Cost of Capital Professor Laurence Booth CIT Chair in Structured Finance

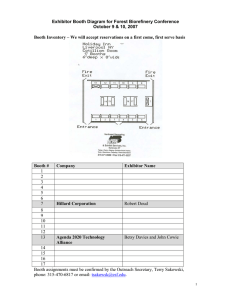

advertisement

Cost of Capital Professor Laurence Booth CIT Chair in Structured Finance Rotman School of Management BOOTH GMI 2009 Key Issues before the Regie u u u Has Gaz Metro’s business risk increased since 2007 when the Regie increased its allowed ROE due to increased business risk? Has Gaz Metro’s fair ROE increased? – What has been the impact of the financial crisis of 2008-9 – Is it legitimate to continue to base the fair ROE on long term Canada (LTC) bond yields? – How do you interpret “A” and Gaz Metro’s bond spreads over LTC yields? – Have Canadian LDCs experienced any problems accessing capital in 2008-9? What are the implications, if any, of the NEB’s TQM Decision using ATWACC BOOTH GMI 2009 Gaz Metro’s Business Risk u Short run u Long run u TransCanada Mainline and TQM – Has Gaz metro earned its allowed ROE? – What is the record of Canadian utilities? – Is there any change in the risk that Gaz Metro may not be able to recover the capital invested in its operations? – Viability of the natural gas market in Quebec – NEB regards TQM as integrated into the Mainline – Load on the Mainline has dropped due to declining productivity in WCSB and increasing intra Alberta demand – NEB has allowed the Mainline’s common equity ratio to increase from 30% to 40% since 2002 to reflect this increased longer term risk BOOTH GMI 2009 Gaz Metro Gaz Metro Allowed vs Actual ROE 15 14 13 12 11 10 9 8 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Allowed Incentive Actual So far no indication of any inability by Gaz Metro to earn its allowed ROE BOOTH GMI 2009 Revenue Breakdown Gaz Metro 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 1997 1998 1999 2000 2001 2002 2003 D! 2004 D3 2005 2006 2007 2008 2009 D4+D5 Gradually falling importance of industrial revenues Increased commercial BOOTH GMI 2009 2010 No indication of a deterioration in the competitive position of natural gas BOOTH GMI 2009 Natural gas seems to be becoming more competitive with fuel oil for industrial customers BOOTH GMI 2009 Absolute cost of natural gas has come down: wells are being shut in in Alberta BOOTH GMI 2009 Relevance of TQM Decision? NGTL Throughput Forecast 12 10 8 6 4 2 0 2008/09 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 Empress McNeil ABC Other Alberta Increasing intra-Alberta demand and flat supply from WCSB BOOTH GMI 2009 Throughput: Mainline vs TQM % of 2001 throughput 120.00% 100.00% 80.00% 60.00% 40.00% 20.00% 20 01 /0 20 2 02 /0 20 3 03 /0 20 4 04 /0 20 5 05 /0 20 6 06 /0 20 7 07 /0 20 8 08 /0 20 9 09 /1 20 0 10 /1 20 1 11 /1 20 2 12 /1 20 3 13 /1 20 4 14 /1 20 5 15 /1 20 6 16 /1 20 7 17 /1 20 8 18 /1 20 9 19 /2 20 0 20 /2 20 1 21 /2 20 2 22 /2 20 3 23 /2 20 4 24 /2 5 0.00% Mainline % TQM Base TQM High TQM Low TQM throughput forecast to be stable: increasing supplies from Dawn Hub NEB disregarded this as TQM integrated with the Mainline. BOOTH GMI 2009 Financial u u u US economy has been in recession for the last 18 months as result of losses on sub-prime mortgages Canada was largely immune from this: – TSX hit record highs in July 2008 – CDN$ stayed over $1 US through Summer 2008 – Bank of Canada had begin lowering interest rates to stimulate the economy Catalyst: Failure of Lehman Brothers September 14, 2008 – Domino effect around the world as banks focused on survival: v v v v Hoarded cash Reduced lending Sold of securities to bolster capital Reduced principal trading in debt markets: reduced liquidity BOOTH GMI 2009 BOOTH GMI 2009 CP BA Money market now back to normal in Canada 7/1/2009 6/17/2009 6/3/2009 5/20/2009 5/6/2009 4/22/2009 4/8/2009 3/25/2009 3/11/2009 2/25/2009 2/11/2009 1/28/2009 1/14/2009 12/31/2008 12/17/2008 12/3/2008 11/19/2008 11/5/2008 10/22/2008 10/8/2008 9/24/2008 9/10/2008 8/27/2008 8/13/2008 7/30/2008 7/16/2008 7/2/2008 Short Term Credit Spreads Money Market Spreads 300 250 200 150 100 50 0 Stock Market Collapse Index or Exchange United States Composite (US Dollar) Japan Composite (US Dollar) United Kingdom Composite (US Dollar) Canada Composite (US Dollar) Germany Composite (US Dollar) Hong Kong Composite (US Dollar) Spain Composite (US Dollar) Switzerland Composite (US Dollar) Last Trade Date 213.40 10/24/2008 82.39 10/24/2008 149.79 10/24/2008 278.25 10/24/2008 218.89 10/24/2008 186.44 10/24/2008 388.93 10/24/2008 374.65 10/24/2008 1Day Change -7.52 1 Day % -3.40% 1 Month % -27.53% 6 Month % -37.17% YTD % -2.74 -3.21% -22.00% -32.07% -35.54% -11.63 -7.21% -35.44% -48.66% -52.51% 3,441 -4.74 -1.67% -40.46% -48.15% -49.61% 1,636 -14.62 -6.26% -39.40% -51.88% -56.28% 1,426 -10.10 -5.14% -31.80% -51.39% -57.97% 1,361 -26.01 -6.27% -34.22% -50.24% -51.93% 1,146 -10.44 -2.71% -22.21% -32.06% -34.35% 1,111 -40.46% 2006 $b Value 18,039 4,422 Real Economy can not flourish if the financial system is broken: 1) Credit crunch: banks hoard cash 2) Real economy stops spending 3) Sharp recession started 2008Q4 in Canada BOOTH GMI 2009 BOOTH GMI 2009 BBB A CAN LTC Yields fell, Corporate debt yields increased 2/25/2009 6/9/2008 9/20/2007 1/2/2007 4/14/2006 7/27/2005 11/8/2004 2/19/2004 6/3/2003 9/13/2002 12/26/2001 4/9/2001 7/20/2000 11/2/1999 2/12/1999 5/27/1998 9/8/1997 12/19/1996 4/2/1996 7/14/1995 10/26/1994 2/7/1994 5/20/1993 9/1/1992 12/13/1991 3/27/1991 7/9/1990 10/19/1989 1/31/1989 5/13/1988 Yields 15 13 11 9 7 5 3 BOOTH GMI 2009 11/20/2008 11/20/2007 11/20/2006 11/20/2005 11/20/2004 11/20/2003 11/20/2002 11/20/2001 11/20/2000 11/20/1999 11/20/1998 11/20/1997 11/20/1996 11/20/1995 11/20/1994 11/20/1993 11/20/1992 11/20/1991 REAL BOND YIELD 5.50 5.00 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 Real Canada bond yield increased: no sign of a rush into long Canada bonds BOOTH GMI 2009 Drop in LTC yield was caused by: * Fear of a Great Depression 2 and deflation * Current inflation rate: 0.5% will rise to 2% in 2010/11 2009-05 2008M11 2008M5 2007M11 2007M5 2006M11 2006M05 2005M11 2005M05 2004M11 2004M05 2003M11 2003M05 2002M11 2002M05 2001M11 2001M05 2000M11 2000M05 1999M11 1999M05 1998M11 1998M05 1997M11 1997M05 1996M11 1996M05 1995M11 1995M05 1994M11 1994M05 1993M11 1993M05 1992M11 1992M05 1991M11 Break-Even Inflation Rate (BEIR) 6 5 4 3 2 1 0 1935 1937 1939 1941 1943 1945 1947 1949 1951 1953 1955 1957 1959 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 Dr. Vilbert’s 1.0% Spread Premium Add on to the LTC Yield BondBetas 0.8 0.6 0.4 0.2 0 -0.2 -0.4 US BOOTH GMI 2009 Canada Conclusion u u u u u LTC Yields remain the only opportunity cost or expected rate of return in the capital market The real yield increased indicating no “rush to quality in LTC bonds” Drop in nominal yield reflected lower expected inflation I expect LTC yields to increase to 4.5-4.75% over 2010, (currently 4.0%) The rush to quality occurs in short term bonds: – T Bill yields went negative in the US – Currently 0.26% in Canada BOOTH GMI 2009 BOOTH GMI 2009 A BBB 11/25/2008 4/3/2008 8/13/2007 12/20/2006 4/28/2006 9/6/2005 1/13/2005 5/24/2004 10/1/2003 2/7/2003 6/18/2002 10/25/2001 3/5/2001 7/12/2000 11/19/1999 3/30/1999 8/6/1998 12/15/1997 4/23/1997 8/30/1996 1/9/1996 5/18/1995 9/26/1994 2/2/1994 6/11/1993 10/20/1992 2/27/1992 7/8/1991 11/14/1990 3/23/1990 8/1/1989 12/8/1988 4/18/1988 A and BBB Spreads 500 450 400 350 300 250 200 150 100 50 0 5.477% is not an unfair or unreasonable debt cost BOOTH GMI 2009 BOOTH GMI 2009 Forecast Test Year u u u u u MVIX: Volatility of the Canadian equity market has declined precipitously TSX is up 40% since March lows and recently was above 11,000 “A” spreads now close to normal cyclical levels Economy recovering Has this affected the equity cost going forward and should it affect the ROE mechanism? BOOTH GMI 2009 Risk Premium Models u Explicit Risk premium model – CAPM – Primary reliance by NEB (RH-1-2008) – NEB rejected ECAPM since it is based on empirical work using Treasury Bill yields as the risk free rate and (Dr. Vilbert) produces Nonsense results K RF MRP * Time Value of Money BOOTH GMI 2009 Market Risk Premium * “beta” BOOTH GMI 2009 Annual Returns 1926-2008 Annual Rate of Return Estimates 1926-2008 U.S. CANADA S&P Long US Excess TSE Long Excess Equities Treasury Return Equities Canadas Return AM 11.66 6.05 5.61 11.10 6.56 4.54 GM 9.61 5.67 3.94 9.41 6.21 3.20 OLS 11.13 5.06 6.07 10.44 5.74 4.70 Volatility1 20.56 9.19 18.90 8.84 Arithmetic is simple average; geometric is compound and OLS is the least squares estimate. Approximately Geometric Mean = Arithmetic Mean - .5*variance For example, US variance is about 4%, so AM and GM diverge by about 2% BOOTH GMI 2009 Fernandez Survey May 2009 1) US MRP is higher than in Canada 2) Median Canadian MRP is 5.1%, 1) Dr. Booth uses 5.0% 2) Dr. Vilbert uses 7.75% BOOTH GMI 2009 If the Regie randomly asked a Canadian finance professor what the MRP is, the answer would almost certainly be 5.0% or 6.0% BOOTH GMI 2009 -0.100 BOOTH GMI 2009 Utility beta Utility (No TAU) Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 Jan-90 Jan-89 Jan-88 Jan-87 Jan-86 Jan-85 Relative Risk (BETA) Average Utility Betas 0.600 0.500 0.400 0.300 0.200 0.100 0.000 Stock Performance over Last Year BOOTH GMI 2009 Stock Performance over Last Year BOOTH GMI 2009 Stock Performance over Last Year BOOTH GMI 2009 Stock Performance over Last Year BOOTH GMI 2009 Stock Performance over Last Year BOOTH GMI 2009 Stock Performance over Last Year BOOTH GMI 2009 BOOTH GMI 2009 Fair ROE u u u u LTC Yield: Market Risk Premium: Beta: Raw Estimate: 4.50% 5.0% 0.5 7.0% u Issue costs: 0.50% Margin of Error (6% MRP & beta of 0.50 = 0.50%): 0.25% u Recommended ROE: u u BOOTH GMI 2009 7.75% ATWACC u After tax weighted average cost of capital ATWACC Equity cos t * u u EquityValu e Debt Aftertaxde bt cos t * Totalvalue Totalvalue Dr. Kolbe assumes ATWACC constant and uses it to get utility ROE. All else constant if M/B>1 the result is a higher ROE Normally high M/B indicates the ROE is too high, ATWACC reverse this by claiming that financial risk is higher! BOOTH GMI 2009 ATWACC u u u NEB TQM Decision (RH-1-2008) NEB used Dr. Vilbert’s base CAPM estimate of 7.4% Dr. Vilbert now increases this estimate: – Market Risk Premium +2% – Spread adjustment to LTC Yield +1% BOOTH GMI 2009 BOOTH GMI 2009 Dr Kolbe u Takes Dr. Vilbert’s 7.25% and increases it u At TQM’s 6.4% ATWACC – – – – BOOTH GMI 2009 +0.25% for higher risk +0.10% for embedded cost of debt +0.15% for issue costs Note this is applied to total rate base Traditional Methodology u u u 7.75% ATWACC means 12.39% ROE on current deemed common equity of 38.5% Dr. Vilbert’s direct estimates of the equity cost estimates are similar to mine How does a reasonable equity cost estimate become an unreasonable ROE recommendation of 12.39%? BOOTH GMI 2009 Answer: :Leverage Adjustments u u Dr. Kolbe assumes that the ATWACC is constant so that if the M/B ratio >1, the utility cost of capital with book weights has to have a higher ROE to get the same ATWACC as with market value weights Suppose the regulator lowers the utility’s risk – market value goes up and ROE should be lowered – ATWACC places higher weight on equity sot eh ATWACC increases keeping the ROE higher than a fair return – Produces the exact opposite result from that which you would expect BOOTH GMI 2009 NEB vs Alberta EUB u AEUB “the Board considers that beta and the cost of equity do not change to the extent necessary for an ATWACC, determined from market capitalization weights, to remain constant when applied to the book capitalization for a pure play regulated utility. The increase required to the cost of equity to achieve a constant ATWACC would be excessive and violate the fair return standard.” 1 2 3 4 u NEB simply used an ATWACC of 6.4%. They said nothing about a constant ATWACC or Dr. Kolbe’s leverage adjustments – Consistent with 9.7% ROE on 40% Common equity – 40% common equity is the same as the TransCanada Mainline BOOTH GMI 2009 Financing u No bond rating downgrades of Canadian utilities over the last year – Newfoundland Power just got upgraded two notches and it has an RTOE formula u u u u u Significant new financing by major utilities during last year’s crisis: TransCanada, Enbridge and Fortis No dividend cuts by significant Canadian utilities AltaGas just been sold for a 45% premium over its market price Canadian Utilities remain financial sound with no market access problems No indication that the Regie’s ROE formula is unfair. BOOTH GMI 2009