Northern Illinois Gas Company ) d/b/a Nicor Gas Company

advertisement

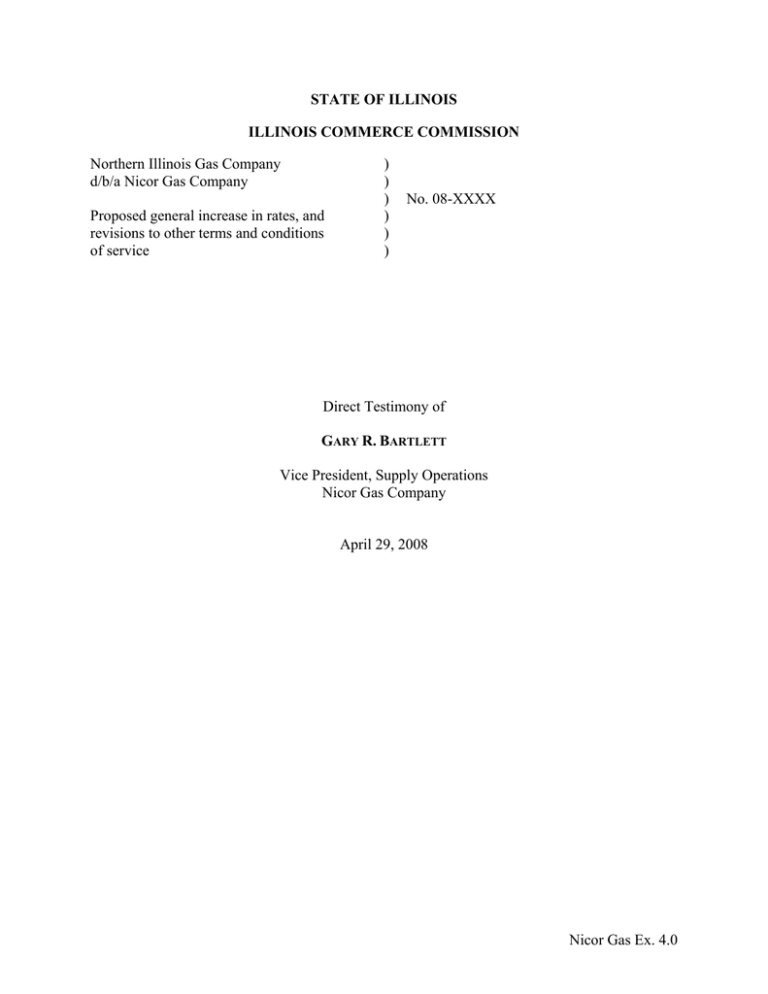

STATE OF ILLINOIS ILLINOIS COMMERCE COMMISSION Northern Illinois Gas Company d/b/a Nicor Gas Company Proposed general increase in rates, and revisions to other terms and conditions of service ) ) ) ) ) ) No. 08-XXXX Direct Testimony of GARY R. BARTLETT Vice President, Supply Operations Nicor Gas Company April 29, 2008 Nicor Gas Ex. 4.0 TABLE OF CONTENT Page I. II. III. IV. V. Background and Qualifications........................................................................................... 1 Storage Operations & Assets .............................................................................................. 4 A. Stored Gas............................................................................................................... 5 B. Balances for Storage and Processing Plant............................................................. 7 C. Certain Discrete Capital Additions (Part 285) ........................................................ 8 D. Storage Operating Expenses ................................................................................. 12 Company Use Gas............................................................................................................. 13 Proposed Riders for Company Use Gas............................................................................ 17 Proposed Tariff Revisions Affecting Transportation Customers...................................... 18 Nicor Gas Ex. 4.0 1 Q. Please state your name and business address. 2 A. Gary R. Bartlett, 1844 Ferry Road, Naperville Illinois 60563. 3 Q. By whom are you employed and in what position? 4 A. I am the Vice President, Supply Operations for Northern Illinois Gas Company d/b/a 5 Nicor Gas Company (“Nicor Gas” or the “Company”). 6 I. BACKGROUND AND QUALIFICATIONS 7 Q. Please describe your duties as Vice President, Supply Operations. 8 A. I have executive responsibility for all gas supply operations at Nicor Gas. The functions 9 under my management include planning Nicor Gas’ gas supply portfolio, purchasing gas 10 for sales to customers and for Company use, gas control including dispatching gas for 11 transportation or sale, and overseeing Nicor Gas’ storage assets and the operation of its 12 storage fields as well as all of its transmission facilities. I am also involved in the 13 evaluation and utilization of risk management tools to mitigate Nicor Gas’ exposure to 14 gas price risks inherent in the natural gas market. 15 Q. Please summarize your educational background and work experience. 16 A. I received my Bachelors Degree in Electrical Engineering from the University of 17 Missouri-Rolla in 1971. In 1981, I received a Masters of Business Administration from 18 the University of Chicago. I am a registered Professional Engineer in the State of 19 Illinois. 20 Prior to becoming Vice President, Supply Operations, for Nicor Gas, I served as 21 Vice President, Technology for EN Engineering, L.L.C., a joint venture between Nicor 22 Inc. and A. Epstein & Sons, International. In that position, I was the lead executive for Nicor Gas Ex. 4.0 23 the technology business unit, accountable for all of its activities, including engineering, 24 design, project management, procurement, and business development relating to 25 industrial piping systems, pipeline integrity, corrosion control, and combined heat and 26 power projects. 27 Prior to that, I served as Executive Vice President, Resource Management, for 28 MidCon Corp. (“MidCon”), a national energy company whose assets included interstate 29 pipelines, and as Executive Vice President and Chief Operating Officer for Natural Gas 30 Pipeline Company of America, a MidCon affiliate and major interstate natural gas 31 pipeline that, inter alia, interconnects Nicor Gas’ system with various production fields 32 and other sources and users of natural gas. 33 Preceding those assignments, I was Senior Vice President, Product / Performance 34 Management; Vice President, Gas Supply; and Vice President, Planning, for MidCon. In 35 the course of my 37-year career in the natural gas industry, I have also held a variety of 36 lower-level executive, management, and engineering positions, principally dealing with 37 gas supply acquisition, gas supply operations, gas transportation, planning, system 38 design, and construction management of numerous pipeline and storage facilities. 39 Q. 40 41 Have you testified before the Illinois Commerce Commission (“Commission”) previously? A. Yes. I testified in Nicor Gas’ last rate case, Docket No. 04-0779 (“2004 Rate Case”). I 42 also provided testimony in Nicor Gas’ last four gas supply cost reconciliation cases 43 (Docket Nos. 04-0681, 05-0747, 06-0750 and 07-0575). 2 Nicor Gas Ex. 4.0 44 Q. What are the purposes of your direct testimony? 45 A. In general, I will address issues relating to Nicor Gas’ storage and supply operations and 46 that the investments made and costs incurred were prudent and at reasonable cost. In 47 particular, the purposes of my direct testimony are to: 48 49 • Explain the contribution of stored gas to Nicor Gas’ rate base and revenue requirement; 50 51 • Identify and describe significant investments in new storage assets not included in the Company’s current rate base; 52 53 • Describe Nicor Gas’ practices for the acquisition of Company Use Gas and its forecast for test year gas required for Company use; 54 55 • Provide support for the Company’s proposed alternative rate design mechanisms as they relate to Company Use Gas; 56 57 • Describe Nicor Gas’ storage operations, including the use of its storage assets in providing various services to its customers; and 58 59 • Identify and describe proposed tariff revisions affecting end-use Transportation customers and explain why the Commission should approve them. 60 Q. Are there any Exhibits attached to your testimony? 61 A. Yes. 62 63 64 • Nicor Gas Exhibit 4.1 identifies the eight Company-owned storage fields and their inventory levels and is referenced in the portion of my testimony regarding the contribution of stored gas to Nicor Gas’ rate base and revenue requirement. 65 66 67 68 • Nicor Gas Exhibit 4.2 graphically displays historical end-use Transportation Customer on-system storage activity and is referenced in the portion of my testimony regarding the Company’s proposed tariff changes affecting Transportation Customers. 3 Nicor Gas Ex. 4.0 69 II. STORAGE OPERATIONS & ASSETS 70 Q. Please summarize this portion of your testimony. 71 A. This section of my testimony supports and quantifies the amount of stored gas that the 72 Company is including in rate base along with the inclusion in Nicor Gas’ rate base of the 73 Company’s other gas storage assets. I will also support the inclusion in Nicor Gas’ 74 revenue requirement of the operating expenses related to the Company’s storage 75 operations. 76 Q. 77 78 Before turning to the specific issues you summarized above, please describe briefly the storage assets held by Nicor Gas. A. Nicor Gas stores gas in its eight Company-owned underground gas storage reservoirs 79 (“on-system storage”) and under contracted storage services from interstate pipelines 80 under FERC-approved tariffs. Nicor Gas’ natural gas supply inventories are maintained 81 to meet multiple objectives: to provide supplies required to meet seasonal demand, to 82 ensure peak demand can be met, to provide supply flexibility and to enhance the 83 reliability of deliveries. The utilization of storage offers the additional benefit of being 84 able to purchase a significant portion of winter supply requirements during the summer 85 period when prices are typically lower. 86 Q. 87 88 89 Can you please provide a description of the gas supply inventories to which you just referred? A. From a storage operations perspective, the gas inventory held in storage falls into two main categories: (1) base gas, which remains unchanged throughout the year, and 4 Nicor Gas Ex. 4.0 90 (2) working gas, which represents the gas that is cycled in and out of the reservoir over an 91 annual cycle. 92 Base gas consists of both recoverable base gas and non-recoverable base gas. 93 Recoverable base gas consists of those volumes which could be economically withdrawn 94 over a period of time if operations of a storage field were halted and it was abandoned, 95 but which cannot typically be withdrawn during a normal injection/withdrawal cycle. 96 Non-recoverable base gas consists of those volumes which cannot be economically 97 recovered, as well as those volumes that become permanently entrapped within the 98 reservoir and cannot be recovered, even after normal operations of a field have been 99 halted and it has been abandoned. The total amount of base gas, including both 100 recoverable and non-recoverable base gas, acts as a cushion, providing the pressure 101 support needed within the reservoirs, to allow for withdrawal of the working gas 102 inventories. 103 In addition, the gas inventories held by the Company under contracted storage 104 services, that is storage services supplied by pipelines, are all working gas inventories. 105 Any base gas required by the pipeline in the operations of their storage fields is provided 106 by the pipeline. 107 A. STORED GAS 108 Q. What is the level of base gas that is included in the Company’s rate base? 109 A. As shown in Nicor Gas Exhibit 4.1, the total amount of base gas included in rate base is 110 316.5 Bcf. This volume includes 242.8 Bcf of non-recoverable base gas and 73.7 Bcf of 111 recoverable base gas. 5 Nicor Gas Ex. 4.0 112 Q. How is the level of base gas on Nicor Gas Exhibit 4.1 verified? 113 A. The Storage group that reports to me conducts an internal inventory analysis annually, 114 along with continuous monitoring of the hydrology and behavior of the Company’s 115 storage assets. These analyses continue to confirm that the level of base gas reflected is 116 correct. Further, in 2004, an independent reservoir consultant, James W. Fairchild, 117 President of Fairchild and Wells, Inc. conducted a study that analyzed the top to base 118 ratio. Fairchild and Wells, Inc. is an experienced petroleum engineering consulting firm 119 that has conducted similar analysis of the Company’s assets in the past. The results of 120 that study also concluded that the base gas volumes shown on Nicor Gas Exhibit 4.1 were 121 appropriate and were adopted by the Commission in the Company’s 2004 Rate Case. 122 Finally, Fairchild and Wells, Inc. has recently conducted a review of the Company’s 123 2006-2007 Inventory Verification Studies and provided an opinion that the volumes 124 reflected were appropriate within reasonable engineering accuracy. 125 Q. 126 127 What is the working gas level of inventory in the eight Company-owned on-system storage fields and how do you know the level is accurate? A. As shown in Nicor Gas Exhibit 4.1, the level of working gas targeted for the on-system 128 storage fields is 134.6 Bcf. The target of 134.6 Bcf is an optimal level of storage 129 inventory that supports daily and seasonal supply levels, peak day deliverability 130 requirements and seasonal cycling targets. This non-coincidental inventory level has 131 been targeted and has proven to be very beneficial in maintaining good reservoir 132 performance. Such performance is achieved by allowing the storage fields to reach lower 133 inventory levels at the end of the withdrawal season through increased cycling while 6 Nicor Gas Ex. 4.0 134 maintaining reservoir pressures at sufficient levels to ensure peaking requirements can be 135 met. 136 Q. What is the working gas inventory level that is utilized in forecasting the Gas in 137 Storage component in the Company’s proposed rate base as mentioned in the direct 138 testimony of Nicor Gas witness James M. Gorenz? (Nicor Gas Ex. 11.0). 139 A. A total of 134.6 Bcf of working gas inventory is targeted for the on-system storage fields 140 by the beginning of the withdrawal season, which is comprised of both Company owned 141 gas and third party inventories. Of that total, 80.9 Bcf is utilized in forecasting the Gas in 142 Storage component in the Company’s proposed rate base. The 80.9 Bcf is derived by 143 subtracting forecasted third party on-system storage inventory at the beginning of the 144 withdrawal season from the 134.6 Bcf of total working gas. In addition to the 80.9 Bcf, 145 the Gas in Storage component in the Company’s proposed rate base also includes a 146 working gas inventory of 37.3 Bcf stored under the contracted storage services from 147 interstate pipelines mentioned earlier in my testimony. Therefore, the total amount of 148 working gas inventory that is utilized in determining the Gas in Storage component in the 149 Company’s proposed rate base is 118.2 Bcf. The forecasted injection and withdrawal 150 activity around the 118.2 Bcf is identified in Schedule F-9, which is filed as part of the 151 Company’s Part 285 submission related to this proceeding. 152 B. 153 154 Q. BALANCES FOR STORAGE AND PROCESSING PLANT Have you reached a conclusion concerning the inclusion in the Company’s proposed rate base of the forecast test year balances for Storage and Processing Plant? 7 Nicor Gas Ex. 4.0 155 A. Yes. I have reviewed the forecast test year balances for Storage and Processing Plant 156 assets included in the Company’s proposed rate base, and I am familiar with that plant, 157 and with the requirements for, and uses of, such plant. The departments that report to me 158 participated in the development and review of the forecast. I have reached such a 159 conclusion based on that information and my experience. 160 Q. 161 162 What is your conclusion concerning the inclusion in the Company’s rate base of the forecast end of test year balances for Storage and Processing Plant? A. The forecast end of test year balances for Storage and Processing Plant represent assets 163 that the Company will use in the provision of utility services to its customers and that are 164 useful in the provision of those services. Many of those assets were in service at the time 165 of the Company’s 2004 Rate Case, were found to be reasonable and prudent and were 166 already included by the Commission in the Company’s current rates. The assets acquired 167 since 2005 have been or will be, in my opinion, acquired prudently and at a reasonable 168 cost. 169 C. 170 Q. CERTAIN DISCRETE CAPITAL ADDITIONS (PART 285) Please refer to Nicor Gas Exhibit 3.1 attached to the testimony of Nicor Gas witness 171 Rocco J. D’Alessandro. (Nicor Gas Ex. 3.0). Do any of the identified capital 172 addition projects relate to storage operations? 173 A. Yes. Several additions relate to storage operations. The “Gas Storage Improvement - 174 Compressor Replacements” project (Line No. 2), the “Air Emission Compliance Project 175 – Retrofit Engine Compressor Units – Phase 1” project (Line No. 7), the “Air Emission 176 Compliance Project – Retrofit Engine Compressor Units – Phase 2” project (Line 8 Nicor Gas Ex. 4.0 177 No. 10), and “Air Emission Compliance Project – Retrofit Engine Compressor Units – 178 Phase 3” project (Line No. 11) are storage assets. For ease of reference, I will refer to 179 these projects, respectively, as “Compressor Project”, “Air Emission Project – Phase 1”, 180 “Air Emission Project – Phase 2”, and “Air Emission Project – Phase 3”. These projects 181 are new and in addition to costs identified and approved for inclusion in rate base in the 182 2004 Rate Case. 183 Q. Please describe the Compressor Project referenced at Line Number 2. 184 A. This project involves the replacement of two of Nicor Gas’ Orenda/Delaval 9,900 HP 185 turbine compressor units at the Troy Grove storage field with new turbine units, expected 186 to be referred to as Solar units #28 and #29. The new compressor units will replace 187 Orenda units that have been in service since 1964 and are considered to be at the end of 188 their service life. The new compressors will be placed in service in 2009 and will be used 189 and useful in the provision of gas utility services to Nicor Gas’ customers commencing in 190 November 2009, in order to provide service for the 2009/2010 heating season, and 191 thereafter. 192 Q. 193 194 Please describe the basis on which the Compressor Project was undertaken by Nicor Gas and how the Company made the decision to pursue this project. A. The Company elected to proceed with the Compressor Project because of the need to 195 ensure the availability of reliable mechanical compression capability at the Troy Grove 196 field. The Troy Grove storage field requires mechanical compression to function 197 effectively during portions of the withdrawal season and to support its peak day 198 deliverability of 1.05 Bcf, which represents about 40% of the Company’s total peak day 199 storage deliverability and over 20% of total system peak day demand. The Orenda 9 Nicor Gas Ex. 4.0 200 compressors that are being replaced provide over 35% of the horsepower required to 201 meet Troy Grove’s peak day deliveries. The compression provided by the Orenda 202 compressors is a highly critical link in the overall reliability of Troy Grove. However, 203 the Orenda compressors are becoming difficult and impractical to maintain and have 204 reached the end of their useful lives. 205 Q. How will the assets included in the Compressor Project be used and useful? 206 A. The assets included in the Compressor Project will provide required mechanical 207 compression at the Troy Grove field. They will permit the field’s continued reliable 208 operation at its designed daily injection and withdrawal capacity, and will be used to 209 maintain the field’s important contribution to peak day deliverability. The assets will be 210 used to support service to Nicor Gas’ sales and transportation customers consistently 211 throughout the annual storage cycle, and will not only be useful, but essential, in the 212 reliable provision of that service. 213 Q. Will the assets included in the Compressor Project be used and useful in 2009? 214 A. Yes. The order for the compressor units has already been placed, with delivery scheduled 215 between June and July 2009. The new units will be placed into service by November 216 2009 so that they are available for the 2009/2010 heating season. 217 Q. 218 219 220 Will the assets included in the Compressor Project be acquired and placed into service prudently, and at reasonable costs? A. Yes. This project, with a forecasted total cost of $25.5 million, including overhead costs, is reasonable and prudent. 10 Nicor Gas Ex. 4.0 221 Q. Please describe the Air Emission Project – Phase 1 referenced at Line Number 7 of 222 Nicor Gas’ Schedule F-4, and why the assets installed should be included in rate 223 base. 224 A. During 2006, the Company embarked on a multi-year program to retrofit existing 225 reciprocating engines at its storage facilities in order to bring them into compliance with 226 nitrogen oxide (“NOx”) emission reduction regulations being promulgated by the Illinois 227 Environmental Protection Agency (“IEPA”) in conjunction with USEPA requirements. 228 The Phase I Project, which was initiated in 2006 and completed in May 2007, covered the 229 installation of pre-combustion technology on four 4,000 hp compressor units at the 230 Company’s Hudson and Lexington storage facilities. The $6.0 million total cost, 231 including overheads, was reasonable for the equipment installed, and the installation of 232 the emission control equipment to achieve the targeted reduction in NOx emissions was 233 prudent. 234 Q. Please describe the Air Emission Project – Phase 2 and the Air Emission Project – 235 Phase 3 referenced at Line Numbers 10 and 11, respectively, of Nicor Gas’ 236 Schedule F-4, and why the assets installed should be included in rate base. 237 A. The second and third phases of the Air Emission Projects are a continuation of the multi- 238 year program discussed previously. Phase 2 covered the retrofitting of four additional 239 units starting in the fall of 2007 with completion in May 2008. The forecasted cost of 240 Phase 2 is $3.9 million including overhead costs. Phase 3 involves retrofitting the 241 remaining four units requiring modification with work commencing in the fall of 2008 242 and completion set for May 2009. The projected cost of Phase 3 is $3.8 million, 243 including overhead costs. 11 Nicor Gas Ex. 4.0 244 The storage compressor units modified under both Phase 1 and Phase 2 are used 245 in the provision of utility service to customers and are used and useful in that function. 246 The compressor units being modified under Phase 3 will be used in the provision of 247 utility service to customers and will be used and useful in that function during the test 248 year. The forecasted cost, including overheads, is reasonable and prudent. 249 Q. 250 251 Discrete Additions? A. 252 253 Does this complete your direct testimony regarding Storage Assets and Certain Yes. D. Q. STORAGE OPERATING EXPENSES Have you reached a conclusion concerning the inclusion in the Company’s proposed 254 revenue requirement of the forecast test year operating expenses associated with the 255 Company’s storage operations? 256 A. Yes. I have reviewed the forecast test year operating expenses relating to the storage 257 function included in the Company’s proposed revenue requirement. I am familiar with 258 the operation and requirements of the Company’s storage function, and the departments 259 that report to me participated in the development and review of that forecast. I have 260 reached such a conclusion based on that information and my experience. 261 Q. 262 263 Please describe Nicor Gas’ test year Underground Storage Operation and Maintenance expenses. A. Nicor Gas’ test year Underground Storage Operation and Maintenance (“O&M”) 264 expenses are projected to be $32,789,000. Underground Storage Operation expenses 265 include operation supervision and engineering, wells, lines, compressor stations, 12 Nicor Gas Ex. 4.0 266 compressor station fuel and power, measuring and regulating stations, purification related 267 expenses, gas losses and rent. The total Underground Storage Operation expense forecast 268 for the test year is $28,550,000. Underground Storage Maintenance expenses include 269 maintenance supervision and engineering, structures and improvements, reservoirs and 270 wells, lines, compressor station equipment, purification equipment, and other equipment. 271 The total Underground Storage Maintenance expense forecast for the test year is 272 $4,239,000. 273 Q. What is your conclusion concerning the inclusion in the Company’s proposed 274 revenue requirement of the forecast test year O&M expenses associated with the 275 Company’s storage operations? 276 A. The forecast test year O&M expenses associated with the Company’s storage operations 277 reflect the costs of providing storage services to the Company’s customers. The forecast 278 test year O&M expenses associated with the Company’s storage operations are 279 reasonable in light of the services offered, and reflect activities and costs that will be 280 prudently incurred. 281 III. COMPANY USE GAS 282 Q. Please summarize the matters you will address in this portion of your testimony. 283 A. I will describe the process of gas acquisition for Company purposes, also known as 284 “Company Use Gas,” and support the forecasted expenses included in the Company’s 285 revenue requirement calculation. 13 Nicor Gas Ex. 4.0 286 Q. What is meant by the term “Company Use Gas?” 287 A. “Company Use Gas” refers to gas purchases which are made, not for resale to retail 288 customers but rather, more specifically, to satisfy franchise delivery requirements and for 289 the Company’s own operational and other requirements. Company Use Gas includes gas 290 purchased by the Company for four different purposes: (1) Franchise gas; (2) Compressor 291 fuel; (3) Company facilities gas; and (4) Storage field operations requirements. Franchise 292 gas is the gas supply which the Company is responsible for purchasing and providing to 293 the communities in which it operates as a condition for the Company to operate within 294 those municipalities. Compressor fuel is fuel gas used in the operation of the Company’s 295 compressors at its storage stations. Company facilities gas is gas consumed in the 296 buildings or facility locations owned or leased by the Company for heating and day to 297 day operations. Storage field operations requirements represent the volumes of gas 298 related to the sales customers’ portion of the 2% storage withdrawal factor, which 299 accounts for the gas utilized in operating the storage fields (other than compressor fuel). 300 These four components collectively represent Company Use Gas. 301 Q. How is the cost of Company Use Gas recovered? 302 A. The cost of Company Use Gas is an operating expense. The Franchise gas portion of 303 Company Use Gas is recovered under Rider 2 of the Company’s tariffs, as discussed in 304 the direct testimony of Nicor Gas witness Robert R. Mudra (Nicor Gas Ex. 14.0), and the 305 remainder is recovered through base rates. The costs are established using forecasted test 306 year expenses. 14 Nicor Gas Ex. 4.0 307 Q. How does Nicor Gas acquire Company Use Gas? 308 A. The Company has contracted with an unaffiliated wholesale gas supplier for the purchase 309 of Company Use Gas. The Company is treated as if it were an end use transportation 310 customer with an allocation of storage like that of any other analogous customer. The gas 311 supplier is assigned access to allocated storage to facilitate management of its obligations 312 to meet Company Use Gas delivery requirements. In an effort to protect itself from 313 volatility in operating costs, the Company may fix the prices on some portion of required 314 supplies in advance, by securing fixed prices from its supplier and/or through the use of 315 financial hedges. 316 Q. 317 318 Does the current gas acquisition program provide a prudent and adequate means for acquiring Company Use Gas? A. Yes. This gas acquisition program provides a prudent means for acquiring Company Use 319 Gas at market prices and attempts to help mitigate some of the impact of extreme 320 volatility of gas prices within a year. 321 Q. How is the cost forecast developed? 322 A. The Company forecast is based on individual volume forecasts for each of the four 323 components of Company Use Gas. The volume forecasts are based on: (1) forecasted 324 municipal franchise use under normal weather, which takes into consideration the 325 municipal rights as well as their historical usage; (2) forecasted compressor fuel based on 326 expected compression required to cycle the forecasted storage volumes; (3) forecasted 327 use at Company facilities based on normal weather and historical use; and (4) forecasted 15 Nicor Gas Ex. 4.0 328 storage field operations requirements expected to result from cycling the sales customers’ 329 portion of total withdrawals of gas in storage. 330 Expenses for Company Use Gas are then calculated for this estimated volume by 331 applying (1) forecasted gas prices for the test year to those forecasted volumes that have 332 not been hedged, and (2) prices of existing hedges in effect for the test year to those 333 volumes that have already been hedged. 334 Q. 335 336 What is your forecast for the quantity and cost of Company Use Gas for the test year? A. The Company’s test year forecast reflects the acquisition of approximately 4 Bcf of gas at 337 a total cost of $34,321,000 (which includes .86 Bcf for Franchise gas at a cost of 338 $7.5 million). 339 Q. How were the forecasted gas prices for the test year determined? 340 A. The Company used the average of the closing prices over a three day period 341 (December 31, 2007, January 2, 2008 and January 3, 2008) for each of the months of the 342 test year, as listed on the New York Mercantile Exchange (“NYMEX”). The Company 343 used the same prices in developing its forecasts for the 2009 test year. 344 Q. 345 346 Have you reached a conclusion concerning the inclusion in the Company’s proposed revenue requirement for the forecast test year expenses for Company Use Gas? A. Yes. I have reviewed the forecast test year expenses relating to Company Use Gas. The 347 departments that report to me participated in the development and review of the forecast. 348 Based on that information and my experience, I have concluded that the forecasted test 349 year expenses for Company Use Gas represent expenses that are reasonable and prudent. 16 Nicor Gas Ex. 4.0 350 IV. PROPOSED RIDERS FOR COMPANY USE GAS 351 Q. Are you familiar with the proposed changes to Rider 2 and the proposed Rider 27 352 353 (Rider CUA – Company Use Gas Cost Adjustment)? A. Yes. In summary form, these proposals would establish a means of tracking Company 354 Use Gas expenses. Rider 27 is proposed and supported in the direct testimony of Nicor 355 Gas witness Gerald P. O’Connor and the changes to Rider 2 are covered in the testimony 356 of Mr. Mudra. (Nicor Gas Exs. 12.0 and 14.0, respectively). 357 Q. 358 359 Please explain the nature of these costs that makes the use of a cost recovery rider appropriate. A. These costs are a function of the volume requirements and the price that has to be paid to 360 secure such volumes. The price of the natural gas has been and continues to be very 361 volatile and is outside the control and influence of the Company. The price of natural gas 362 in the United States is set in a highly competitive market that reflects the market’s 363 perception of supply and demand fundamentals. While I am not an economist, it is my 364 experience that the price of natural gas is influenced today by fundamental market 365 changes in both the long and short run. The tightening of the supply and demand balance 366 and the small but increasing use of imported gas supplies has resulted in what are, in my 367 opinion, high gas prices relative to historical norms. The overall market’s expectations 368 regarding future gas prices are reflected in the NYMEX futures prices. The level and 369 volatility of gas prices as reflected by the NYMEX is show in Figure 1 below. 17 Nicor Gas Ex. 4.0 370 Figure 1: Daily Nymex Strip Prices Daily Nymex Settlement Prices $11 $10 $9 ($/MMBtu) 2007 Futures (A g) 2008 Futures (A ) $8 $7 2009 Futures (Avg) $6 371 372 373 V. PROPOSED TARIFF REVISIONS AFFECTING TRANSPORTATION CUSTOMERS 374 Q. Are you familiar with the Transportation tariff changes the Company is proposing? 375 A. Yes. As discussed in Mr. Mudra’s direct testimony (Nicor Gas Ex. 14.0), the Company is 376 proposing changes to the Storage Banking Service (“SBS”) provisions in its tariffs for 377 Transportation customers, including Rates 74, 75, 76 and 77 and through Rider 25, 378 Rates 4, 5, 6 and 7. 379 Q. What is the purpose of your testimony regarding the proposed tariff changes? 380 A. The Company’s proposed tariff changes seek to positively impact Nicor Gas’ ability to 381 manage its storage fields and to reduce the need for Nicor Gas to periodically impose 382 restrictions on deliveries to Nicor Gas’ system (commonly referred to as issuing pipeline 18 Nicor Gas Ex. 4.0 3/3/08 1/3/08 9/3/07 7/3/07 5/3/07 3/3/07 1/3/07 11/3/07 Trade Date 11/3/06 9/3/06 7/3/06 5/3/06 3/3/06 1/3/06 11/3/05 9/3/05 7/3/05 5/3/05 3/3/05 1/3/05 $5 383 “caps”) in certain months. My testimony provides support for the proposed tariff changes 384 and discusses the operational issues associated with the proposed tariff changes. 385 Q. Please describe Nicor Gas’ storage operations. 386 A. As mentioned previously, Nicor Gas operates eight underground natural gas storage 387 reservoirs which Nicor Gas uses to provide peaking, supply flexibility, reliability of 388 deliveries, and to capture the price benefits of purchasing a portion of winter supply 389 requirements during the summer when prices are typically lower. 390 Nicor Gas’ eight storage fields are underground aquifer reservoirs. An aquifer 391 reservoir is a naturally occurring underground formation that consists of water-filled, 392 porous sandstone layers covered by a solid dome-shaped caprock. When gas is injected 393 into the storage reservoir, water is displaced by the gas from the pores of the sandstone 394 structure, and the pressure in the reservoir rises to levels greater than the reservoir’s 395 original pressure. The displaced water provides pressure needed for Nicor Gas to 396 withdraw the gas later. 397 The Company’s eight storage fields are referenced on Nicor Gas Exhibit 4.1. The 398 fields vary in size and deliverability. All eight storage fields contribute to providing 399 seasonal supply, system balancing, and peak day deliverability. Seasonally, these on- 400 system storage fields provide approximately 40% of winter demand and approximately 401 50%, or 2.5 Bcf, of the Company’s total system design day demand of 4.9 Bcf. 402 Because these storage fields are aquifer reservoirs, Nicor Gas strives to operate 403 them in a controlled manner in order to maintain optimal field performance, which is 404 necessary to ensure the deliverability from each field required to satisfy peak day and 19 Nicor Gas Ex. 4.0 405 seasonal needs is maintained. Failing to operate in this manner jeopardizes the ongoing 406 operational integrity of the fields. For example, if the fields are left shut in (neither on 407 injection or withdrawal) for extended periods of time, the “energy” within the reservoir 408 will diminish thus reducing withdrawal capabilities, and a portion of the gas will 409 eventually become ineffective and non-recoverable. As another example, sustained 410 withdrawals or injections in excess of optimal rates will also result in a degradation of 411 field performance. The Company’s storage fields do not have a static, fixed level of 412 deliverability. However, the ability of a storage field to store and deliver gas can be 413 enhanced or harmed within a season and from year-to-year by the manner in which the 414 field is used. I liken it to a nickel-cadmium battery that many people have become 415 familiar with and use in their electronics and small appliances. If the battery is only 416 partially discharged and then recharged before its next use, its ability to be recharged to 417 its full potential in the future is compromised. Similarly, the best way to preserve its 418 capacity is to wait to begin the recharging process until whatever charge the battery 419 currently holds is fully discharged. So the best way to use and recharge such a battery is 420 first, to make sure it is fully charged, then second, to use the battery and not begin 421 recharging until it is fully spent. 422 The analogy can be applied to the Company’s storage fields though their 423 operation is more complex. In order to maintain the performance of a field, our engineers 424 create an optimal operational plan which calls for the fields to be filled and then emptied 425 on a seasonal schedule. We aim to fill the field during the summer (low demand) season 426 to the optimal level just prior to the beginning of the winter (high demand) heating 427 season, and to nearly empty it by the end of the winter season. The plan is designed to 20 Nicor Gas Ex. 4.0 428 ensure maximum deliverability is available on January 20, the Company’s design day, or 429 highest demand day, as well as satisfying subsequent deliverability targets over the 430 remainder of the heating season, while also providing for the cycling of as much gas as 431 possible. This plan has some flexibility on the margins, so that on any given day we are 432 not rigidly required to fill or withdraw a precise amount. However, each deviation from 433 the plan, such as injections into storage during the winter caused, for example, by lower 434 weather related demand or economic decisions by third-party storage customers, has an 435 impact on the storage plan for the balance of the season. Repeated deviations will have 436 an adverse cumulative impact on storage operations for the balance of the season and 437 potentially over the next several seasons. 438 Q. 439 440 Has the Company faced any issues with operating its storage fields in the manner required and described above? A. Yes. Transportation customers access and utilize storage through an elected SBS that is 441 offered by the Company. This service currently affords such customers significant levels 442 of daily and monthly flexibility in the management of their allocated storage capacity. 443 As described later in my testimony, their storage utilization has often been counter to the 444 operational requirements of the Company’s storage fields. 445 Q. 446 447 What is the Storage Banking Service that is available to end-use Transportation customers? A. Nicor Gas’ SBS is a service offered to Transportation customers which allows them to 448 serve all or part of their demands from supplies of gas that they have stored in the 449 Company’s storage fields. In addition, where such customers’ deliveries in a day exceed 450 demand, they may store the excess with Nicor Gas. These balancing storage rights 21 Nicor Gas Ex. 4.0 451 include both the allocation of storage capacity and daily deliverability associated with 452 such capacity in accordance with individual customer rights. On an annual basis, SBS 453 rights are made available to transportation customers as a class. Each eligible customer 454 then has the right to elect for that annual period an amount of SBS that it wishes to take 455 up to a calculated guaranteed amount and has an opportunity to elect additional SBS if all 456 the available capacity has not been selected by other customers. Most recently, the total 457 volume of SBS capacity available to Transportation customers has been about 35 Bcf. 458 Q. What are the current SBS quantity limitations applicable to users of SBS? 459 A. As I testified above, Nicor Gas customers who take transportation services are permitted, 460 as part of the terms of their service, to use defined amounts of Nicor Gas’ on-system 461 storage assets by subscribing to SBS. Currently, such customers are entitled to a storage 462 capacity of up to 28 times their Maximum Daily Contract Quantity (“MDCQ”), i.e., the 463 maximum amount of gas that the customer requires the Company to deliver on a given 464 day. This is also described as 28 “days” of storage capacity. No change to the number of 465 days of storage capacity is being proposed in this case. 466 Nicor Gas’ tariff also applies withdrawal limitations on a Critical Day which, as 467 defined in the Terms and Conditions section of the tariff, can be declared for various 468 reasons to ensure the Company is able to fulfill its firm contractual obligations and 469 maintain the overall operational integrity of its system. Storage withdrawals on a Critical 470 Day are currently limited to the customer’s Storage Withdrawal Factor (“SWF”) times 471 .017 times the customer’s SBS capacity. 472 473 In addition, SBS users are restricted to monthly maximum injection levels during the summer months. These customers are currently allowed to inject up to 25% of their 22 Nicor Gas Ex. 4.0 474 SBS capacity in any one month during the period April through October. The injection 475 rights awarded Customers are determined by the limits set by the calculated Maximum 476 Daily Nomination (“MDN”). 477 Q. Do any other limitations currently exist with SBS? 478 A. Yes. SBS withdrawal rights on a Critical Day are reduced for a customer if an inventory 479 level of at least 90% of their elected storage capacity is not met on November 1. 480 Withdrawal limitations are implemented through a reduction of the customer’s SWF as 481 further detailed in the Terms and Conditions section of Nicor Gas’ tariffs. 482 Q. How is a customer’s SBS capacity and SWF determined? 483 A. These particular SBS rights are reflective of Nicor Gas’ physical and operational storage 484 and/or design day demand. Available SBS capacity is a function of total system design 485 day demand relative to targeted on-system storage inventory. A customer’s SWF is a 486 function of targeted on-system storage inventory relative to its expected design day 487 deliverability. 488 Q. 489 490 Are you also familiar with the change that the Company is proposing regarding the SBS users’ Critical Day withdrawal rights? A. Yes. As mentioned previously, a customer’s Critical Day withdrawal rights are currently 491 limited to the customer’s SWF of .017 times the customer’s SBS capacity. The Company 492 is proposing that the .017 factor be increased to .018, as reflected in the testimony of 493 Mr. Mudra. (Nicor Gas Ex. 14.0). This proposed change to the SWF will increase a 494 customer’s storage withdrawal rights on a Critical Day. A customer’s storage withdrawal 495 rights on a non-Critical Day will remain unchanged. 23 Nicor Gas Ex. 4.0 496 Q. Do you support this proposal? 497 A. Yes. I have reviewed the method used to determine the SWF, which is the same method 498 as that adopted by the Commission in the 2004 Rate Case. The .018 SWF is based on the 499 Company’s forecasted design day demand of 4.9 Bcf and the Company’s on-system 500 storage deliverability on a peak day of 2.5 Bcf. 501 Q. What changes does the Company propose to implement regarding SBS? 502 A. The Company is proposing two changes: (1) to revise the method of calculating a 503 customer’s MDN; and (2) to revise the daily nomination limit for the months of March 504 and April. 505 Q. 506 507 Please explain a customer’s MDN and the change that is proposed for the MDN calculation. A. A Transportation customer’s MDN is currently applicable in the months of April through 508 October. It is the maximum amount of gas that a customer can nominate for delivery into 509 Nicor Gas’ system on a day. It is currently calculated for each month April through 510 October by adding (1) the customer’s historical monthly usage for the month, and 511 (2) 25% of the customer’s SBS capacity, with the resulting volume then converted to a 512 daily rate by dividing it by the number of days in the month. 513 The Company proposes to change the second part of this calculation for the 514 months of July through October. Instead of using 25% of the customer’s entire SBS 515 capacity in the MDN calculation, it is proposed that 25% of the difference between the 516 customer’s SBS capacity and the customer’s actual inventory balance at the end of April 517 be included in the MDN calculation. 24 Nicor Gas Ex. 4.0 518 Q. Why is this change appropriate and necessary? 519 A. Daily injection rights currently determined by using the entire amount of capacity in the 520 MDN calculation are predicated on the assumption that customers begin their injection 521 season with an inventory balance of zero in their accounts. However, the Company’s 522 actual daily injection capacity is reduced as total inventories increase due to the physical 523 characteristics of the fields. If a customer starts an injection season with an inventory 524 balance greater than zero, that customer would then have less open capacity to fill over 525 the summer and, therefore, should not require as high a level of injection rights over the 526 season in order to fill that capacity. In other words, a customer’s daily injection right 527 should be a function of its need to re-fill its empty storage capacity. This recognizes that, 528 for example, a customer that ends the withdrawal season with its storage capacity 50% 529 full needs half the level of injections as does a customer with its storage capacity 100% 530 empty to fully replenish its inventory. Changing the MDN calculation to be a function of 531 the open capacity remaining in a customer’s account at the end of the withdrawal season, 532 instead of a customer’s entire capacity, simply recognizes this fact and brings injection 533 rights more in line with actual storage operational limitations. 534 This proposal to change the MDN calculation is expected to help reduce the 535 potential need for Nicor Gas to “cap” pipeline deliveries for those days during the 536 injection season on which too much gas is being nominated to Nicor Gas’ system relative 537 to the level of injections which can be physically accommodated by the storage fields. 538 The Company has heard from shippers to its system that caps are disruptive. While the 539 Company must retain the current rights to impose caps to protect the operational integrity 540 of its operations and its ability to maintain reliable service to its customers, it is proposing 25 Nicor Gas Ex. 4.0 541 this change to reduce the likelihood that such actions will be required. This proposal 542 makes daily nomination limits proportionate to a customer’s need to fill storage. While 543 this proposal may not completely eliminate the need to issue caps as customers will 544 continue to be able to inject gas into their storage accounts during the month, it is 545 expected to help reduce the need to issue caps. 546 Q. 547 548 Why is the proposed change in calculation of the MDN not being applied for the months of May and June? A. The answer lies in the practical limitations centered around the time when accurate 549 customer specific inventory balances are available. Daily meter reads are not available 550 for a number of customers with SBS rights, making it impractical to know each 551 customers specific inventory balance at April 30 until well into May. Even if that were 552 possible, being able to incorporate such numbers in a calculation to establish rights and 553 then being able to communicate the results to affected parties by an effective date of 554 May 1 would just not be possible. While Nicor Gas strongly believes that the rationale 555 set forth for the months of July through October are just as valid for May and June, the 556 Company has chosen to keep the process simple by accepting the practical limitations 557 associated with the lag in available data. This will allow time for an accurate 558 determination of April ending inventory balances for all customers and then an adequate 559 notice period for the new MDN that will take effect on July 1. This, of course, will 560 provide the customer with the benefits of the higher MDN levels for May and June. 561 Q. Is the Company requiring SBS users to cycle their storage with this proposal? 562 A. No. While the Company strongly encourages full cycling to maintain the operational 563 integrity of the fields, it is not requiring these customers to cycle the inventory they place 26 Nicor Gas Ex. 4.0 564 in storage. If a customer does fully cycle the gas they have placed in inventory, then they 565 will receive higher daily injection rights, by means of their MDN, than those customers 566 that did not fully cycle their inventory. Again, those customers who do not fully cycle 567 their inventory do not have as much empty, or open, capacity to fill and thus do not 568 require as high a level of injection rights to refill to their full storage capacity. It should 569 be pointed out that even though the daily rate is reduced for those not fully cycling their 570 inventory, the number of days allowed to achieve full inventory is the same for all 571 customers regardless of their starting point. 572 Q. Please explain the Company’s second proposal. 573 A. The Company’s second proposal is to change the Transportation customers’ daily 574 nomination limits for the months of March and April. 575 Q. Why is such a change appropriate and necessary? 576 A. March and April are two months that are critical to ensuring that Nicor Gas is 577 operationally able to cycle gas in inventory. These months are typically problematic 578 since weather begins to warm, which in turn reduces customer usage. Yet withdrawals 579 from Nicor Gas’ aquifer fields are operationally required through the month of April to 580 achieve maximum cycling. Cycling the gas in inventory provides significant operational 581 benefits through improved reservoir performance. Several disadvantages exist if targeted 582 levels of gas in inventory are not cycled including declining reservoir performance, 583 thereby increasing the potential for the gas not cycled to become ineffective, and lower 584 reservoir pressures going into the next withdrawal season translating into reduced 585 deliverability. 27 Nicor Gas Ex. 4.0 586 Historically, as shown on Nicor Gas Exhibit 4.2, Transportation customers 587 typically inject into their storage accounts during the months of March and April when, 588 operationally, Nicor Gas needs to be withdrawing from storage. There is no evidence to 589 suggest that this trend will change, nor are there currently any tariff limitations that 590 provide appropriate limits on injections in these months. 591 Q. 592 593 Please describe the Company’s proposal regarding daily nomination limits in March and April. A. Transportation customers are currently allowed a significant level of injections during the 594 month of March, because their current daily nomination limit for March equals two times 595 their MDCQ. To put this in perspective, assuming typical normal usage for the month of 596 March, Transportation customers as a group could inject significantly more than 1 Bcf 597 per day into their storage accounts. This potential March storage activity by 598 Transportation customers is extremely adverse to Nicor Gas’ physical storage operations 599 given the Company’s need to be on withdrawal to maintain optimal field performance 600 and avoid a degradation of the integrity of the fields. Therefore, the Company proposes 601 to reduce March’s daily nomination limit on non-Critical Days for Transportation 602 customers from two times their MDCQ to 150% of the customer’s historical usage 603 calculated on a daily basis. If a customer has issues on a particular day with the daily 604 nomination limit (i.e., a customer expects to have usage greater than their stated MDN), 605 the Company will address the problem to the benefit of the customer. 606 Transportation customers currently are allowed to inject 25% of their storage 607 capacity during the month of April (based on the MDN previously discussed). The 608 Company proposes to limit the amount of inventory these customers can inject into 28 Nicor Gas Ex. 4.0 609 storage in April by changing April’s MDN on non-Critical Days for Transportation 610 customers from their historical usage plus 25% of their storage capacity to 110% of the 611 customer’s historical usage calculated on a daily basis. The Company fully expects this 612 MDN level will be sufficient to allow the customer to satisfy all of its delivery 613 requirements. However, as with the proposed change for March, if a customer has issues 614 on a particular day with the daily nomination limit (i.e., a customer expects to have usage 615 greater than their stated MDN) the Company will again address the problem to the benefit 616 of the customer. 617 Q. Do any other benefits result from this second proposal? 618 A. In addition to the operational benefits for storage this proposal provides, it also is 619 expected to reduce the potential need for pipeline caps. Nicor Gas has had to cap, or 620 limit, pipeline deliveries to its system several times over the last few years in order to 621 protect the operational integrity of its system and storage fields. Often times, these cap 622 periods were several days, even weeks, in length instead of just for a day or a few days. 623 As mentioned earlier, the Company has heard from shippers to Nicor Gas’ system that 624 caps are disruptive, and the Company wishes to reduce the chance for caps by proposing 625 this change. As with the first proposal, this change will not completely eliminate the 626 need to issue caps in these months as customers will continue to be able to inject gas into 627 their storage accounts during March and April (when storage operations are necessarily 628 withdrawing gas). However, the proposed change is expected to help reduce the need to 629 issue caps. 29 Nicor Gas Ex. 4.0 630 Q. 631 632 Does this conclude the portion of your testimony regarding end-use Transportation Customers? A. Yes. 30 Nicor Gas Ex. 4.0