast? b) Please indicate whether Union Gas and EDGY for whom Dr. Carpenter testified in 2006 have suffered the same declining in average use. c) Please indicate any decisions by the Ontario Energy Board and provide extracts from the decisions that have specifically accepted declining average gas consumption as a risk factor for Union Gas and EDGY. Réponses : 11.1.a) The issue is not simply whether declining average use has made natural gas consumption more difficult to forecast. Gaz Métro’s distribution system is a fixed asset in place. It cannot be easily adjusted for declines in average use. Therefore, declining average use increases the risk to Gaz Métro of having stranded distribution system assets. 11.1.b) Dr. Carpenter testified in their respective 2007 rates cases that Union Gas and EGDI have experienced declining average use, but he has not testified that the declining average use is the same in all cases. See pages 16 – 20 of “Written Evidence of Paul R. Carpenter for Union Gas Limited,” OEB Docket No. 2005-0520, Exhibit E2, Tab 2, January 2006 and pages 14 – 16 of “Written Evidence of Paul R. Carpenter for Enbridge Gas Distribution Inc.,” OEB Docket No. EB-2006-0034, Exhibit E2, Tab 1, Schedule 2, August 2006. Original : 2007.06.19 Révisé : 2007.08.03 Gaz Métro – 7, Document 9.11 Page 1 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 11.1.c) The Staff of the Ontario Energy Board and its consultant have recognized that Union Gas and EGDI have experienced declining average use in the ongoing proceeding to establish incentive regulation regimes for these distributors as part of the OEB’s Natural Gas Forum proceeding. See for example the OEB Staff discussion paper titled “On an Incentive Regulation Framework For Natural Gas Utilities” (January 5, 2007), which states: Board staff recognizes that declining average use is being experienced by many gas utilities in North America. This trend has financial implications for the gas utilities that “increase the need for rate escalation”. As a result, a number of gas utilities in North America have rate mechanisms that separate or decouple the recovery of fixed system costs from the volume of gas delivered to customers or use novel rate methodologies to stabilize earnings or revenue flow. Therefore, Board staff sees merit in investigating this issue further. PEG [the OEB Staff’s consultant] will undertake analysis to determine the extent of declining average use, and whether it differs materially among rate classes. (p. 18, footnotes omitted) OEB Staff’s consultant Pacific Economics Group (PEG) did investigate declining average use for EGDI and Union, and found in its study titled “Rate Adjustment Indexes for Natural Gas Utilities” (June 8, 2007): Declining average use is being experienced by many gas utilities in North America today. The conditions encouraging declining average use include more efficient gas furnaces, better home insulation, and customer response to higher natural gas prices. This trend has increased the need of gas utilities for rate escalation. The trend affects rates for different customer rate classes differently. Heat-sensitive loads are primarily in the residential and commercial rate classes. Growth in the number of customers and input price inflation are the principle drivers of higher cost of gas distributor base rate inputs. For the PCI, the AU factor [the factor that accounts for average use trends] was calculated as the difference between the revenue-weighted and elasticity-weighted output indexes. Weather normalized volumes are used in these calculations. For Enbridge and Union, the AU factors are -0.81 and -0.72. (p. vi) Original : 2007.06.19 Révisé : 2007.08.03 Gaz Métro – 7, Document 9.11 Page 2 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 EB-2005-0520 Exhibit E2 Tab 2 WRITTEN EVIDENCE OF PAUL R. CARPENTER FOR UNION GAS LIMITED The Brattle Group 44 Brattle Street Cambridge, Massachusetts 02138 617.864.7900 January 2006 Original : 2007.08.03 Gaz Métro - 7, Document 9.11 Page 3 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 7 Commercial Rate 01 600 Total Bill Amount ($) 500 400 300 200 Annual 100 Summer Winter 0 1991 1992 Annual Summer Winter 1993 1994 1995 1996 1997 1998 Commercial 01 Pre-1998 Yearly Standard Average % Change Deviation 180.35 (15.70) 13.96 40.61 (15.81) 4.43 316.98 (9.30) 22.97 1999 2000 Annual Summer Winter 2001 2002 2003 2004 Commercial 01 Post-1998 Yearly Standard Average % Change Deviation 258.26 71.63 51.15 68.14 70.85 17.74 425.69 93.12 106.97 Notes: Summer rate is calculated using the average of June, July, and August. Winter rate is calculated using the average of November and December from previous year, January, February, and March from current year. Rate for Summer 2005 is not available as the latest data provided is March 2005. 1 2 These fundamental changes in the commodity price environment have begun to induce 3 changes in customer use of Union’s network. This can be seen in decreases in Union’s 4 historical and forecast usage per customer and in an increase in customer elasticity of 5 demand. 6 7 Q28. What do the usage per customer statistics show? 8 A28. I have asked Union to run its regression models used to estimate usage per customer 9 (Normalized Average Consumption or NAC) using prices for 1998, 2004 and forecast 10 2007 assuming that no other variables are changing but the price of natural gas reflected 11 in the customers’ bills. This exercise will isolate changes in the NAC associated with 12 changes in the gas commodity environment, holding other factors that affect utilization 13 constant. Table 1 shows the results. For example, for residential rate M2 estimated NAC 14 at 1998 price levels is 2,583 m3. At 2004 prices estimated NAC declines to 2,486 m3, or 15 3.8%. The M2 NAC estimate for 2007 prices based on the current NYMEX forward 16 prices for that time period is 2,397 m3, a decline of an additional 3.6%. Thus, Union’s 17 forecasting models suggest that the decline in NAC forecast to occur between 2004 and Original : 2007.08.03 16 Gaz Métro - 7, Document 9.11 Page 4 de 12 WRITTEN EVIDENCE OF PAUL R. CARPENTER Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 1 2007 is nearly as large as the decline over the entire six years from 1998 to 2004, due to 2 prices alone. Moreover, the forecast uncertainty in the residential rate M2 NAC estimate 3 due to prices at a 95 percent confidence limit for 2007 ranges from 2,149 to 2,644 m3, or 4 roughly a 23 percent range from low to high. Therefore, based on historical experience 5 these data tell us that there is a risk that the decline in M2 NAC from 1998 to 2007 could 6 be as high as 17 percent due to the effect of the commodity price alone on residential 7 consumption, with most of the effect occurring after 2004. 8 Table 1 Estimated NAC by Residential Customer Class (Annual m³ per Customer) 1998 2004 2007 2007 95% Conf. 9 Res M2 2,583 2,486 2,397 2,149-2,644 Res 01 2,568 2,501 2,437 2,097-2,777 Note: Estimated NAC is not reduced for the impact of Union's DSM plan. Source: Union Gas. 10 11 Q29. How has the elasticity of customer demand changed? 12 A29. Another way of describing how the commodity price changes affect Union and its 13 customers is to calculate how the elasticity of demand (represented by percentage change 14 in NAC divided by percentage change in customer bill) has changed over time. Elasticity 15 of demand is a measure of how sensitive customer usage is to changes in price (or their 16 total bill). The higher the elasticity (higher the negative number) is, the more sensitive is 17 usage to price. 18 19 These results are summarized in Table 2. For residential rate M2, for example, the 20 elasticity of demand estimated over the period 1998 to 2004 was -0.051. For the period 21 2004 to 2007 the M2 elasticity estimate nearly doubles to -0.094. 22 Original : 2007.08.03 17 Gaz Métro - 7, Document 9.11 Page 5 de 12 WRITTEN EVIDENCE OF PAUL R. CARPENTER Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 Table 2 Change in Estimated NAC Elasticity of Customer Demand NAC Change 2004-1998 2007-2004 Bill Change 2004-1998 2007-2004 Elasticity 2004-1998 2007-2004 Source: 1 Res M2 Res 01 -3.8% -3.6% -2.6% -2.5% 74.0% 38.1% 66.5% 36.0% -0.051 -0.094 -0.040 -0.071 Union Gas. 2 3 Q30. Are these results likely to be conservative? 4 A30. Yes they are. These estimates of decline in usage per customer and increase in elasticity 5 of demand were performed using Union’s forecasting models. The models, of necessity, 6 estimate these relationships using historical data that do not yet fully incorporate how the 7 very recent changes in prices may influence customer behaviour in the future. For 8 example, if in the residential sector these changes in prices accelerate customers’ 9 decisions to conserve natural gas relative to their behaviour in the past, then the use per 10 customer forecasts may be significantly higher than what will actually be experienced. In 11 other words, the estimated elasticities of demand may be conservatively low. 12 13 Q31. How is the change in the commodity price environment affecting the demand for Union’s services by industrial customers? 14 15 A31. Higher gas commodity prices and higher gas prices relative to the price of alternative 16 fuels, such as heavy #6 fuel oil (“HFO”), have led to demand destruction, plant closures 17 and fuel switching that currently is more than offsetting the growth in the number and 18 production of industrial customers on Union’s system.9 With respect to fuel switching, 9 Union Prefiled Evidence of Bruce E. Rogers, Exhibit C1, Tab 2, Table 3, page 8. Original : 2007.08.03 18 Gaz Métro - 7, Document 9.11 Page 6 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 the change in the relationship between the price of natural gas and the price of HFO since 2 the period prior to 1998 is significant, as seen in Figure 8. 3 Figure 8 Nova (AECO) Spot Prices and NY Harbor Residual Fuel Oil Spot Prices (Jan 1994 - Dec 2005) 14 Gas Oil Pre-1998 Average 1.15 US$/GJ 37.74 US Cents/Gallon Gas Oil Post-1998 Average 3.91 US$/GJ 61.35 US Cents/Gallon 120 100 8 80 20 0 0 3/ 8/ 20 0 12 /9 /1 9 2/ 7/ 19 9 4/ 1/ 19 9 AECO Oil 4 1/ 18 /2 00 5 11 /2 1/ 20 05 2 8/ 13 /2 00 1 6/ 20 /2 00 2 4/ 29 /2 00 3 40 99 10 /1 2/ 20 00 4 9 60 8 6 1/ 27 /1 99 4 11 /2 8/ 19 94 9/ 27 /1 99 5 7/ 27 /1 99 6 5/ 29 /1 99 7 Natural Gas Price (US$/GJ) 10 Residual Fuel Oil Price (US Cents/Gallon) 12 140 Note: Null prices are omitted to adjust for inactivity. Sources: Gas Daily and EIA Petroleum Data. 4 5 6 As the figure indicates, in the period prior to 1998 natural gas at wholesale from the 7 WCSB was quite cheap in comparison to HFO purchased at the New York Harbor. Since 8 1998, while the average price of HFO has increased by about 63 percent relative to the 9 pre-1998 period, the price of natural gas has increased by 240 percent over the same 10 period. Consequently, the price advantage that natural gas had relative to oil for 11 customers with fuel-switching capability has been essentially eliminated. 12 13 Q32. Can you give an example of how this change in relative prices since 1998 has affected one class of Union industrial customers? 14 15 A32. Yes. Union serves a number of greenhouse customers that have fuel switching 16 capabilities between natural gas and HFO. Using a sample of 59 greenhouse accounts 17 that were in existence in both 1999 and forecast for 2007, Union shows total 1999 Original : 2007.08.03 19 Gaz Métro - 7, Document 9.11 Page 7 de 12 WRITTEN EVIDENCE OF PAUL R. CARPENTER consumption for those accounts of 1 122 106m3. 6 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 Union’s current forecast 2007 3 consumption for those same accounts is 58 10 m , a reduction of 53 percent. 2 3 4 Q33. What do you conclude regarding the effects of the changed gas commodity environment on the risk associated with Union’s gas distribution business? 5 6 A33. Equity investors looking at Union’s gas distribution business will be primarily concerned 7 with uncertainty surrounding the short and long-term utilization of Union’s distribution 8 assets. 9 price environment in which Union operates. This change has already begun to affect 10 negatively the utilization of Union’s network across its rate classes, and there is 11 substantial future uncertainty in this utilization. This represents a significant change in 12 Union’s business risk. Since 1998 there has been a fundamental change in the natural gas commodity 13 B. 14 15 16 INCREASED POTENTIAL FOR BYPASS OF UNION’S TRANSMISSION AND DISTRIBUTION SYSTEM 17 Q34. Is Union currently at risk for potential bypass of its system? 18 A34. Yes, it is. On January 6, 2006 the Board issued a decision regarding the application of 19 Greenfield Energy Centre Limited Partnership (“GEC”) to construct a gas pipeline to 20 serve its 1,005 MW gas-fired generating station in Courtright, Ontario, that would bypass 21 Union.10 Union also filed an application to serve the GEC power station. In its decision 22 the Board authorized both projects, and essentially is “letting the market decide” which 23 project should be built. The policy reflected in this decision increases the uncertainty 24 associated with Union’s exposure to future bypass. 25 26 Q35. What is the extent of Union’s potential exposure to bypass by its existing customers? 27 A35. It is significant. In the evidence filed by Union in the GEC proceeding, it estimated that 28 potential bypass threatens the loss of up to $29 million in annual delivery margin 29 associated with 19 existing customers representing nearly 3,500 106m3 of volume.11 This 10 11 Ontario Energy Board, Decision and Order, RP-2005-0022 et.al., January 6, 2006. Intervenor Evidence of Union Gas Limited, RP2005-0022, page 24 and Schedule 3. Original : 2007.08.03 20 Gaz Métro - 7, Document 9.11 Page 8 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 WRITTEN EVIDENCE OF PAUL R. CARPENTER FOR ENBRIDGE GAS DISTRIBUTION INC. The Brattle Group 44 Brattle Street Cambridge, Massachusetts 02138 617.864.7900 August 2006 Original : 2007.08.03 Gaz Métro - 7, Document 9.11 Page 9 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 5 Rate Class 6 1600 1400 Total Bill Amount ($) 1200 1000 800 Annual Summer 600 Winter 400 200 0 1990 Annual Summer Winter 1991 1992 1993 1994 1995 1996 Rate Class 6 Pre-1999 Yearly Standard Average % Change Deviation 346.43 84.94 600.47 33.77 38.57 33.96 1997 1998 1999 29.92 9.01 49.61 2000 Annual Summer Winter 2001 2002 2003 2004 2005 Rate Class 6 Post-1999 Yearly Standard Average % Change Deviation 692.45 178.62 1155.38 65.65 51.53 80.34 123.23 44.06 213.46 Notes: Summer rate is calculated using the average of June, July, and August. Winter rate is calculated using the average of November and December from previous year, January, February, and March from current year. 1 2 These fundamental changes in the commodity price environment have begun to induce 3 changes in customer use of the Company’s network. This can be seen in decreases in the 4 Company’s historical and forecast usage per customer. 5 6 Q25. What impact has increased commodity price volatility had on the Company’s 7 8 demand forecasts? A25. Increased commodity price volatility has led to increased uncertainty in the Company’s 9 forecast usage per customer. This can be seen by comparing Board-approved average 10 usage per customer to actual average usage per customer in the years 2001 and 2005, two 11 years in which gas commodity prices were particularly high and volatile. Unexpectedly 12 high prices in these two years contributed to decreases in actual usage relative to forecast 13 usage. 14 15 16 Q26. How is the change in the commodity price environment affecting the demand for the Company’s services by industrial customers? Original : 2007.08.03 14 Gaz Métro - 7, Document 9.11 Page 10 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 A26. The current commodity price environment contributes to increased uncertainty regarding 2 usage by industrial customers. It makes it more likely that the Company will lose 3 industrial load, either through demand destruction (the closure of industrial facilities) or 4 fuel switching. With respect to fuel switching, the change in the relationship between the 5 price of natural gas and the price of HFO since the period prior to 1999 is significant, as 6 seen in Figure 6. 7 Figure 6 Nova (AECO) Spot Prices and NY Harbor Residual Fuel Oil Spot Prices (Jan 1994 - July 2006) 14 140 Post 1999 4.30 US$/GJ 69.40 US cents/Gallon Gas Oil 120 Natural Gas Price (US$/GJ) 10 100 8 80 Residual Fuel Oil Price 6 60 4 40 2 Residual Fuel Oil Price (US Cents/Gallon) Pre 1999 1.25 US$/GJ 37.28 US cents/Gallon Gas Oil 12 20 Natural Gas Price 0 27 1/ 99 /1 0 4 /2 11 94 19 3/ 19 9/ 9 /1 95 7/ 15 9 /1 96 11 5/ 9 /1 97 3/ 7 8 99 /1 99 19 1/ 1/ /2 10 99 19 8/ 23 8/ 0 /2 00 6/ 19 0 /2 01 15 4/ 0 /2 02 2 3 00 /2 /9 12 /6 0 /2 03 /1 10 0 /2 04 7/ 28 0 /2 05 5/ 24 0 /2 06 Note: Null prices are omitted to adjust for inactivity. 8 Sources: Gas Daily and EIA Petroleum Data. 9 10 As the figure indicates, in the period prior to 1999 natural gas at wholesale from the 11 WCSB was quite cheap in comparison to HFO purchased at the New York Harbor. Since 12 1999, while the average price of HFO has increased by about 85 percent relative to the 13 pre-1999 period, the price of natural gas has increased by 245 percent over the same 14 period. Consequently, the price advantage that natural gas had relative to oil for 15 customers with fuel-switching capability has been essentially eliminated. 16 Original : 2007.08.03 15 Gaz Métro - 7, Document 9.11 Page 11 de 12 Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 Q27. What do you conclude regarding the effects of the changed gas commodity 2 3 environment on the risk associated with the Company’s gas distribution business? A27. Equity investors looking at the Company’s gas distribution business will be primarily 4 concerned with uncertainty surrounding the short and long-term utilization of the 5 Company’s distribution assets. Since 1993 there has been a fundamental change in the 6 natural gas commodity price environment in which the Company operates. This change 7 has already begun to affect negatively the utilization of the Company’s network across its 8 rate classes, and there is substantial future uncertainty in this utilization. This represents 9 a significant change in the Company’s business risk. 10 11 12 13 B. INCREASED POTENTIAL FOR BYPASS OF THE COMPANY’S DISTRIBUTION SYSTEM 14 Q28. Is the Company currently at risk for potential bypass of its system? 15 A28. Yes, it is. On January 6, 2006 the Board issued a decision regarding the application of 16 Greenfield Energy Centre Limited Partnership (“GEC”) to construct a gas pipeline to 17 serve its 1,005 MW gas-fired generating station in Courtright, Ontario in Union Gas 18 Limited’s service territory that would bypass Union.4 Union also filed an application to 19 serve the GEC power station. In its decision the Board authorized both projects, and 20 essentially is “letting the market decide” which project should be built. The policy 21 reflected in this decision increases the uncertainty associated with both Union’s and the 22 Company’s exposure to future bypass. 23 24 25 26 27 C. Q29. How has the market to serve gas-fired power generation in Ontario changed since 28 29 UNCERTAINTY IN THE GROWTH OF GAS-FIRED POWER GENERATION FORECASTS 1993? A29. 30 Since 1993 there have been fundamental changes in the structure and regulation of the power generation market in Ontario. Most important to the Company’s equity investors 4 Ontario Energy Board, Decision and Order, RP-2005-0022 et.al., January 6, 2006. Original : 2007.08.03 16 Gaz Métro - 7, Document 9.11 Page 12 de 12