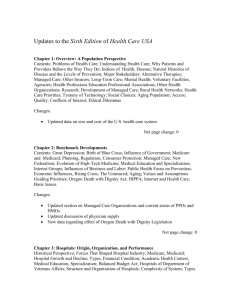

The RAND Health Care Payment and Delivery Simulation Model (PADSIM)

advertisement