Strategic Plan 2006–2010

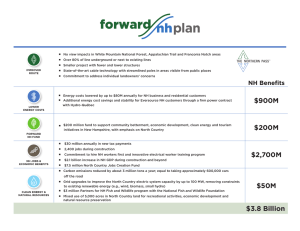

advertisement