INTEGRATING LARGE AMOUNTS OF WIND ENERGY WITH A SMALL ELECTRIC-POWER SYSTEM

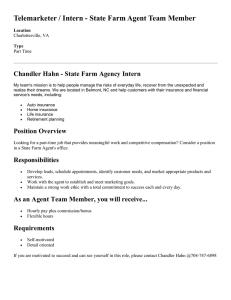

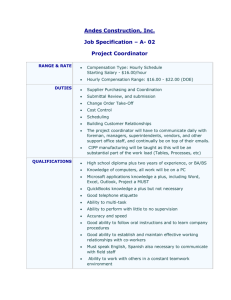

advertisement